Global Market Comments

September 14, 2018

Fiat Lux

Featured Trade:

(SOME GOOD NEWS FROM TESLA), (TSLA),

(SOME SAGE ADVICE ABOUT ASSET ALLOCATION)

I’ll give you a chance to pick yourself off the floor first.

While the media focus seems to be overwhelmingly on problems with the Tesla 3 (TSLA) production these days, the fact is that some of the company’s other business lines are growing like gangbusters.

Orders for the groundbreaking Tesla Powerwall were up an eye-popping 450% during the first half of 2018. This device costs $5,800 ($4,060 after the federal alternative investment tax credit) and can store enough power to run your house for three days. When integrated with your solar rooftop array the combined system allows you to reap a greater return from your alternative energy investment.

Tesla could sell more Powerwalls but is constrained by lithium ion battery supplies from its Sparks, Nevada, Gigafactory. Doubling the world’s lithium ion battery supply in one shot, Tesla is already shopping for a location for a second Gigafactory.

As the company made ramping up Tesla 3 production to 100,000 units this year its top priority, the car has first call on battery supplies.

Tesla has also recently completed several utility-sized battery projects that have consumed lithium ion supplies, including those in Australia, Moss Landing, California, for PG&E, and for Green Mountain Energy in Vermont.

This means that Tesla has already carved out a dominant position in a market that is expected to grow by tenfold over the next five years. GTM Research estimated that sales of energy storage products in the U.S. will soar from $541 million in 2018 to $1 billion in 2019 and $4.6 billion by 2013.

It is developing into a global market. The U.S. only accounts for 30% of the global battery storage market, with energy poor Japan and South Korea holding major shares.

Tesla competitors include Florida-based NextEra Energy in America, E.on in Germany, and Fluence, a joint venture between Siemens and AES, also from Germany. Germany seems to be the place where green energy philosophies and top-rate engineering meet.

It’s impossible to see how much the battery business is contributing to Tesla’s overall bottom line as it does not break out earnings separately. They are subsumed within a Tesla division that once comprised Solar City, which Tesla took over in 2016. Running two businesses off a single lithium ion supply was a stroke of genius, permitting vertical integration and vast economies of scale.

However, Tesla’s solar business saw revenues rise by 56.7% to $784 million over the year-earlier period. Selling a product with exponential demand but limited supply is a good place to be in.

It is puzzling to see so much media attention paid to a company with a market capitalization of only $50 billion. Last week, the controversial firm soaked up perhaps a quarter of all financial reporting coverage.

But when you add up all of the industries that Tesla is radically disrupting, such as autos, the oil industry, the dealer local network, local power utilities, and advertising, it comes close to 25% of U.S. GDP.

If I had just taken the online payments system, auto, rocket, solar, and the battery industries a decade into the future and made $30 billion for myself along the way, I’d probably be smoking a joint, too.

And Elon is only 47. It makes you wonder what you’ve been doing with all your free time.

Send Me Another Half Dozen

Global Market Comments

September 13, 2018

Fiat Lux

Featured Trade:

(EXPANDING MY “TRADE PEACE” PORTFOLIO),

(BABA), (BIDU), (TCTZF) (MU), (LRCX), (KLAC), (EEM),

(FXI), (EWZ), (SOYB), (CORN), (WEAT), (CAT), (DE),

(THE LEAGUE OF EXTRAORDINARY TRADERS)

This morning, U.S. Treasury Secretary Steven Mnuchin mentioned that an effort was being made to get trade talks with China back on track. The Dow soared 160 points in a heartbeat.

Past murmurings by the Treasury Secretary demonstrate that his musings have zero credibility in the marketplace and the move vaporized in minutes. However, given the extreme moves made by the shares of trade war victims, I think it is time to review my “Trade Peace” portfolio and make some additions.

The shares have been so beaten up that I think you can start scaling in now with limited downside and a ton of potential upside.

It’s not a matter of if, but when Trump has to run up the white flag with his wildly unpopular trade wars. As they now stand the new tariffs are threatening to chop $10 off of S&P 500 earnings in 2018, from $168 down to $158, according to J.P. Morgan. Some two-thirds of all U.S. companies have been negatively impacted.

Tariffs have effectively wiped out the benefits of the corporate tax cuts for most companies enacted last December. Who has been the worst hit? Thousands of small manufacturers in Midwest red states that can’t function because they are missing crucial cheap parts they can only obtain from the Middle Kingdom.

At last count there are a staggering 37,000 applications for exemptions from tariffs filed with the U.S. Treasury and only a dozen people to process them. A mere 10% have been granted. It is a giant bureaucratic nightmare.

