Global Market Comments October 10, 2016 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE COMING WEEK), (SPY), (TLT), (TNX), (FXB), (WHY DOCTORS MAKE TERRIBLE TRADERS) SPDR S&P 500 ETF (SPY) iShares 20+ Year Treasury Bond (TLT) CBOE Interest Rate 10 Year T No (^TNX) CurrencyShares British Pound Ster ETF (FXB)

On Friday, another nail was driven into the coffin for the December Fed rate rise. That is the undeniable conclusion derived from the tepid September Non Farm Payroll Report at 156,000. The headline unemployment rate ticked up slightly to 5.0%. The Fed tells us every day that it is data driven, and this number certainly

At my Global Strategy Luncheon in Incline Village, Nevada last week, I had the pleasure of sitting next to an anesthesiologist who was a long time reader of my research.As much as he loved my service, he confided in me that his trading results were awful.I told him I knew why.Doctors, scientists, aircraft pilots, and

Global Market Comments October 7, 2016 Fiat Lux Featured Trade: (OCTOBER 12th LIVE GLOBAL STRATEGY WEBINAR), (THE INCREDIBLE FUTURE OF THE AUTOMOBILE), (TSLA), (GM), (F), (TM), (TESTIMONIAL) Tesla Motors, Inc. (TSLA) General Motors Company (GM) Ford Motor Co. (F) Toyota Motor Corporation (TM)

It was the kind of dinner invitation I couldn?t turn down. What I learned was amazing. I usually prefer to spend my evenings at home catching up on my research, calling subscribers, and plotting my next Trade Alert. So it takes a lot to get me out of my cozy digs, especially during an evening

Global Market Comments October 6, 2016 Fiat Lux Featured Trade: (OCTOBER 21ST SAN FRANCISCO, CA GLOBAL STRATEGY LUNCHEON), (THE TRUMP INSURANCE TRADE), (SPY), ($INDU), (VIX), (INTRODUCING THE MAD HEDGE FUND TRADER EXECUTIVE CONCIERGE SERVICE) SPDR S&P 500 ETF (SPY) Dow Jones Industrial Average (INDU) VOLATILITY S&P 500 (^VIX)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco, CA on Friday, October 21, 2016. An excellent meal will be followed by a wide ranging discussion and an extended question and answer period.I?ll be giving you my up to date view on

I have spent a lifetime analyzing risk for major hedge funds, and what I can always rely on is that firms staffed by the smartest people in the industry never fail to underestimate the threats to their business. Often, they are totally ignorant of the biggest risks of all. My friend, mathematician Nassim Taleb, explained

I am pleased to announce the Mad Hedge Fund Trader Executive Concierge Service, a program that is aimed at our most valuable clients. The goal is to provide high net worth individuals with the extra degree of assistance they may require in managing diversified portfolios. Tax, political, and economic issues will all be covered. It

Global Market Comments October 5, 2014 Fiat Lux Featured Trade: (IS THERE A BITCOIN IN YOUR FUTURE?), (TESTIMONIAL)

Global Market Comments October 4, 2016 Fiat Lux Featured Trade: (LAST CHANCE TO ATTEND OCTOBER 7th INCLINE VILLAGE, NV GLOBAL STRATEGY LUNCHEON), (11 SURPRISES THAT WOULD DESTROY THIS MARKET), (SPY), (TLT), (FXE), (USO) SPDR S&P 500 ETF (SPY) iShares 20+ Year Treasury Bond (TLT) CurrencyShares Euro ETF (FXE) United States Oil (USO)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Incline Village, NV on Friday, October 7, 2016. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on

Global Market Comments October 3, 2016 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE COMING WEEK), (SPX), (VIX), (USO), (AAPL), (WHY TECHNICAL ANALYSIS DOESN?T WORK), (SPY) S&P 500 (^GSPC) VOLATILITY S&P 500 (^VIX) United States Oil (USO) Apple Inc. (AAPL) SPDR S&P 500 ETF (SPY)

It?s a good thing I went to an Oktoberfest last week. That gave me a chance to get my German up to snuff just in time for Deutsche Bank to run into financial troubles. Since 2008, the knee jerk reaction to bad news about any major bank is that the Lehman Brothers nightmare is about

The S&P 500 has just bounced off the 214 level for the second time this month. Is it safe to come out of your cave? Is to time to take the hard hat back to the basement? If you had taken Cunard?s round-the-world cruise three months ago, as I recommended, you would be landing in

Global Market Comments September 30, 2016 Fiat Lux Featured Trade: (YOUR BEST PERFORMING ASSET JUST GOT BETTER), (IYR), (PHM), (LEN), (DHI), (PETER F. DRUCKER ON MANAGEMENT) iShares US Real Estate (IYR) PulteGroup, Inc. (PHM) Lennar Corporation (LEN) DR Horton Inc. (DHI)

As most of my subscribers? know, I try to call all of them at least once a year and address their individual concerns. Not only do I pick up some great information about regions, industries, businesses, and companies, I also learn how to rapidly evolve the Diary of a Mad Hedge Fund Trader service to

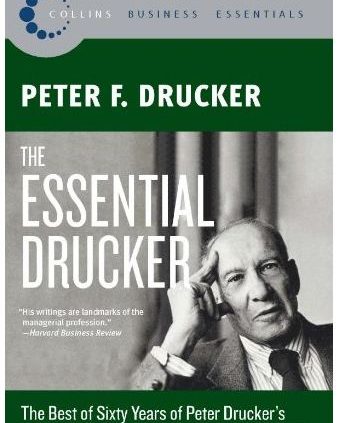

If you have been living in a cave for the last 75 years and missed the work of management guru, Peter F. Drucker, here is your chance to catch up.I finished reading The Essential Drucker, a weighty tome of 368 pages which summarized the high points and pearls of wisdom of the author's 38 books

Global Market Comments September 29, 2016 Fiat Lux Featured Trade: (DON?T BUY THE OIL RALLY), (USO), (XLE), (XOM), (SOME SAGE ADVICE ON ASSET ALLOCATION), (BECOME MY FACEBOOK FRIEND) United States Oil (USO) Energy Select Sector SPDR ETF (XLE) Exxon Mobil Corporation (XOM)

I could see this one coming a mile off. Expectations of a substantial outcome from the Algiers OPEC meeting were zero. Traders loaded up on the short side. So when word leaked out about a production cap to take place in November, futures went screaming, adding $3, or 6.75% to the price of Texas tea

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.