The focus of this letter is to show people how to make money through investing in fast-growing, highly profitable companies which have stiff, long-term macroeconomic winds at their backs. That means I ignore a large part of the US economy, possibly as much as 80%, whose time has passed and are headed for the dustbin

Global Market Comments September 17, 2019 Fiat Lux Featured Trade: (PROFITING FROM AMERICA’S DEMOGRAPHIC COLLAPSE)

Global Market Comments September 16, 2019 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or CHOPPY WEATHER AHEAD), (SPY), (TLT), (FB), (GOOGL), (M), (C), (XOM), (NFLX), (DIS), (FXE), (FXI)

When commercial pilots fly across the US, they often give each other a heads up about dangerous conditions so other can avoid them. “Chop” is a common one, clear air turbulence that appears on no instruments. Usually, a simple altitude change of a few thousand feet is enough to deal with the problem. “Chop” is

Global Market Comments September 13, 2019 Fiat Lux Featured Trade: (SOME SAGE ADVICE ON ASSET ALLOCATION), (BREAKFAST WITH BOONE PICKENS)

It was with a heavy heart that I learned of the passing last night of the legendary Boone Pickens who has dominated oil markets for the past 50 years. I owe him much of my understanding of the energy markets, which I picked up in crumbs that fell off his table over the past 40

Global Market Comments September 12, 2019 Fiat Lux Featured Trade: (WILL ANTITRUST DESTROY YOUR TECH PORTFOLIO?), (FB), (AAPL), (AMZN), (GOOG), (SPOT), (IBM), (MSFT)

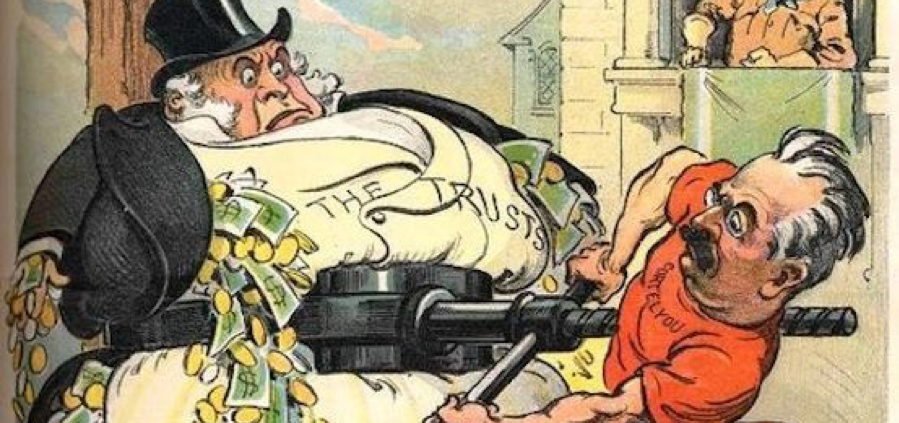

In recent days, two antitrust suits have arisen from both the Federal government and 49 states seeking to fine, or break up the big four tech companies, Facebook (FB), Apple (AAPL), Amazon (AMZN), and Google (GOOG). Let’s call them the “FAAGs.” And here is the problem. These four companies make up the largest share of

Global Market Comments September 11, 2019 Fiat Lux Featured Trade: (HAS THE VALUE OF YOUR HOME JUST PEAKED?), (ITB), (PHM), (KBH), (LEN), (DHI), (NVR), (TOL), (JOIN US AT THE MAD HEDGE LAKE TAHOE, NEVADA CONFERENCE, OCTOBER 25-26, 2019)

Lately, my inbox has been flooded with emails from subscribers asking how to hedge the value of their homes. This can only mean one thing: the residential real estate market has peaked. They have a lot to protect. Since prices hit rock bottom in 2011 and foreclosures crested, the national real estate market has risen

Global Market Comments September 10, 2019 Fiat Lux SPECIAL ARTIFICIAL INTELLIGENCE ISSUE Featured Trade: (NEW PLAYS IN ARTIFICIAL INTELLIGENCE), (NVDA), (AMD), (ADI), (AMAT), (AVGO), (CRUS), (CY), (INTC), (LRCX), (MU), (TSM)

It’s been three years since I published my first Special Report on artificial intelligence and urged readers to buy the processor maker NVIDIA (NVDA) at $68.80. The stock quadrupled, readers are understandably asking me for my next act in the sector. The good news is that I have one. For a start, you could go

Global Market Comments September 9, 2019 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or SAVED BY A HURRICANE) (FXB), (M), (XOM), (BAC), (FB), (AAPL), (AMZN), (ROKU), (VIX), (GS), (MS),

This was the week when the stock market was saved by Hurricane Dorian. Why a hurricane? Because it gave President Trump something else to Tweet about beside China and Jay Powell. The White House went totally silent, at least on matters concerning the stock market. There, the focus instead turned on whether Trump predicted Dorian

Global Market Comments September 6, 2019 Fiat Lux Featured Trade: (SEPTEMBER 4 BIWEEKLY STRATEGY WEBINAR Q&A), (INDU), (FXY), (FXB), (USO), (XLE), (TLT), (TBT), (FB), (AMZN), (MSFT), (DIS), (WMT), (IWM), (TSLA), (ROKU), (UBER), (LYFT), (SLV), (SIL)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader September 4 Global Strategy Webinar broadcast from Silicon Valley with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: If Trump figures out the trade war will lose him the election; will he stop it? A: Yes, and that is

Global Market Comments September 5, 2019 Fiat Lux SPECIAL VOLATILITY ISSUE Featured Trade: (SHOPPING FOR FIRE INSURANCE IN A HURRICANE), (VIX), (VXX), (XIV), (THE ABCs OF THE VIX), (VIX), (VXX), (SVXY),

I am one of those cheapskates who buy Christmas ornaments by the bucketload from Costco in January for ten cents on the dollar because my 11-month theoretical return on capital comes close to 1,000%. I also like buying flood insurance in the middle of the summer drought when the forecast in California is for endless

Global Market Comments September 4, 2019 Fiat Lux Featured Trade: (HOW FREE ENERGY WILL POWER THE COMING ROARING TWENTIES), (SPWR), (TSLA) (ARE YOU IN THE 1%?), (SNE), (HMC), (TLT)

I have been in the much-talked-about and often despised 1% for most of my adult life. I started my relentless march towards wealth and financial independence when I was 11 years old and landed a job delivering newspapers for the Los Angeles Herald Examiner, an old Hearst rag, earning $30 a month. I’ll never forget

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.