Global Market Comments April 22, 2013 Fiat Lux Featured Trade: (MAY 8 LAS VEGAS STRATEGY LUNCHEON), (THE TAX RATE FALLACY), (AN AFTERNOON WITH BOONE PICKENS)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on

When anyone starts lecturing you that the US has the highest tax rate in the industrialized world, just turn around, walk away, and pretend you never heard of them. This person is either ignorant about this country's taxation system, or is deliberately trying to deceive you. According to a report released by the Internal Revenue

Reformed oil man, repenting sinner, and borne again environmentalist T. Boone Pickens says that ?When we turn the US green, it will have the best economy ever.? I met the spry, homespun billionaire at San Francisco?s Mark Hopkins on a leg of his self-financed national campaign to get America to kick its dangerous dependence on

Global Market Comments April 19, 2013 Fiat Lux Featured Trade: (MAY 8 LAS VEGAS STRATEGY LUNCHEON), (AMERICA?S NATIVE INDIAN ECONOMY), (BUSINESS IS BOOMING AT ROUGH TIMES), (GLD), (SLV), (CCJ), (NLR) SPDR Gold Shares (GLD) iShares Silver Trust (SLV) Cameco Corporation (CCJ) Market Vectors Uranium+Nuclear Enrgy ETF (NLR)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on

When I was remodeling my 160-year-old London house, the chimney was in desperate need of attention. After the bricklayer crawled up the fireplace, he found a yellowed and somewhat singed envelope addressed to Santa Claus. Thinking it was placed there by my kids, he handed it over to me. In it was a letter dated

Following Howard Ruff for the last 35 years has always been eye opening, if not entertaining. The irascible Mormon is the publisher of Ruff Times, one of the oldest investment letters in the business, and one of the original worshipers of hard assets. Ruff says that any investment denominated in dollars is a mistake, which

Global Market Comments April 18, 2013 Fiat Lux Featured Trade: (APRIL 19 CHICAGO STRATEGY LUNCHEON), (NOTICE TO MILITARY SUBSCRIBERS), (CHINA?S COMING DEMOGRAPHIC NIGHTMARE), (THE TECHNOLOGY NIGHTMARE COMING TO YOUR CITY)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Friday, April 19. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds, foreign

To the dozens of subscribers in Iraq, Afghanistan, and the surrounding ships at sea, thank you for your service! I think it is very wise to use your free time to read my letter and learn about financial markets in preparation for an entry into the financial services when you muster out. Nobody is going

Thanks to China's ?one child only? policy adopted 30 years ago, and a cultural preference for children who grow up to become family safety nets, there are now 32 million more boys under the age of 20 than girls. Large scale interference with the natural male:female ratio has been tracked with some fascination by demographers

I tell people at my strategy luncheons that living in the San Francisco Bay area is like living in the future. There is an explosion of high tech innovation going on here, and we locals often find ourselves the guinea pigs for the latest hot products. However, sometimes the future is not such a great

Global Market Comments April 17, 2013 Fiat Lux Featured Trade: (AMERICA?S DEMOGRAPHIC TIME BOMB), (TRIBUTE TO A GIANT OF JOURNALISM, ROY ESSOYAN)

Global Market Comments April 16, 2013 Fiat Lux Featured Trade: (MAY 8 LAS VEGAS STRATEGY LUNCHEON), (BIDDING FOR THE STARS), (DOW AVERAGE), (SPY), (AN EVENING WITH TRAVEL GURU ARTHUR FROMMER), (HAPPY BIRTHDAY IRS!) SPDR S&P 500 ETF Trust (SPY)

Come join me for the lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view

A few years ago, I went to a charity fundraiser at San Francisco?s priciest jewelry store, Shreve & Co. The well-heeled masters of the universe bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war over one of

Travel guru, Arthur Frommer, says that now is the best time to travel in 20 years, thanks to a combination of a strong dollar and desperate price-cutting forced by the recession. Three years after oil hit an historic peak at $148/barrel, when $500 fuel surcharges abounded, and the demise of the travel industry was widely

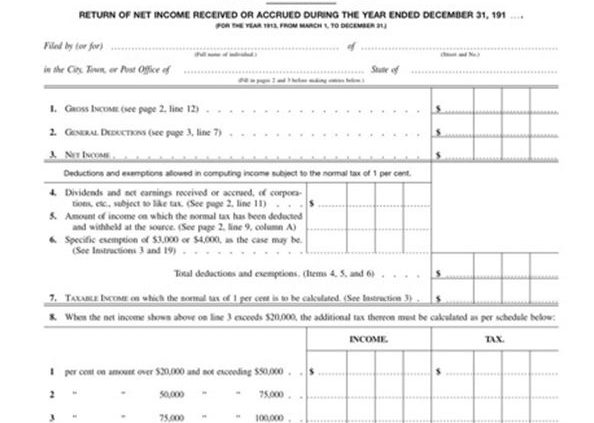

Some taxpayers have been sending birthday cards in with their tax returns this year. That?s because the International Revenue Service, the collector of America?s tax revenues, is 100 years old this week. Although the wealthy have been paying income taxes since the 1861-65 Civil War, they did not apply to the rest of us until

Global Market Comments April 15, 2013 Fiat Lux Featured Trade: (GOLD: NEXT STOP $1,250!), (GLD), (GDX), (SLV), (PPLT), (PALL), (USO), (CU), (FXY), (APRIL 17 GLOBAL STRATEGY WEBINAR), (APRIL 19 CHICAGO STRATEGY LUNCHEON), (SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS) SPDR Gold Shares (GLD) Market Vectors Gold Miners ETF (GDX) iShares Silver Trust (SLV)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.