Global Market Comments

April 4, 2019

Fiat Lux

Featured Trade:

(TEN REASONS WHY STOCKS CAN’T SELL OFF BIG TIME),

(SPY)

(SCAM OF THE MONTH CLUB)

Having trouble raising capital for your new hedge fund?

Just list Warren Buffet as your “Honorary Chairman.”

That’s what California prison guard Ottoniel Medrano did. To help his marketing efforts, he also claimed that he had $4.8 billion in assets under management as well as massive real estate holdings somewhere in Asia.

Medrano’s International Realty Holdings managed to raise $700,000 from individuals with this scam which he promptly shipped to offshore bank accounts before the Feds shut him down.

When you think you’ve heard everything, something like this pops up. Unbelievable.

You would think that people have heard of “due diligence” by now.

People with famous financial names like Morgan, Rockefeller, Rothschild, Getty, and DuPont often find out they are endorsing things they have never heard of to help someone’s fundraising effort.

I once heard of a guy who got a license plate of GETTY 1 just so he could get free valet parking at restaurants.

More recently, president Donald Trump has faced the same problem.

More than 200 companies in China are marketing products under his name without his permission.

After years of languishing in the courts, one judge finally ruled in his favor, the day after the new president affirmed the long-standing ‘One China Policy.”

Who said being Commander in Chief didn’t have its benefits?

It all brings back unpleasant memories of the Bernie Madoff scandal.

By the way, Bernie has only 123 years left on his sentence. By then he will be 201 years old.

Who knows? Maybe on that low-fat, low-carb prison diet, he’ll make it. He has a better health plan than I do.

I’m only on Medicare.

Want to Invest in My Fund?

"Markets will over value what you can quantify," said Ann Lamont at Oak Investment Partners, referring to the extreme high prices for public companies versus the discount valuations of private ones.

Global Market Comments

April 3, 2019

Fiat Lux

Featured Trade:

(WHO WILL BE THE NEXT FANG?)

(FB), (AMZN), (NFLX), (GOOGL), (AAPL),

(BABA), (TSLA), (WMT), (MSFT),

(IBM), (VZ), (T), (CMCSA), (TWX)

FANGS, FANGS, FANGS! Can’t live with them but can’t live without them either.

I know you’re all dying to get into the next FANG on the ground floor, for to do so means capturing a potential 100-fold return, or more.

I know because I’ve done it four times. The split adjusted average cost of my Apple shares is only 25 cents compared to today’s $174, so you can understand my keen interest. My average on Tesla is $16.50.

Uncover a new FANG and the riches will accrue rapidly. Facebook (FB), Amazon AMZN), Netflix (NFLX), and Alphabet (GOOGL) didn’t exist 25 years ago. Apple (AAPL) is relatively long in the tooth at 40 years. And now all four are in a race to become the world’s first trillion-dollar company.

One thing is certain. The path to FANGdom is shortening. It took Apple four decades to get where it is today, Facebook did it in one. As Steve Jobs used to tell me when he was running both Apple and Pixar, “These overnight successes can take a long time.”

There is also no assurance that once a FANG always a FANG. In my lifetime, I have seen far too many Dow Average components once considered unassailable crash and burn, like Eastman Kodak (KODK), General Electric (GE), General Motors (GM), Sears (SHLD), Bethlehem Steel, and IBM (IBM).

I established in an earlier piece that there are eight essential attributes of a FANG, product differentiation, visionary capital, global reach, likeability, vertical integration, artificial intelligence, accelerant, and geography.

We are really in a “What have you done for me lately” world. That goes for me too. All that said, I shall run through a short list for you of the future FANG candidates we know about today.

Alibaba (BABA)

Alibaba is an amalgamation of the Chinese equivalents of Amazon, PayPal, and Google all sewn together. It accounts for a staggering 63% of all Chinese online commerce and is still growing like crazy. Some 54% of all packages shipped in China originate from Alibaba.

The juggernaut has over half billion active users, and another half billion placing orders through mobile phones. It is a master of AI and B2B commerce. There is nothing else like it in the world.

