Global Market Comments

April 6, 2018

Fiat Lux

Featured Trade:

(FRIDAY, JUNE 15, DENVER, CO, GLOBAL STRATEGY LUNCHEON)

(DON'T MISS THE APRIL 11 GLOBAL STRATEGY WEBINAR),

(A NOTE ON OPTIONS CALLED AWAY),

(TLT), (GOOGL), (JPM), (VXX)

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Luncheon, which I will be conducting in Denver, CO, on Friday, June 15, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too. Tickets are available for $228.

I'll be arriving at 11:30 AM, and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown private club. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase a ticket, please click here.

"It's a terrible mistake to own something, just because somebody else owns it, even if that other person is Benjamin Graham, the dean of investing," said Oracle of Omaha, Warren Buffett.

Global Market Comments

April 5, 2018

Fiat Lux

Featured Trade:

(WEDNESDAY, JUNE 13, 2018, PHILADELPHIA, PA, GLOBAL STRATEGY LUNCHEON),

(IS THE STOCK MARKET CALLING A DEMOCRATIC WIN IN NOVEMBER?),

(XOM), (KOL), (X), (QQQ),

(THE CRASH COMING TO A MARKET NEAR YOU),

(TLT), (TBT)

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Philadelphia, PA, on Wednesday, June 13, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too. Tickets are available for $238.

I'll be arriving at 11:45 AM, and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive downtown private club. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase a ticket, please click here.

If true, the implications for your stock portfolio could be momentous. So why is the stock market REALLY going down?

The oil industry would far and away be the worst affected. That explains why big companies such as Exxon Mobile (XOM) are hitting new one-year lows, even though the price of Texas tea has risen by an impressive 50% since the summer.

Also taken out to the woodshed for a spanking have been steel and coal. It is fascinating to note that the shares of the supposed beneficiaries of the trade war, coal (KOL) and steel (X), have on average dropped twice as much as the victims, such as technology, since the correction began in February.

China buys some 70% of all US coal exports, which is why the principal US rail routes have shifted from going from North-South to East-West.

Tape readers believe it is a direct outcome of the tit-for-tat trade war with China. But given the small numbers out so far I believe this is being vastly overexaggerated by the media.

The $100 billion out of $1 trillion in two-way trade, generating a total of $25 billion in new tariffs between the two countries, is too small to even affect the GDP numbers.

Academics and Fed watchers argue that the infinitesimal rate of interest rate hikes by our central banks, six in three years, is finally starting to bite. It's just a matter of time before the frog realizes that it has been boiled.

Technology is the lead sector in the market, and it doesn't borrow AT ALL, accounting for 25% of market capitalization, funding growth entirely through cash flow.

In Washington there is a different view.

Plunging share indexes, bringing the biggest intraday swings seen in a decade, can only mean one thing. The Democrats may be about to retake Congress.

The Democrats only need to seize 24 seats in the House and two seats in the Senate to achieve a simple majority.

So far, some 38 House Republicans have announced they are not running for reelection. It's not because they are tired of exercising power. It's because they don't believe they can survive either a Democratic onslaught, or a primary challenge from the far right wing of their own party.

They also are facing the lowest presidential popularity ratings ever seen for a midterm election. Until a few weeks ago, Trump was scraping the basement with a 36% approval, also it has ticked up recently.

So if the Dems take control, what are the investment implications?

A president from one party and a congress from the other is a fairly common occurrence. That was the state of affairs during the past six years of the Obama administration, and the past two years of George Bush's.

In other words, it's a survivable situation.

It has long been said that markets love gridlocked government. At the end of the day, they wish Washington would go away so everyone can get on with the important business of making money.

For a start, a Democratic win would assure that no important legislation would be passed into law for two years.

But it goes beyond that. Majority control means that the Democrats would get control of the chairmanships of every committee. That means that the investigation of Trump's various actions would escalate from a slow burn to a full-fledged flash fire.

While this may occupy the headlines of newspapers, it will have minimal impact on the markets or the economy. Only the hard cases will even notice.

And now for a quickie civics lesson, which I understand they don't teach in high school anymore.

A Democratic win in the Senate would almost certainly bring an impeachment trial, where only a simple major majority of 51 is required. That would stall markets for about three months.

And no matter how rosy the prospects are for Democratic gains, they are unlikely to reach the two-thirds majority needed for an actual conviction.

For that the Dems would have to win 94 seats, a near impossibility in this heavily gerrymandered country. Just to get a simple majority in the House, the Democrats have to win 58% of the popular vote. But they could reach a tipping point.

In short, it's all looking like 1975 all over again. What happened after 1975? After collapsing 45%, then rallying from a Nixon resignation low of a Dow Average of 550 to 1,000, it then took EIGHT YEARS for stocks to rally another 1,000 points.

