Trade Alert - (AAPL) – BUY

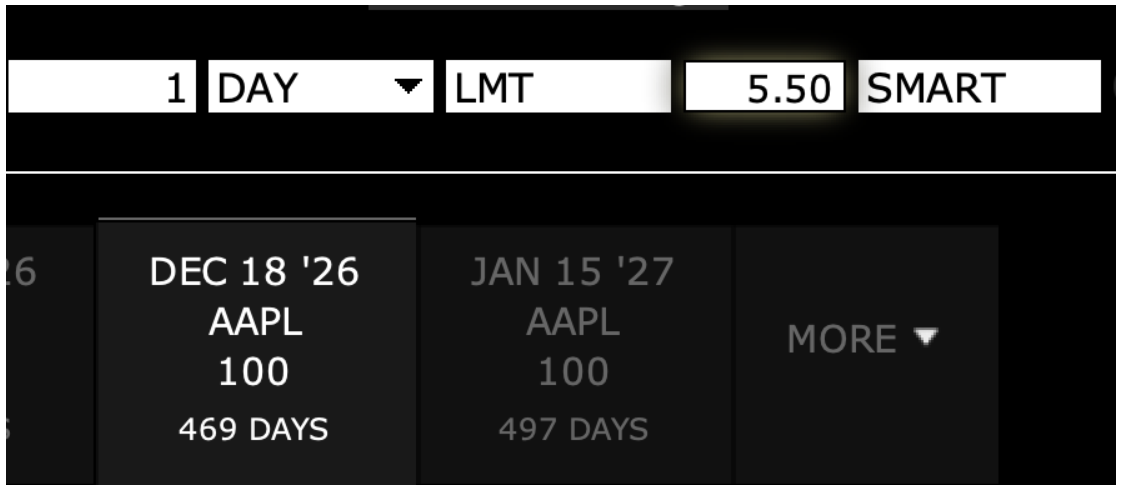

BUY the Apple (AAPL) December 2026 $230-$240 at-the-money vertical Bull Call spread LEAPS at $5.50 or best

Opening Trade

9-5-2025

expiration date: December 18, 2026

Number of Contracts = 1 contract

With Apple about to announce its next-generation iPhone 17 on Sunday, which is AI-enabled, this is a good time to dive into a long-term Apple LEAPS.

You hear a lot of incredible stories in Silicon Valley.

An electronic compact disc is coming that can deliver perfect sound and movies. Have you heard of the Internet? Compaq is offering a computer that will sit on your laptop! Do you have any idea how Google is going to make money? Steve Jobs is building a smartphone! Is he out of his mind? Elon Musk is building an electric car with a 250-mile range. Hey, I heard about this thing called “artificial intelligence.”

