Global Market Comments May 13, 2020 Fiat Lux Featured Trade: (HERE’S AN EASY WAY TO PLAY ARTIFICIAL INTELLIGENCE), (BOTZ), (NVDA), (ISRG)

We are now in the throes of a market correction that could last anywhere from a couple of weeks more to a couple of months. So, generational opportunities are starting to open up in some of the best long term market sectors. Suppose there was an exchange-traded fund that focused on the single most important

Global Market Comments May 12, 2020 Fiat Lux Featured Trade: (HOW THE MAD HEDGE MARKET TIMING ALGORITHM TRIPLED MY PERFORMANCE)

I couldn’t believe my eyes. Upon analyzing my performance data for the past year, it couldn’t be clearer. After three years of battle testing, the algorithm has earned its stripes. I started posting it at the top of every newsletter and Trade Alert last year and will continue to do so in the future. Once

Global Market Comments May 11, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE NEXT GOLDEN AGE HAS ALREADY STARTED) (TLT), (TBT), (SPY), (INDU), (VIX), (DAL), (BRK/A), (LUV), (AA), (UAL)

I always get my best ideas when hiking up a steep mountain carrying a heavy backpack. Yesterday, I was just passing through the 9,000-foot level on the Tahoe Rim Trail when suddenly, the fog lifted and the skies cleared. I was hit with an epiphany. It was my “AHA” moment. The next American Golden Age,

Global Market Comments May 8, 2020 Fiat Lux Featured Trade: (MAY 6 BIWEEKLY STRATEGY WEBINAR Q&A), (UNG), (UAL), (DAL), (INDU), (SPY), (SDS), (P), (BA), (TWTR), (GLD), (TLT), (TBT)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader May 6 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: What broker do you use? The last four bond trades I couldn’t get done. A: That is purely a function of

"No one is line dancing over the fact that the market is at 2,700. No one feels good about it. The market likes to climb a wall of worry, and the stonemason has been hard at work. So I think we continue to grind higher," said Jason Trennert, chief investment strategist at Strategas Research Partners.

Global Market Comments May 7, 2020 Fiat Lux Featured Trade: (HOW TO EXECUTE A VERTICAL BULL CALL SPREAD) (AAPL) (DINING WITH THE BOTTOM 20%) (TESTIMONIAL)

Global Market Comments May 6, 2020 Fiat Lux Featured Trade: (NOW THE FAT LEADY IS REALLY SINGING FOR THE BOND MARKET), (TLT), (TBT)

The most significant market development so far in 2020 has not been the epic stock market crash and rebound, the nonstop rally in tech stocks (NASDQ), the rebound of gold (GLD), or negative oil prices, although that is quite a list. It has been the recent peaking of the bond market (TLT), which a few

“Your margin is my opportunity,” said Amazon founder Jeff Bezos.

Global Market Comments May 5, 2020 Fiat Lux Featured Trade: (FIVE STOCKS TO BUY AT THE BOTTOM), (AAPL), (AMZN), (SQ), (ROKU), (MSFT)

With the Dow Average down 1,400 points in three trading days, you are being given a second bite of the apple before the yearend tech-led rally begins. So, it is with great satisfaction that I am rewriting Arthur Henry’s Mad Hedge Technology Letter’s list of recommendations. By the way, if you want to subscribe to

Global Market Comments May 4, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE NEXT BOTTOM IS THE ONE YOU BUY), (SPY), (SDS), (TLT), (TBT), (F), (GM), (TSLA), (S), (JCP), (M)

It was only a year ago that I was driving around New Zealand with my kids, admiring the bucolic mountainous scenery, with Herb Albert and the Tijuana brass blasting out over the radio. Believe me, the tunes are not the first choice of a 15-year-old. Today, it is all a distant memory, with any kind

Global Market Comments May 1, 2020 Fiat Lux Featured Trade: (A NOTE ON ASSIGNED OPTIONS OR OPTIONS CALLED AWAY) (TRADING THE NEXT KOREAN WAR)

With the May 15 options expiration only ten trading days away, there is a heightened probability that your short options position gets called away. We have the good fortune of having a large number of deep in-the-money call and put options spreads about to expire at their maximum profit points, five to be precise. If

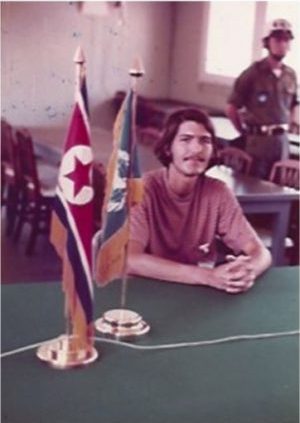

There are disturbing rumors circulating that North Korean dictator, Kim Jung-un, either has the Coronavirus or is dead. With North Korea firing several short-range missions again and three years’ worth of high-level US negotiations having come to absolutely nothing, the prospect of another Korean War is back on the table. The big question for these

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.