Wall Street shrank dramatically, and many brokers become taxi drivers. It's not a pleasant prospect, except that today they would become Uber drivers.

I remember it like it was yesterday.

The endless bear market was a major reason why I started my career as a financial journalist for The Economist magazine in London rather than heading straight for Wall Street.

Once the new bull market started in 1983, I was inside Morgan Stanley (MS) within a year, while it was still private.

And thanks to Bob Baldwin for the job, a Navy man and Ivy Leaguer who lived to 95!

If the election was held tomorrow, the Democrats would almost certainly get control. But the election is not tomorrow, it is in seven months, and in politics that could be seven lifetimes.

Polls could improve for Trump. But then they could get a whole lot worse, too. And then there is Robert Mueller constantly lurking at the periphery.

In the end, markets might not do much of anything in a gridlocked government.

Much of the prosperity of America has occurred independent of the goings on in the nation's capital. It has taken place in spite of, not because of government policies.

Technology companies, now 25% of the economy (it was 26% two weeks ago) will continue to push the envelope forward at a hyperaccelerating rate, creating trillions of dollars in new shareholder value.

Thank goodness for that!

However, the volatility to get to nothing could be extreme, as we now are witnessing.

Dow Average 1972-83

I'm sure that most of you are spending your free time devouring the utterly fascinating pages of "Fire and Fury" these days, now in its 12th week on the New York Times best-seller list.

I, however, am reading slightly different subject matter.

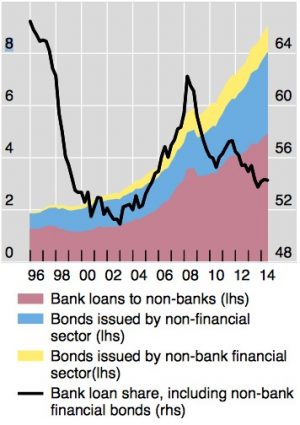

As obscure, academic, and abstruse the "Global Dollar Credit: Links to US Monetary Policy and Leverage" may sound, published by the Bank for International Settlements (BIS), it has been an absolute blockbuster among strategists at the major hedge funds.

And given the apocalyptic conclusions of the report, it might well rank as one of the best horror stories of the year, worthy of the bloodiest zombie flick.

I'll give it to you in a nutshell.

Corporate borrowers outside the US have ramped up their borrowing astronomically over the past 17 years, from $2 trillion to $9 trillion.

This makes them extraordinarily sensitive to any rise in US interest rates and the dollar. Emerging market debt alone has doubled to $4.5 trillion.

Easy money has encouraged mal investment and overinvestment in projects that never would have seen the light of day if unlimited financing were not available at 1%. In other words, it is all a giant house of cards ready to collapse.

I know a lot of you thrive on folk-based economic theories you picked up on the Internet based on monetarism, Austrian economics, and the theories of Friedrich August von Hayek, that all have the dollar collapsing under a mountain of debt.

In fact, the complete opposite has come true. The global economy has become "dollarized," with companies and governments in almost all nations relying on the buck as their principal means of financing.

The end result of all this has been to vastly expand the power of the Federal Reserve far beyond America's borders. Even the smallest rise in US interest rates, such as the 1/4% hike mooted for June, could trigger a cascade of corporate defaults around the world.

Think of subprime, with a turbocharger, running on pure nitro.

This is having a huge deflationary effect on the economies of many emerging nations.

Malaysia's sovereign wealth fund has almost gone under after a series of bad bets against the dollar. There is thought to be another troubled dollar short coming out of Hong Kong worth $900 million.

This is forcing countries to liquidate their US Treasury Bonds to cover local losses.

Further exacerbating the situation has been the crash of the price of oil, which has turned producing countries from suppliers to takers of liquidity to the global credit markets. Even after last year's monster rally, oil is still trading at 60% below the 2011 peak.

The net net of all of this is to increase the risk of surprise blowups overseas, both by banks and the private borrowers. This will increase the volatility of financial instruments everywhere.

The Bank for International Settlements is an exclusive club of the world's central banks. It is based in Basel, Switzerland (great swimming in the Rhine there), with further offices in Hong Kong and Mexico City. Its goal is it to coordinate policies among different nations.

The BIS was originally founded in 1930 to facilitate payment of German reparations following the Versailles Treaty ending WWI.

As a regular groupie on the central banking scene, I have been reading the research publications for many decades.

It All Started Here in Versailles

Global Market Comments

April 4, 2018

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE FRIDAY, APRIL 6, INCLINE VILLAGE, NEVADA, GLOBAL STRATEGY LUNCHEON),

(WHY YOU SHOULD CARE ABOUT THE LIBOR CRISIS), (DB),

(ARE YOU A FINANCIAL ADVISOR LOOKING FOR NEW CLIENTS?)

