“This is not a time to go to the grocery store or the pharmacy,” said Dr. Deborah Birx, coordinator of the White House Coronavirus task force.

Global Market Comments

April 3, 2020

Fiat Lux

Featured Trade:

(THE CODER BOOM)

(HOW TO EXECUTE A VERTICAL BULL CALL SPREAD)

(AAPL)

Global Market Comments

April 2, 2020

Fiat Lux

Featured Trade:

(THE DEATH OF PASSIVE INVESTING)

(SPY), (SPX), (INDU)

(NOTICE TO MILITARY SUBSCRIBERS)

Global Market Comments

Apri1, 2020

Fiat Lux

Featured Trade:

(DINNER WITH DAVID POGUE)

(TSLA)

(WHY DOCTORS MAKE TERRIBLE TRADERS)

Global Market Comments

March 31, 2020

Fiat Lux

Featured Trade:

(MORE PLAYERS ENTER THE RACE FOR A CORONA CURE)

(MRNA), (ARCT), (JNJ), (SNY), (GOVX), (ALT), (NVAX), (GSK), (GNBT), (VXL.V), (INO), (APDN), (CADILAHC)

Special issue on COVID-19 vaccines: Moderna Inc (MRNA), Arcturus (ARCT), Johnson & Johnson (JNJ), Sanofi (SNY), GeoVax (GOVX), Altimmune (ALT), Novavax (NVAX), GlaxoSmithKline (GSK), Generex (GNBT), Vaxil Bio (VXL.V), Inovio Pharmaceuticals (INO), Applied DNA Sciences (APDN), Zydus Cadila (CADILAHC)

The hunt is definitely underway for potential treatments to fight COVID-19 but coming up with vaccines will take a much longer time.

Since we already have the genetic code of the novel coronavirus (click here for the link), researchers can now use the complete blueprint to come up with ways to defeat this disease.

With code in hand, it takes a supercomputer just three hours to create model vaccines. Then it is just a question of how fast you can make them, if at all. Many proposed models are far beyond our existing technology.

To date, there are roughly 35 companies and academic organizations actively seeking ways to come up with a COVID-19 vaccine. While the process will still take time, there are several promising prospects.

Among the companies working on this, Moderna Inc (MRNA) has been recognized as the first biotechnology company to conduct human trials to test its COVID-19 vaccine in March. The trial includes 45 males and non-pregnant females aged 18 to 55.

Moderna’s vaccine utilizes the genetic sequence of the novel coronavirus. Basically, the goal is to build a vaccine out of messenger RNA.

Aside from Moderna, another biotech company called Curevac has been at the forefront of this cutting-edge technology.

In China, RNACure Biopharma has been working with Fudan University and Shanghai JiaoTong University on using the same technique to come up with a vaccine as well.

China’s CDC along with Tongji University and Stermina as well as Duke-NUS in partnership with Arcturus (ARCT) are also using a similar approach.

Although Moderna’s vaccine reached Phase 1 in record time, authorities cautioned that the development time frame is somewhere between 12 and 18 months — and this is even dubbed as an “overly optimistic” timeline.

Meanwhile, there are companies like Sanofi Pasteur (SNY) elected to use previously deployed vaccine platforms in earlier epidemics like SARS.

Johnson & Johnson (JNJ) also decided to employ the same strategy using its Ebola vaccine platform. In fact, JNJ shared that it’ll be ready to conduct human testing of its non-replicating viral vector by November.

Aside from JNJ, another biotechnology company in China called CanSino Biologics (HKG: 6185) in collaboration with the Academy of Military Medical Sciences is utilizing the same technology.

Just last week, Chinese authorities approved CanSino’s Phase 1 clinical trials.

Apart from JNJ and CanSino, other biotechnology companies are also working on a vaccine using the same non-replicating viral vector technology.

