Global Market Comments

December 6, 2016

Fiat Lux

Featured Trade:

(DECEMBER 7TH LIVE GLOBAL STRATEGY WEBINAR),

(THE ONE STOCK YOU HAVE TO ABSOLUTELY BEG, BORROW, OR STEAL),

(NVDA),

(TESTIMONIAL)

NVIDIA Corporation (NVDA)

Global Market Comments

December 6, 2016

Fiat Lux

Featured Trade:

(DECEMBER 7TH LIVE GLOBAL STRATEGY WEBINAR),

(THE ONE STOCK YOU HAVE TO ABSOLUTELY BEG, BORROW, OR STEAL),

(NVDA),

(TESTIMONIAL)

NVIDIA Corporation (NVDA)

Nvidia (NVDA) is a stock that you should beg, borrow, or steal your way into any way you can.

Fortunately for you, the recent presidential election just gave you an opportunity to steal it.

By making instant pariahs out of the technology sector, and their globalization-based models, the? President-Elect is forcing portfolio managers to throw babies out with their bathwater.

That includes Nvidia, which gave up 10.52% from its high during last week?s tech wreck.

I first recommended Nvidia on November 2nd, (read more about ?The Great Artificial Intelligence Stock You?ve Never Heard Of?).

In the piece I argued that the shares could double over the next three years.

I lied.

They rocketed by a stunning 43.93% in the following three weeks!

And after what I heard at an exclusive Silicon Valley dinner party last week, I now believe that my doubling call is ultra conservative.

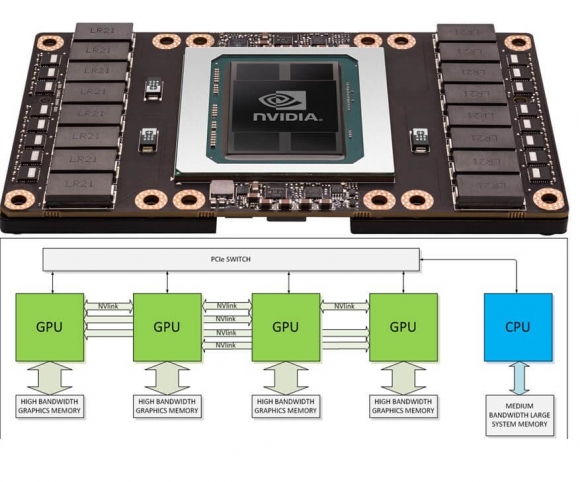

Leaks are emerging that Nvidia is about to make public its SATURN V supercomputer, so named after the NASA rocket that took astronauts to the moon during the 1960s and 1970s.

It is a cluster of 124 DGX-1s super computers, known as Nvidia's "AI in a Box". It delivers 9.46 gigaflops per watt, a 42 percent improvement from the 6.67 gigaflops per watt delivered by the most efficient machine on the Top 500 list released only last June.

This is a big step towards exascale computing, or one completing quintillion floating-point operations per second.

In addition, (NVDA) wants to combine AI and supercomputing, unlocking the power of AI for large-scale problems like autonomous vehicles, modeling fusion reactors, and a plethora of breakthroughs where deep learning would be a good fit for the problem at hand.

I have been covering Silicon Valley since it was a verdant, sun-kissed peach orchard in Northern California.

I have to say that in the half century that I have followed the technology industry, I have never seen the principals, gurus, and visionaries so excited about a major new trend.

That would be artificial intelligence or AI.

Asking if AI is relevant now is like pondering the future of Thomas Edison?s new electricity in 1890.

If you think AI still belongs in the realm of science fiction, you obviously didn?t get the memo. It is all around us all the time, 24/7. You just don?t know it yet.

And here?s the rub.

It is impossible to invest purely in AI.

All new AI startups comprise small teams of experts from labs and universities financed by big venture capital firms like Sequoia Capital, Kleiner Perkins, and Andreeson Horowitz.

After developing software for a year or two, they are sold on to major technology firms at huge premiums. They never see the light of day in the form of a public offering.

Alphabet (GOOG) acquired Britain based, Deep Mind, in 2014. Later that year, Google?s AlphaGo program defeated the world?s top ranked Go player.

