Global Market Comments June 17, 2019 Fiat Lux Featured Trade: (THE MARKET OUTLOOK FOR THE WEEK AHEAD, or THE SCARY THING ABOUT THE MARKETS) (SPY), (TLT), (GLD), (TSLA)

There’s one big scary thing about the markets right now. As I mentioned last week, the major indexes are sitting on a precipice of a right shoulder of a ‘Head and Shoulders” top. Traders are expecting a trade war settlement and a Fed interest rate cut in July. While the economy in no way needs

Global Market Comments June 14, 2019 Fiat Lux Featured Trade: (WEDNESDAY JUNE 26 BRISBANE, AUSTRALIA STRATEGY LUNCHEON) (MAY 29 BIWEEKLY STRATEGY WEBINAR Q&A), (TSLA), (BYND), (AMZN), (GOOG), (AAPL), (CRM), (UT), (RTN), (DIS), (TLT), (HAL), (BABA), (BIDU), (SLV), (EEM)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Luncheon which I will be conducting in Brisbane, Australia on Wednesday, June 26, 2019 at 1:15 PM. An excellent meal will be followed by a wide-ranging discussion and a question-and-answer period. I’ll be giving you my up to date view on stocks,

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader June 12 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: Do you think Tesla (TSLA) will survive? A: Not only do I think it will survive, but it’ll go up 10 times from the current level.

Global Market Comments June 13, 2019 Fiat Lux Featured Trade: (TUESDAY, JUNE 25 SYDNEY, AUSTRALIA STRATEGY LUNCHEON) (CYBERSECURITY IS ONLY JUST GETTING STARTED), (PANW), (HACK), (FEYE), (CSCO), (FTNT), (JNPR), (CIBR)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update, which I will be conducting in Sydney, Australia at 1:15 PM on Tuesday, June 25, 2019. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period. I’ll be giving you my up to date view on

Global Market Comments June 12, 2019 Fiat Lux Featured Trade: (MONDAY, JUNE 24 MELBOURNE, AUSTRALIA STRATEGY LUNCHEON) (AMGEN’S BIG LUNG CANCER BREAKTHROUGH), (AMGN), (GSK), (MRTX)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update which I will be conducting in Melbourne, Australia on Monday, June 24, 2019 at 1:15 PM. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period. I’ll be giving you my up to date view on

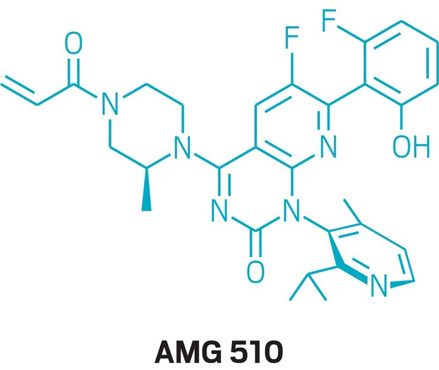

I recently heard that some of my hedge fund friends were loading up on Amgen (AMGN) and now I know why. It’s a company I know well because my UCLA biochemistry professor was its first chairman. Amgen has accomplished a major medical breakthrough. The company has revealed that its experimental drug, AMG 510, exhibited the

Global Market Comments June 11, 2019 Fiat Lux Featured Trade: (BEYOND RATIONAL), (BYND) (PLEASE USE MY FREE DATA BASE SEARCH) (HOW TO AVOID PONZI SCHEMES)

Global Market Comments June 10, 2019 Fiat Lux Featured Trade: (JUNE 21 AUCKLAND NEW ZEALAND STRATEGY LUNCH) (MARKET OUTLOOK FOR THE WEEK AHEAD, OR THE GRAND PLAN) (MSFT), (GOOGL), (AMZN), (TESLA), (TLT), ($TNX)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Luncheon, which I will be conducting in Auckland, New Zealand on Friday, June 21, 2019. An excellent meal will be followed by a wide-ranging discussion and question-and-answer period. I’ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals,

You knew when the price of margaritas was going up that the new Mexican tariff dispute was not going to last very long, especially going into the summer. No wonder the Texas senators were so upset. As of this writing, the tariffs have been called off two days before they were going to be implemented

"If a cluttered desk is a sign of a cluttered mind, what is an empty desk a sign of?" asked Albert Einstein.

Global Market Comments June 7, 2019 Fiat Lux Featured Trade: (SUNDAY, JUNE 30 MANILA, PHILIPPINES STRATEGY LUNCHEON) (THE CONTINUING DEATH OF RETAIL), (AMZN), (WMT), (M), (JWN), (TESTIMONIAL)

Global Market Comments June 6, 2019 Fiat Lux Featured Trade: (WEDNESDAY, JUNE 28 PERTH, AUSTRALIA STRATEGY LUNCHEON) (THE IRS LETTER YOU SHOULD DREAD), (PANW), (CSCO), (FEYE), (CYBR), (CHKP), (HACK), (SNE) (CHINA’S COMING DEMOGRAPHIC NIGHTMARE)

Global Market Comments June 5, 2019 Fiat Lux Featured Trade: (WEDNESDAY, JUNE 26 BRISBANE, AUSTRALIA STRATEGY LUNCHEON) (WHY CONSUMER STAPLES ARE DYING), (XLP), (PG), (KO), (PEP), (PM), (WMT), (AMZN), (WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

"If horses could have voted, there never would have been cars," said my friend, Tom Friedman, a columnist at the New York Times.

Global Market Comments June 4, 2019 Fiat Lux Featured Trade: (WEDNESDAY, JUNE 26 SYDNEY, AUSTRALIA STRATEGY LUNCHEON) (TEN UGLY MESSAGES FROM THE BOND MARKET), (TLT), (TBT), (USO), (GLD), (GS), (SPY)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.