However, it does have some obvious shortcomings. Its brand is almost unknown in the US. It has a huge problem with fakes sold through their sites.

It also has an ownership structure for foreign investors that is byzantine, to say the least. It is a contractual right to a share of profits funneled through a PO box in the Cayman Island. The SEC is interested, to say the least.

We also don’t know to what extent founder Jack Ma has sold his soul to the Beijing government. It’s probably a lot. That could be a problem if souring trade relations between the US and the Middle Kingdom get worse, a certainty with the current administration.

Tesla (TSLA)

Before you bet on a new startup breaking into the Detroit Big Three, go watch the movie “Tucker” first. Spoiler Alert: It ends in tears.

Still, Tesla (TSLA) has just passed the 270,000 mark in the number of cars manufacturered. Tucker only got to 50.

Having led my readers into the stock after the IPO at $16.50, I am already pretty happy with this company. Owning three of their cars helps too (two totaled). But Tesla still has a long way to go.

It all boils down to the success of the $35,000, 200-mile range Tesla 3 for which it already has 500,000 orders. So far so good.

It’s all about scale. If it can produce these cars in sufficient numbers, it will take over the world and easily become the next FANG. If it can’t, it won’t. It’s that simple.

To say that a lot is already built into the share price would be an understatement. Tesla now trades at ten times revenues compared to 0.5 for Ford (F) and (General Motors (GM). That’s a relative overvaluation of 20:1.

Any of a dozen competing electric car models could scale up with a discount model before they do, such as the similarly priced GM Bolt. But with a ten-year lead in the technology, I doubt it.

It isn’t just cars that will anoint Tesla with FANG sainthood. The firm already has a major presence in rooftop solar cell installation through Solar City, utility sized solar plants, industrial scale battery plants, and is just entering commercial trucks. Consider these all seeds for FANGdom.

One thing is certain. Without Tesla, there wouldn’t be s single mass-market electric car on the road today.

For that, we can already say thanks.

Uber

In the blink of an eye, ride sharing service Uber has become essential for globe-trotting travelers such as myself.

Its 2 million drivers completely disrupted the traditional taxi model for local transportation which remains unchanged since the days of horses and buggies.

That has created the first $75 billion of enterprise value. It’s what’s next that could make the company so interesting.

It is taking the lead in autonomous driving. It could also replace FeDex, UPS, DHL, and the US post office by offering same day deliveries at a fraction of the overnight cost.

It is already doing this now with Uber Foods which offers immediate delivery of takeouts (click here if you want lunch by the time you finish reading this piece.)

UberCopters anyone? Yes, it’s already being offered in France and Brazil.

Uber has the potential to be so much more if it can just outlive its initial growing pains.

It is a classic case of the founder being a terrible manager, as Travis Kalanick has lurched from one controversy to the next. The board finally decided he should spend much time on his new custom built 350-foot boat.

Its “bro” culture is notorious, even in Silicon Valley.

It is also getting enormous pushback from regulators everywhere protecting entrenched local interests. It has lost its license in London, the only place in the world that offered a decent taxi service pre-Uber. Its drivers are getting beaten up in Paris.

However, if it takes advantage of only a few of the doors open to it, status as a FANG beckons.

Walmart (WMT)

A few years ago, I was heavily criticized for pointing out that half the employees at my local Walmart (WMT) were missing their front teeth. They have since received a $2 an hour's pay raise, but the teeth are still missing. They don’t earn enough money to get them fixed.

The company is the epitome of bricks and mortar in a digital world with 12,000 stores in 28 countries. It is the largest private employer in the US, with 1.4 million workers, mostly earning minimum wage.

The Walmart customer is the very definition of the term “late adopter.” Many are there only because unlike Amazon, Wal-Mart accepts cash and Food Stamps.

Still, if Walmart can, in any way, crack the online nut, it would be a turbocharger for growth. It moved in this direction with the acquisition of Jet.com for $3 billion, a cutting-edge e-commerce firm based in Hoboken, NJ.

However, this remains a work in progress. Online sales account for only 4% of Walmart’s total. But they could only be a few good hires at the top away from success.