Last year, Microsoft (MSFT) purchased Equivio, a small firm that applies AI to advanced document searches on the Internet.

Amazon (AMZN) recently bought out Orbeus, a startup known for machine learning tools for image recognition.

Amazon?s Jeff Bezos now says that his Amazon Fresh home food delivery service is using AI to grade strawberries.

Really!

We?re not talking small potatoes here.

The global artificial intelligence market is expected to grow at an annual rate of 44.3% a year to $23.5 billion by 2025.

Nearly half of all applications now use some form of AI that by 2020 will earn businesses an extra $60 billion a year in profits.

And from what I have learned from speaking to the major players over the last few weeks, I am convinced that these numbers are low by an order of magnitude.

It gets better.

If you have, in any way, been involved in the stock market for the past five years, AI has invaded your life.

High frequency trading and hedge funds now account for 70% of the daily trading volume on the major stock exchanges, and almost all of this is AI driven.

Having spent my entire life trading stocks, I can confirm that in recent years the market?s character has dramatically changed and not for the better. Call it trading untouched by human hands.

Algorithms are trading against algorithms, and whoever wins the nuclear arms race brings home the big bucks.

You used to need degrees in Finance and Economics, or perhaps an MBA, to become a professional fund manger. Now it?s a PhD in Computer Science.

Remember the May, 2010 flash crash, when the Dow Average plunged 1,100 points in minutes, wiping out $4.1 billion in equity value? AI?s fingerprints were all over that.

And only weeks ago, the British pound lost 6% of its value in a mere two minutes, a move unprecedented in the history of foreign exchange markets. The culprit was AI.

Don?t expect the path forward to AI to be an easy or smooth one.

Indeed, the machines already have the power of life and death over all of us.

Since we aren?t venture capitalists, we can?t buy into pure AI firms in their early stages. And I?m too old to get a PhD in computer science.

We therefore have to be sneaky and get in through the back door via an indirect play which still has plenty of upside leverage.

What is the one medium sized, publicly listed company that most benefits from the AI explosion?

I have found exactly such a company (it was small at the beginning of the year) that represents the marrying of the four biggest trends in technology today: AI, self-driving cars, big data, and virtual reality.

That would be Nvidia (NVDA).

The Santa Clara, California based company manufactures graphics processing units (GPUs) for the gaming market as well as system-on-a-chip units (SOCs).

It is heavily involved in super computing and mobile computing, producing processors for tablets, iPhones, and vehicle navigation systems.

Nvidia, named after the Roman god, Nemesis, was founded in 1993. It was the original supplier of processors for the Microsoft Xbox and Sony?s (SNE) PlayStation 3.

In 2011, it demonstrated the first quad-core processor for mobile devices.

Nvidia has been on an acquisition tear over the past decade, picking up more than a dozen companies to expand its reach into the most advanced AI and manufacturing technologies, as well as picking up some first class talent.

Nvidia has more engineers working on AI than any other company, or institution, in the world.

Its integrated stack of imaginative chip designs is unmatched.

Its principal competitors are Advanced Micro Devices (AMD), Intel (INTC) and QUALCOM (QCOM).

To learn more about Nvidia, please visit their website at Nvidia

http://www.nvidia.com/content/global/global.php .

Thanks for your very informative daily updates and stories. I subscribe to four daily investment advisors and yours are the only one I always read and almost always follow.

I followed your trades to the letter and most were successful. The problem was I was not trading live (always at least half a day late and sometimes a full day due to the time difference (US versus AUD), and my trade size was too small.

I am basically using your alerts as the trigger to place the trade as a CFD (entry via a stop just above previous day?s high ? for a long/call) and then manage them with a trailing stop loss using the daily charts (stop loss just below previous day?s low unless the day was an inside bar).

This seems to work much better and entry and exits from trades are far more successful at the price you want to trade at.

Looking forward to applying this strategy for 2017 and hopefully I will catch up with you next time you are in Australia.

Hope you have a great XMAS and New Year.

Regards,

David

Pullenvale, Australia

?People are investing with a rear view mirror. Last year, you had people legitimately scared out of the market. Unfortunately, you are losing a generation of investors at a time when they ought to be thinking about buying high quality stocks.? said Hersh Cohen of Clearbridge Advisors.

