Global Market Comments

December 5, 2017

Fiat Lux

Featured Trade:

(TRADING THE NEW TAX BILL),

(AAPL), (FB), (BAC), (IWM), (TLT), (X), (UNP), (XOM),

(WHAT I HEARD ABOUT GM AT DINNER LAST NIGHT),

(GM), (F), (TM), (TSLA)

Global Market Comments

December 5, 2017

Fiat Lux

Featured Trade:

(TRADING THE NEW TAX BILL),

(AAPL), (FB), (BAC), (IWM), (TLT), (X), (UNP), (XOM),

(WHAT I HEARD ABOUT GM AT DINNER LAST NIGHT),

(GM), (F), (TM), (TSLA)

The greatest remaking of the US economy in history looks like it is about to be signed into law. I have been running the numbers, and the impact on your portfolio is pretty clear-cut. I'll summarize the high points and then go into detail on each measure.

1) It will create a higher high in all asset prices, including stocks and real estate, followed by a lower low later, probably sometime in 2020.

2) New asset allocations will shift out of growth stocks and into value ones.

3) That means new asset allocations will move out of FANG's (AAPL), (FB), etc.) and technology into financials (BAC), industrials (X), transports (UNP), and energy (XOM).

4) Money will move from large international companies which don't pay tax anyway to small domestic ones that do, hence the recent outperformance of the Russell 2000 (IWM) over NASDAQ (QQQ).

5) Bond prices (TLT) will stay higher, and yields lower, for longer. The 1% will receive the overwhelming amount of benefits from the tax bill, and they will pour most of this newfound wealth into capital preservation strategies in fixed income markets. This is consistent will all past economic cycles. However, US government deficits are already rocketing, and that will eventually take bonds down.

6) All funds repatriated from abroad will go into more stock buybacks and increased dividend payments. This is what happened with the last repatriation in 2003.

7) Stocks will rise in 2018 at half the 2017 rate, but with higher volatility. This is typical for the last year of the bull market.

8) The net impact on the US economy will be either zero or a small negative. Blue states that deliver nearly half of US consumer spending, like California, New York, New Jersey, Illinois, and Washington, are about to get hit with massive tax increases, depressing consumption. There will NOT be an offsetting increase in spending in red states, where tax windfalls will be saved, and not spent.

9) There will be no increase in employment. The same is true with inflation, which is now largely technology driven.

10) However, stimulus while economic activity is at a decade high will scare the Fed into raising interest rates sooner than later. Whatever gains companies see from a lower tax rate will be offset by higher interest rates, with the net effect on earnings at zero.

11) There will be no increase in capital spending, as companies are now hoarding record levels of cash and have no need for additional finance. They will only add to capacity if they see an immediate return, not something any intelligence management does in the ninth year of an economic recovery.

12) Short term traders were punished by the loss of FIFO (first in, first out) accounting, which amounts to a new back door capital gains tax.

13) The bill is a huge picker of winners and losers in the economy. Subsidies and write offs were particularly focused on the oil and commercial real estate industries. Money will move out of sectors with the lowest effective tax rate over the past five years (technology), to those with the highest tax rate (energy).

Most of the tax bill will be reversed the next time there will be democratic control of the government, which could be in as little as three years.

It's really hard to see how ANY blue state House Republican gets reelected in November after voting for an average $10,000 tax increase for their constituent homeowners, and there are 60 of those.

So companies are NOT going to be making any large long-term investments based on taxes remaining in their current form for very long.

Regular readers of this letter are already aware that my Trade Alert recommendations have been following the above line of logic since July.

It is all part of my strategy of dealing with expensive markets by only buying cheap stuff.

Those who followed my advice, well done!

Highest Effective Tax Rates Over the Past Five Years

35% Energy

33% Telecom

32% Industrial

31% Utilities

30% Consumer Discretionary

30% Consumer Staples

28% Financials

27% Materials

26% Health Care

24% Technology

It was the kind of dinner invitation I couldn't turn down. What I learned was amazing.

I usually prefer to spend my evenings at home catching up on my research, calling customers, and plotting my next great Trade Alert.

So, it takes a lot to get me out of my cozy digs, especially during an evening of rare torrential downpours.

Attending would be senior executives from Tesla (TSLA), General Motors (GM), and engineering professor from the University of California at Berkeley, and the California Air Resources Board.

The dinner was hosted by a retired billionaire from Microsoft at the top of the Mark Hopkins Hotel in San Francisco.

The topic for discussion would be the very long-term future of the car industry. I get invited to these things because the guests want to know how their views would fit in within a long term global geopolitical/economic context, my own particular specialty.

I didn't want to cramp anyone's style, so I kept my notebook under the table and scribbled away blindly, and illegibly. There's no particular story line here. I'll just give you my random thoughts that I picked up.