Microsoft (MSFT)

Talk about going from being the 800-pound gorilla to an 80 pound one, and then back to 800 pounds.

I don’t know why Microsoft (MSFT) lost its way for 15 years, but it did. Blame Bill Gates’s retirement from active management and his replacement by his co-founder Steve Ballmer.

Since Ballmer’s departure in 2014, the performance of the share price has been meteoric, rising by some 125% over the past two years.

You can thank the new CEO Satya Nadella who brought new vitality to the job and has done a complete 180, taking Microsoft belatedly into the cloud.

Microsoft was never one to take lightly. Windows still powers 90% of the world’s PCs. No company can function without its Office suite of applications (Word, Excel, and PowerPoint). SQL Server and Visual Studio are everywhere.

That’s all great if you want to be a public utility, which Microsoft shareholders don’t.

LinkedIn, the social media platform for professionals, could be monetized to a far greater degree. However, specialization does come at the cost of scalability.

It seems that the future is for Microsoft to go head to head against next door neighbor Amazon (AMZN) for the cloud services market while simultaneously duking it out with Alphabet (GOOGL).

My bet is that all three win.

Airbnb

This is another new app that has immeasurably changed my life for the better. Instead of cramming myself into a hotel suite with a wildly overpriced minibar for $600 a night, I get a whole house for $300 anywhere in the world, with a new local best friend along with it.

Overnight, Airbnb has become the world’s largest hotel chain without actually owning a single hotel. At its latest funding round in 2017, it was valued at $31 billion.

The really tricky part here is for the firm to balance out supply and demand in every city in the world at the same time. It is also not a model that lends itself to vertical integration. But who knows? Maybe priority deals with established hotels are to come.

This is another firm that is battling local regulation, that great barrier to technological innovation. None other than its home town of San Francisco now has strict licensing requirements for renters, a 30 day annual limitation, and a $1,000 a day fine for offenders.

The downtowns of many tourist meccas like Florence, Italy and Paris, France have been completely taken over by Airbnb customers, driving rents up and locals out.

IBM (IBM)

There was a time in my life when IBM was so omnipresent we thought like the Great Pyramids of Egypt it would be there forever. How times change. Even Oracle of Omaha Warren Buffet became so discouraged that he recently dumped the last of his entire five-decade long position.

A recent 20 consecutive quarters of declining profits certainly hasn’t helped Big Blue’s case. It is one of the only big technology companies whose share price has gone virtually nowhere for the past two years.

IBM’s problem is that it stuck with hardware for too long. An entrenched bureaucracy delayed its entry into services and the cloud, the highest growth areas of technology.

Still, with some $80 billion in annual revenues, IBM is not to be dismissed. Its brand value is still immense. It still maintains a market capitalization of $144 billion.

And it has a new toy, Watson, the supercomputer named after the company’s founder, which has great promise, but until now has remained largely an advertising ploy.

If IBM can reinvent itself and get back into the game, it has FANG potential. But for the time being, investors are unimpressed and sitting on their hands.

The Big Telecom Companies

My final entrant in the FANGstakes would be any combination of the four top telecommunication companies, Verizon (VZ), AT&T (T), Comcast (CMCSA), and Time Warner (TWX), which now control a near monopoly in the US.

There is a reason why the administration is blocking the AT&T/Time Warner merger, and it is not because these companies are consistently cited in polls as the most despised in America. They are trying to stop the creation of another hostile FANG.

Still, if any of the big four can somehow get together, the consequences would be enormous. Ownership of the pipes through which the modern economy courses bestows great power on these firms.

And Then….

There is one more FANG possibility that I haven’t mentioned. Somewhere, someplace, there is a pimple-faced kid in a dorm room thinking up a brand-new technology or business model that will take the world by storm and create the next FANG.

Call me crazy, but I have been watching this happen for my entire life.

I want to thank my friend, Scott Galloway, of New York University’s Stern School of Business, for some of the concepts in this piece. His book, “The Four” is a must read for the serious tech investor.

Creating the Next FANG?

While driving back from Lake Tahoe last weekend, I received a call from a dear friend who was in a very foul mood.