Global Market Comments

December 5, 2016

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK OF DECEMBER 5th),

(THE AMERICAN ONSHORING TREND IS ACCELERATING),

(GE), (TSLA)

General Electric Company (GE)

Tesla Motors, Inc. (TSLA)

I am willing to make a bet with you.

In four years, the unemployment rate will be much higher than the 4.6% reported today by the Department of Labor which is the lowest number in a decade.

The jobless rate may decline more initially thanks to deficit financed government reflationary programs.

However, the US will fall into a deep recession within the next three years, triggered by high inflation, rocketing interest rates, and a strong US dollar.

And while growth will rise next year and in the following year, it will be posting negative numbers by 2020. The overall net growth in the economy over the full four years will probably come in at zero.

And where will the job losses be the greatest? In the industrial rust belt states of Pennsylvania, Michigan and Indiana.

So, there is your new investment strategy.

Rape, pillage, and plunder now, but don?t forget to find a chair when the music stops playing. The big money will be made on the short side down the road.

You may have been a long-term investor until now. From here on, you have to trade or die.

Yes, my Golden Age scenario for the 2020s is still intact. But the demographic wave that will drive it doesn?t start for five more years.

The November Nonfarm Payroll Report came in dead on expectations at 178,000. The U-6 long-term structural unemployment rate also hit an eight-year low at 9.3%.

Hourly earnings fell by 0.1%.

Professional and business services jumped by 63,000, health care by 28,000, and construction by 19,000. Retail jobs declined by 8,000.

The ongoing seven-year economic recovery continues.

Of course, by the time you read this, the outcome of the Italian elections on Sunday will be known.

The country is voting on constitutional reform which may grant more power to their lower parliamentary house. Heaven knows they need it. Italy has seen 63 governments since 1945.

If reform fails, Prime Minster Matteo Renzi will resign and the Euro (FXE) will crash. If it wins, the Euro and European stock markets will rally, especially the banks.

With one of the most difficult markets in history in the rear view mirror, a lot of traders will start to wind down their activities early this year.

The stock market has gone about as far as it can on the few hints of economic policy we have received so far from the future Trump administration.

Investors won?t be able to make any major moves until they get their capital allocations and sector weightings for the New Year. So the Trump bump has pretty much run its course.

The only event to trade off of for the rest of 2016 will be the Federal Reserve meeting on December 13-14. Will it be a 25 basis point snugging now, or will Janet go for the full 50 basis points?

I expect markets to trade in narrow ranges until then.

As for the coming week?s data releases:

Monday, December 5th at 9:45 AM EST, we get the PMI Services Index.

On Tuesday, December 6th at 10:00 AM EST, we get a new update on October Factory Orders.

On Wednesday, December 7th at 10:00 EST, the Labor Department?s October JOLTS report is released, showing us the changes in job openings. This is a deep lagging report so I don?t pay it much attention.

At 10:30 AM the EIA Petroleum Status Report will give us updated inventory numbers. Will oil peak out here? Or does it have a few more dollars to run?

Thursday, December 8th, we learn the Weekly Jobless Claims at 8:30 AM EST.

On Friday, December 9th, we learn December Consumer Sentiment which will almost certainly show an uptick, now that the presidential election is over.

Keep in mind that virtually all economic indicators will be useless for the next two months, because they will only reflect spending and investment conditions prior to the November 8th presidential election and will be for a world that no longer exists.

?Treat everyone you meet with professionalism and respect, but also have a plan to kill them.? said my friend, former Marine Corps General James ?Mad Dog? Mattis, the newly appointed Defense Secretary.

Global Market Comments

December 2, 2016

Fiat Lux

Featured Trade:

(DECEMBER 7TH LIVE GLOBAL STRATEGY WEBINAR),

(TRUMP?S BIG DILEMMAS),

(SPY), (TLT),

(TESTIMONIAL)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

The financial markets think President-elect Donald Trump is in fact two different people.

I?ll use my baseball analogies here.

The stock market thinks he is Babe Ruth, the Home Run King of the 1920s. Stocks (SPY) have blasted through to new all time highs almost every day since he has been elected, with some shares up a heady 35%.

