Global Market Comments

February 12, 2026

Fiat Lux

Featured Trade:

(LEARNING THE ART OF RISK CONTROL)

Global Market Comments

February 12, 2026

Fiat Lux

Featured Trade:

(LEARNING THE ART OF RISK CONTROL)

Global Market Comments

February 11, 2026

Fiat Lux

Featured Trade:

(SOME SAGE ADVICE ON ASSET ALLOCATION)

“Fair value doesn’t mean you have to go down. It just means you have to be cautious,” said hedge fund legend David Tepper of Appaloosa Management.

Global Market Comments

February 9, 2026

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or ICEBERGS AHEAD)

($VIX), ($SPX), (AMZN), (KRE), (XLP), (XLI), (IAT), (TAN), (XLK), (HOOD), (MSTR), (COIN), (SLV), (LLY), (SMCI), (UUP), (MSFT), (MSTR)

“Artificial Intelligence is potentially more dangerous than nukes,” said Andrew McAfee of the MIT Center for Digital Business.

Global Market Comments

February 6, 2026

Fiat Lux

Featured Trade:

(WHY WATER WILL SOON BE WORTH MORE THAN OIL),

(CGW), (PHO), (FIW), (VE), (TTEK), (PNR)

“Every recession sows the seeds for the next business recovery, and every recovery sows the seeds of the next recession,” said hedge fund manager Leon Cooperman of Omega Advisors.

Global Market Comments

February 5, 2026

Fiat Lux

Featured Trade:

(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

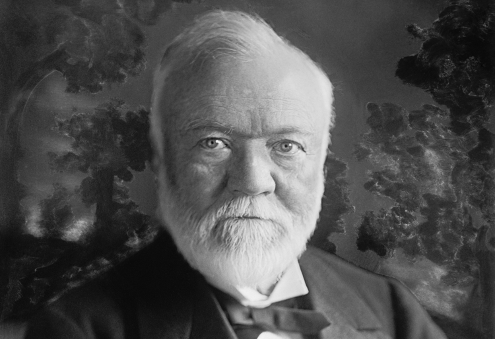

“If you die a rich person, you’ve failed,” said steel pioneer Andrew Carnegie, who gave away $11 billion during his lifetime, including building a library in every town in the United States.

Global Market Comments

February 3, 2026

Fiat Lux

Featured Trade:

(REVISITING THE FIRST SILVER BUBBLE),

(SLV), (SLW), (AGQ)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.