Following the advice of another newsletter whose name I won’t mention, he bailed out of all his stocks during the December meltdown. He was promised that Armageddon was coming, and the Dow would collapse all the way to 3,000.

With the Federal Reserve now on a rate easing path, here we are with the major stock indexes just 2.7% short of all-time highs.

Why the hell are stocks still going up?

I paused for a moment as a kid driving a souped up Honda weaved into my lane of Interstate 80, cutting me off. Then I gave my friend my response, which I summarize below:

1) There is nothing else to buy. Complain all you want, but US equities are now one of the world’s highest yielding securities, with a lofty 2.0% dividend.

A staggering 50% of S&P 500 stocks now yield more than US Treasury bonds (TLT). That compares to two thirds of all developed world debt offering negative rates and US Treasuries at a parsimonious 2.48%.

2) Oil prices have bottomed, but remain historically low, and the windfall cost savings are only just being felt around the world. $60 a barrel is a hell of a lot cheaper than $150.

3) While a low Euro (FXE) if definitely eating into large multinational earnings, we are probably approaching the end of the move. The cure for a weak euro is a weak euro. The worst may be behind for US exporters.

4) What follows a collapse in European economic growth? A European recovery powered by a weak currency. European quantitative easing is working.

5) What follows a Japanese economic collapse? A recovery there too, as hyper accelerating QE feeds into the main economy. Japanese stocks are now among the world’s cheapest.

6) While the next move in interest rates will certainly be up, it is not going to move the needle on corporate P&L’s for a very long time. We might see at most two 25 basis point hikes by the end of this cycle, and that probably won’t happen until the second half of 2019. In a deflationary world, there is no room for more.

This will make absolutely no difference to the large number of high growth corporates, like technology firms, that don’t borrow at all because they have enormous cash internal flows.

7) Technology everywhere is accelerating at an immeasurable pace, causing profits to do likewise. You see this in the FANG stocks, where blockbuster earnings reports are becoming as reliable as free upgrades.

Biotech has been on a tear as well.

See the new Alzheimer’s cure? It involves extracting the cells from the brains of alert 95-year old’s, cloning them, and then injecting them into early stage Alzheimer’s patients. I’ve already put myself on the waiting list.

The success rate has been 70%. That one alone could be worth $5 billion a year. I might be a user of this cure myself someday.

8) US companies are still massive buyers of their own stock, some $1 trillion worth this year, and a relaxed repatriation tax law is pouring gasoline on the fire.

This has created a free put option for investors for the most aggressive companies, like Apple (AAPL), Cisco Systems (CSCO), Microsoft (MSFT), IBM (IBM), and Intel (INTC), the top five re-purchasers.

They have nothing else to buy either. (AIG) has mandated the repurchase of an amazing 25% of its outstanding float.

They are jacking up dividend payouts at a frenetic pace as well and are expected to return more than $700 billion in payouts this year.

9) Ignore this at your peril, but China is stimulating their economy like crazy, and it is just a matter of time before that growth spills over to the US.

10) Ditto for the banks, which were dragged down by falling interest rates for most of the last decade. Reverse that trade this year, and you have another major impetus to drive stock indexes higher.

My friend was somewhat set back, dazzled, and nonplussed by my out of consensus comments.

With that, I told my friend I had to hang up, as another kid driving a souped up Shelby Cobra GT 500, obviously stolen, was weaving back and forth in front of me requiring my attention.

Where is a cop when you need them?

Global Market Comments

April 2, 2019

Fiat Lux

Featured Trade:

(WHAT’S REALLY BEHIND THE BRISTOL MYERS/CELGENE MERGER),

(BMY), (CELG),

(ON EXECUTING MY TRADE ALERTS),

The start of 2019 saw Bristol-Myers Squibb (BMY) reveal a plan that rattled a number of its investors: the 132-year-old biotech giant plans to buy Celgene (CELG) for $74 billion or approximately $102.43 per share.

While these kinds of moves happen often, Bristol’s decision has some of its major shareholders up in arms. So far, Bristol top holder Wellington with 8% of shares, Dodge & Cox with 2.61%, and Starboard Value with 0.06% have publicly expressed their opposition to the merger.

