“The biggest loss I ever suffered was not buying Amazon when I met Jeff Bezos in 1999,” said legendary value investor Ron Baron, when Amazon was trading at $15 a share.

“The biggest loss I ever suffered was not buying Amazon when I met Jeff Bezos in 1999,” said legendary value investor Ron Baron, when Amazon was trading at $15 a share.

Mad Hedge Hot Tips

October 3, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

2) Intel Says it Will Reach Full Year Targets. And the rest of the chip sector seems to be bottoming on the back of the USMCA trade deal. Is it off to the races once again? Buyers are certainly looking for laggards. Click here.

3) Aston Martin IPO Bombs in London. The wrong industry at the wrong time in the wrong place, down 10% on the first day. Buy the car, not the stock. Actually, buy a Tesla (TSLA) instead. The whole world is going electric, and Aston Martin doesn’t fit anywhere in that picture. Click here.

4) Private Sector Hiring Blows Out to the Upside, with the September ADP Report surprising as if you needed more proof of a full employment economy. Smaller companies did most of the hiring, another sign of a topping economy. Click here.

5) ISM Services Index Hits a 21 Year High, jumping from 58.5 to 61.6 in September. It shows how irrelevant manufacturing really has become. And you wondered why investors are so heavily loaded with technology stocks. Buy software, short hardware! Click here.

Published today in the Mad HedgeGlobal Trading Dispatch and Mad Hedge Technology Letter:

(TAKING A LOOK AT GENERAL ELECTRIC LEAPS), (GE),

(TEN SURPRISES THAT WOULD DESTROY THIS MARKET),

(USO), (AMZN), (MCD), (WMT), (TGT)

(OUR HOME RUN ON SQUARE),

(SQ), (V), (AMZN), (GRUB), (SPOT), (MSFT), (CRM), (AAPL)

Global Market Comments

October 3, 2018

Fiat Lux

Featured Trade:

(TAKING A LOOK AT GENERAL ELECTRIC LEAPS), (GE),

(TEN SURPRISES THAT WOULD DESTROY THIS MARKET),

(USO), (AMZN), (MCD), (WMT), (TGT)

Mad Hedge Technology Letter

October 3, 2018

Fiat Lux

Featured Trade:

(OUR HOME RUN ON SQUARE),

(SQ), (V), (AMZN), (GRUB), (SPOT), (MSFT), (CRM), (AAPL)

Long Term Equity Anticipation Securities, or LEAPS, are a great way to play the market when you expect a substantial move up in a security over a long period of time. Get these right and the returns over 18 months can amount to several hundred percent.

At market bottoms these are a dollar a dozen. At all-time highs they are as scarce as hen’s teeth. However, scouring all asset classes there are a few sweet ones to be had.

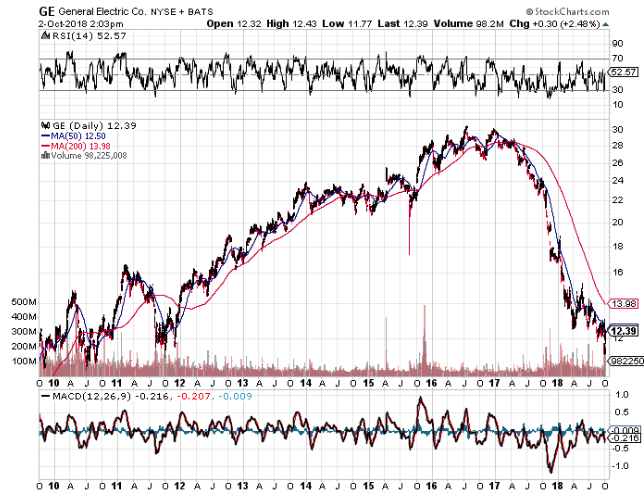

General Electric (GE) is a stock that has been taken out to the woodshed and beaten senseless. Management has made every possible mistake they could have over the past two decades.