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Incline Village, Nevada, on Friday, April 6, 2018. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too. Tickets are available for $218.

I'll be arriving at 11:30 AM, and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at the premier restaurant in Incline Village, Nevada, on the sparkling shores of Lake Tahoe. Those who live there already know what it is. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for the luncheons, please click here.

You know those bond shorts you're carrying on my recommendation? They are about to pay off big time.

We are only one more capitulation sell-off day in the stock market from bonds starting to fall like a rock.

There is a financial crisis taking place overseas, which you probably don't know, or care about.

Here is my one-liner on this: You should care.

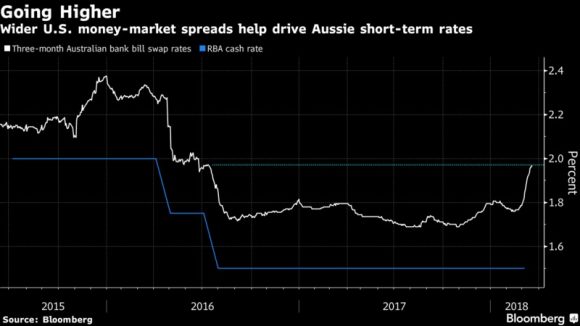

The London Interbank Offered Rate (LIBOR) is a measure of the cost of short-term borrowing in Europe. It is essentially their version of our own Fed funds rate. And here's the problem. It has been rising almost every day for two months.

If you read the financial press, you probably already know about LIBOR as the subject of a bid rigging scandal that prompted billion-dollar fines and jail terms for the parties involved.

You can take this as the opening salvo in the coming credit crisis. It probably won't start to seriously bite here in the US for two years. But it is already hurting the profitability of European banks now.

A staggering $350 trillion in loans in the US and abroad are tied to LIBOR-based loans, including $1.2 trillion in mortgages for high-end homeowners. Rising interest rates for this debt bring immediate pain.

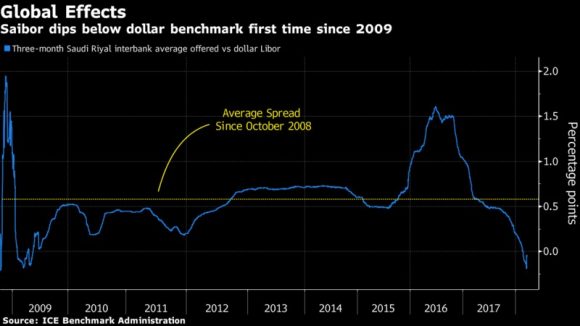

You can see this clearly is the cost of funds around the world, as outlined by the charts below.

Saudi Arabia's cost of funds, or SAIBOR, historically a net supplier of funds to the continent thanks to its perennial oil surplus, has just been raised 60 basis points, the first such move in a decade.

It is causing cash squeeze in Hong Kong, as seen through escalating HIBOR rates. Even Australian banks, normally seen as the bedrock of the global financial system, have seen the sharpest rise in interest rates in eight years.

Of course, the reasons for the global credit squeeze here at home are screamingly obvious. The US government is in the process of tripling its annual borrowing needs, as the budgets deficit soars from $400 billion to $1.2 trillion.

Exacerbating the influence on the markets is the US Treasury's new preference for short-term borrowing instead of the long-term kind, thus boosting the cost of shorter-term money.

This is to reduce the immediate up-front cost of borrowing. Like so many administration policies, it is reaping a short-term paper advantage for a very much higher long-term real cost.

As we are just entering a 20-year bear market for bonds, the Feds should be borrowing as much long-term money as they possibly can.

This is what private corporations are doing, such as Apple (AAPL) and Goldman Sachs (GS), issuing 30- to 100-year bonds, even though they don't need the money.

The tax bill passed at the end of 2017 also has had the unintended side effect of raising European rates. US companies now are mobilizing some $2.5 trillion to bring home at minimal tax rates.

That has brought them to unload longer term investments and shift the funds into overnight commercial paper, further boosting rates.

You normally don't see this kind of divergence in domestic and foreign costs of money without some kind of credit crisis.

Nervous eyes are cast toward Germany's Deutsche Bank (DB), holder of the world's largest derivatives book, and whose share price has plunged a stunning 30% in two months. Clearly, the insider money is getting out. Expect to hear a lot more about Deutsche Bank in the coming months.

I have said all along that the true cost of the tax bill won't be in the immediate up-front price tag, but the long-range unintended consequences.

You don't turn America's $20.5 trillion economy on a dime without creating a lot of disruption. And now they want to pass a second tax bill!

Spiking Rates are Becoming a Real Headache

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.