Aside from labeling this deal as “ill-advised,” Starboard suggested that Bristol should either consider selling itself or simply put an end to this plan.

Here’s a short background on the matter.

For Bristol, this deal seemed to have stemmed from the dwindling performance of its mega-blockbuster immuno-oncology drug Opdivo compared to its greatest competitor, Merck & Co’s (MRK) Keytruda.

Unfortunately for Bristol, Opdivo failed to obtain a monotherapy in first-line lung cancer result while Keytruda succeeded on this front. The whole process resulted in costly losses to Bristol and massive sales for Merck in the tune of $7.2 billion, outpacing Opdivo’s $6.7 billion in 2018 – a first for both drugs since the two had been neck to neck since their launches.

The threat of competing cancer drugs – generic and otherwise – against Opdivo didn’t help either. In effect, Bristol has been facing pressure from investors to recoup the costs either via expansion or a profitable merger. By comparison, Bristol’s annual revenue is at $22.6 billion while Merck is at $42.3 billion and fellow competitor Pfizer (PFE) is at $53.4 billion.

On the other side of the merger, Celgene (CELG) has been struggling with the looming loss of its patent protection for their major drug Revlimid, a multiple myeloma medication which accounts for 65% of the company’s $14.2 billion annual revenue. By 2022, generic alternatives are anticipated to eat away the shares of Revlimid. This puts roughly $10 billion in annual sales at risk for Celgene.

In comparison, Celgene’s competitors seem miles ahead based on their reported annual revenues alone, with Eli Lilly (LLY) at $24.6 billion and Novartis (NOVN) at $51 billion.

Celgene’s response to this impending “doom” is to come up with a promising stable of treatments and medications to offset their future losses. This is where Bristol comes in.

While it’s still up in the air if the merger would actually benefit Bristol massively, Celgene seems to be on a win-win situation here. With the money from Bristol, Celgene can relax a bit about the competitors chomping at the bit to decimate Revlimid’s status in the market. On top of that, they’ll be able to insulate themselves (and portfolios) from potential failures in their pipeline.

What about Bristol?

Well, you can look at the merger as Bristol paying for Celgene’s ideas. With a pipeline brimming at the seams, Bristol would be able to have choice picks on what could be their next blockbuster drug especially in light of the weakening performance of Opdivo in the market.

Not only that, another Bristol mega-blockbuster drug Eliquis, an atrial fibrillation medication, is expected to see a decline in sales starting 2022 due to its pending patent expiration.

So far, Bristol shares have experienced a drop by -25.29% or -$17.25, putting it at $50.97 per share in comparison with its previously recorded high of $68.22 last week. The past 52 weeks have also seen Bristol trade as low as $44.3. Meanwhile, its current earnings-per-share (EPS) is estimated to sit at around $1.04 per share.

These estimates make a number of investors bullish with regard to the near-term reports of Bristol a modest prediction of an 11.3% increase in its average price target. This is estimated to lead to a potential market cap rise to $93.04 billion.

How realistic is this promising future of overflowing pipeline for Bristol?

Details of the merger reveal that Celgene will get a contingent value right (CVR) worth a one-time $9-per-share bonus if the company’s three most promising treatments snag FDA approval on set dates: multiple sclerosis drug Ozanimod and Liso-cel by December 31, 2020, as well as bb2121 by March 31, 2021.

Is it achievable?

It looks like it since all three drugs already have available data and are set for late-stage trials necessary for regulatory approvals.

Is this a slam dunk deal then?

This depends greatly on how Celgene works out the kinks of their drugs. So far, Ozanimod was rejected by the FDA in 2018 due to doubts on the company’s capacity to execute the trials effectively. Will Bristol’s backing guarantee approval in the next round? Possibly, especially since the FDA’s rejection was reportedly due to a lack of potential funding by Celgene to support their trials.

Whether or not this deal pushes through heavily depends on the other major shareholders of Bristol. So far, the opposition raised by the three investors hasn’t really resulted in the company wavering on this plan.