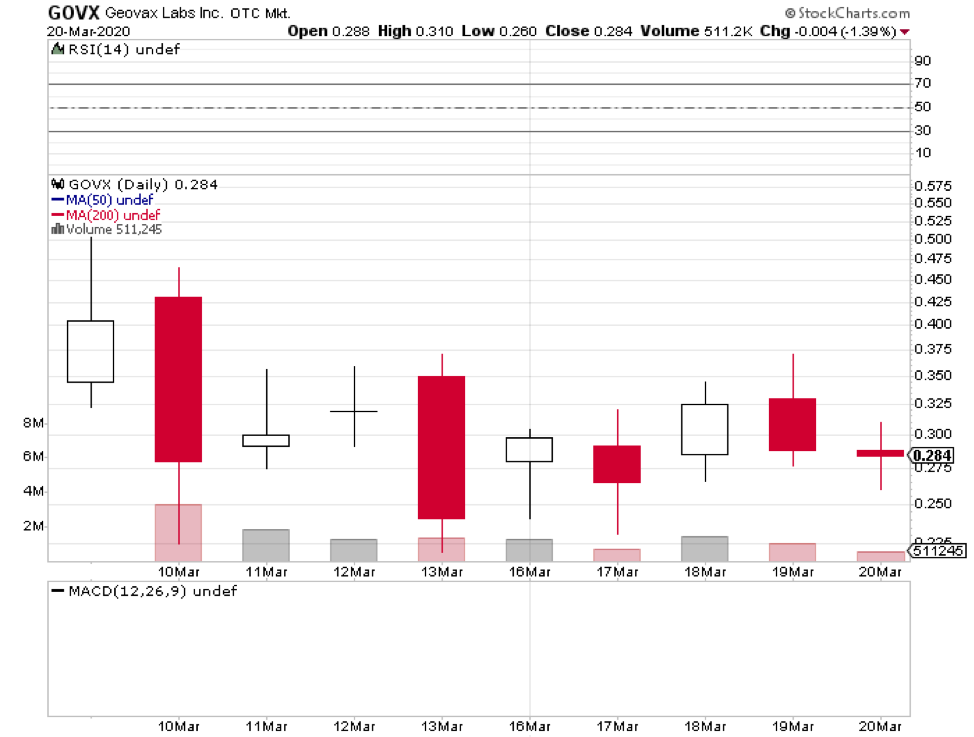

The list includes Wuhan’s BravoVax along with GeoVax (GOVX), Altimmune (ALT), Vaxart (VXRT), Greffex, and the University of Oxford.

Another strategy is employed by Novavax (NVAX), which is to construct a “recombinant” vaccine.

In a nutshell, this strategy entails extraction of the genetic code for the protein found on the Sars-CoV-2. This is a part of the virus that can trigger the immune system. This will then be pasted into the genome of a bacterium or yeast.

In effect, this vaccine will force the microorganisms to produce huge quantities of the protein to be able to fight off the virus.

