Oil, The US Dollar, and Silicon Valley

The dollar, tech stocks, and Saudi Arabian investment are inextricably linked almost like a web of nodes that shouldn’t be messed with.

The Saudis are a financial heavyweight and I would never dismiss their capital flows as it relates to tech stocks.

It is definitely not a drop in a bucket and we should take notice when Saudi Arabia creates a $100 billion fund this year to invest in AI and other technology.

That is just pocket change for one year.

It is in talks with Andreessen Horowitz, the Silicon Valley venture capital firm, and other investors to put an additional $40 billion into A.I. companies.

In March, the government said it would invest $1 billion in a Silicon Valley-inspired start-up accelerator to lure A.I. entrepreneurs to the kingdom.

Saudi wants to invest in tech and to do that they need dollars. Tech and its value are almost always entirely priced using dollars and not any other currency.

So I will address the conspiracy theory that we are about to go completely off the dollar as the global reserve currency.

The behavior of foreign investors suggests that the dollar’s role in global currencies is increasing and not the other way around.

Some even suggest that the Chinese yuan is about to replace the dollar as the world’s most important currency.

I strongly disagree with that opinion.

A place still using capital controls for trillions worth in tech seems like lunacy.

It flat-out does not happen.

Middle East oil-producing nations have other reasons to stick to the dollar.

A crucial one is that most of their currencies are pegged to the greenback, requiring a constant influx of dollars to support the arrangement. Those savings are held in dollar accounts, so Middle East countries have an interest in keeping the dollar strong.

There is not much traction in practical terms of the much-hyped idea of using the yuan to price oil.

American investor Ray Dalio likes to describe America as a weakening power that is succumbing to China. I strongly disagree with that hot take from Dalio. China is in fact faltering at an accelerating pace and its internal problems are piling up like a stray dog locked in a strangers back yard.

If you believe in conspiracy theories, the introduction of a petroyuan, and the ensuing collapse of the petrodollar, would be a first domino, potentially weakening the whole US financial system.

Redraw the global economic map amid a backdrop of crisis and wars.

Astonishing as it is, the narrative is a mirage.

The appetite among OPEC producers to price oil in yuan using a Chinese exchange is basically zero.

Middle Eastern national oil companies closely watch how Beijing tries to manipulate local commodity prices such as iron ore, cotton, coal, or grains every time prices rise above its pain threshold. Having spent 60 years building a formidable cartel, why would Middle East nations cede pricing power to China using a whacked-out currency?

The Saudis need to put their money somewhere and the anointed place has been technology and many times Silicon Valley technology.

They have already invested in many of the most high-profile tech companies in the US and will continue to do that.

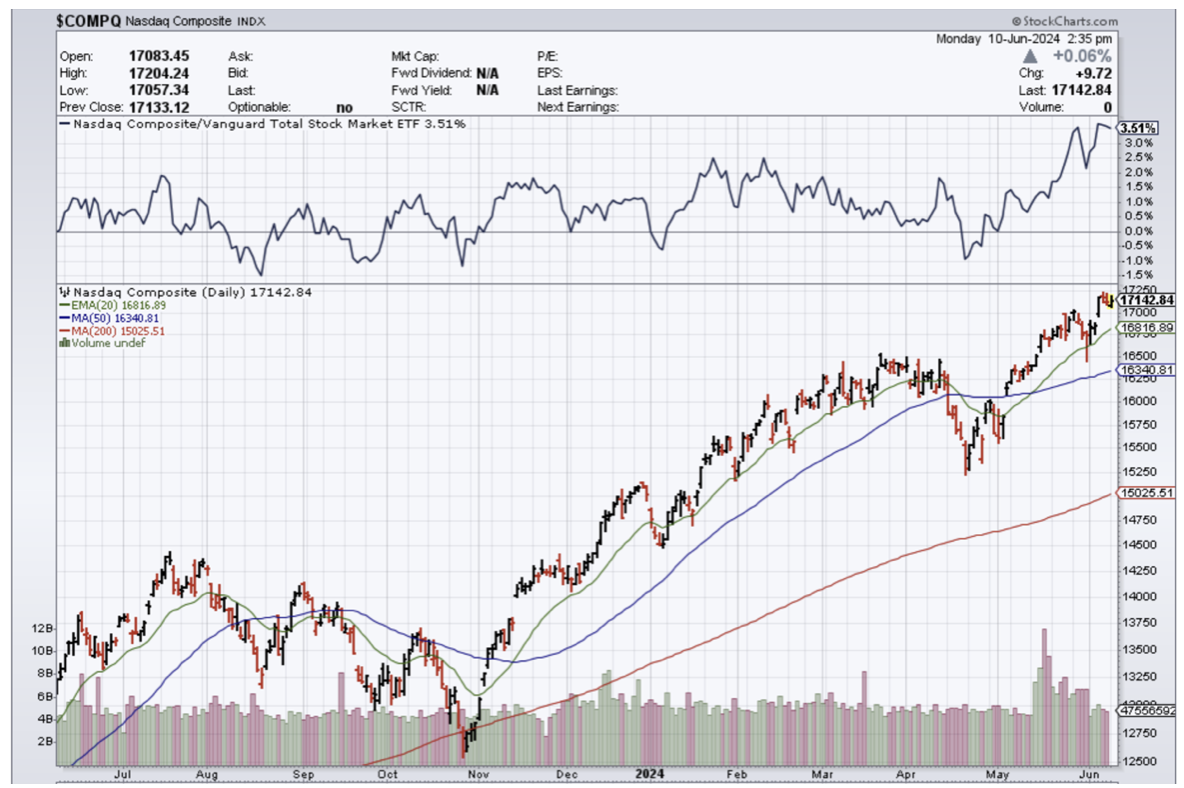

Saudi and other foreign money is another reason why this tech market can’t and won’t get sideswiped.

Any dip is viewed as a prime buying opportunity as other industries give way to the freight train that is the AI narrative.

Anyone would be crazy to short the AI trade with unlimited petro-dollars from the Middle East.

Pump the black gold from the ground and dump the profits into volatile tech stocks.

Wait for them to explode to the moon – rinse and repeat.

I am bullish on tech in the short term.