Global Market Comments

May 15, 2015

Fiat Lux

Featured Trade:

(JUNE 29 LONDON STRATEGY LUNCHEON)

(A NOTE ON THE FRIDAY OPTIONS EXPIRATION),

(AN EVENING WITH BILL GATES, SNR.)

(TESTIMONIAL)

Global Market Comments

May 14, 2015

Fiat Lux

Featured Trade:

(JUNE 22 WASHINGTON DC GLOBAL STRATEGY LUNCHEON)

(WHAT TO DO ABOUT APPLE),

(AAPL), (CHL)

(DON?T BE SHORT CHINA HERE),

($SSEC), (FXI), (CYB), (CHL), (BIDU)

Apple Inc. (AAPL)

China Mobile Limited (CHL)

Shanghai Stock Exchange Composite Index (EOD)

iShares China Large-Cap (FXI)

WisdomTree Chinese Yuan Strategy ETF (CYB)

Baidu, Inc. (BIDU)

Global Market Comments

May 13, 2015

Fiat Lux

Featured Trade:

(JUNE 25 NEW YORK STRATEGY LUNCHEON)

(TIME TO TAKE ANOTHER RIDE WITH GENERAL MOTORS), (GM), (F), (TM),

(TESTIMONIAL)

(QUANTITATIVE EASING EXPLAINED TO A 12 YEAR OLD)

General Motors Company (GM)

Ford Motor Co. (F)

Toyota Motor Corporation (TM)

It is safe to say that all of the bad news is finally in the price at General Motors (GM).

In the wake of the latest batch of recalls, the total number of cars slated for mandatory repairs now equals virtually all of the company?s production of the last five years.

Woe to the outside supplier who provided those faulty, but cheap ignition switches to the beleaguered company! Penny wise, but 100 million pounds foolish!

What is more important is that ace mediator, Kenneth Feinberg, has finally come up with a number to offer the grieving families of the 17 who were senselessly killed driving GM?s deathtraps of yore. A fatality is now worth $1 million, and the company is offering as little as $20,000 for lesser accidents.

GM should put these numbers on their new car stickers.

In all honesty, this is just a ?feel good? gesture. The company that is actually responsible for these deaths went bankrupt in 2009, and the management long since sent into retirement to practice their gold swings. The new GM bears no legal liability whatsoever.

However, the company needs to preserve the value of its brand. The GM logo still goes out with every vehicle the firm manufactures. So, it will do the right thing for the victims.

Even if you apply these numbers to the much higher number of deaths claimed by plaintiffs? lawyers, more than 88, the total liability will not be enough to put a substantial dent in GM?s earnings. It is really just sofa change for them.

Many of the higher figures include drunk-driving deaths and fatalities of those driving at high speed without seatbelts. But every law school graduate out there is gunning for a piece of the action.

Don?t you just love America!

So all of this bad news is really good news in disguise. This will enable GM shares to catch up with those at Ford and Toyota, which have been on a tear this year. The industry seems poised to reach annual production of 17 million in 2014, an eight-year high. This will be great for profits for everyone.

I knew as much a few weeks ago, when I learned of massive insider buying of stock at GM all the way down to the middle management level. As has so often been the case this year, I waited for a dip that never came.

Now that the upside breakout is undeniable, I have to jump in. A share price appreciation up into the mid $40?s is in the cards.

The shares are starting from such a low base that even if a 5%-10% correction comes, the August, 2015 $32-$34 in-the-money bull call spread should be able to weather the selling. This strike combination particularly benefits from huge chart support at the 200 day moving average.

It doesn?t hurt that during the entire ignition crisis, GM?s market share actually rose. This was no doubt due to the heavy discount and attractive financing that was offered. What they?re losing in margin, they?re making up on volume.

Things are not so good that I am going to run out and buy a GM tomorrow. I am happy with my Tesla Model S-1, thank you very much.

