I hate using worn out, hackneyed cliches like "Teflon market" or "Goldilocks," but it was one heck of a Teflon Goldilocks market last week.

The FANG's truly went bananas.

Stocks had every excuse for the wheels to fall off.

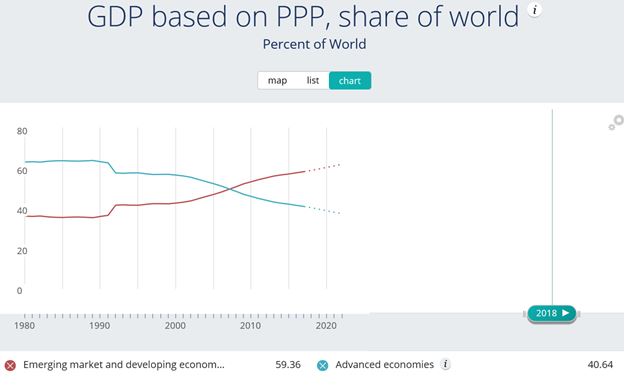

The president's chief economic advisor resigned. The US declared the most ferocious trade war since the 1930's, which should cut US GDP growth by 0.5%. The administration appeared to be lurching from one disaster to the next.

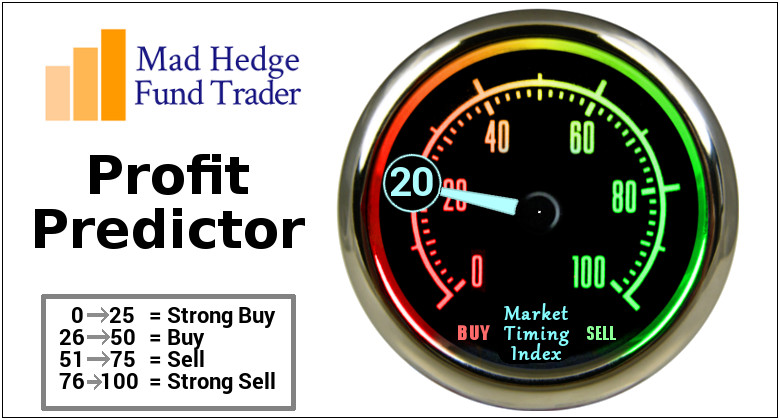

And it all turned out to be yet another fabulous buying opportunity, and a chance to go solidly "RISK ON".

As I expected.

It is another demonstration of an old trading nostrum that has served me faithfully for half a century. If you throw bad news on a market and it fails to fall, you buy it.

With the buckets of bad news poured on the market it should go ballistic.

And so it has.

If you were long technology stocks like (INTC), (AAPL), (FB), short US Treasury bonds (TLT), and short the Euro (FXE), as I have been begging, pleading, and beseeching you to do, you just saw one of your best trading weeks of the year.

And guess what? It's going to get a lot better. We still have two months of seasonal buying before stocks depart for the normal summer correction. And you can make a lot of money in two months.

What really poured gasoline on the fire was a blockbuster February Nonfarm Payroll Report, up some 313,000. That is 120,000 over expectations. The Headline Unemployment Rate remained steady at 4.1% a ten year low.

The real crusher was that this frenetic rate of job creation caused Hourly Wages to go up only 0.1%, or essential zero, meaning that inflation is nowhere to be seen anywhere. It was a number that left economists everywhere scratching their heads.

The December and January reports were revised upward by 54,000 jobs.

Construction was up by 61,000, Retail was up 50,000, and Professional and Business Services up by 50,000. No doubt a big chunk of this was prompted by deficit financed tax cuts.

The only sector showing job losses was in Information Technology, down some 12,000.

The U-6 broader "discouraged worker" jobless rate stayed at 8.2%.

Overall, the total size of the workforce jumped by 806,000, the largest gain since 1983.

It was essentially a perfect report.

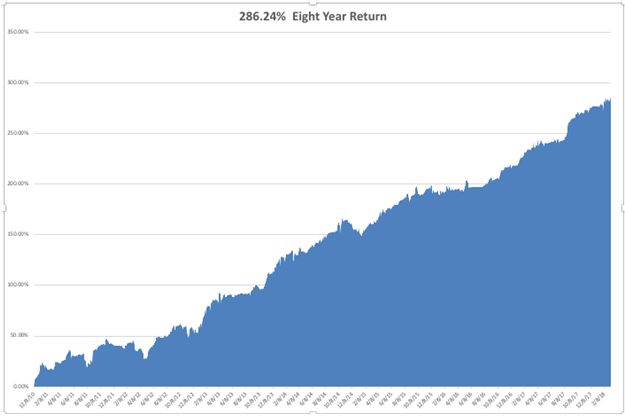

I would be remiss in not remembering the nine-year anniversary of the end of the stock market crash on March 9, 2009.

In those days, the S&P 500 futures were wildly swinging at 100 points a pop. The Nonfarm Payroll Reports were then printing horrifying losses of 700,000 a month.

As the bad news always seemed to come out on Sundays, you could buy a put option at the Friday afternoon close and it would be up 400% at the Monday morning opening. We raked the profits in. Those were the days!

I turned bullish a week later and have remained so ever since. How times have changed.

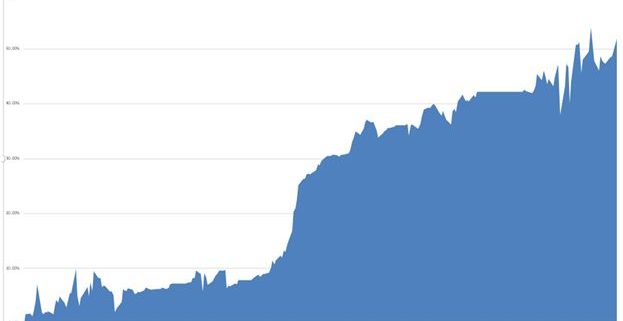

It was another great week for the Mad Hedge Fund Trader Alert Service, almost clawing our way all the way back to another new all-time high. We only need to make another 1.95% and we'll be there, hopefully sometime next week.

A double position in Apple (AAPL) really gave us a turbocharger, with that stock just short of a new all-time high, and up $10 from our last "BUY". The Iron Condor in Facebook (FB) will expire at its maximum profit point on Friday.

We already took profits in our short in the US Treasury bond market (TLT) on a quick 48-hour turnaround. The short position in the Euro is firing on all cylinders.

Mercifully, we got out of your short in the Japanese yen (FXY) at cost as a risk control measure. It looks like those who kept the positon will get the maximum profit there anyway.

Having survived the February nightmare, I now feel invincible.

This coming week is fairly subdued on the data front.

On Monday, March 12 nothing of note is released.

On Tuesday, March 13 at 8:30 AM we learn the all-important February Consumer Price Index to see if inflation really is asleep. This has recently become one of the most important numbers of the month.

On Wednesday, March 14, at 8:30 AM EST, we get February Retail Sales.

Thursday, March 15 leads with the Empire State Manufacturing Survey at 8:30 AM EST. Weekly Jobless Claims are announced at the same time.

On Friday, March 16 at 8:30 AM EST we get the February Housing Starts.

At the close we undergo a Quadruple Witching in the options market with several monthly series expiring today.

At 1:00 PM we receive the Baker-Hughes Rig Count, which saw a small rise of only one last week.

As for me, I am going to be shopping for a new Steinway Grand Piano. I have made so much money this year that it's time to upgrade and go for the max with a Model D concert grand piano!

Good luck and good trading!