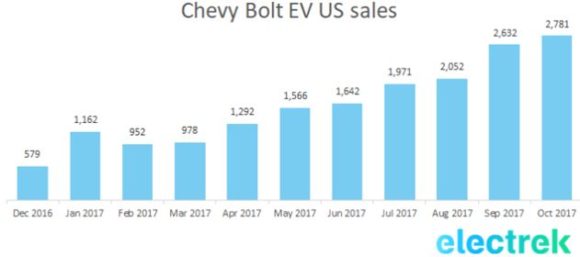

(GM) launched its second-generation Chevy Volt and followed up with the all-electric 238 mile range Bolt. The customer response was fantastic, and sales exceeded its monthly target of 3,000 units. The company is building a new $400 million battery plant on the east coast to help meet demand.

Some 60% of the buyers are coming from other auto makers. It is fast becoming the new face of Chevy, like the Corvette Stingray and Camaro of years past.

The future is in a 200-mile range $30,000 car, and the Volt is that car. Customers want to get away from oil and will only buy the products that do that, be they hybrids or all electric.

He also mentioned that GM is launching an electric bike, which is already widespread in Europe. Not a big needle mover there.

The Tesla guy then proceeded to jump all over him, saying the Volt was "green washing" as usual, since it represents only a tiny fraction of the company's sales. GM had a vested interest in promoting the internal combustion engine, in which it had made a century long investment. Its real focus can be seen in the giant new Suburban factory it was now building in Texas.

Mr. Tesla had driven from the south Bay with his S-1 entirely on autopilot. The hardware has already been pre-installed in every S-1 produced since 2014, and all that is needed to make them self-driving is to execute a wireless overnight software upgrade. Point to point self-driving will be activated in two years.

What is truly amazing is that each car will have a learning program unique to the vehicle. If it misses a hard turn the first time, it will remember that turn and then make it perfectly every time from then on.

The Tesla person said that once the new Gigafactory comes online, the company will be on schedule for a tenfold ramp up in car production by 2020.

The $35,000 Tesla 3 that will make this possible, which will be offered in two wheel and four wheel drive variations. That will take them from 100,000 units a year to 500,000.

I asked him if this means that if your wife suspects you of cheating, will your Tesla rat you out. He answered, "Only if she is a coder."

Then I wondered what would stop Tesla from selling your driving habits to marketers, who would then make special offers from stores you prefer. A previous Tesla experiment landed me a pair of Seven for All Mankind designer jeans for half off.

Tesla outsold every other luxury car of its class during 2017, including the Mercedes S class, the BMW Series 7, and the Audi 8. Among the US car industry, only Ford and Tesla have never filed for bankruptcy. Tesla is the first new car manufacturer to succeed since Chrysler made its debut in 1928.

I asked about the S-1 maximum single charge range achieved by a driver. An enthusiast in Norway managed to take one 800 miles on a flat track with no wind and perfect conditions. Wow! My drive from Lake Tahoe record of 400 miles doesn't come close.

I also enquired about the Cambridge University battery breakthrough (click here for "Battery Breakthrough Promises Big Dividends".

He said he was aware of it, but that it takes a long time to get a technology from the bench to the marketplace. Just with their own in-house tinkering, Tesla is boosting battery ranges by 3-5% a year. The current S-1 gets a 290-mile range, compared to my three-year-old 255-mile range.

The Berkeley professor made some interesting observations about Millennials. He said that while 75% of baby boomers got drivers licenses at 16, and 70% of Generation Xer's did so by then, only 55% of Millennials took to the road at that age. The rule of thumb for anything regarding Millennials is that they do everything late.

The gentleman from the Air Resources Board brought out some interesting facts. More than 80% of all cancer-causing chemicals entering the atmosphere come from diesel engines, so a major effort will be made to cut back emissions from commercial trucks. Look for the electric fleet coming to a neighborhood near your. Goodbye Volkswagen!

By the way, the State of California recently received a $800 million settlement from Volkswagen over the "dieselgate" issue. That money is being spent on 7,500 new charging stations for electric cars.

Workplace charging of employee cars will be the next big growth area for charging stations.

Half of all greenhouse gases derive from the burning of oil. The biggest savings in greenhouse gas emissions will come from a clampdown on the refining industry. Think Koch Brothers.

I was amazed at his commitment to meet California's goal of obtaining 50% of its energy from alternative sources by 2030. The oil industry, managed to exempt gasoline from the legislation, SB 350. But Governor Jerry Brown put it back in through an executive order.

The state is paying for the initial build out of hydrogen refueling stations for the new $57,500 Toyota Mirai. A single tank will take the fuel cell vehicle 312 miles.

The state is making major investments in biofuel, planning to obtain 10% of the 50% target from this source.

During a slow moment, I asked a woman sitting next to me of her interest in electric cars, expecting the worst. To my surprise, she said that last summer, she drove an electric bike from New York to Los Angeles, towing a trailer with a solar panel cut in half to provide power.

The southern route avoided the high mountain ranges. I noticed she seemed unusually tanned, and it wasn't from a can.

I was humbled. For once, I knew less about electric cars than anyone else in the room.

After the dinner, I went up to the Tesla executive and told him "Job well done." I owned one of the oldest S-1's, number 125 off the assembly line, and the clock had just turned 40,000, with no major problems.

I even tested their safety claims after a crash with a GM Silverado driven by a texting soccer mom (click here for "16 Facts and 6 Big Surprises I learned Tearing Apart My Tesla S-1").

