Holy smokes! You really did it with the UNG trade. Up 25% in two hours? How did you do that? It was the best trade you?ve ever done. It?s the best trade I?ve ever done. It was the right thing to do at the right time. And you had the balls to put it on

?Investing and investment is the one sphere of life where victory, security, and success are always to the minority and never to the majority. When you find anyone agreeing with you, change your mind,? said the famous economist, John Maynard Keynes.

Global Market Comments November 12, 2015 Fiat Lux Featured Trade: (NEW TRAINING VIDEO ON VERTICAL BEAR PUT SPREADS), (HAPPY BIRTHDAY IRS!)

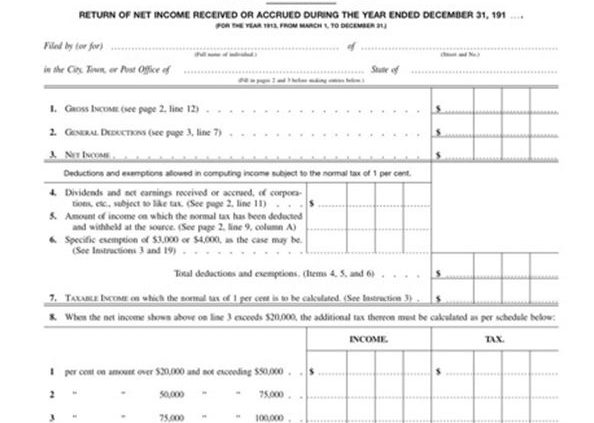

Some taxpayers have been sending birthday cards in with their tax returns this year. That?s because the International Revenue Service, the collector of America?s tax revenues, is 102 years old this year. Although the wealthy have been paying income taxes since the 1861-65 Civil War, they did not apply to the rest of us until

?I?d rather have Tim Cook running my company than Carl Icahn,? said Internet journalist and biographer, Walter Isaacson.

Global Market Comments November 11, 2015 Fiat Lux SPECIAL VETERAN?S DAY ISSUE Featured Trade: (WE?RE HIRING!) (THE TAX RATE FALLACY), (A TRIBUTE TO A TRUE VETERAN)

Thanks to an influx of new readers from around the world, the Diary of a Mad Hedge Fund Trader has no choice but to expand its staff. We are looking for someone who can help us with the innards of our website. That involves the daily maintenance of the website, software updates, and the posting

Global Market Comments November 10, 2015 Fiat Lux Featured Trade: (TRADING FOR THE NON-TRADER), (ROM), (UXI), (UCC), (UYG), (AN EVENING WITH TRAVEL GURU ARTHUR FROMMER)ProShares Ultra Technology (ROM) ProShares Ultra Industrials (UXI) ProShares Ultra Consumer Services (UCC) ProShares Ultra Financials (UYG)

Global Market Comments November 9, 2015 Fiat Lux Featured Trade: (THE BLOCKBUSTER OCTOBER NONFARM PAYROLL AND YOUR PORTFOLIO), (SPY), (TLT), (TBT), (FXY), (YCS), (BANK OF AMERICA IS BREAKING OUT ALL OVER), (BAC), (XLF), (TLT) (THE TECHNOLOGY NIGHTMARE COMING TO YOUR CITY) SPDR S&P 500 ETF (SPY) iShares 20+ Year Treasury Bond (TLT) ProShares UltraShort 20+

You could almost hear the roof blow off the top of the New York Stock Exchange when they announced the October nonfarm payroll. At a mind blowing 271,000, it came in at double the low ball pessimistic estimates. The headline unemployment rate dropped to 5.0%, a decade low. The 4% handle beckons next month. Bonds

In view of the blockbuster October nonfarm payroll report, and the collapse of the bond market that followed, it is time to take a cold, steely eyed look, and the financials, especially Bank of America (BAC). What did the stock do? It rocketed by 6.5%, along with the rest of the market, hitting four month

Global Market Comments November 6, 2015 Fiat Lux Featured Trade: (WELCOME TO THE SIX WEEK YEAR), (SPY), (TLT), (BAC), (GS), (SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS) SPDR S&P 500 ETF (SPY) iShares 20+ Year Treasury Bond (TLT) Bank of America Corporation (BAC) The Goldman Sachs Group, Inc. (GS)

Both the major stock and bond indexes are unchanged on the year, as of this week. Those who left on January 1 to sail a yacht around the world, engage in a research project in Antarctica, or meditate at an Ashram in India, will return today and discover that 2015 effectively didn?t happen, at least

Global Market Comments November 5, 2015 Fiat Lux Featured Trade: (WHY DOCTORS MAKE TERRIBLE TRADERS) (KEEP AMERICAN EXPRESS ON YOUR SHORT LIST), (AXP), (V)American Express Company (AXP) Visa Inc. (V)

I remember that the highlight of my 1968 trip to Europe was always my visit to the nearest American Express (AXP) office to pick up my mail.In those pre Internet and email days, it was the only way that a fresh faced 16 year old could stay in touch with a hand wringing family while

Global Market Comments November 4, 2015 Fiat Lux SPECIAL CAR ISSUE Featured Trade: (WHAT I HEARD AT DINNER LAST NIGHT), (GM), (F), (TM), (TSLA) General Motors Company (GM) Ford Motor Co. (F) Toyota Motor Corporation (TM) Tesla Motors, Inc. (TSLA)

It was the kind of dinner invitation I couldn?t turn down. What I learned was amazing. I usually prefer to spend my evenings at home catching up on my research, calling customers, and plotting my next great Trade Alert. So it takes a lot to get me out of my cozy digs, especially during an

?If you want to learn the art of medicine, it is best to follow an army,? said Hippocrates, the ancient Greek physician.

Global Market Comments November 3, 2015 Fiat Lux Featured Trade: (NOVEMBER 4 GLOBAL STRATEGY WEBINAR), (WHAT COULD DESTROY THIS MARKET?), (SPY), (TLT), (FXE), (USO)SPDR S&P 500 ETF (SPY) iShares 20+ Year Treasury Bond (TLT) CurrencyShares Euro ETF (FXE) United States Oil (USO)

The Teflon market is back. Good news is good news. Bad news is good news. What could be better than that? However, there are a few issues out there lurking on the horizon that could pee on everyone?s parade. Let me call out the roster for you. 1) Economic Data Continues to Weaken - After

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.