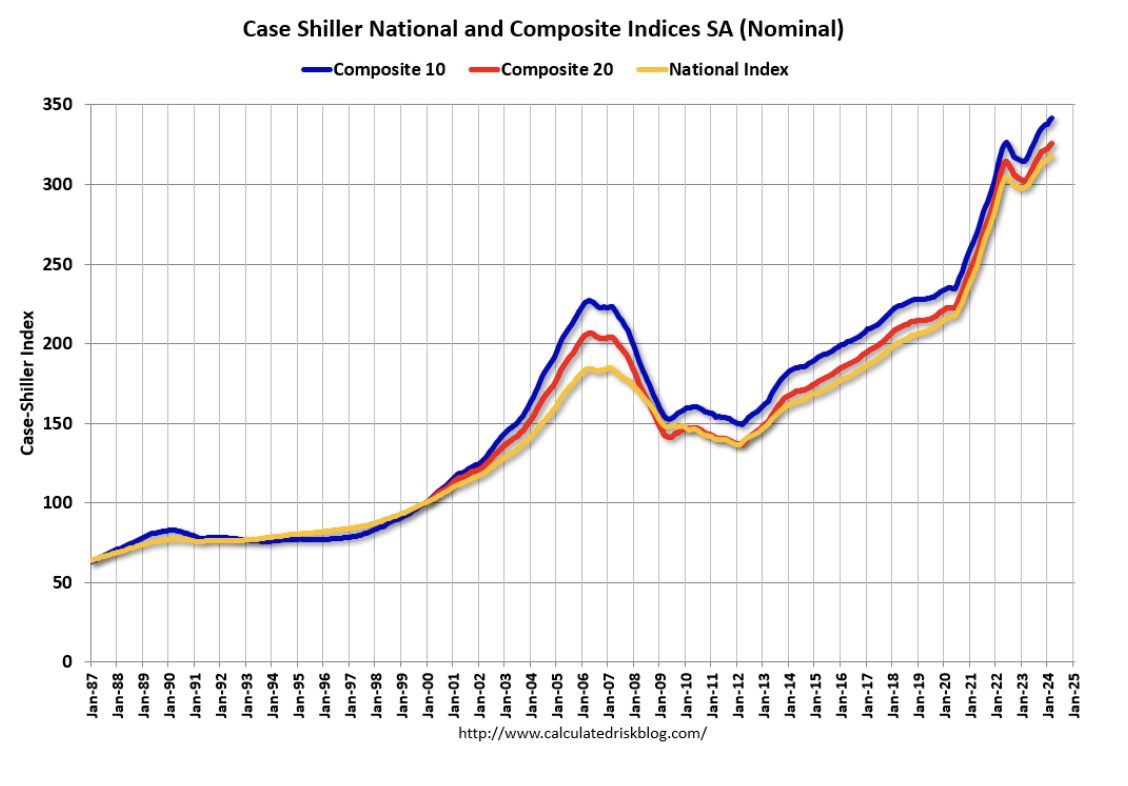

So I listened very carefully the other day when a friend of mine told me he had scored the real estate deal of the century.

His house had sat on the market like dead wood for a year and a half, priced at $4.0 million. It was a very nice 5,000 square foot Italian villa-type home with a huge garden and a fantastic 360-degree view.

Then out of the blue, a cash buyer said he wanted to rent the house for a year for the spectacular over-the-market rent of $20,000 a month, plus all utilities. Then, he offered to pay 10% over the asking price, or $4.4 million to buy the house outright, and would pay $400,000 in cash for the option to do so, payable immediately.

My friend, puzzled but ecstatic, asked why he was going about buying a home in this way. The buyer answered that he had some stock options from his company that he didn’t want to cash in for a year. His profession? He had a PhD in artificial intelligence.

That set the alarm bells off in my head.

I pulled out a paper map of the San Francisco Bay Area and drew a circle around the house within one hour driving time to reduce the number of potential candidates. Then I called a seasoned technical analyst and asked him which big California stock had a chart that was just about to break out to the upside. He didn’t hesitate.

Apple!

It all makes so much sense. Apple is one company behind in artificial intelligence that has the most money to do something about it. All they have to do is buy a ready-made AI company like Perplexity, and it will be out front. The shares will race to $260. I then calculated how high Apple shares would have to rise to justify the enormous premium for my friend’s house. I hit bang on $260.

I am therefore buying the Apple (AAPL) December 2026 $230-$240 at-the-money vertical Bull Call spread LEAPS at $5.50 or best

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

These LEAPS are illiquid, so you are going to have to play around with prices to get a position. Start at $5.00, then increase to $5.50, $5.60, $5.70, and so on. Don’t pay more than $7.00, or these will get expensive. It is easier to do this on days when the stock market is down.

