Both the major stock and bond indexes are up about 6% on the year.

Those who left on January 1st to sail a yacht around the world, engage in a research project in Antarctica, or meditate at an Ashram in India, will return today and discovery that 2016 effectively didn?t happen, at least as far as the financial markets are concerned.

Index funds are still showing barely positive numbers, as they have to atone for management, administration, and other hidden costs. Active managers are down even more.

And who is doing worst of all?

The Masters of the Universe, like hedge fund titan Bill Ackman, who is licking massive double-digit performance wounds this year. Other hedge funds are dying on the vine.

I heard that Citadel?s unfortunate hedge fund manager has moved to Brazil to look for all the money he lost there.

Watch out for those aging Nazis!

So, almost everyone in the financial advisory and portfolio management industry now has two months in which to make their 2016.

The industry effectively shuts down on December 18.

WELCOME TO YOUR EIGHT WEEK YEAR!

Unless, of course, you read the Diary of a Mad Hedge Fund Trader, and are up a blistering 15% this year. I know of many who have doubled their money since January following my timely advice.

Which brings us all to the eternal question of ?NOW WHAT DO WE DO??

There is absolutely no doubt that we have entered the next leg of what could eventually be an 8-10 year bull market. The S&P 500 hit new all time highs only months ago. New peaks are to come shortly.

I looked to other asset classes to add ?RISK ON? positions. That means buy stocks (SPY), QQQ), (IWM) on absolutely every dip from here on and sell short ?RISK OFF? positions like the Treasury bond market (TLT), (TBT) and the Japanese yen (FXY), (YCS).

Almost every Trade Alert in these areas has proven profitable for me in recent months.

As for equities, I am not inclined to chase monster 20%-30% rallies. What I will do is buy them on a nice 5%-10% dip, or after a sideways digestion-type move of several weeks.

Post election November is setting up to be just that kind of month.

Here are ten reasons why I believe the bull market in shares is still alive and well:

1) Stocks are selling at only 19 X 2016 earnings, not exactly a bargain (it?s double the 2009 low). The October rally is telling us that there will be a major rebound in earnings next year, and that GDP growth could ratchet back up to 3%.

Look no further than technology and cyclicals which are all on fire.

2) The $60 plunge in oil prices from the 2014 highs is still with us. So is the windfall tax cut on consumer spending. This could add a full 1% to US GDP growth in 2017, which has essentially come out of nowhere. However, consumers are, at last, spending their money now, not banking it.

3) The Christmas selling seasons is setting up to be a strong one, thanks to a friendly calendar and renewed consumer confidence. Good luck standing in line at Needless Mark Up, I mean Neiman Marcus.

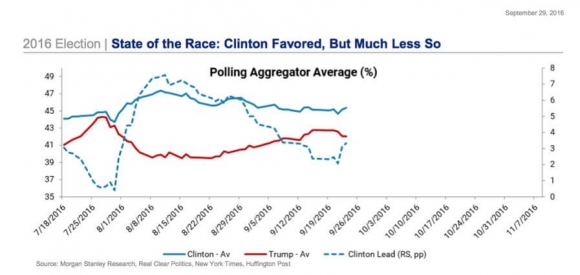

4) The November 8 elections are basically over, but I already know who the winner is: Gridlock. No matter who wins the Senate, they are unlikely to also capture both houses of congress.

Plan for another 5-9 years of gridlock, and no change in economic policies or tax law. By then, I?ll be dead and won?t care what happens.

5) The final blow off top is in for the bond market. There is a 50/50 chance that my friend, Federal Reserve Chairwoman Janet Yellen, will drive the final dagger through the heart of this monster with a 25 basis point rate hike at the next meeting on December 16-17.

What a nice Christmas present that will be! A reversal would be very friendly for financials, Bank of America (BAC) and Goldman Sachs (GS) which should provide new market leadership.

6) Mergers and acquisitions are continuing at a torrid pace and are getting larger and larger. This is happening because companies see each other as cheap, not expensive, and this usually happens at market bottoms.

The quickest way to grow earnings in a hyper competitive world is to buy them, especially if you can obtain them at a zero cost of funds.

7) Those who aren?t merging are buying their own stock back with both hands, like Apple, at a staggering $1 trillion annualized rate. Such purchases will peak this month.

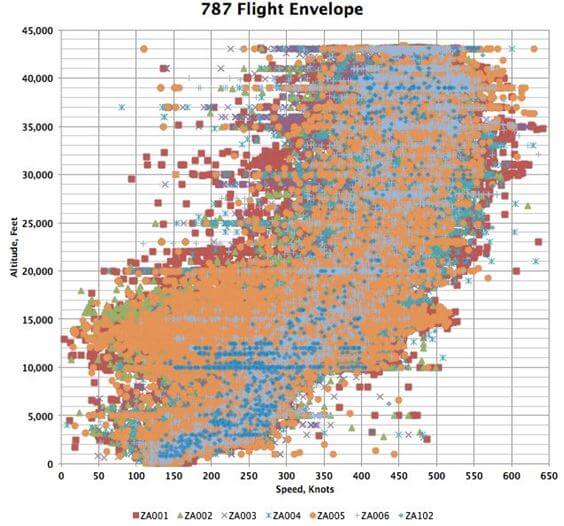

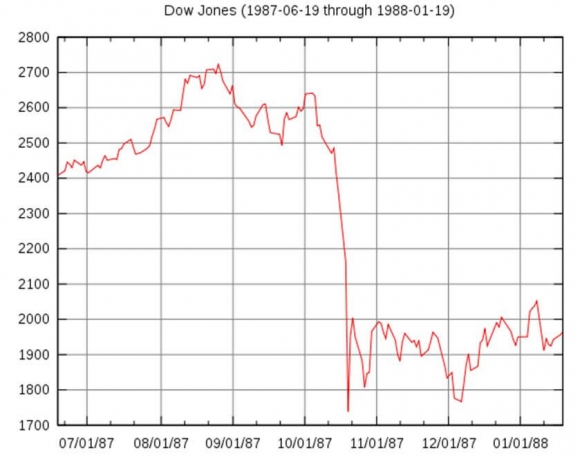

8) Volatility (VIX) spikes like the ones we saw in August and September also signal major market bottoms (see chart below). After briefly tickling 21 in September, we have made it all the way back to an unbelievable 13.38.

9) A strong dollar demolished multinational earnings this year. While rising interest rates assure the bull market for the greenback will continue, it will be at nowhere near the rate that we saw this year. This is stock market positive.

10) Ever heard of ?Sell in May and Go Away?? Well, ?Buy in November and stay put until April? is also true. October is usually the worst month of the year to sell and is not the path to untold riches.

The net net of all of this is that you can look for the S&P 500 to reach 2,300-2,400 by March, up 10%-15% from present levels.

Just thought you?d like to know.