Global Market Comments

April 23, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE COMES THE FOUR HORSEMEN OF THE APOCALYPSE),

(SPY), (GOOGL), (TLT), (GLD), (AAPL), (VIX), (VXX), (C), (JPM),

(HOW TO AVOID PONZI SCHEMES),

(TESTIMONIAL)

Have you liked 2018 so far?

Good.

Because if you are an index player, you get to do it all over again. For the major stock indexes are now unchanged on the year. In effect, it is January 1 once more.

Unless of course you are a follower of the Mad Hedge Fund Trader. In that case, you are up an eye-popping 19.75% so far in 2018. But more on that later.

Last week we caught the first glimpse in this cycle of the investment Four Housemen of the Apocalypse. Interest rates are rising, the yield on the 10-year Treasury bond (TLT) reaching a four-year high at 2.96%. When we hit 3.00%, expect all hell to break loose.

The economic data is rolling over bit by bit, although it is more like a death by a thousand cuts than a major swoon. The heavy hand of major tariff increases for steel and aluminum is making itself felt. Chinese investment in the US is falling like a rock.

The duty on newsprint imports from Canada is about to put what's left of the newspaper business out of business. Gee, how did this industry get targeted above all others?

The dollar is weak (UUP), thanks to endless talk about trade wars.

Anecdotal evidence of inflation is everywhere. By this I mean that the price is rising for everything you have to buy, like your home, health care, college education, and website upgrades, while everything you want to sell, such as your own labor, is seeing the price fall.

We're not in a recession yet. Call this a pre-recession, which is a long-leading indicator of a stock market top. The real thing shouldn't show until late 2019 or 2020.

There was a kerfuffle over the outlook for Apple (AAPL) last week, which temporarily demolished the entire technology sector. iPhone sales estimates have been cut, and the parts pipeline has been drying up.

If you're a short-term trader, you should have sold your position in April 13 when I did. If you are a long-term investor, ignore it. You always get this kind of price action in between product cycles. I still see $200 a share in 2018. This too will pass.

This month, I have been busier than a one-armed paper hanger, sending out Trade Alerts across all asset classes almost every day.

Last week, I bought the Volatility Index (VXX) at the low, took profits in longs in gold (GLD), JP Morgan (JPM), Alphabet (GOOGL), and shorts in the US Treasury bond market (TLT), the S&P 500 (SPY), and the Volatility Index (VXX).

It is amazing how well that "buy low, sell high" thing works when you actually execute it. As a result, profits have been raining on the heads of Mad Hedge Trade Alert followers.

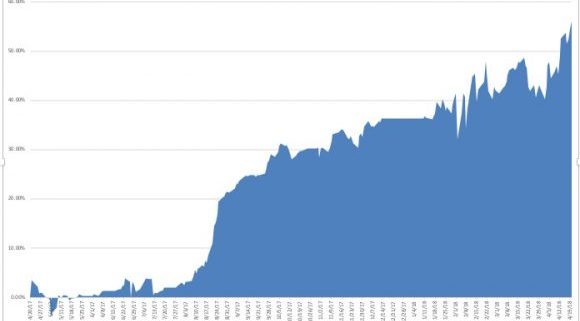

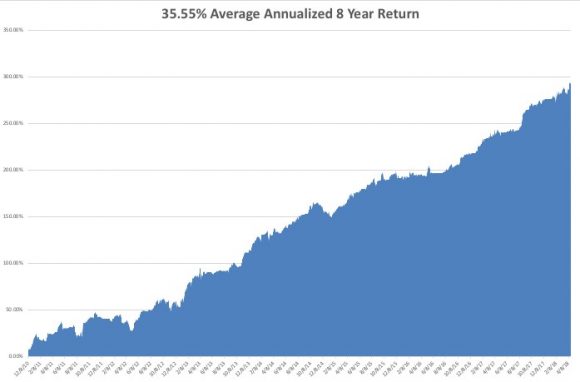

That brings April up to an amazing +12.99% profit, my 2018 year-to-date to +19.75%, my trailing one-year return to +56.09%, and my eight-year performance to a new all-time high of 296.22%. This brings my annualized return up to 35.55% since inception.