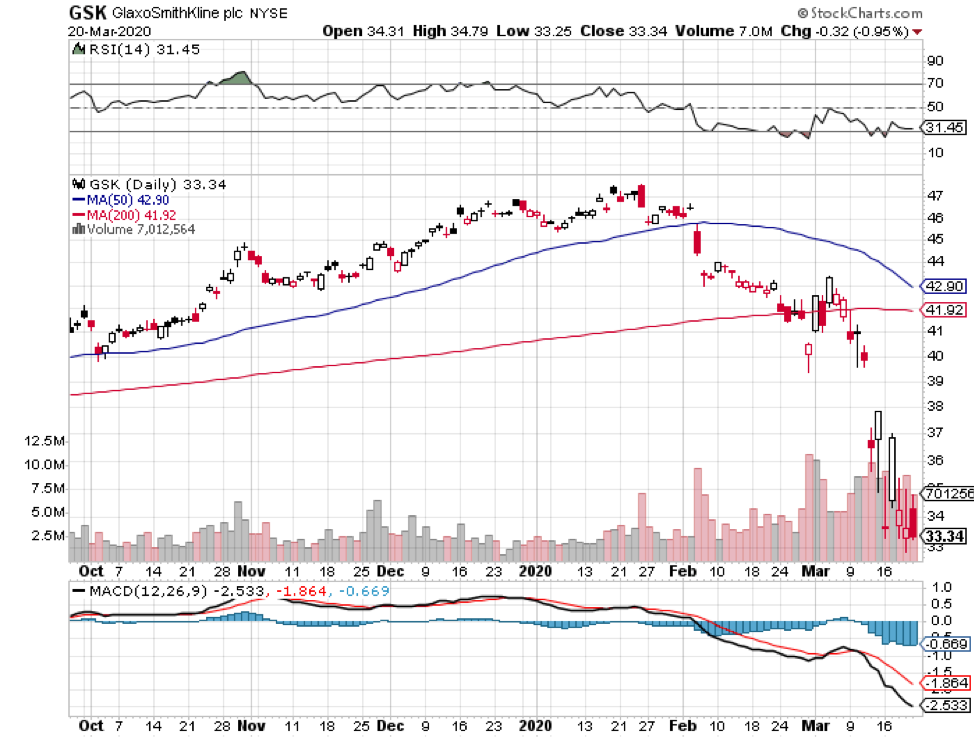

Big biotechnology companies like Sanofi and GlaxoSmithKline (GSK) are following the same technique.

Smaller firms are also in on the action including Generex Biotechnology Corporation (GNBT), Vaxil Bio (VXL.V), EpiVax, and Clover Biopharmaceuticals.

The University of Georgia, Baylor College of Medicine, and the University of Miami are pursuing the same lead as well.

On top of these, several biotechnology companies use a DNA-based approach to come up with a vaccine.

Last March 12, the Bill & Melinda Gates Foundation provided a $5 million grant to Pennsylvania-based biotech firm Inovio Pharmaceuticals (INO) to help the company speed up the tests needed for its DNA vaccine called INO-4800.

This is on top of the roughly $9 million in funding it received from the Coalition for Epidemic Preparedness Innovations earlier.

At the moment, INO-4800 is in preclinical studies with plans to push it to Phase 1 clinical trials by April.

Aside from Inovio, Applied DNA Sciences (APDN), Zydus Cadila (CADILAHC), Takis, and Evivax are also pursuing the same strategy.

Despite implementing the most effective and even draconian measures to contain COVID-19, these tactics only managed to slow down the spread of the virus.

With the World Health Organization tagging this situation as a pandemic, everyone has become more desperate in the search for a vaccine because only a vaccine can stop people from getting sick.

However, even the unprecedented speeds afforded, the biotechnology companies couldn’t change the fact that developing a vaccine requires at least a year. It’s crucial to not make mistakes along the way especially since the product could potentially be injected into most of the world’s population.

After all, there’s only a single thing that can be considered worse than a bad virus — and that is a bad vaccine.

“The government doesn’t set the timeline, the virus does” said Dr. Antony Fauci, the Director of the National Institute of Allergy and Infectious Diseases.

Global Market Comments

March 30, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or COPING WITH CORONA),

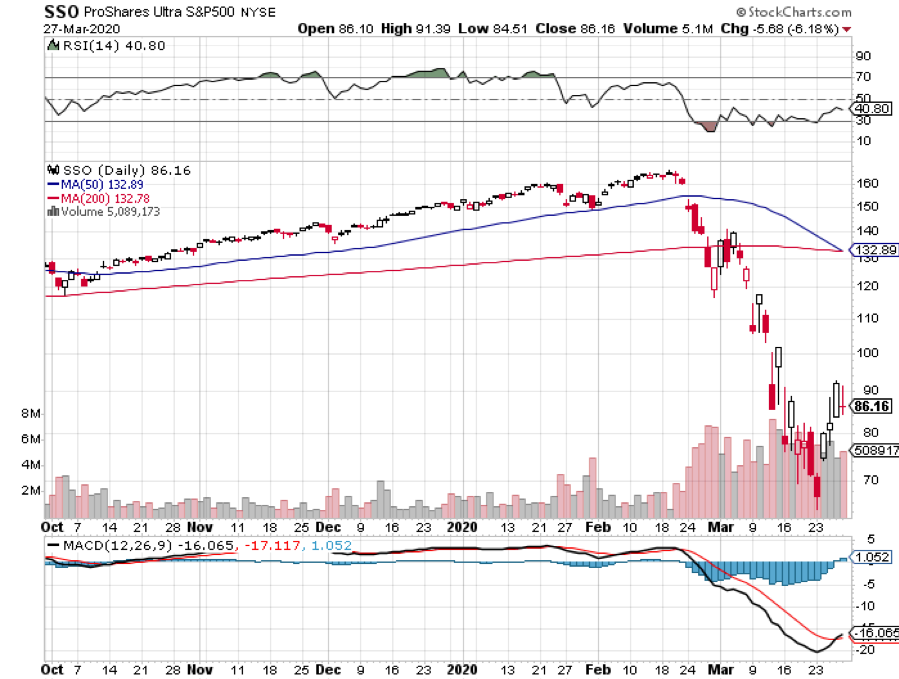

(INDU), (VIX), (VXX), (UAL), (WYNN), (CCL), (SSO), (SPXU)

I am sitting in my Lake Tahoe office watching a light snow blanket the surrounding High Sierras. There is a stiff north wind whipping up whitecaps on a cerulean blue lake.