![Corvette]() Time to Take Another Ride with GM

Time to Take Another Ride with GM

Global Market Comments

May 8, 2015

Fiat Lux

SPECIAL FIXED INCOME ISSUE

Featured Trade:

(FRIDAY, MAY 15 SAN FRANCISCO STRATEGY LUNCHEON),

(THE LIQUIDITY CRISIS COMING TO A MARKET NEAR YOU),

(TLT), (TBT), (MUB), (LQD),

(TAKE A RIDE IN THE NEW SHORT JUNK ETF),

(SJB), (JNK), (CORN)

(TESTIMONIAL)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

iShares National AMT-Free Muni Bond (MUB)

iShares iBoxx $ Invst Grade Crp Bond (LQD)

ProShares Short High Yield (SJB)

SPDR Barclays High Yield Bond ETF (JNK)

Teucrium Corn ETF (CORN)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, May 15, 2015. An excellent meal will be followed by a wide ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $207.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Global Market Comments

May 7, 2015

Fiat Lux

Featured Trade:

(JUNE 22 WASHINGTON DC GLOBAL STRATEGY LUNCHEON)

(WHY I?M GETTING CAUTIOUS ON THE MARKET),

(SPY), (QQQ), (IWM), (UVXY), (FXE), (USO), (TLT),

(POPULATION BOMB ECHOES),

(POT), (MOS), (AGU), (WEAT), (CORN), (SOYB), (RJA)

SPDR S&P 500 ETF (SPY)

PowerShares QQQ Trust, Ser 1 (QQQ)

iShares Russell 2000 (IWM)

ProShares Ultra VIX Short-Term Futures (UVXY)

CurrencyShares Euro ETF (FXE)

United States Oil ETF (USO)

iShares 20+ Year Treasury Bond (TLT)

Potash Corp. of Saskatchewan, Inc. (POT)

The Mosaic Company (MOS)

Agrium Inc. (AGU)

Teucrium Wheat ETF (WEAT)

Teucrium Corn ETF (CORN)

Teucrium Soybean ETF (SOYB)

ELEMENTS Rogers Intl Cmdty Agri TR ETN (RJA)

Let?s face it. We?ve had a great run since the stock market bottomed in a furious selling climax on October 15.

Since then, the large cap S&P 500 (SPY) had tacked on some 18%, while the high tech NASDAQ (QQQ) has gained an impressive 23.6%, and the small cap Russell 2000 (IWM) flew 24.4%.

My Own Trade Alert service performance improved by a positively steroidal 27.7%, as the onslaught of testimonials from ecstatic readers confirms (click here).

Therefore, I have cut the size of my trading book by half, and over hedged what I have left, leaving me with the first net short position since the darkest days of 2014.

Why am I running for the sidelines? Am I getting cautious in my old age? Have I suddenly become a wimp?

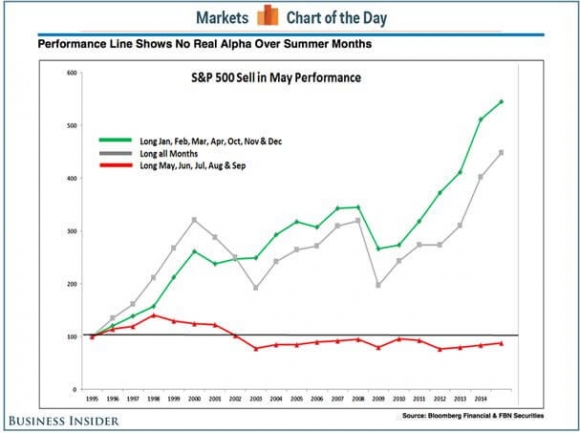

For a start, we have just entered a period in the calendar when it is notoriously difficult to make money in the market. You?ve heard of ?Sell in May and go away?? This year, it may work with a turbocharger.

Take a look at he chart below provided by my friends at Business Insider. It shows that active managers make all of their money during January to April and October to December. Those who are long during the May to September period reliably lose money.

Hey, isn?t that April I see rapidly receding in my rear view mirror?

You may have noticed that the price of oil (USO) has been going up. In fact, the price of Texas tea has added 43% in seven weeks, the sharpest gain since the 1979 oil crisis. As a result, we have just lost 29% of the de facto tax cut for the economy since prices peaked last year at $107 a barrel. You probably have already noticed the double digit rises in the price of gasoline at your local pump.