With the midterm elections now only 37 trading days away, the clock is ticking. If Trump doesn’t cut trade deals with all of our major counterparties around the world before then, the Republican Party stands to lose both the House of Representatives and the Senate on November 6. That will make Trump a “lame duck” president for two more years.

China Technology Stocks – Includes Alibaba (BABA), Baidu (BIDU), and Tencent (TCTZF). It’s not often that you get to buy a company with 61% sales growth, which has seen its shares plunge by 27% in three months, as is the case with (BABA). Just to get (BABA) back up to its June level it has to rise by 37%. This is a stock that will easily double or triple over the long term.

U.S. Semiconductor Stocks – With China buying 80% of its chips from the U.S., stocks such as Micron Technology (MU), Lam Research (LRCX), and KLA-Tencor (KLAC) have been taken out to the woodshed and beaten senseless. Micron is off a withering 41% since the trade war began in earnest in May.

Emerging Markets – China is the largest trading partner for most of the world, and a recession there sparks a global contagion effect. Reverse that, and you stimulate not only emerging markets, but the U.S. economy, too. Look at the charts for the iShares MSCI Emerging Markets ETF (EEM), the iShares China Large-Cap ETF (FXI), and the iShares MSCI Brazil ETF (EWZ) and you will salivate.

Oil – Boost the global economy and oil demand (USO) also. China is the world’s largest incremental buyer of new oil, and it will absorb all of the Iranian crude freed up by the U.S. abrogation of the treaty there.

Agricultural – No sector has been punished more than agriculture, where profit margins are small, lead times stretch into years, and mother nature plays her heavy hand. In this area you can include soybeans (SOYB), corn (CORN), and wheat (WEAT), as well as equipment makers Caterpillar (CAT) and Deere (DE).

Some 20 years of development efforts in China by American farmers have gone down the toilet, and much of this business is never coming back. Trust and reliability are gone for good. Storage silos across the country are full. Did I mention that red states are taking far and away the biggest hit? There are not a lot of soybeans grown in California, New York, or New Jersey.

Even if Trump digs in and refuses to admit defeat, as is his way, there is still a light at the end of the tunnel. Sometime in 2019, the World Trade Organization will declare virtually all of the new American tariffs illegal and hit the U.S. with its own countervailing duties. This is the Chinese strategy. Waiting for them to fold could be a long wait, a very long wait.

Time to Look at the “Trade Peace” Portfolio?

Global Market Comments

September 12, 2018

Fiat Lux

THE FUTURE OF AI ISSUE

Featured Trade:

(THE NEW AI BOOK THAT INVESTORS ARE SCRAMBLING FOR),

(GOOG), (FB), (AMZN), MSFT), (BABA), (BIDU),

(TENCENT), (TSLA), (NVDA), (AMD), (MU), (LRCX)

“I’m prepared to eat our children because if I don’t, somebody else will,” said Sir Martin Sorrell about the extreme competitiveness of online marketing.

Global Market Comments

September 11, 2018

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS,

OR OPTIONS CALLED AWAY), (MSFT),

(TEN MORE REASONS WHY BONDS WON’T CRASH),

(TLT), (TBT), (ELD), (MUB)

Global Market Comments

September 10, 2018

Fiat Lux

Featured Trade:

(WEDNESDAY, OCTOBER 17, 2018, HOUSTON

GLOBAL STRATEGY LUNCHEON INVITATION),

(THE MARKET OUTLOOK FOR THE WEEK AHEAD,

or “IT WASN’T ME!”),

(AMZN), (NKE), (SPY), (PCG)

First of all, I want to confirm absolutely and without any doubt that I did not write the anonymous and controversial New York Times op-ed entitled “I Am Part of the Resistance Inside the Trump Administration.” It wasn’t me.

During the 1970s I tried to write for the Grey Lady about the Chinese Cultural Revolution, the threat to the U.S. posed by the Japanese auto industry, and the coming appreciation of the Japanese yen. But they would have none of it.

That’s because they only ran copy from their own full-time journalists and didn’t accept work from freelancers. The Wall Street Journal, Barron’s, The Economist, no problem. The New York Times, no way Jose.

Anyway, anyone with any knowledge of military aviation knows who wrote it. Yes, it’s that obvious.

I was driving over the Oakland Bay Bridge on my way to San Francisco the other day and what I saw stunned me.

This time of year, you usually see 18 enormous Chinese container ships waiting to offload their cargo at the Port of Oakland in the run-up to the Christmas shopping season. This time I saw only 10.

Either the Chinese are sending their toys, electronics, and apparel to other U.S. ports, or they are not sending them at all. If it’s the latter it means that U.S. consumer demand is about to fall off a cliff, driven away by the high prices demanded by the new 25% import duties.

I called around to see if this was just a local problem. In fact, U.S. port landings are down 10% year on year, and off by a dramatic 25% in the hardest hit ports such as New Orleans, a major agricultural exporter.

