"The most powerful weapon of a modern army is the printing press," said T.E. Lawrence, otherwise known as Lawrence of Arabia.

Global Market Comments April 30, 2020 Fiat Lux SPECIAL HOUSING ISSUE Featured Trade: (WHY A US HOUSING BOOM IS IMMINENT) (LEN), (KBH), (PHM)

Lately, my inbox has been flooded with emails from subscribers asking if the housing market is about to crash as a result of the pandemic and if they should sell their homes. They have a lot to protect. Since prices hit rock-bottom in 2011 and foreclosures crested, the national real estate market has risen by

Global Market Comments April 29, 2020 Fiat Lux Featured Trade: (LEARNING THE ART OF RISK CONTROL)

Global Market Comments April 28, 2020 Fiat Lux Featured Trade: (EIGHT "REOPENING" STOCKS TO BUY AT THE MARKET BOTTOM) (UAL), (DAL), (UNP), (CSX), (WYNN), (MGM), (BRK/A), (BA)

With the massive technology rally off the March 23 market bottom, the risk/reward for entering new trades has dramatically shifted. Back then. I was begging followers to load the boat with the best big tech and biotech & healthcare names with call options and two-year LEAPS (Long Term Equity Participation Securities). One reader told me

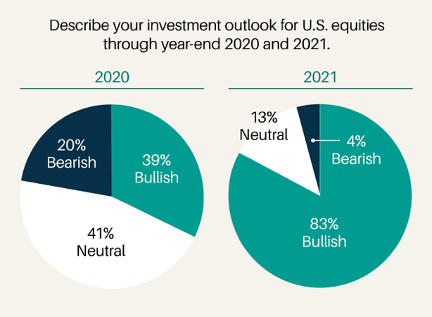

“I don’t think anyone has made money in the long term by betting against the United States,” said Kevin Bernzott of Bernzott Capital Advisors.

Global Market Comments April 27, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE GREAT LOOK THROUGH) (INDU), (SPX), (MSFT), (AAPL), (FB), (VXX)

It was a week when traders and investors alike were confused, befuddled, and gob-smacked. If you believed that the worst Great Depression in a hundred years was worth more than a 12% pullback in the market you were punished, quite severely so if you were short tech stocks. April has turned out to be the

Global Market Comments April 24, 2020 Fiat Lux Featured Trade: (APRIL 22 BIWEEKLY STRATEGY WEBINAR Q&A), (SPY), (INDU), (GILD), (NEM), (GOLD), (USO), (SOYB), (CORN), (SHOP), (PALL), (AMZN)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader April 22 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: Will Trump louse up the recovery by bringing people back to work too soon? A: Absolutely, that’s a risk. Georgia is

Global Market Comments April 23, 2020 Fiat Lux Featured Trade: (HOW TO FIND A GREAT OPTIONS TRADE)

Global Market Comments April 22, 2020 Fiat Lux Featured Trade: (THE MAD HEDGE DICTIONARY OF TRADING SLANG)

Global Market Comments April 21, 2020 Fiat Lux Featured Trade: (OIL CATACLYSM) (USO), (XLE)

I spent the day trying to charter a 500,000-tonne oil tanker. No luck. If I had found one, I could have bought oil at the close of the market today at negative -$37.78 a barrel and then immediately resold it for June delivery for $21, generating an instant $57.78 a barrel profit. At 7.33 barrels

Global Market Comments April 20, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or WHAT’S A FED PUT WORTH?), (INDU), (SPX), (TLT), (ZM), (TDOC), (NFLX), (UAL), (WYNN), (CCL)

What is a Fed put worth? That the question that traders and investors alike are pondering. If the government had taken no action whatsoever in the face of the Corona pandemic the Dow average would easily be at 15,000 today, if not 12,000. After all, the economic collapse we have seen has been even greater

“The worst advice I have received is to look in the rearview mirror and think that what led to success somehow can lead you to new success. Because it doesn’t. History will come back and bite you in the ass,” said Satya Nadella, CEO of Microsoft.

Global Market Comments April 17, 2020 Fiat Lux Featured Trade: (REMEMBERING GUADALCANAL)

When the Commandant of the Marine Corps asks for a favor, I say “Yes Sir” without hesitating. So, when General David H. Berger called me and asked to represent him at the 78th annual memorial service for the 1942 Battle of Guadalcanal, I started booking my flight. It turned out to be one of the

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.