Not good, not good.

It also appears that the free lunch on interest rates is coming to an end ($TNX). Even if you believe that the Federal Reserve will not act until 2016, that date with destiny is approaching by the day.

You see this is in the steadily rising cost of home mortgages and car loans, neither of which bode well for the economy.

Some may have noticed the meteoric rise on the Euro (FXE) against the US dollar in recent weeks. An aggressive program of quantitative easing seems to be turning around the economy there much faster than expected.

No doubt, businesses on the continent are inspired by the wildly successful results of the same strategy that was employed in the US six years ago. This has led some to assume that Euro QE may end sooner than expected, definitely taking the wind out of the stock markets there.

How about the dollar? Although it has given up half its gains against the Euro this year, it is still high enough to hurt the profits of big multinationals.

We saw evidence of this this morning with the release of the US trade deficit, worst since the crisis days of 2008. The red ink has bubbled up from $34.9 billion in February to $51.4 billion in March, up a staggering 41% month to month.

Clearly, foreign exporters are using their cheaper currency to flood the US market with their goods.

Politics? Did I hear someone mention politics? New candidates are announcing their intentions to run for the top office daily.

What do they all have in common? The need to spend billions of dollars convincing you how terrible the economy is.

This is despite the fact that the stock market has tripled, unemployment is at a decade low, and home prices have doubled off the bottom (at least they have in San Francisco).

Yes, these campaigns only work on people who don?t look at numbers. But there are a lot of people who don?t look at numbers, eroding confidence, creating confusion and postponing spending decisions until after the November, 2016 election.

All of the above me makes me a better seller of rallies than a buyer of dips for the time being. It is certainly is worth a 5% drawdown, if not a 10% hickey later on this summer, when no one is looking.

However, we are not entering a new bear market, and the long term strength of the economy augurs for otherwise. We?re just taking a vacation from the bull market.

It all makes a trip to Europe, some 20% cheaper than last year thanks to the Euro collapse, look all the more enticing.

![John Thomas - beer]() See You in Europe

See You in Europe

Global Market Comments

May 6, 2015

Fiat Lux

Featured Trade:

(JUNE 29 LONDON STRATEGY LUNCHEON)

(MAD HEDGE FUND TRADER HITS 23.7% PROFIT IN 2015),

(FXE), (EUO), (FCX), (AAPL), (GS), (PANW), (DXJ), (LEN), (GOOG),

(THE COOLEST TOMBSTONE CONTEST)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

Freeport-McMoRan Inc. (FCX)

Apple Inc. (AAPL)

The Goldman Sachs Group, Inc. (GS)

Palo Alto Networks, Inc. (PANW)

WisdomTree Japan Hedged Equity ETF (DXJ)

Lennar Corp. (LEN)

Google Inc. (GOOG)

I am sitting here in my luxury suite atop the Bellagio Hotel in Las Vegas. The vast expanse of the southern Nevada desert sprawls out before me, stretching all the way out to the red rock mountains.

Fluffy clouds dot the horizon, and the weather is perfect. Reports say it will only be 95 degrees today.

Nearby, the flashing LED?s of the Nevada strip continue their never ending, multi colored light show. It?s nice to be back.

