Global Market Comments

September 21, 2018

Fiat Lux

Featured Trade:

(SEPTEMBER 19 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (VIX), (VXX), (GS), (BABA), (BIDU), (TLT), (TBT),

(TSLA), (NVDA), (MU), (XLP), (AAPL), (EEM),

(MONDAY, OCTOBER 15, 2018, ATLANTA, GA,

GLOBAL STRATEGY LUNCHEON)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader September 19 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: Do you expect a correction in the near term?

A: Yes. In fact, we may even see it in October. Markets (SPY) have been in extreme, overbought territory for a month now, the macro background is terrible, trade wars are accelerating, and interest rates are rising sharply. The only thing holding the market up is the prospect of one more quarter of good earnings, which companies start reporting next month. So once that’s out of the way, be careful, because people are just hanging on to the last final quarter before they sell.

Q: I just got out of my cannabis stock, what should I do now?

A: Thank your lucky stars you got away with that—it was an awful trade and you made money on it anyway. Stay away in droves. After all, the cannabis industry is all about growing a weed and how hard is that? This means the barriers to entry are zero. In fact, I’m thinking of growing some in my own backyard. My tomatoes do well, so why not Mary Jane?

Q: The Volatility Index (VIX) is now at $11.79—should I buy?

A: No, the rule of thumb for the (VIX) is to wait for it to sit on a bottom for one to two weeks and let some time decay work itself out. You’ll see that in the ETF, the iPath S&P 500 VIX Short-Term Futures ETN (VXX). When it stops breaking to new lows, that means it’s ready for another bounce. I would wait.

Q: What do you think about banks here? Is it time to get in?

A: No, these are not promising charts. If anything, I’d say Goldman Sachs (GS) is getting ready to do a head and shoulders and go to new lows. I would stay away from financials unless I see more positive evidence. The industry is ripe for disruption from fintech, which has already started. That’s said, they are way overdue for a dead cat bounce. That’s a trade, not an investment.

Q: Would you short Alibaba (BABA) and Baidu (BIDU) here?

A: No. Shorting is what I would have done six months ago; now it’s far too late. If anything, I would be a buyer of those stocks here, based on the possibility that we will see progress or an end to the trade war in the next couple of months. If the trade wars continue, they will put the U.S. in recession next year, and then you don’t want to own stocks anywhere.

Q: Is Apple (AAPL) going to get hit by the trade wars?

A: So far, this has not been the case, but they are whistling past the graveyard right now—an obvious target in the trade wars from both sides. For instance, the U.S. could suddenly start applying a 25% import duty to iPhones from China, which would make your $1,000 phone a $1,250 phone. Similarly, the Chinese could hit it in China, restricting their manufacturing in one way or another. I’m being very cautious of Apple for this reason. The stock already has one $10 drop just because of this worry.

Q: Can the U.S. ban China from selling bonds?

A: No, they can’t. The global U.S. Treasury bond market (TLT) is international by nature—there is no way to stop the selling. It would take a state of war to reach the point where the Fed actually seizes China’s U.S. Treasury bond holdings. The last time that happened was when Iran seized the U.S. embassy in Tehran in 1979. Iran didn’t get its money back until the Iran Nuclear Deal in 2015. Before that you have to go back to WWII, when the U.S. seized all German and Japanese assets. They never got those back.

Q: What are your thoughts on the chip sector?

A: Stay away short-term because of the China trade war, but it’s a great buy on the long term. These stocks, like NVIDIA (NVDA) and Micron Technology (MU) have another double in them. The fundamentals are outrageously good.

Q: Is the market crazy, or what?

A: Yes, it is crazy, which is why I’m keeping 90% cash and 10% on the short side. But “Markets can remain irrational longer than you can stay liquid,” as my friend John Maynard Keynes used to say.

Q: What’s your take on the Consumer Staples sector (XLP)?

A: It will likely go up for the rest of the year, into the Christmas period; it’s a fairly safe sector. The uptrend will remain until it doesn’t.

Q: Should we buy TBT now?

A: No, the time to buy the ProShares Ultra Short 20+ Year Treasury ETF (TBT) was two months ago. Now is the time to sell and take profits. I don’t think 10-year U.S. Treasury yields (TLT) are going above 3.11% in this cycle, and we are now at 3.07%. Buy low and sell high, that’s how you make the money, not the opposite.