During the 2000’s the company paid enormous premiums to get into the financial sector, thus causing the pros to dub it as the “hedge fund that made light bulbs.” They bailed out right at the market bottom after the 2008 crash for pennies on the dollar.

If it weren’t for Oracle of Omaha Warren Buffet’s generous move to buy their 10% yielding convertible bonds the company would have almost certainly gone under.

Another legacy dud dates back to former CEO Jack Welch’s entry into the insurance business. Although most of that business has been sold off, it still managed to lose $6.2 billion in the fourth quarter of 2017.

The result of this epic mismanagement has been to wipe out over $1 trillion in market capitalization. The shares have plunged some 66%, from $32 to $11.

At the urging of major shareholders a long-suffering board ousted GE’s latest CEO, John Flannery, after only a year in the job and replaced him with former Danaher (DHR) CEO Lawrence Culp. The move may have finally put a bottom in the stock.

It’s obvious what GE has to do here. It needs to liquidate the remaining money losing assets that have been such a huge drain on cash flow.

It could also sell a few other successful business lines at big premiums that are money makers, just as jet engines or its Baker Hughes oil subsidiary. These days investors are paying up for almost everything.

I don’t know how long it will take Culp to work his magic. However, I bet the stock market will start to sniff out a turnaround sometime in the next year and a half.

The GE January 17, 2020 $15-$18 vertical bull call spread (called a LEAP because it has a maturity of more than one year) is currently priced at 55 cents.

If the shares make it back up to $18, the price it traded at in January, the LEAP would be worth $3.00, delivering you a gain of 345%. It makes a very low risk, high return set up for investors tired of paying new all-time highs for everything else.

Whatever happened to Jack Welch, who originally created this disaster? Jack retired a billionaire and is now giving lectures on corporate managements. Go figure.

I’ll try to come up with another interested LEAP idea tomorrow. I know you’re all starved for them.

Pat yourself on the back if you pulled the trigger on Square (SQ) when I told you so because the stock has just lurched over an intra-day level of $100.

It was me aggressively pushing readers into buying this gem of a fin-tech company at $49. To read that story, please click here (you must be logged in to www.madhedgefundtrader.com).

Since then, the price action has defied gravity levitating higher each passing day immune to any ill-effects.

The Teflon-like momentum boils down to the company being at the cross-section of an American fin-tech renaissance and spewing out supremely innovative products.

At first, Square nurtured the business by targeting the low hanging fruit– small and medium size enterprises in dire need of a strong injection of fin-tech infrastructure.

It largely stayed away from the big corporations that adorn billboards across the Manhattan skyline.

That was then, and this is now.

Square is going after the Goliath’s fueling a violent rise in gross payment volume (GPV).

Modifying themselves for larger institutions is the next leg up for Square.

They recently inaugurated Square for Restaurants for larger full-service restaurants.

Business owners do not need technical backgrounds to operate the software and integrating Caviar into this program emphasizes the feed through all of Square’s software.

Dorsey has built an ecosystem that has morphed into a one-stop shop for comprehensively running a business.

Migrating into business with the premium corporations offers an opportunity to augment higher margin business.

This is the lucrative path ahead for Square and why investors are festively lining up at the door to get a piece of the action.

The downside with an uber-growth company like Square are lean profits, but they have managed to eke out three straight quarters of marginal spoils.

However, the absence of profits can be stomached considering the total addressable market is up to $350 billion.

Grabbing a chunk of that would mean profits galore for this too hot to handle company.

Expenses are always a head spinner for Silicon Valley firms and attracting a dazzling array of engineers to spin out breathtaking profits can’t be done on the cheap.

The Cash app download figures are sizzling and is one of the most popular apps in the app store.

Square’s marketing strategy is also turning a corner getting out their name leading to sale conversions.

These are just several irons in the fire.