The last 14 consecutive Trade Alerts have been profitable. As for next week, I am going in with a net short position, with my stock longs in Alphabet (GOOGL) and Citigroup (C) fully hedged up.

And the best is yet to come!

I couldn't help but laugh when I heard that Republican House Speaker Paul Ryan announced his retirement in order to spend more time with his family. He must have the world's most unusual teenagers.

When I take my own teens out to lunch to visit with their friends, I have to sit on the opposite side of the restaurant, hide behind a newspaper, wear an oversized hat, and pretend I don't know them, even though the bill always mysteriously shows up on my table.

This will be FANG week on the earnings front, the most important of the quarter.

On Monday, April 23, at 10:00 AM, we get March Existing-Home Sales. Expect the Sohn Investment Conference in New York to suck up a lot of airtime. Alphabet (GOOGL) reports.

On Tuesday, April 24, at 8:30 AM EST, we receive the February S&P CoreLogic Case-Shiller Home Price Index, which may see prices accelerate from the last 6.3% annual rate. Caterpillar (CAT) and Coca Cola (KO) report.

On Wednesday, April 25, at 2:00 PM, the weekly EIA Petroleum Statistics are out. Facebook (FB), Advanced Micro Devices (AMD), and Boeing (BA) report.

Thursday, April 26, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a fall of 9,000 last week. At the same time, we get March Durable Goods Orders. American Airlines (AAL), Raytheon (RTN), and KB Homes (KBH) report.

On Friday, April 27, at 8:30 AM EST, we get an early read on US Q1 GDP.

We get the Baker Hughes Rig Count at 1:00 PM EST. Last week brought an increase of 8. Chevron (CVX) reports.

As for me, I am going to take advantage of good weather in San Francisco and bike my way across the San Francisco-Oakland Bay Bridge to Treasure Island.

Good Luck and Good Trading.

My financial advisory clients, by and large, have expressed a desire to be kept in the loop once a quarter and when it matters in between, but don't want to hear from me on an ongoing constant basis.

I know because I've asked.

They are mostly retired, conservative by nature, and want to enjoy life while trusting that I know what I'm doing.

I often get my talking points from you, and it's interesting to watch the relief on their faces when I talk, for example, about the millennials being the hope behind the national debt.

I point out that we have something China and Japan don't have - a large group of young people coming up the pike. For them those talking points bring a great sign of relief.

I'm going into some detail because it's something to think about when you're marketing your service.

My thoughts off the top of my head.

Cheryl

Portland, Oregon

Global Market Comments

April 20, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE APRIL 25 GLOBAL STRATEGY WEBINAR),

(AN EVENING WITH BILL GATES, SR.),

(TESTIMONIAL)

My next global strategy webinar will be held live from Silicon Valley on Wednesday, April 25, at 12:00 PM EST.

Co-hosting the show will my friend, options expert Mike Pisani.

I'll be giving you my updated outlook on stocks, bonds, commodities, currencies, precious metal, and real estate.

The goal is to find the cheapest assets in the world to buy, the most expensive to sell short, and the appropriate securities with which to take these positions.

I will also be opining on recent political events around the world and the investment implications therein.

I usually include some charts to highlight the most interesting new developments in the capital markets. There will be a live chat window with which you can pose your own questions.

The webinar will last 45 minutes to an hour. International readers who are unable to participate in the webinar live will find it posted on my website within a few hours.

I look forward to hearing from you.

To log into the webinar, please click on the link we emailed you entitled, "Next Bi-Weekly Webinar - April 25, 2018" or click here.

I had a chat with Bill Gates, Sr. recently, co-chairman of the Bill and Melinda Gates Foundation, the world's largest private philanthropic organization. There, a staff of 800 help him manage $36.8 billion.

The foundation will give away $3.5 billion this year, a 10% increase over last year. Some $1.5 billion will go to emerging national health care, and another $750 million to enhance American education.

The foundation's spending in Africa has been so massive that it is starting to have a major impact on conditions and is part of the bull case for investing there.

The fund happens to be one of the best managed institutions out there, having sold the bulk of its Microsoft (MSFT) stock just before the dot-com bust and moving the money into Treasury bonds.