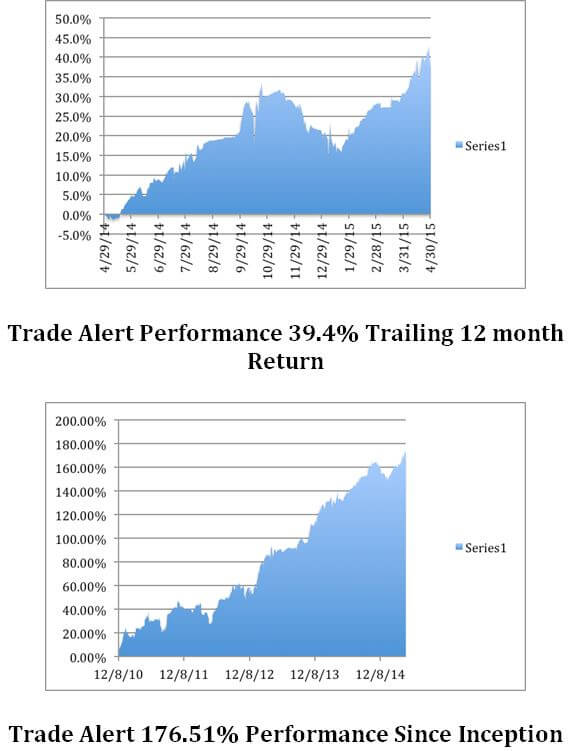

After surviving a meat grinder of a January, putting the pedal to the metal in February, and dodging the raindrops of March, the model-trading portfolio of the Mad Hedge Fund Trader has posted a year-to-date gain of 23.7%.

We have generated profits for followers every month this year, and on our best day were up an eye popping 12.44% at the April high. We have been posting new all time performance highs almost every day for the past three weeks.

Mad Day Trader, Jim Parker, and myself have performed like tag team wrestlers, delivering winners for our paid subscribers one right after the other. Some 25 out of my last 30 Trade Alerts have been profitable.

I managed to nail the collapse in the euro (FXE), (EUO) big time, backing that up with profitable long positions in the Apple (AAPL), Gilead Sciences (GILD), Goldman Sachs (GS), Japan Hedged Equity ETF (DXJ) Freeport McMoRan (FCX) and Palo Alto Networks (PANW).

These more than amply cover modest loses in Lennar Homes (LEN) and Google (GOOG).

Jim has been on an absolute hot streak in 2015, shaking the Bull Run in biotech?s for all it is worth (ZIOP), (THRX), (ZTS), and executing some perfectly timed shorts in oil (USO).

This is compared to the miserable performance of the Dow Average, which is up a pitiful +1.6% during the same period.

To top it all, I even bet on the winners last Saturday of the Kentucky Derby (American Pharoah, the favorite), and the Mayweather/Pacquiao fight in Las Vegas.

When it rains, it pours.

The four and a half year return of my Trade Alert service is now at an amazing 173%, compared to a far more modest increase for the Dow Average during the same period of only 51%.

That brings my averaged annualized return up to 38.4%. Not bad in this zero interest rate world. It appears better to take on some risk and reach for capital gains and trading profits, than surrender to the paltry fixed income yields out there.

This has been the profit since my groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud.

What saved my bacon this month was my instant and accurate decoding of Fed chairman Janet Yellen?s cryptic comments on the future of possible interest rate hikes, or the lack thereof.

We got to eat our ?patience? and have it too.

Wall Street gets so greedy, and takes out so much money out for itself, there is now nothing left for the individual investor any more. They literally kill the goose that lays the golden egg.

The Mad Hedge Fund Trader seeks to address this imbalance and level the playing field for the average Joe. Looking at the testimonials that come in every day, I?d say we?ve accomplished that goal.

It has all been a vindication of the trading and investment strategy that I have been preaching to followers for the past seven years.

Quite a few followers were able to move fast enough to cash in on my trading recommendations. To read the plaudits yourself, please go to my testimonials page by clicking here.

Watch this space, because the crack team at Mad Hedge Fund Trader has more new products and services cooking in the oven. You?ll hear about them as soon as they are out of beta testing.

Our business is booming, so I am plowing profits back in to enhance our added value for you.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere by the end of 2015.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013, and 30.3% in 2014.

Our flagship product,?Mad Hedge Fund Trader PRO, costs $4,500 a year. It includes?Global Trading Dispatch (my trade alert service and daily newsletter). You get a real-time trading portfolio, an enormous research database and live biweekly strategy webinars. You also get Jim Parker?s?Mad Day Trader?service and?The Opening Bell with Jim Parker.

To subscribe, please go to my website, ?www.madhedgefundtrader.com, click on the ?Memberships? located on the second row of tabs.

By the way, those of you who ran up huge profits with your euro shorts in January and February, and the overnight 25% killing I scored with Freeport McMoRan (FCX) last week all owe me new testimonials.

Ship em in!

![John Thomas]() Looking for the Next Great Trade

Looking for the Next Great Trade

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.