However, April 12 is a long way to go when it comes to finalizing this takeover and both sides are still working on persuading their fellow shareholders to stand by their arguments.

What about Celgene? How does this takeover sound to their investors?

Celgene’s investors should be celebrating since this merger has a lot of promising upsides for them and quite frankly, offers a highly lucrative escape plan. Bristol’s buying price of $102.43 per stock is a 54% premium in comparison to the average price of per Celgene share. The CVR incentive offered by Bristol definitely adds the icing to the cake for Celgene investors as well.

Overall, the deal seems to be a reasonable move for both Celgene and Bristol. While the merger definitely has its fair share of risks, Bristol’s key takeaway here is the plethora of opportunities to grow their SKUs. Even with the threat of Celgene’s Revlimid losing patent protection in the years to come, this takeover still offers good strategic positioning shots and promising pipeline expansion for Bristol.

After all, both companies are not necessarily goldmines for investors and are poised to crash sometime soon given their recent performance trends. Perhaps joining forces would give them a fighting chance to ward off more hostile takeovers or worse, a bankruptcy.

Global Market Comments

April 1, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR THE INMATES ARE RUNNING THE ASYLUM)

(SPY), (TLT), (FCX), (DIS), (TSLA), (IWM), (AAPL),

(GOOGL), (MSFT), (PYPL), (AMZN)

I have decided to run for president next year. If you wondered why my content has been slacking off lately, it’s because I’ve been hard at work writing the Mueller Report. Oh, and the Dow Average will reach 100,000 by December.

Ha! Gotcha! April fool.

Still, looking at the market action last week, you really have to wonder if the inmates have seized control of the asylum when the average rose four of five days. These are people who are buying stocks at a decade high, with collapsing earnings, and the rest of the world falling into recession.

However, there is a method to their madness. Interest rates across every maturity in Europe and Japan turned negative last week. Suddenly both US stocks AND bonds looked like the bargain of the century, but only if you were foreign. An avalanche of cash into the US followed triggering an explosive move up in the bond market. For the first time in three years, I was not short.

And here’s the interesting part. It could continue for months.

In the meantime, investors have been grappling with a number that will be the most important print of the year. The first look at Q1 2019 GDP will be published on April 23, and it is widely expected to be awful, at less than a 1% annual rate. It will include the effects of the record 34-day government shutdown as well as the horrendous weather and flooding of last winter.

So, on the one hand, you have a stock market that is simultaneously being propped up by enormous cash flows and held back by a weakening economy and earnings and profit-taking from the best quarterly start in ten years. It all adds up to a market that could go absolutely nowhere.

And I just so happen to have the perfect portfolio for such a market. These are the precise conditions where deep in-the-money call and put option spreads absolutely prosper. When everything is going nowhere, spreads always expire at their maximum profit points.

The global easing trend is accelerating as central banks rush to head off the next global recession. Expect interest rates to drop to levels you once thought impossible.

The global bond short covering panic continues, with ten-year US Treasury yields dropping to an eye-popping 2.33%. Slowing global growth is to blame. Did I hear the word “refi”?

Foreign investors poured into the US bond market, driving ten-year US Treasury yields down to 2.33%. When everyone else in the world has negative yields, our bonds become the best paying in the world.

Q4 GDP final report came in at 2.2% as expected, down a third from Q3. Expect that figure to more than halve in Q1 2019. Put on your hard hat.

The Mueller Report gave Trump a clean bill of health, at least on the collusion issue. But it opened up a dozen other lines of investigation that will continue for years. It’s definitely a “RISK ON” development.

US Existing Home sales jumped 11.8% in January. Low mortgage interest rates are finally kicking in with the 30-year fixed at 4.23%. This is a one hit wonder, not the beginning of a new trend. But interest rates are going lower.

New Home Sales were up 4.9% to 667,000 units in February in a rare positive data point. Could low interest rates finally be kicking in? Still, avoid homebuilders.