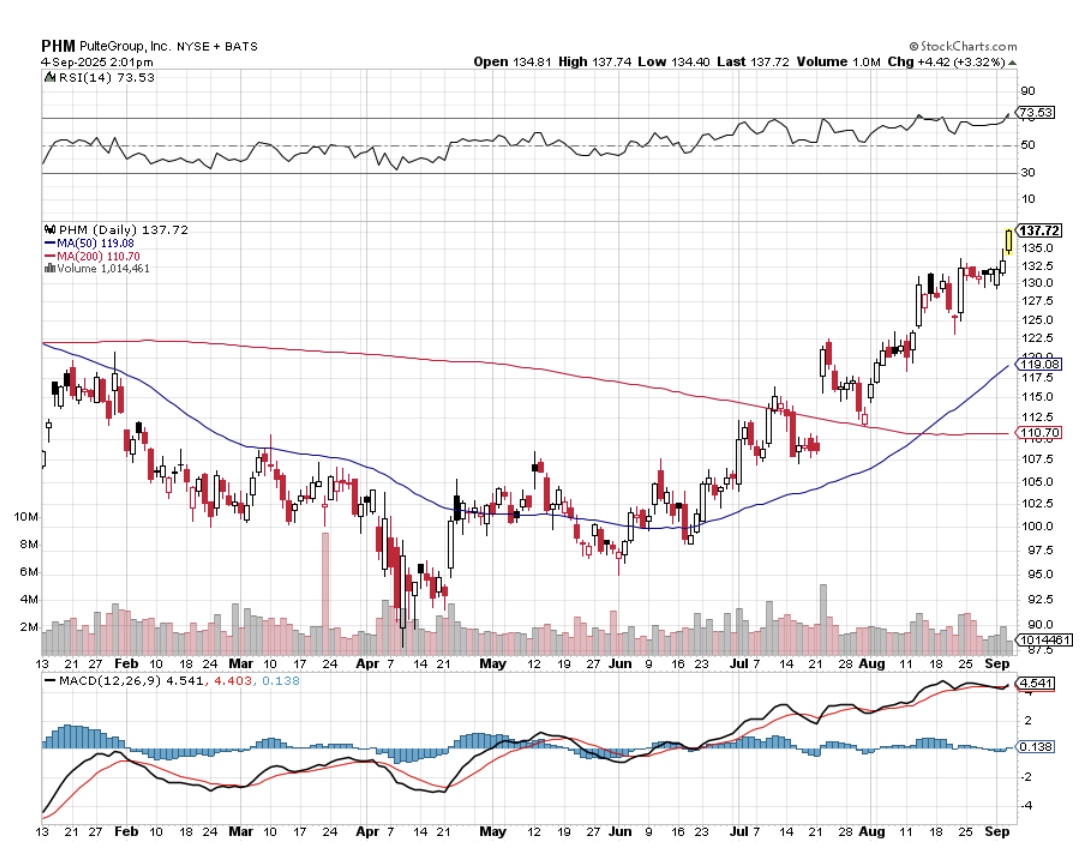

This is a bet that Apple (APPL) will not fall below $240 by the December 18, 2026, option expiration in 15 months. Apple shares have to rise only 70 cents in 15 months to hit the upper strike in this LEAPS.

To learn more about the company, please click here to visit their website.

Notice that the day-to-day volatility of LEAPS prices is minuscule, less than 10%, since the time value is so great and you have a long position simultaneously offset by a short one.

This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month, just entering new orders every day. I know this can be tedious, but getting screwed by overpaying for a position is even more tedious.

Look at the math below, and you will see that a 70-cent rise in (AAPL) shares will generate an 82% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 117:1. LEAPS stand for Long Term Equity Anticipation Securities.

(AAPL) doesn’t even have to get to a new all-time high of $260 to make the max profit in this position, which it will probably do in weeks, if not months. It only has to get back to $240, where it traded in March before the meltdown.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

Here are the specific trades you need to execute this position:

Buy 1 December 2026 (AAPL) $230 calls at………….………$38.00

Sell short 1 December 2026 (AAPL) $240 calls at…………$32.50

Net Cost:………………………….………..………….…...................$5.50

Potential Profit: $10.00 - $5.50 = $4.50

(1 X 100 X $4.50) = $450 or 82% in 15 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.