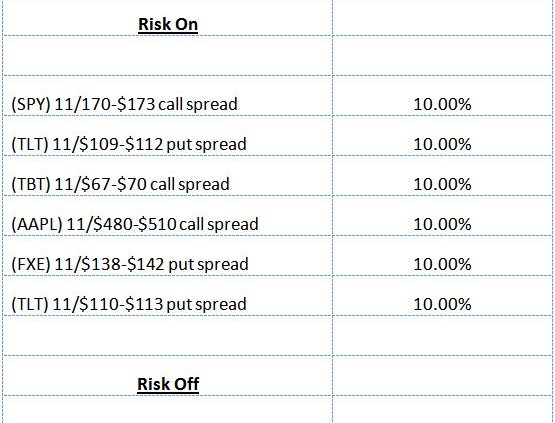

Today, many followers of the Mad Hedge Fund Trader?s Trade Alert service have up to eight November option spreads expiring at their maximum potential profit. My strategy of taking advantage of the short November expiration calendar and betting that the markets stay in narrow ranges turned out to be wildly successful. At this stage I

We have a fantastic double bottom developing here on the charts for the Australian dollar (FXA). I think that RISK ON will be the order of the day for the next six months, and the currency of the Land Down Under should prosper mightily. This is a play on the modest recovery of the Chinese

Global Market Comments November 14, 2013 Fiat Lux Featured Trade: (LOADING UP ON THE FINANCIALS), (C), (BAC), (JPM), (MS), (XLF) (THE BULL MARKET IN AMERICAN COLLEGE DEGREES) Citigroup, Inc. (C) Bank of America Corporation (BAC) JPMorgan Chase & Co. (JPM) Morgan Stanley (MS) Financial Select Sector SPDR (XLF)

After ignoring the financial sector for most of the year, I am more than happy to jump into it here. The sector has been a serious laggard for the past three months, trailing the front-runners I picked in technology, industrials, health care, and consumer cyclicals. After chasing these favorites, traders are now looking for new

Global Market Comments November 13, 2013 Fiat Lux Featured Trade: (DOUBLING UP ON MY YEN SHORTS), (FXY), (YCS), (DXJ), (UUP), (SAN FRANCISCO?S SUFFERING RENTERS TAKE ANOTHER HIT), (WHERE THE ECONOMIST ?BIG MAC? INDEX FINDS CURRENCY VALUE), (MCD), (FXE), (YCS), (FXF), (CYB) (TESTIMONIAL) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS) WisdomTree Japan Hedged Equity

My bet that the Japanese yen (FXY) would weaken against the dollar has paid off handsomely. I am now so confident that we are finally breaking out of a six month trading range to the downside that I am more than happy to double my short position in the yen. I am therefore taking on

Global Market Comments November 12, 2013 Fiat Lux Featured Trade: (YOU JUST CAN?T KEEP AMERICA DOWN), (TLT), (SPY), (GLD), (A SPECIAL NOTE ON NOVEMBER EXERCISED OPTIONS) iShares 20+ Year Treasury Bond ETF (TLT) SPDR S&P 500 (SPY) SPDR Gold Shares (GLD)

You just can?t keep America down. That is the overwhelming message from Friday?s blockbuster October nonfarm payroll showing that 204,000 jobs were added, double the industry forecasts. The headline unemployment rate ratcheted back up from 7.2% to 7.3%, the first gain in many months. August and September were revised up by an eye popping 60,000

There are only 4 days left until the equity option expiration on November 15. My short dated November expiration play turned out to be wildly successful, with all nine of these trades quickly turning profitable. Including the six positions we now have on board, the last 14 consecutive Trade Alerts have been profitable, raising the