Thank you Tesla! You saved my life!

Now, if only the stock will do the same! (click here for "About That Tesla Recommendation").

Oops!

Oops! Fill Her Up With H2 Please

Fill Her Up With H2 PleaseGlobal Market Comments

December 4, 2017

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR THE CHICKENS COME HOME TO ROOST),

(DECEMBER 6 GLOBAL STRATEGY WEBINAR),

(CHICAGO WEDNESDAY, DECEMBER 27 GLOBAL STRATEGY LUNCHEON)

Well what an interesting day that was!

News that former National Security Advisor Michael Flynn had been arrested and turned state's evidence against the president, his family, and his campaign, ignited the most volatile day of 2017.

The Dow Average crashed 350 points in minutes as thousands of pre programmed algorithms simultaneously kicked on the sell side. US Treasury bonds (TLT) rocketed a full three points.

It was like the world was ending.

This could be the beginning of the end for a certain former resident of Queens, NY, but it may take another year to play out.

As if the day did not resemble the plot line of a cheap dime novel enough, the headline hit just as the Republicans were holding a crucial vote on the tax bill.

The Volatility Index (VIX), (VXX), soared 30% in seconds, to $14.50. "RISK OFF" hedges like gold (GLD) and the Euro (FXE) popped nicely.

It certainly was a day when the cautious were rewarded. Cautious people like you, who have hopefully been following my advice.

Me, being the opportunistic, ever nimble trader that I am, took advantage of the turmoil to add two positions to my model trading portfolio.

I used the extreme spike in bonds to re-establish my short position in the United States Treasury Bond Fund (TLT).

I also used the dip in bank shares to add a long position in Bank of America (BAC), which I think could double in value in the next 2-3 years.

The hallmarks of the week were new trends which I have been predicting for months.

Stock pickers viciously rotated out of FANG's and into financials, energy, and industrials. The Wednesday Silicon meltdown, where some stocks fell as much as 15%, confirmed this view.

Big money moved from growth to value.

With the economy heating up the way it is, it couldn't go any other way.

Consider it all an early preview of how stock markets in 2018 will play out.

I am sticking to the same game plan that has worked since 2009. Use every Washington and geopolitical inspired selloff to add to your longs.

In the end, it is all about corporate earnings, no matter what the president says, does, or has happened to him, and those are improving dramatically, as the hard economic data confirms.

You heard it here first.

By the way, the economic data continued to deliver a gangbuster performance. Q3 GDP was revised up from 3.0% to 3.3%, The Chicago Purchasing Managers Index came in at an absolutely blazing 63.0, a decade high.

These hot numbers are coming in not just for the US, but for every major economy in the world. It is all the Global Synchronized Recovery I have been predicting since January.

The global economy is really in the best shape since the 1990's. That is a tough thing to bet against.

While a poor risk/reward has scaled back my trading significantly, the Mad Hedge Trade Alert performance continues to press to new all-time highs.

November finished at 2.08%, and December is already up 1.43%. This brings my trailing 12-month performance up to 55.66%.

This coming week it is all about jobs, jobs, jobs.

On Monday, December 4, at 10:00 AM EST, the November Factory Orders are published.

On Tuesday, December 5 at 8:55 AM EST we get the Redbook for the previous week, a read on chain store sales, which should be fabulous.

On Wednesday, December 6, we obtain November ADP Employment Report on private sector employment at 8:15 AM EST.

The weekly EIA Petroleum Status Report is out at 10:30 AM EST.

Thursday, December 6 leads with the 8:30 EST release of the Weekly Jobless Claims.

On Friday, December 7 at 8:30 AM EST the November Nonfarm Payroll Report is out.

Then at 1:00 PM, we receive the Baker-Hughes Rig Count, which lately has started to turn up again.

As for me, I'll be performing like a FIFA World Cup goalie, fielding all of the Amazon packages sent my way. I was pretty busy on Black Friday and Cyber Monday.

"Short term volatility creates long term opportunity," said Rupal Bhansali, of the Ariel International Fund.

Global Market Comments

December 1, 2017

Fiat Lux

Featured Trade:

(THURSDAY DECEMBER 28 MINNEAPOLIS STRATEGY LUNCHEON),

(THE BRAVE NEW WORLD OF ONLINE RETIALING),

(SFIX), (M), (KSS), (GPS), (JCP)

(BIDDING FOR THE STARS), (SPX), (INDU),

(TESTIMONIAL)

In my wealth management practice, you helped me finesse September like a virtuoso. As my client's investments were crashing through their stops...I hung on.

Your sage counsel helped me ignore the noise, focus on the numbers and add to positions at a great entry point. The scar tissue you've built up over your career is no small benefit to your subscribers.

Thank you so much!

Brad

Bakersfield, California

Global Market Comments

November 30, 2017

Fiat Lux

Featured Trade:

(THE SILICON MELTDOWN FINALLY HITS),

(NVDA), (LRCX), (TSLA), (AMZN), (GS),

(THE GOVERNMENT'S WAR ON MONEY),

(TESTIMONIAL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.