Q: Does this webinar get posted on the website?

A: Yes, but you have to log in to access it. Then hover your cursor over My Account and a drop-down menu magically appears. Click on Global Trading Dispatch, then the Webinars button, and the last nine years of webinars appear. Pick the webinar you want and click on the “PLAY” arrow. Just give us a couple of hours to get it up.

Q: Can Chinese companies use Southeast Asia as a conduit to export to the U.S.?

A: Yes. This is an old trick to bypass trade restrictions. For example, most of the Chinese steel coming into the U.S. is through third countries, like Singapore. Eventually they do get found out, at which point companies or imports from Vietnam will be identified as Chinese origin and get hit with the import duties anyway, but it could take a year or two for those illegal imports to get discovered. This has been going on ever since trade started.

Q: Will the currency crisis in Argentina and Turkey spread to a global contagion?

A: Yes, and this could be another cause of a global recession late next year. The canaries in the coal live there (EEM).

Q: Would you use the DOJ probe to buy into Tesla (TSLA)?

A: No, buy the car, not the stock as it is untradeable. This is in fact the third DOJ investigation Tesla has undergone since Trump came into office. The last one was over how they handled the $400 million they have in deposits for their 400,000 orders. It turns out it was all held in an escrow account. There are easier ways to make money. It’s a black swan a day with Tesla. This is what happens when you disrupt about half of the U.S. GDP all at once, including autos, the national dealer network, big oil, and advertising. All of these are among the largest campaign donors in the U.S.

Time to Bring Out the Big Guns

Global Market Comments

September 20, 2018

Fiat Lux

SPECIAL VOLATILITY ISSUE

Featured Trade:

(SHOPPING FOR FIRE INSURANCE IN A HURRICANE),

(VIX), (VXX), (XIV),

(THE ABC’s OF THE VIX),

(VIX), (VXX), (SVXY)

Global Market Comments

September 19, 2018

Fiat Lux

Featured Trade:

(THE QUANTUM COMPUTER IN YOUR FUTURE),

(AMZN), (GOOG),

(WEDNESDAY, OCTOBER 17, 2018, HOUSTON

GLOBAL STRATEGY LUNCHEON)

Global Market Comments

September 18, 2018

Fiat Lux

Featured Trade:

(DON’T MISS THE SEPTEMBER 19 GLOBAL STRATEGY WEBINAR),

(COFFEE WITH RAY KURZWEIL), (GOOG)

My next global strategy webinar will be held on Wednesday, September 19 at 12:00 PM EST, which I will be broadcasting live from Silicon Valley in California.

Mad Day Trader Bill Davis will be my willing co-conspirator.

I’ll be giving you my updated outlook on stocks, bonds, commodities, currencies, precious metals, energy, and real estate.

The goal is to find the cheapest assets in the world to buy, the most expensive to sell short, and the appropriate securities with which to take positions.

I will also be opining on recent political events around the world and the investment implications therein.

I usually include some charts to highlight the most interesting new developments in the capital markets. There will be a live chat window with which you can pose your own questions.

The webinar will last 45 minutes to an hour. International readers and new subscribers who are unable to participate in the webinar live will find it posted on my website within a few hours. I look forward to hearing from you.

To log into the webinar, please click on the link we emailed you entitled, "Next Bi-Weekly Webinar – September 19, 2018" or click here.

“You are the average of the last five people you spend the most time with,” said Peter Diamandis, the founder of the Singularity University.

Global Market Comments

September 17, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD),

(AAPL), (CBS), (EEM), (BABA), (UUP), (MSFT), (VIX), (VXX), (TLT),

(TUESDAY, OCTOBER 16, 2018, MIAMI, FL, GLOBAL STRATEGY LUNCHEON)

Talking to hedge fund managers, financial advisors, and portfolio managers around the country de-risking seems to be the name of the game. It’s like they expect a category five hurricane to hit the markets tomorrow.

Even my friend, hedge fund legend David Tepper, says that the stock market is fairly valued and that he is cutting back his equity exposure. However, he is hanging onto his position in Micron Technology (MU), which he believes is deeply oversold. Will the last person to leave Dodge please turn out the lights?

You can expect a real hurricane, Florence, to impact the coming economic data. The usual pattern is for GDP growth to take an initial hit when the big storms hit, and then make back more as reconstruction and government spending kicks in. The scary thing is that there are three more hurricanes on the way.