Spring break normally packs the Diamond Peak ski resort at Incline Village, Nevada. This year, it is a ghost town. The resort is closed, the streets deserted and the hotels empty.

Driving up from San Francisco, I had to stop at a Tesla Supercharging station at Rocklin, California next to a huge shopping mall for a top-up to cross Donner Pass. It was bereft of shoppers, looking like everyone had been wiped out by an uncontrollable plague. Of a hundred stores only Subway, Chipotle Mexican Grill (CMG), and Target (TGT) were open. I could almost hear the rent and interest payments ticking on.

And economically, it has.

Let’s do some raw, back-of-the-envelop calculations. Congress has just passed the largest stimulus package in history, some $2 trillion. If Morgan Stanley is right and the US is about to lose 30% of its economic growth on an annualized basis, that means the GDP is about to drop from $21.4 trillion to $19.8 trillion. Get two quarters like this and we fall back to $18.2 trillion, or to the 2016 levels.

That means the government is already $1.2 trillion behind the curve in bridge spending to carry over the economy to the other side of the epidemic. It can come back with another rescue package. If it does, there is no guarantee the money will end up in the right place to have any real effect.

Yes, we have just lost three years of economic growth, and the stock market is reflecting the same.

Of course, there are silver linings behind the clouds. Some 90% of the demand in the economy hasn’t been destroyed, it has been deferred. Cruises not taken, restaurant meals not eaten, and vacations not taken are gone for good.

However, a lot of discretionary purchases, such as for home, car, and computer purchases have simply been delayed until the fall. That's why so many forecasts call for an exploding economy in the second half.

A lot more economic economy isn’t lost, it has simply been rearranged. There has been a vast migration of legacy businesses to online. Most workers in Silicon Valley have adjusted from one to two days of work at home to five or six. The background noise of kids crying, and pets barking during an online meeting has become a normal part of business life.

And let’s face it, a lot of people are being paid for doing nothing. Government employees are receiving paychecks even though their agencies have been closed. Teachers are paid in annual contracts. Those Social Security and pension payments keep coming like clockwork.

I have spent the last week talking to old friends in the scientific community. Realistically, the economy will be shut down until June. You can open it up earlier, but only at the cost of hundreds of thousands of lives. Without restrictions, mathematically, everyone in the United States will be infected with Coronavirus within two months causing 6 million deaths. That’s the worst-case scenario.

Only when the infection rate hits 53% do we start to acquire herd immunity. That happens when there’s greater than 50% chance that the next person the virus contacts is immune.

Also, the greater the number of recovered individuals, the more we can tap for serum to treat existing patients and increase immunity and survival rates. Some 98% of those infected recover and become immune and non-contagious within two weeks.

Shelter-in-place orders and social distancing will greatly reduce those numbers. That’s what China did, and they have had no growth in new cases for two weeks.

My bet is that the epidemic will peak first in the states that sheltered-in-place early, and then peak in the Midwest later. That sets up two big waves of the disease, one in the spring, and a second in the summer and fall. Every state will have its own New York crisis moment sooner or later.