Mr. Gates' pet peeve is the precarious state of the US K-12 public education system, where teaching is not as good as it could be, expectations are low, and financial incentives and national standards are needed.

When asked about retirement, he said, "Having a son with a billion dollars puts a whole new spin on things."

Now a razor-sharp 92 and towering over me at 6'7", his favorite treat is the free NetJets miles he gets for Christmas every year from his son, Bill Jr.

In his memoir Showing up for Life, he says a major influence on his life was his Scoutmaster 70 years ago.

Being an Eagle Scout myself, I quickly drilled him on some complex knots, and he whipped right through all of them.

The world needs more Bill Gates Srs.

A Bowline Knot

Nice work! You do great analysis and execution. I got a 100% overnight profit on the (UVXY) calls!

Zev

Potomac, Maryland

Global Market Comments

April 19, 2018

Fiat Lux

Featured Trade:

(DIVING BACK INTO THE VIX),

(VIX), (VXX), (SPX),

(THE GREAT AMERICAN JOBS MISMATCH)

I think we are only days, at the most weeks, away from the next crisis coming out of Washington. It can come for any of a dozen different reasons.

Wars with Syria, Iran or North Korea. The next escalation of the trade war with China. The failure of the NAFTA renegotiation. Another sex scandal. The latest chapter of the Mueller investigation.

And then there's the totally unexpected, out of the blue black swan.

We are spoiled for choice.

For stock investors, it's like hiking on the top of Mount Whitney during a thunderstorm with a steel ice axe in hand.

So, I am going to buy some fire insurance here while it is on sale to protect my other long positions in technology and financial stocks.

Since April 1, the Volatility Index (VIX) has performed a swan dive from $26 to $15, a decline of 42.30%.

I have always been one to buy umbrellas during parched summers, and sun tan lotion during the frozen depths of winter. This is an opportunity to do exactly that.

Until the next disaster comes, I expect the (VXX) to trade sideways from here, and not plumb new lows. These days, a premium is paid for downside protection.

The year is playing out as I expected in my 2018 Annual Asset Class Review (Click here for the link.). Expect double the volatility with half the returns.

So far, so good.

If you don't do options buy the (VXX) outright for a quick trading pop.

You may know of the Volatility Index from the many clueless talking heads, beginners, and newbies who call (VIX) the "Fear Index."

For those of you who have a PhD in higher mathematics from MIT, the (VIX) is simply a weighted blend of prices for a range of options on the S&P 500 index.

The formula uses a kernel-smoothed estimator that takes as inputs the current market prices for all out-of-the-money calls and puts for the front month and second month expirations.

The (VIX) is the square root of the par variance swap rate for a 30-day term initiated today. To get into the pricing of the individual options, please go look up your handy-dandy and ever-useful Black-Scholes equation.

You will recall that this is the equation that derives from the Brownian motion of heat transference in metals. Got all that?

For the rest of you who do not possess a PhD in higher mathematics from MIT, and maybe scored a 450 on your math SAT test, or who don't know what an SAT test is, this is what you need to know.

When the market goes up, the (VIX) goes down. When the market goes down, the (VIX) goes up. Period.

End of story. Class dismissed.

The (VIX) is expressed in terms of the annualized movement in the S&P 500, which today is at $806.06.

So, for example, a (VIX) of $15.48 means that the market expects the index to move 4.47%, or 121.37 S&P 500 points, over the next 30 days.

You get this by calculating $15.48/3.46 = 4.47%, where the square root of 12 months is 3.46 months.

The volatility index doesn't really care which way the stock index moves. If the S&P 500 moves more than the projected 4.47%, you make a profit on your long (VIX) positions. As we know, the markets these tumultuous days can move 4.47% in a single day.

I am going into this detail because I always get a million questions whenever I raise this subject with volatility-deprived investors.

It gets better. Futures contracts began trading on the (VIX) in 2004, and options on the futures since 2006.

Since then, these instruments have provided a vital means through which hedge funds control risk in their portfolios, thus providing the "hedge" in hedge fund.