Apple (AAPL) announced its new streaming service, Apple TV Plus, and the stock fell on a “sell the news” drop. Roku is included in the package so buy (ROKU). The Apple offering is weak enough to allow plenty of room for Disney to launch its own streaming service Disney Plus at the end of this year. Prepare for an onslaught of princesses. Buy (DIS) too.

Home price appreciation hit a four-year low with the S&P Case Shiller National Home Price Index growing only 4.2% YOY in January, down from 4.6% the previous month. Las Vegas, Phoenix, and Minneapolis are still showing the biggest gains while San Francisco and Seattle are seeing the biggest price drops. Avoid homebuilders (ITB).

Lyft (LYFT) priced at $72 a share, the top end of expectations, valuing the company at an eye popping $25 billion at the end of the day. Never mind that the company is losing money hand over fist, it’s all about potential. The tech IPO bubble top has started!

The Mad Hedge Fund Trader was up on the week with time decay in our combed 13 positions our best friend. The quarter end window dressing was kind to us.

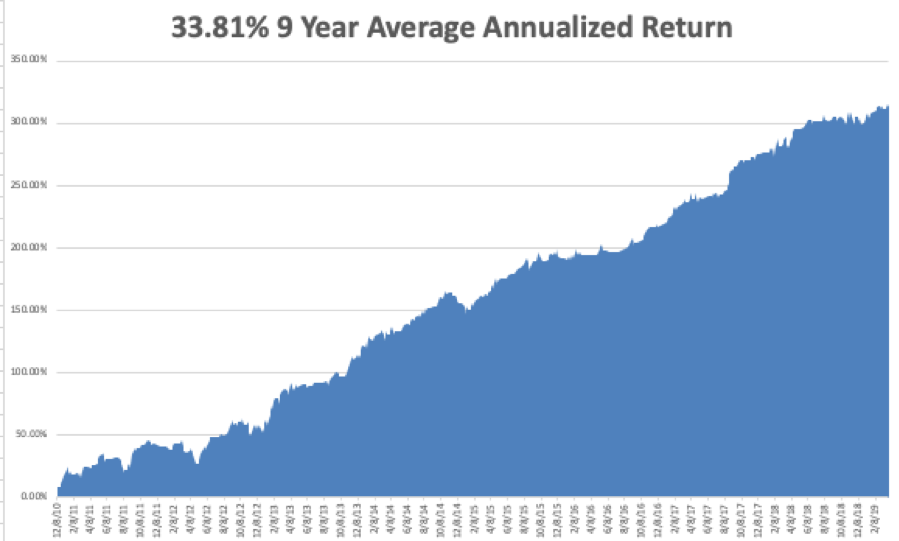

March turned positive in a final burst, up 1.78%. My 2019 year to date return retreated to +15.49%, boosting my trailing one-year return back up to +35.16%.

My nine-year return recovered to +315.56%, a new all-time high. The average annualized return appreciated to +33.81%. I am now 45% in cash, 30% long and 25% short, and my entire portfolio expires at the April 18 option expiration day in 9 trading days. I took generous profits on my positions in copper miner Freeport McMoRan (FCX) right when it bounced off the 200-day moving average.

The Mad Hedge Technology Letter maintained long positions in Microsoft (MSFT), Alphabet (GOOGL), and PayPal (PYPL), and Amazon (AMZN), which are clearly going to new highs.

It’s jobs week again with the usual trifecta of employment reports. Last month was a disaster, so this month will be interesting.

On Monday, April 1 at 8:30 AM, February Retail Sales are published.

On Tuesday, April 2, 8:30 AM EST, we learn February Durable Goods.

On Wednesday, April 3 at 8:15 AM, the ADP Employment Report comes out for private hiring.

On Thursday, April 4 at 8:30 AM EST, the Weekly Jobless Claims are announced.

On Friday, April 5 at 8:30 AM, we obtain the big number of the week, the February Nonfarm Payroll Report.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’m going to use a rare spell of good weather to drive up to Lake Tahoe and start the planning work on my October 25-26 Mad Hedge Lake Tahoe Conference. Half the dinner tickets sold out on the first day, so you better get moving now.

Maybe it’s something I said? To learn more about the conference, please click here. I’ll see you there.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.