Global Market Comments November 11, 2013 Fiat Lux Featured Trade: (MAD HEDGE FUND TRADER 2013 PERFORMANCE TOPS 51%), (TLT), (TBT), (AAPL), (XLI), (IWM), (SPY) (TESTIMONIAL), (A TRIBUTE TO A TRUE VETERAN) iShares 20+ Year Treasury Bond ETF (TLT) ProShares UltraShort 20+ Year Treasury (TBT) Apple Inc. (AAPL) Industrial Select Sector SPDR (XLI) iShares Russell 2000

The Trade Alert service of the Mad Hedge Fund Trader has posted a new all time high in performance, taking in 46.05% so far in 2013. The three-year return is an eye popping 101.7%, taking the averaged annualized return to 35%. That compares to a far more modest increase for the Dow Average during the

Global Market Comments November 8, 2013 Fiat Lux Featured Trade: (THE RISING RISK OF A MARKET MELT UP) (FXE), (FXY), (YCS), (FXA), (SPY), (USO), (THE PARTY IS JUST GETTING STARTED WITH THE JAPANESE YEN), (FXY), (YCS), (DXJ) CurrencyShares Euro Trust (FXE) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS) CurrencyShares Australian Dollar Trust (FXA)

The risk of a major market melt up just took a quantum leap upward with the European Central Bank?s surprise 25 basis points in interest rates a few minutes ago. The move had not been expected from normally sleepy and moribund European monetary authorities for a few more months. The ECB?s action has major positive

Global Market Comments November 7, 2013 Fiat Lux Featured Trade: (SELLING THE YEN, AGAIN), (FXY), (YCS), (DXJ), (ENJOY THE DOLLAR RALLY WHILE IT LASTS), (FXA), (FXC), (BNZ), (CYB), (FXE) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS) WisdomTree Japan Hedged Equity (DXJ) CurrencyShares Australian Dollar Trust (FXA) CurrencyShares Canadian Dollar Trust (FXC) WisdomTree Dreyfus

The Bank of Japan released the minutes of its previous meeting last night, so we now officially know what?s bothering them. While the inflation rate has edged up to 0.7%, it is still miles (kilometers) away from its two year target of 2.0%. The 100% growth in the money supply promised by the end of

Any trader will tell you the trend is your friend, and the overwhelming direction for the US dollar for the last 220 years has been down. Our first Treasury Secretary, Alexander Hamilton, found himself constantly embroiled in sex scandals. Take a ten-dollar bill out of your wallet and you?re looking at a picture of a

Global Market Comments November 6, 2013 Fiat Lux (SPECIAL BATTERY ISSUE) Featured Trade: (THE GREAT RACE FOR BATTERY TECHNOLOGY), (TSLA), (GM), (BYDDF), (NSANY), (SQM), (TM) Tesla Motors, Inc. (TSLA) General Motors Company (GM) BYD Company Ltd. (BYDDF) Nissan Motor Co. Ltd. (NSANY) Chemical & Mining Co. of Chile Inc. (SQM) Toyota Motor Corporation (TM)

One hundred years from now, historians will probably date the beginning of the fall of the American Empire to 1986. That is the year President Ronald Reagan ordered Jimmy Carter?s solar panels torn down from the White House roof, and when Chinese Premier Deng Xiaoping launched his secret ?863? program to make his country a

Global Market Comments November 5, 2013 Fiat Lux Featured Trade: (WHY I?M HAMMERING THE BOND MARKET), (TLT), (TBT), (LQD), (LINE), (MUB), (HYG), (JNK), (TAKE A LOOK AT OCCIDENTAL PETROLEUM), (OXY), (BP), (OIL), (UNG),? (NSANY), (XOM) iShares 20+ Year Treasury Bond ETF (TLT) ProShares UltraShort 20+ Year Treasury (TBT) iShares iBoxx $ Invst Grade Crp Bond

Those lucky traders who have been following my Trade Alert service are well aware that I have been hamming the bond market for the past week. These new positions were a major factor in adding an impressive 5% to my model trading portfolio P&L during a week when there was very little happening in the

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.