Global Market Comments November 2, 2015 Fiat Lux Featured Trade: (WHY TECHNICAL ANALYSIS DOESN?T WORK) (SPY), (QQQ), (IWM), (VIX), (IBB), (HCA), (PANW), (SCTY), (TSLA), (BIDDING FOR THE STARS), (SPX), (INDU), (TESTIMONIAL)SPDR S&P 500 ETF (SPY) PowerShares QQQ Trust, Series 1 (QQQ) iShares Russell 2000 (IWM) VOLATILITY S&P 500 (^VIX) iShares Nasdaq Biotechnology (IBB) HCA Holdings,

A few years ago, I went to a charity fund raiser at San Francisco?s priciest jewelry store, Shreve & Co., where the well-heeled men bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war over one of the

?Short term volatility creates long term opportunity, said Rupal Bhansali, of the Ariel International Fund.

Global Market Comments October 30, 2015 Fiat Lux Featured Trade: (NOVEMBER 4 GLOBAL STRATEGY WEBINAR), (BATTERY BREAKTROUGH PROMISES BIG DIVIDENDS), (TSLA), (BECOME MY FACEBOOK FRIEND) Tesla Motors, Inc. (TSLA)

Global Market Comments October 29, 2015 Fiat Lux Featured Trade: (CELGENE WILL MAKE A COMEBACK), (CELG), (XLV), (IBB), (REVISITING CHENIERE ENERGY), (LNG), (USO), (UNG) (TESTIMONIAL) Celgene Corporation (CELG) Health Care Select Sector SPDR ETF (XLV) Health Care Select Sector SPDR ETF (XLV) Cheniere Energy, Inc. (LNG) United States Oil Fund LP (USO) United States Natural

It was known as the ?Tweet that sank Wall Street.? When presidential candidate Hillary Clinton attacked the drug industry last summer, the entire pharmaceutical and health care industries were taken out to the woodshed and beaten like the proverbial red headed stepchild (my apologies in advance to red heads). One of the principal victims was

I am constantly asked if there are any ways investors can take advantage of the current collapse in natural gas prices. You don?t want to touch the gas producing companies, like Chesapeake (CHK) and Devon (DVN), because prices for natural gas are probably going to stay down for years. Good firms that benefit from the

Global Market Comments October 28, 2015 Fiat Lux Featured Trade: (LAST CHANCE TO ATTEND THE FRIDAY, OCTOBER 30 SAN FRANCISCO STRATEGY LUNCHEON), (GENERAL ELECTRIC?S IMAGINATION REALLY IS AT WORK), (GE), (ELUXY), (SYF) (TEN REASONS WHY BONDS WON?T CRASH) General Electric Company (GE) Electrolux AB (ELUXY) Synchrony Financial (SYF)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, October 30, 2015. An excellent meal will be followed by a wide ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on

Global Market Comments October 27, 2015 Fiat Lux SPECIAL ENERGY ISSUE Featured Trade: (IS THIS THE BOTTOM FOR OIL?), (USO), (XOM), (COP), (OXY), (KOL) United States Oil ETF (USO) Exxon Mobil Corporation (XOM) ConocoPhillips (COP) Occidental Petroleum Corporation (OXY) Market Vectors Coal ETF (KOL)

There have been two sources of oil information this year. The producers saw nothing but endless supply stretching over the horizon, and sold every rally with both hands. The speculators and futures traders have been overwhelmingly positive, buying every dip because their charts told them to, and getting stopped out more times than I have

Global Market Comments October 23, 2015 Fiat Lux Featured Trade: (THE COAST IS CLEAR), (SPY), (XLI), (XLY), (HOW TO EXECUTE A VERTICAL BULL CALL SPREAD) (AAPL), (TESTIMONIAL) SPDR S&P 500 ETF (SPY) Industrial Select Sector SPDR ETF (XLI) Consumer Discret Sel Sect SPDR ETF (XLY) Apple Inc. (AAPL)

Sometimes I hate being so right. I was almost alone in the desert last August, when I asserted that the dramatic sell off in share prices was nothing more than a stock market event (click here for ?The Volatility Peak is In?. The economy was fine, there were no geopolitical events of importance, and prices

Global Market Comments October 22, 2015 Fiat Lux Featured Trade: (FRIDAY, OCTOBER 30 SAN FRANCISCO STRATEGY LUNCHEON) (SWITCHING FROM GROWTH TO VALUE), (GE), (BAC), (C), (GS), (HD), (DIS), (AAPL), (MSFT), (UUP), (FXE), (FXY), (YCS), (CYB), (FXA), (FXC) General Electric Company (GE) Bank of America Corporation (BAC) Citigroup Inc. (C) The Goldman Sachs Group, Inc. (GS)

All good things must come to an end. For most of 2015, growth stocks far and away have been the outstanding performers in the US stock market. Almost daily, I delighted in sending you trade alerts to buy winners, like Palo Alto Networks (PANW), Tesla (TSLA), and the Russell 2000 (IWM). And so they delivered.

?They ring a bell at the bottom, and right now the bell is ringing,? said Robert Reynolds, a manager at Putnam Investment Fund.

Global Market Comments October 21, 2015 Fiat Lux Featured Trade: (EL NINO IS CLOSING IN ON YOUR PORTFOLIO), (CORN), (SOYB), (DBA), (MOO), (TEN TIPS FOR SURVIVING A DAY OFF WITH ME) Teucrium Corn ETF (CORN) Teucrium Soybean ETF (SOYB) PowerShares DB Agriculture ETF (DBA) Market Vectors Agribusiness ETF (MOO)

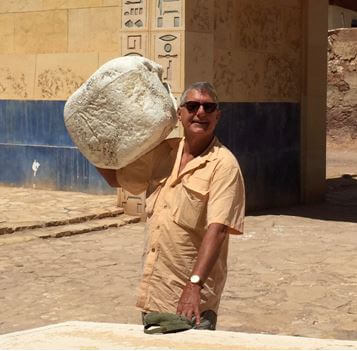

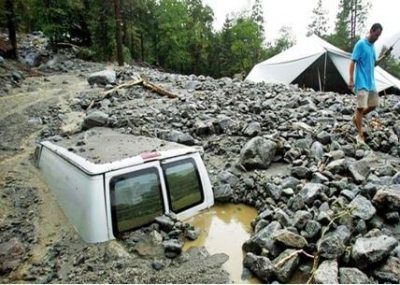

I came up to my Tahoe lakefront mansion in Nevada this week so I could get in some serious mountain climbing after the markets closed every day. What did I get? Three days of torrential downpours. The rain was hitting the roof so hard last night that it kept me awake. Flash floods are wreaking

Global Market Comments October 20, 2015 Fiat Lux Featured Trade: (LAST CHANCE TO ATTEND THE FRIDAY, OCTOBER 23 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON), (OCTOBER 21 GLOBAL STRATEGY WEBINAR), (ARE YOU IN THE 1%?), (SNE), (HMC) Sony Corporation (SNE) Honda Motor Co., Ltd. (HMC)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Incline Village, Nevada on Friday, October 23, 2015. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.