Global Market Comments June 26, 2020 Fiat Lux Featured Trade: (THEY’RE NOT MAKING AMERICANS ANYMORE),

Global Market Comments June 25, 2020 Fiat Lux Featured Trade: (5 REASONS GOLD IS GOING TO A NEW HIGH), (GLD), (GOLD), (NEM), (GDX)

Global Market Comments June 24, 2020 Fiat Lux Featured Trade: (HOW TO HEDGE YOUR CURRENCY RISK), (FXA), (UUP), (TESTIMONIAL)

Global Market Comments June 23, 2020 Fiat Lux Featured Trade: (HERE ARE THE FOUR BEST PANDEMIC-INSPIRED TECHNOLOGY TRENDS), (AMZN), (CHWY), (EBAY), NFLX), (SPOT), (TMUS), (ATVI), (V), (PYPL), (AAPL), (MA), (TDOC), (ISRG), (TMDI)

By now, we have all figured out that the pandemic has irrevocably changed the course of technology investment. Some sectors are enjoying incredible windfalls, while others are getting wiped out. The digitization of the economy has just received a turbocharger. It has become a stock pickers market en extemus. The good news is that we

Global Market Comments June 22, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, OR THE FED RIDES AGAIN), (TLT), (SPY), (TSLA), (IBB), (AMGN), (GILD), (ILMN)

The free Fed put was tested once again last week, and once again it held. It seems that the line in the sand is $300 for the (SPY), and if that doesn’t hold, $270 will do. At least, for a month. How long this game will last is anyone’s guess. $14 trillion is a lot

Global Market Comments June 19, 2020 Fiat Lux Featured Trade: (JUNE 17 BIWEEKLY STRATEGY WEBINAR Q&A), (SPY), (AAPL), (FXE), (FXA), (BA), (UAL), (AAPL), (MSFT), (BIIB), (PFE), (OXY), (SPCE), (WMT), (CSCO), (TGT)

Below please find subscribers’ Q&A for the June 17 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: What is the best way to buy long term LEAPS for unlimited profits? A: There is no such thing as unlimited

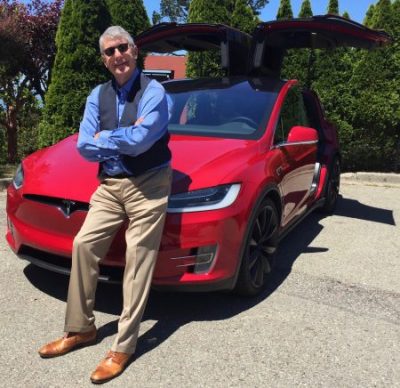

Global Market Comments June 18, 2020 Fiat Lux Featured Trade: (TESTING TESLA’S SELF DRIVING TECHNOLOGY), (TSLA) (TESTIMONIAL)

I knew I was on the right track when the salesman told me that the customer who just preceded me for a Tesla Model X 90D SUV was the Golden Bay Warriors star basketball player, Steph Currie. Well, if it’s good enough for Steph, then it’s good enough for me. Last week, I received a

Global Market Comments June 17, 2020 Fiat Lux Featured Trade: (THE SECRET FED PLAN TO BUY GOLD), (GLD), (GDX), (PALL), (PPLT), (TESTIMONIAL)

Thanks for all your help with my trading. Your service is very effective. As you know, I went heavily into some LEAPS two days ago including United Airlines, (UAL), Delta Airlines (DAL), Wynn Resorts (WYNN), MGM Resorts International (MGM), and Simon Property Group (SPG) that have returned as much as a 25% ROI over that

Global Market Comments June 16, 2020 Fiat Lux Featured Trade: (THE IDIOT’S GUIDE TO INVESTING), (TSLA), (BYND), (JPM) (TESTIMONIAL)

Global Market Comments June 15, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or WAITING FOR MY SUGAR CUBE), (SPY), (INDU), (UUP), (GLD), (TLT), (HTZ), (TSLA)

I was born in the middle of a pandemic. It was polio, and in the early 1950s, it was claiming 150,000 kids a year just in the US. You know polio. You’ve seen the pictures of the kids with withered legs or living in iron lungs, the ventilators of their day. My mom contracted polio

Global Market Comments June 12, 2020 Fiat Lux Featured Trade: (WHEN THE BILL COMES DUE) (SPY), (TLT), (GD), (USO), (HTZ), (JCP)

This was a top you could see coming a mile off. Now, the correction for the greatest rally in stock market history has begun. Will it be the greatest correction in history? It could be. It was the awful news that the Coronavirus is starting to run away again that started the panic. New cases

Global Market Comments June 11, 2020 Fiat Lux Featured Trade: (WHY TECHNICAL ANALYSIS DOESN’T WORK) (FB), (AAPL), (AMZN), (GOOG), (MSFT), (VIX) (TESTIMONIAL)

Santa Claus came early this year. We have now rocketed all the back from -37% to a feeble 0% return for the Dow Average for 2018. By comparison, the Mad Hedge Fund Trader is up a nosebleed 8.5% during the same period. If you had taken Cunard’s round-the-world cruise four months ago, as I recommended, you

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.