The big event of the week was Apple’s (AAPL) roll out of its new product line, which will beat the daylights out of competitors. Think better and more expensive across the board, with the top iPhone now costing an eye-popping $1,499.

If you are Life Alert, the private company that sells safety devices to seniors, Apple just ate your lunch. Welcome to the cutthroat world of technology investing.

The drama at CBS (CBS) played out with the departure of CEO Les Moonves. He basically generated virtually all the profits for the company for the past two decades. But in this modern age not keeping your zipper zipped carries a heavy price.

A happier departure was seen by Alibaba’s (BABA) Jack Ma, China’s richest man to focus on philanthropic activity.

Emerging markets (EEM) continued their relentless meltdown, only given a brief respite by profit taking in the U.S. dollar (UUP) on Friday.

A coming strike by the United Steelworkers may mark the onset of new wage demands by labor nationwide. In the meantime, the JOLTS report hit a new all-time high with 650,000 job openings.

For the final “screw you” of the week, Trump indicated he was going forward with tariffs on another $200 billion in Chinese imports. Consumer goods will dominate the new black list in the lead up to the Christmas shopping season. Beat the Grinch and shop early!

With the Mad Hedge Market Timing Index ranging from 50 to 78 last week the market keeps trying and failing to reach new all-time highs on small volume. Volatility (VIX) hit a one-month low.

Thank goodness I took profits on my iPath S&P 500 VIX Short Term Futures ETN (VXX) long. The January $40 call options have cratered from $3.60 to only $1.96. Still, there was enough price action to allow us to take nice profits on our bond short (TLT) and Microsoft (MSFT) long. Microsoft was the top-performing Dow stock last and we got in early!

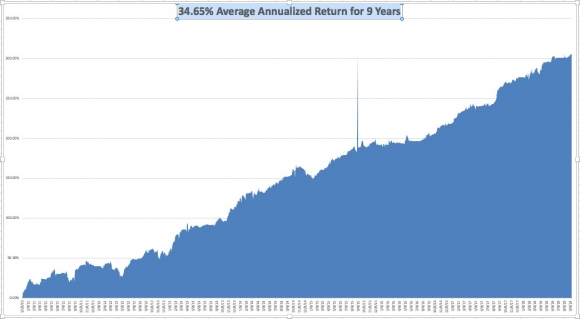

Last week, the performance of the Mad Hedge Fund Trader Alert Service forged a new all-time high. September has given us a middling return of 2.42%. My 2018 year-to-date performance has clawed its way back up to 29.43% and my trailing one-year return stands at 41.35%.

My nine-year return appreciated to 305.90%. The average annualized Return stands at 34.65%. The more narrowly focused Mad Hedge Technology Fund Trade Alert performance is annualizing now at an impressive 29.41%. I hope you all feel like you’re getting your money’s worth.

This coming week is pretty flaccid in terms of economic data releases.

On Monday, September 17, at 8:30 AM, we learn the August Empire State Manufacturing Survey.

On Tuesday, September 18, at 10:00 AM, the National Association of Homebuilders Home Price Index is released. August Home Sales is out at 10:00 AM EST.

On Wednesday September 19, at 8:30 AM, the August Housing Starts is published.

Thursday, September 20 leads with the Weekly Jobless Claims at 8:30 AM EST, which dropped 1,000 last week to 204,000.

On Friday, September 21, at 8:30 AM, we learn August Retail Sales. The Baker Hughes Rig Count is announced at 1:00 PM EST. Last week saw a gain of 7.

As for me, the harvest season in nearby Napa Valley is now in full swing, so I’ll be making the rounds picking up my various wine club memberships. Screaming Eagle check, Duckhorn check, Chalk Hill check.

Good luck and good trading.

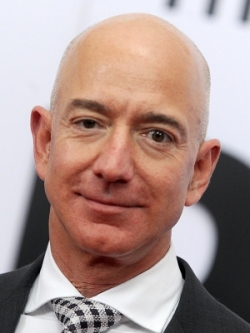

“When the stock goes up 30% in a month don’t think you’re 30% smarter, because when it falls 30% in a month you’ll look 30% dumber,” said Amazon founder Jeff Bezos, the world’s richest man.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.