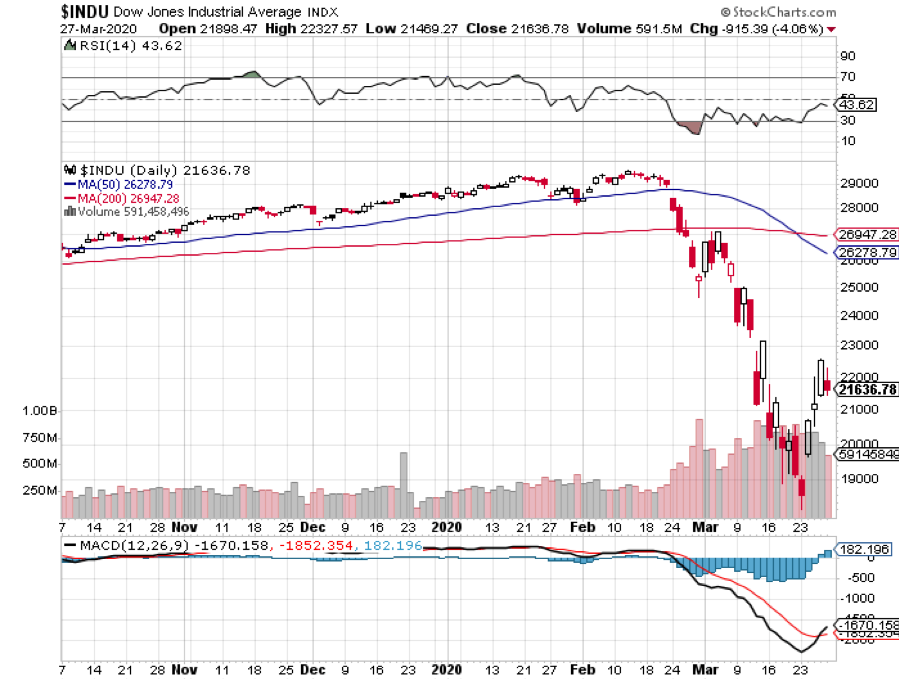

The president has expressed an interest in reopening the economy on April 13. If the stock market (INDU) believes that, then it is in for new lows. There is no point in predicting a final bottom. Once the algorithms get going, they are unstoppable.

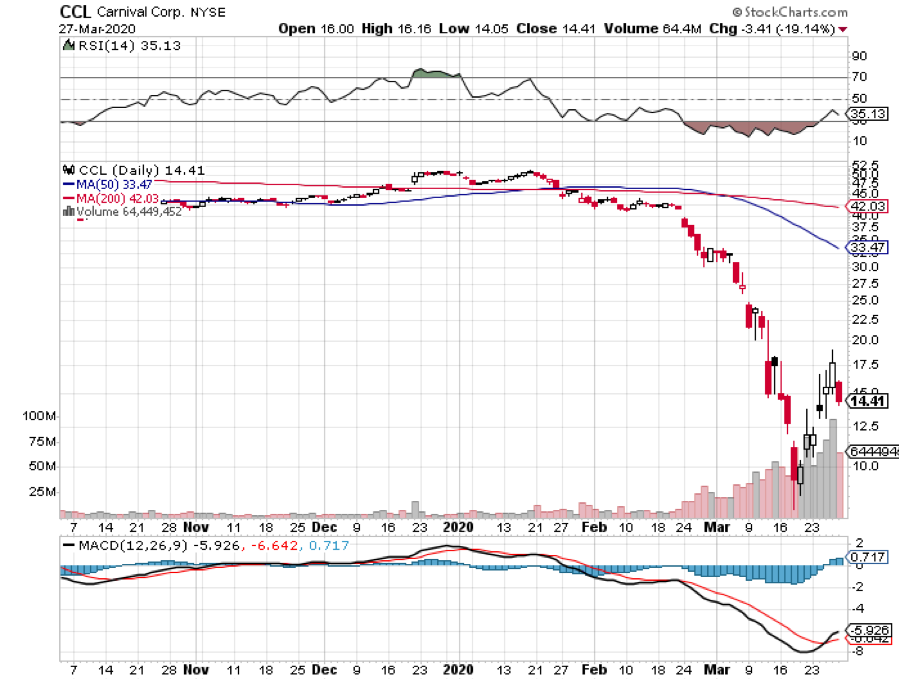

Big companies like United Airlines, Wynn Resorts (WYNN), and Carnival Cruise Lines (CCL), have seen a staggering 90% decline in sales. Yet the wage bills and interest payments mount daily. The cruel math points to disaster on an epic scale.

Face reality. There is no way the stock market can bottom before the number of cases peaks. Front run that at your peril. The consolation is that will likely happen by June. This will be the shortest, sharpest depression in history.

Global Corona cases topped 704,095, and deaths 33,509 (click here for the latest data). Why does the US have 52% more cases than China with one quarter the population? Because the federal government was asleep at the switch and then responded with a test that didn’t work for the first month. That blinded us to an epidemic that was already here in force.

