You know those bond shorts you're carrying on my recommendation? They are about to pay off big time.

We are only one more capitulation sell-off day in the stock market from bonds starting to fall like a rock.

There is a financial crisis taking place overseas, which you probably don't know, or care about.

Here is my one-liner on this: You should care.

The London Interbank Offered Rate (LIBOR) is a measure of the cost of short-term borrowing in Europe. It is essentially their version of our own Fed funds rate. And here's the problem. It has been rising almost every day for two months.

If you read the financial press, you probably already know about LIBOR as the subject of a bid rigging scandal that prompted billion-dollar fines and jail terms for the parties involved.

You can take this as the opening salvo in the coming credit crisis. It probably won't start to seriously bite here in the US for two years. But it is already hurting the profitability of European banks now.

A staggering $350 trillion in loans in the US and abroad are tied to LIBOR-based loans, including $1.2 trillion in mortgages for high-end homeowners. Rising interest rates for this debt bring immediate pain.

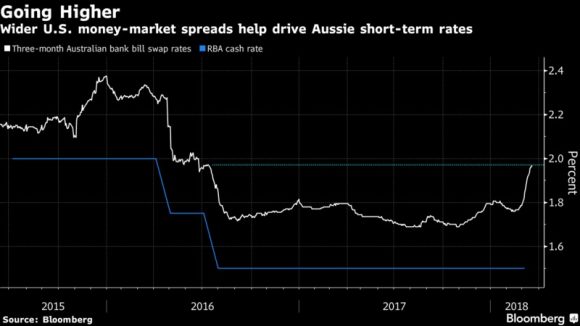

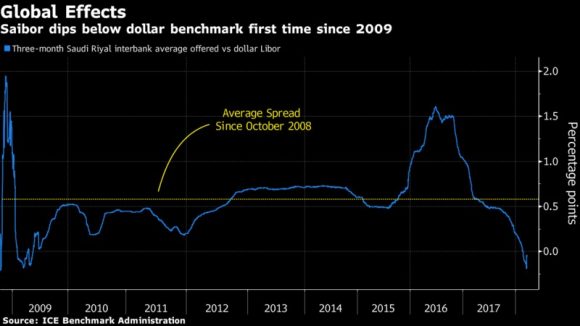

You can see this clearly is the cost of funds around the world, as outlined by the charts below.

Saudi Arabia's cost of funds, or SAIBOR, historically a net supplier of funds to the continent thanks to its perennial oil surplus, has just been raised 60 basis points, the first such move in a decade.

It is causing cash squeeze in Hong Kong, as seen through escalating HIBOR rates. Even Australian banks, normally seen as the bedrock of the global financial system, have seen the sharpest rise in interest rates in eight years.

Of course, the reasons for the global credit squeeze here at home are screamingly obvious. The US government is in the process of tripling its annual borrowing needs, as the budgets deficit soars from $400 billion to $1.2 trillion.

Exacerbating the influence on the markets is the US Treasury's new preference for short-term borrowing instead of the long-term kind, thus boosting the cost of shorter-term money.

This is to reduce the immediate up-front cost of borrowing. Like so many administration policies, it is reaping a short-term paper advantage for a very much higher long-term real cost.

As we are just entering a 20-year bear market for bonds, the Feds should be borrowing as much long-term money as they possibly can.

This is what private corporations are doing, such as Apple (AAPL) and Goldman Sachs (GS), issuing 30- to 100-year bonds, even though they don't need the money.

The tax bill passed at the end of 2017 also has had the unintended side effect of raising European rates. US companies now are mobilizing some $2.5 trillion to bring home at minimal tax rates.

That has brought them to unload longer term investments and shift the funds into overnight commercial paper, further boosting rates.

You normally don't see this kind of divergence in domestic and foreign costs of money without some kind of credit crisis.

Nervous eyes are cast toward Germany's Deutsche Bank (DB), holder of the world's largest derivatives book, and whose share price has plunged a stunning 30% in two months. Clearly, the insider money is getting out. Expect to hear a lot more about Deutsche Bank in the coming months.

I have said all along that the true cost of the tax bill won't be in the immediate up-front price tag, but the long-range unintended consequences.

You don't turn America's $20.5 trillion economy on a dime without creating a lot of disruption. And now they want to pass a second tax bill!

Spiking Rates are Becoming a Real Headache