The bond market thinks he is the worst strike out king in history, not even worthy of a little league slot. US Treasury bonds have collapsed in the past three weeks.

Never mind that these two market trends are diametrically opposed to each other. In the real world, sharply rising interest rates bring stocks market crashes, not booms.

So which Donald Trump are we going to get?

And here is what even Donald Trump almost certainly doesn?t know: How is he going to deal with two huge dilemmas?

I?ll start with dilemma number one.

A key part of Trump?s economic program is for the US government to borrow up to $1 trillion to spend on infrastructure. Who is America?s largest lender?

China, which over the past decade has purchased nearly half of the US Treasury bonds issued. The Middle Kingdom now owns just short of $1 trillion in American government bonds.

Do countries embroiled in trade wars with us lend us money?

No, they don?t.

So for Trump to finance his expansion he needs to cozy up to the Chinese.

My bet is that he will slap some token punitive import duties on a few selective items, like President Obama did with Chinese tires and chicken feet and declare victory. These will be little more than photo ops.

The remaining bilateral trade between the US and China will continue as it has done for years.

That totaled an enormous $416 billion during the first nine months of 2016, $337 billion in Chinese exports to the US (we love those iPhones!), and $79 billion in US exports to China (they love those Buicks and Boeings!).

The Chinese already know this which is why they laughed throughout the presidential campaign, not taking any threats of trade wars seriously.

When forced to chose between a boom and a trade war, the former will win every time, as Trump is about to find out.

As for dilemma number two, it is far more perplexing. The mere prospect of Trump?s economic program has triggered one of the sharpest selloffs in bond market history.

This is why a double short position in US Treasury bonds (TLT), (TBT), has been quite profitably at the core of my trading book since November 8th.

What happens when governments cut taxes and increase spending? Deficits and interest rates explode, crowding private borrowers out of the market (i.e. you and me).

This fuels a stronger US dollar (UUP) which, with higher rates, will act as a major drag on the economy.

It gets worse.

You are not the only one who has been feasting on ultra low interest rates for the past seven years. So has the US government.

Take overnight rates from 25 basis points now to as much as 6% in three years, and the cost of the debt service of the federal government soars.

That takes it very quickly up from $23 billion for fiscal 2017 to as high as $100 billion a year by 2020. That will negate a significant portion of Trump's economic stimulus.

Of course, the other guaranteed outcome of these policies is the return of high inflation. This will prompt the Federal Reserve to greatly accelerate their pace of interest rates hikes.

So how do we trade around all of this?

I believe that it will be totally ?RISK ON? for the next several months, as the optimists and permabulls run the table. Then, reality will set in, once congress decides how much The Donald really gets to spend.

Remember, the majority of congressmen cut their teeth on fighting deficit spending. The budget deficit is about to balloon from $400 billion to $1.50 trillion.

That?s when we find out what kind of negotiator Trump really is.

I went through all of this with President Ronald Reagan 35 years ago and guess what happened? He promised to cut taxes, increase defense spending, and balance the budget.

He certainly cut taxes and increased defense spending in a big way. But the national debt rose 400%, from $1 trillion to $4 trillion. We are STILL paying for it.

The bottom line here is that the deficits ALWAYS win!

One thing you can say about Donald Trump, for sure, is that he will be God?s gift to traders.

Asset prices around the world are already trading at levels undreamed of only a few weeks ago.

BUY STOCKS AND THE US DOLLAR AND SELL SHORT BONDS OF EVERY FLAVOR. IT DOESN?T GET MORE CLEAR THAN THIS.

Just keep discipline and wait for the right entry points. But then that?s my job.

And we are now only three weeks into trends that could have another three years to run.

Trump is God?s gift to financial newsletters for that matter, as we will have plenty to write about and explain going forward.

My BS detector has been refined for 50 years now, and it is about to get a serious workout for your benefit.

Dear MHFT,

I've just completed my third year trading under your guidance. I'm intensely interested in events that move markets and I find your knowledge to be quite insightful. 2016 was a breakout year for me as I made $382,000 on a trading account that started the year with $700,000. Keep sharing your wisdom!

Steve

Basel, Switzerland

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.