A monster 3.28 million in Weekly Jobless Claims hit the market last week, five times the previous record. That’s normally the total number of jobs you lose in a full recession. This is the number of claims you get from an entire recession.

The number was probably higher as many state websites crashed, limiting applications. This rate of claims will probably increase for two more months. One can only guess what the unemployment rate is, probably over 5%. Next week will be worse. Over 50 million work in retail and most will lose their jobs.

Chicago clearing firm Ronin Capital went under, unable to meet their capital requirements. It was one of the CME’s principal clearings firm, and their problems are stemming from the (VIX) spike to $80 this week. I knew it was totally artificial.

The forced liquidation of their massive holdings probably accounted for the incredible 25-point drop in the (VIX) on Thursday and the last 500 points of the fall in Dow Average on Friday. It sounds terrible, but the loss of several brokerage firms like this often markets a market bottom. This is the second time in two years that (VIX)-related blow-ups roiled the markets. For more about the firm, visit https://www.ronin-capital.com

Internet traffic is up 30% on the week as a massive move to online commerce takes place. There is now a laptop shortage as the government outbids the private sector to get machines for first responders. Phishing attacks are at record highs. Don’t click on any links sent to you, especially from Apple, your credit card company, or the IRS.

The Fed expects a 30% Unemployment Rate in Q2, or so says James Bullard, president of the Federal Reserve Bank of St. Louis. The Great Depression only hit 25% unemployment.

The US Real Estate market is freezing up. If you’re trying to sell a house right now, you’re screwed. Closings are impossible because of the shutdown of notaries and title offices. Open houses are now virtual only. The hit to the US economy will be huge.

Tokyo 2020 Olympics were postponed a year, as the Japanese finally cave to the obvious. Canada and Australia had already withdrawn for Corona reasons. Tokyo is really unluckily with Olympics. They lost the 1940 games to the outbreak of WWII. It will be a big hit for the Japanese economy.

Online Hiring is exploding, up 44% in the past week, a decades-old trend that is now vastly accelerating. Entire school systems have moved online. We are all working now on Zoom, Skype, GoToMeeting, and Google Hangouts. Internet traffic has doubled in some neighborhoods, slowing speeds appreciably.

Target saw a staggering 50% growth in same store sales. Lines go around the block, hours are limited, and the police are on standby to maintain order. This has been one of our favorite retailers for years (click here for “Is Target the Next FANG?”). If they only had more toilet paper! Buy (TGT) on the meltdown.

Blackrock rated US stocks a “Strong Overweight.” The firm believes we won’t see a repeat of 2008. The fiscal and monetary response has been overwhelming. It’s just a matter of time before markets settle down, but not until well after new Corona cases peak. Buy (BLK) on the dip.

Oil falls again, back to $21. Not even all the stimulus in the world can save this structurally impaired industry. Ask John Hamm of Continental Resources (CLR), whose stock has just crashed from $36 to $4. He’s the guy who wrote the billion-dollar divorce check. Avoid the entire industry on pain of death.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $20 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