If you make money on your (VIX) trade, it will offset losses on other long positions. This is how the big funds most commonly use it.

If you lose money on your long (VIX) position, it is only because all your other long positions went up.

But then no one who buys fire insurance ever complains when their house doesn't burn down.

"Chance Favors the Prepared," said French scientist Louis Pasteur.

With the Weekly Jobless Claims bouncing around a new 43-year low at 220,000, it's time to review the state of the US labor market.

Yes, I know this research piece isn't going to generate an instant Trade Alert for you.

But it is essential in your understanding of the big picture.

There are also thousands of students who read my website looking for career advice, and I have a moral obligation to read the riot act to them.

With a 4.1% headline unemployment rate, the US economy is now at its theoretical employment maximum. If you can't get a job now, you never will.

We may see a few more tenths of a percent decline in the rate from here, but no more. To get any lower than that you have to go all the way back to WWII.

Then there was even a shortage of one-armed, three-fingered, illiterate recruits with venereal disease, the minimum US Army recruitment standards of the day.

Speaking to readers across the country and perusing the Department of Labor data, I can tell you that not all is equal in the jobs market today.

You can blame America's halls of higher education, which are producing graduates totally out of sync with the nation's actual skills needs.

Take a look at this table of graduating majors to job offers, and you'll see what I am talking about:

Major - Job Offers Offered per Graduating Major

Computer Science - 21:1

Engineering - 15:1

Physical Sciences (oil) - 13:1

Humanities - 5:1

Business and accounting - 4:1

Economics - 4:1

Agriculture - 2:1

Education - 0.4:1

Health Sciences - 0.2:1

To clarify the above data, there are 21 companies attempting to hire each computer science graduate today, while there are five kids battling it out to get each job in Health Sciences.

To understand what's driving these massive jobs per applicant disparities, take a look at the next table nationally ranking graduating majors desired by corporations.

Graduating Majors Desired by Employers

81% - Business and Accounting

76% - Engineering

64% - Computer science

34% - Economics

21% - Physical Science

12% - Humanities

5% - Agriculture

2% - Health Science

There is something screamingly obvious about these numbers.

Colleges are not producing what employers want.

This is creating enormous imbalances in the jobs market.

It explains why computer science students are landing $150,000-a-year jobs straight out of school, complete with generous benefits and health care. Many employers in Silicon Valley are now offering to pay down student debt in order to get the most desirable candidates to sign a contract.

In the meantime, Health Sciences and Humanities graduates are lucky to land a $25,000-a-year posting at a nonprofit with no benefits and Obamacare. And there are no offers to pay down student debt, which can rise to as much as $200,000 for an Ivy League degree.

Agriculture grads usually go to work on a family farm, which they eventually inherit.

As a result of these dismal figures, the character of American education is radically changing.

With students now graduating with an average of $35,000 in debt, no one can afford to remain jobless upon graduation for long.

That's why the number of Humanities graduates has declined from 9% in 2012 to 6% today.

Colleges are getting the message. Since 1990, one-third of those with the words "liberal arts" in their name or prospectus have dropped the term.

Students who do stick with anthropology, philosophy, English literature, or history are learning a few tricks as well.

Add a minor in Accounting and Management and it will increase your first-year salary by $13,000. Toss in some Data Base Management skills, and the increase will be even greater.

And online marketing? The world is your oyster!

These realities have even come home to my own family.

I have a daughter working on a PhD in Education from the University of California, and the mathematics workload is enormous, especially in statistics.

It is all so she can qualify for government research grants upon graduation.

The students themselves are partly to blame for this mismatch.

While recruiters report an average of $45,000 a year as an average first year offer, the graduates themselves are expecting an average first-year income of $53,000.

Companies almost universally report that interviewees have a "bloated" sense of their own abilities, poor interviewing skills, and unrealistic pay expectations.

Some one-third of all applicants are unqualified for the jobs for which they are applying.

The good news is that everyone gets a job eventually. A National Association of Colleges and Employers survey says that companies plan to hire 5% more college graduates than last year.

And where do all of those Humanities grads eventually go.

A lot become financial advisors.

Just ask.

Sorry, STEM Students Only!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.