Global Market Comments October 14, 2013 Fiat Lux Featured Trade: (NOVEMBER 1 SAN FRANCISCO STRATEGY LUNCHEON), (THE GOVERNMENT SHUTDOWN IS WORSE THAN YOU THINK), (A SAD FAREWELL TO HELEN THOMAS)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

I am rapidly coming to the depressing conclusion that the government shutdown, now in its 15th day, is going to have a far greater impact on the economy than most economists realize. When the markets figure this out, the result for share prices could be dire, putting my entire yearend bull case at risk. My

Global Market Comments October 11, 2013 Fiat Lux Featured Trade: (JOIN THE INVEST LIKE A MONSTER SAN FRANCISCO TRADING CONFERENCE), (APPLE IS READY TO EXPLODE), (AAPL), (CHL) Apple Inc. (AAPL) China Mobile Limited (CHL)

I am pleased to announce that I will be participating in the Invest like a Monster Trading Conference in San Francisco during October 25-26. The two-day event brings together experts from across the financial landscape that will improve your understanding of markets by a quantum leap and measurably boost your own personal trading performance. Tickets

You have to be impressed how Apple shares have been trading during the Washington shutdown and the debt ceiling crisis. While other highflying technology stocks have crashed and burned, Apple has held like the Rock of Gibraltar. Is this presaging much better things to come? After the bar was set extremely low in the run

Global Market Comments October 10, 2013 Fiat Lux Featured Trade: (THE BEST ETF?S OF 2013), Guggenheim Solar ETF (TAN) Market Vectors Solar Energy ETF (KWT) First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) Market Vectors Global Alternative Energy ETF (GEX) The PowerShares Wilderhill Clean Energy Portfolio (PBW) The First Trust ISE Global Wind

I?m sure you all spent the better part of last January explaining to your clients that they should be pouring all of their money into alternative energy, social media, and biotech ETF?s. What! You didn?t? You obviously failed to get the memo. Well, neither did I. Yes, I know this sounds like the makeup of

You can? keep a good stock down. That?s the obvious message on Tesla (TLSA) shares in the wake of the fire that consumed one of its $80,000 Model?s S-1?s on a Washington state road after it ran over the rear bumper of the truck it was following. The video was quickly plastered all over YouTube

Global Market Comments October 9, 2013 Fiat Lux Featured Trade: (CUTTING BACK MY RISK), (SPY), (FXY), (YCS), (DXJ), (AAPL), (NFLX), (HLF), (VIX), (WHAT?S GOING ON WITH THE VOLATILITY INDEX?), (VIX), (VXX) SPDR S&P 500 (SPY) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS) WisdomTree Japan Hedged Equity (DXJ) Apple Inc. (AAPL) Netflix, Inc. (NFLX)

By now, you have figured out that I executed a major ?derisking? of my model trading portfolio today, cutting my exposure by two thirds. Most of these positions only had a few basis points in maximum profit left, so bailing here was a no brainer, a case of ?Basic Risk Control 101.? Better to laugh

After crawling off the mat at the 12% level, and rising all the way back up to 21%, traders are wondering if the Volatility Index (VIX) is finally coming back to life. Or is this just another dead cat bounce? It wasn?t supposed to work that way. Falling markets should send investors scrambling to buy

Global Market Comments October 8, 2013 Fiat Lux Featured Trade: (THE NEW WAR ON HEDGE FUND MANAGERS), (TEA WITH SECRETARY OF STATE GEORGE SHULTZ)

Yang Yanming was slowly led from his cell by two burly uniformed guards in Beijing?s central prison to a waiting van in the courtyard, his hands cuffed behind him and his head bowed. Once in the vehicle, he was strapped to a gurney, hooked up to an IV, and given a highly concentrated injection of

Global Market Comments October 7, 2013 Fiat Lux Featured Trade: (NOVEMBER 1 SAN FRANCISCO STRATEGY LUNCHEON), (SAY GOODBYE TO THE WASHINGTON DISCOUNT), (XLY), (UCC), (XLI), (UXI), (XLK), (ROM), (XLV), (RXL), (THIS IS NOT YOUR FATHER?S NUCLEAR POWER PLANT) Consumer Discret Select Sector SPDR (XLY) ProShares Ultra Consumer Services (UCC) Industrial Select Sector SPDR (XLI) ProShares

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

If it hasn?t happened by today, then it is no more than a week away. The deep discount suffered by American stocks is about to go away. Thanks to the manufactured uncertainty emanating from the nation?s capital created by the government shutdown, stocks have been selling at a 10% or more discount to where they

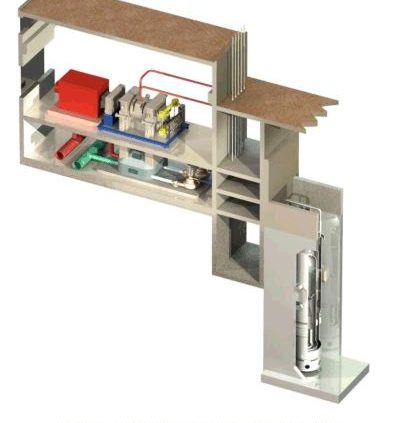

On my recent trip to Oregon I met with venture capital investors in NuScale Power, which is trailblazing, the brave new world of ?new? nuclear. Their technology has been pioneered by Dr. Jose Reyes, dean of the School of Engineering at Oregon State University in Corvallis. This is definitely not your father?s nuclear power plant.

Global Market Comments October 4, 2013 Fiat Lux Featured Trade: (OCTOBER 9 GLOBAL STRATEGY WEBINAR), (AN EVENING WITH THE CHINESE INTELLIGENCE SERVICE), (FXI), (CYB), (BIDU), (CHL), (BYDDF), (CHA) iShares China Large-Cap (FXI) WisdomTree Chinese Yuan (CYB) Baidu, Inc. (BIDU) China Mobile Limited (CHL) BYD Company Ltd. (BYDDF) China Telecom Corp. Ltd. (CHA)

Global Market Comments October 3, 2013 Fiat Lux Featured Trade: (JOIN THE INVEST LIKE A MONSTER SAN FRANCISCO TRADING CONFERENCE), (THE MAD DAY TRADER?S Q4 TARGETS), (SPY), (QQQ), (TLT), (USO), (UNG), (GLD), (FXY), (FXE), (AN AFTERNOON WITH DR. PAUL EHRLICH), (POT), (MOS), (AGU), (CORN), (WEAT), (SOYB) SPDR S&P 500 (SPY) PowerShares QQQ (QQQ) iShares Barclays

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.