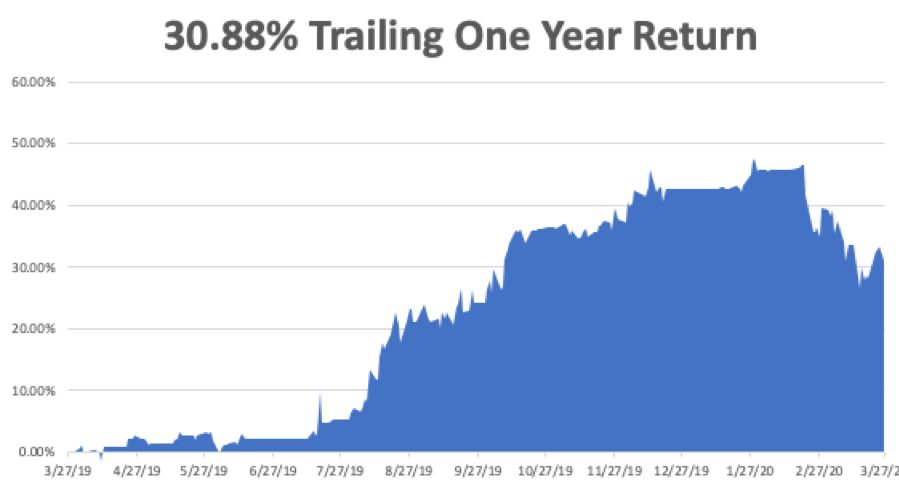

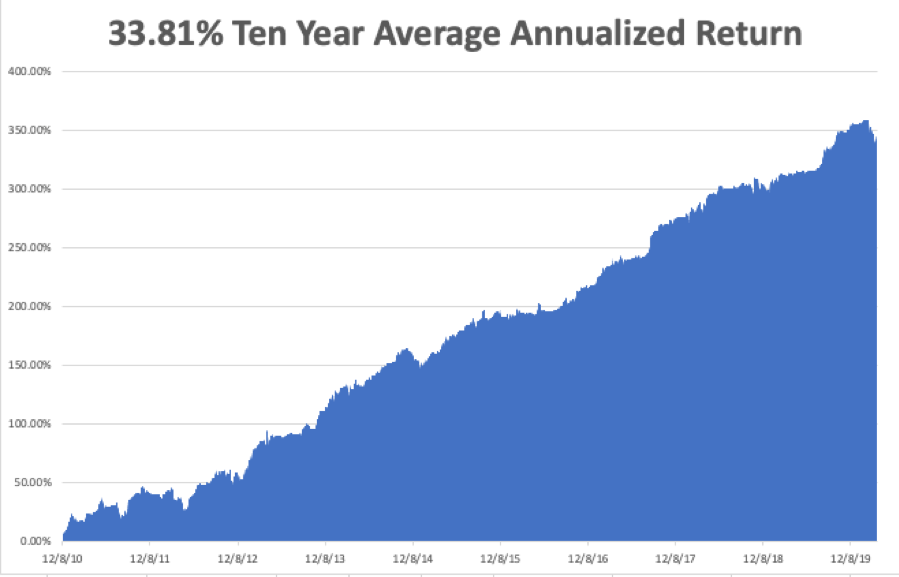

My Global Trading Dispatch performance has had a descent week, pulling back by -8.22% in March, taking my 2020 YTD return down to -11.14%. That compares to an incredible loss for the Dow Average of -37% at the Monday low. My trailing one-year return was pared back to 30.88%. My ten-year average annualized profit recovered to +33.81%.

My short volatility positions have held steady. I used the 3,600-point rally in the Dow Average to add enough short positions to hedge out my risk in my exiting short volatility positions (VXX). Now we have time decay working in our big time favor. These will all come good well before their ten month expiration.

At the slightest sign of a break in the pandemic, the economy and shares should come roaring back. Right now, I have a 60% cash position.

This is jobs week and it should be the most tumultuous in history.

On Monday, March 30 at 9:00 AM, the Pending Home Sales for February are released.

On Tuesday, March 31 at 8:00 AM, the S&P Case Shiller National Home Price Index for January is out and should still show a sharp upward trend.

On Wednesday, April 1, at 8:15 AM, the ADP Private Sector Jobs Index is announced.

On Thursday, April 2 at 7:30 AM, Weekly Jobless Claims are announced. The number could top 3,000,000 again.

On Friday, April 3 at 9:00 AM, the March Nonfarm Payroll is printed. The Baker Hughes Rig Count follows at 2:00 PM. Expect these figures to crash as well.

As for me, I am at Lake Tahoe to hide out from the Zombie Apocalypse with my stockpile of Chloroquine and Azithromycin. There are only 536 cases in Nevada, most of which are in Las Vegas, and has a lot more food (click here for the latest updates).

I am building a Corona-sanitizing Station at the front door made of paper towels and isopropyl or ethyl alcohol. It kills the virus on contact.

I hear they even have toilet paper in a few undisclosed places.

Shelter in place will work. Please stay healthy.

As a public service, I am posting “the entire DNA sequence of Covid-19” in its entirety, which I obtained from a lab in China. A scientist friend asked me to publicize it on my website to the widest possible audience. What better place than the Mad Hedge Fund Trader.

Typical of viruses, it is an incredible small genome, one hundred thousandth the size of our own with only 29,000 base pairs. There are only a handful of genes here compared to our 35,000. For the full code click here.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

I’d rather take risk in a well-researched common stock than in a government bond,” said my old friend and investor, Lee Cooperman, late of Omega Advisors.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.