If this is true, the consequences for U.S. investors are dire.

Let me give you one of my secret trading insights borne of a half century of stock market research. Real world observations front run official government data releases by three to six months. This is why I spend so much time in the field kicking tires, chatting up store managers, and flying over auto landing docks. If this is true, you could see early signs of a recession by early 2019.

The August Nonfarm Payroll Report came in at 201,000 on Friday, with the headline Unemployment Rate unchanged at 3.9%. June and July were revised down by 50,000 jobs.

The real news here is that Average Hourly Earnings popped to 2.9%, the biggest gain in nine years, proving that inflation is edging its way closer.

Health Care added 33,000 jobs, Construction 23,000, and Transportation up 20,000. Manufacturing lost 3,000 jobs, a victim of the trade wars, while Retail lost 5,000.

The U-6 broader “discouraged worker” unemployment fell to 7.4%, a new decade low. Certainly, the job market is firing on all cylinders.

The news gave us a nice little gap down in our short position in the bond market, taking the 10-year U.S. Treasury yield up to 2.95%, a one month high.

Still, you have to wonder why the stock market behaved so poorly after the release of such a healthy number. Was it “buy the rumor, sell the news,” the September effect, or the end of the 8 ½-year bull market? Obviously, I came out of my long (VXX) position too soon.

All doubts were removed when the president delivered a sucker punch to stocks by announcing new tariffs on a further $267 billion in Chinese imports. This is on top of the duties that applied to $200 billion of imports on Monday. The trade war steps up another notch. Now ALL Chinese imports are subject to punitive U.S. duties.

Amazon (AMZN) finally topped $1 trillion in market capitalization, delivering for my followers a ten-bagger on a recommendation I made several years ago.

Nike (NKE) delivered the ad campaign of the century, led by former San Francisco 49ers quarterback Colin Kaepernick. Just think of all the new demand created in the market by all those burning shoes.

The State of California passed a bill to stick the utility PG&E (PCG) with the bill for last year’s big fires. The company will pass it on to rate payers. Thank goodness I went all solar three years ago!

With the Mad Hedge Market Timing Index diving from 78 to 52 we definitely got some topping action in the market, and our short positions paid off handsomely. Both of my remaining positions are making money, my longs in Microsoft (MSFT) and my short in the U.S. Treasury bond market (TLT).

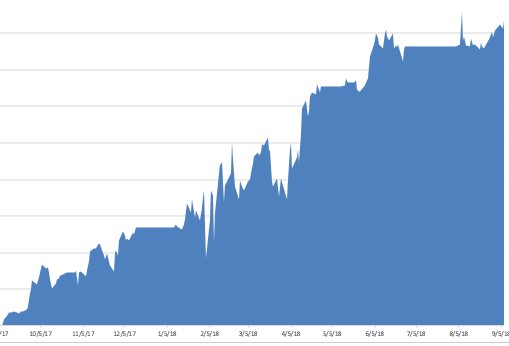

We are off to the races in September, giving us a robust return of 1.37%. My 2018 year-to-date performance has clawed its way back up to 28.39% and my nine-year return appreciated to 304.86%. The Averaged Annualized Return stands at 34.51%. The more narrowly focused Mad Hedge Technology Fund Trade Alert performance is annualizing now at an impressive 29.59%.

This coming week only has one important data release, the Fed Beige Book on Wednesday afternoon.

On Monday, September 10, at 3:00 PM, July Consumer Credit is out and should be at an all-time high as people max out their credit cards at the top of an economic cycle.

On Tuesday, September 11, at 6:00 AM, the NFIB Small Business Optimism Index is released at 6:00 AM.

On Wednesday, September 12, at 2:00 PM, the Federal Reserve discloses its Beige Book, which includes the data from the 12 Fed districts the Federal Open Market Committee at its September 19-20 meeting.

Thursday, September 13 leads with the Weekly Jobless Claims at 8:30 AM EST, which saw an amazing fall of 10,000 last week to 203,000.

On Friday, September 14, at 9:15 AM, we learn August Industrial Production. The Baker Hughes Rig Count is announced at 1:00 PM EST.

As for me,

Good luck and good trading.

41.79% Trailing One Year Return

It Wasn’t Me!

Global Market Comments

September 7, 2018

Fiat Lux

Featured Trade:

(MONDAY, OCTOBER 15, 2018, ATLANTA, GA,

GLOBAL STRATEGY LUNCHEON),

(SEPTEMBER 5 BIWEEKLY STRATEGY WEBINAR Q&A),

(AMZN), (MU), (MSFT), (LRCX), (GOOGL), (TSLA),

(TBT), (EEM), (PIN), (VXX), (VIX), (JNK), (HYG), (AAPL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.