The last two years has seen this stock double each year, could we be in for another double next year?

If measured by growth, then I see why not.

Growth is the ultimate acid test deciding whether this stock will be dragged down into the quick sand or let loose to run riot.

Other second-tier tech firms in the middle of a sweet growth spot pack a potent punch like Spotify (SPOT) and Grubhub (GRUB) which are growing annual sales around 50-60%.

Material profits are also irrelevant for the aforementioned tech juggernauts.

Square is expanding at the same fervent pace too, and the hyper-growth only makes payment processors like Visa (V) quasi-jealous of such staggering numbers.

And when Square trots out numbers to the public like that with (GPV) shooting out the roof, the stock does nothing but go gangbusters.

Either way, Square has popularized making credit card payments through smartphones and that in itself was a tough nut to crack amongst tough nuts.

Square also has a line-up of impressive point-of-sales products such as Caviar.

In fact, merchant sellers are adopting an average of 3.4 Square software apps with invoices, loans, marketing, and payroll software being the most beloved.

Square also offers other software that can handle back office tasks and manage inventory.

The software and services business is on pace to register over $1 billion in sales in 2019.

The breadth of functions that can boost a company’s execution highlights the quality of software Dorsey has produced.

I always revert back to one key ingredient that all tech companies must wildly indulge in to fire up the stock price – innovation.

Innovation in bucket loads is something all the brilliant tech firms crave such as Microsoft (MSFT), Amazon, and Salesforce (CRM).

Overperformance starts from the top and trickles down to the people they hand pick to manage and run the businesses.

Jack Dorsey is right up there with the best of them and his influence cannot be denied or ignored.

His stewardship over his other company Twitter (TWTR) is sometimes worrisome because of a pure scheduling conflict, but it’s obvious which company is having a better year.

Square steers clear of the privacy and regulatory minefields handcuffing Twitter.

And it could be safely assumed that Dorsey enjoys his afternoons more at Square than his mornings across the street at Twitter where he is bombarded by heinous problems up the wazoo.

When you conjure up an up-and-coming company that could rattle the establishment, Square is one of the first companies that comes to mind.

Some analysts even argue this company deserves to be lifted into the vaunted Fang group.

I would say they are on their merry way but they just aren’t big enough to command a spot on the Fang roster.

I have immense conviction this stock will be a deep influencer of our time, and its diversified software offerings add limitless dimensions underpinning massive revenue streams.

In Q2, the subscription revenue grew 127% YOY underscoring the success the software team is having, crafting productive apps applicable to business owners.

Business owners can even take out a loan through Square Capital which issues micro-loans to small business owners.

In need of financing? Ring up Dorsey’s company for a few quid.

Starkly contrasting Square in the payment processors space is Visa (V).

Visa is not a hyper-growth company going ballistic, but a stoic behemoth unperturbed.

The 3.283 billion visa cards that adorn its insignia represents scintillating brand awareness and efficiency.

When Tim Cook was asked if Apple (AAPL) plans to disrupt Visa, he smirked and said, “People love their credit cards.”

This is a prototypical steady as she goes-type of company.

They do not offer micro-loans to small businesses or dabble with any of the murky sort of products that can be found on the edge of the risk curve.

They are a safe and steady pure payment processor.

Its network can digest 65,000 transactions per second and is universally cherished as a brand around the world.

All of this led to an operating margin of 66% in 2017.

Square has identified other parts of the payment process to snatch and do not directly compete with Visa.

They partner with Visa and pay them a processing fee.

Subsequently, Square is paid a merchant fee after the payment is approved.

Visa has a monopoly and a moat around their business as wide as can be.

Square is a different type of beast – growing uncontrollably and hell-bent on spawning a revolutionary fin-tech paradigm shift.

The question is can Square eventually turn payment heavyweights like Visa on its head?

The path is fraught with booby traps and as Square generates the projected sales and bolsters its revenue, it could start to encroach on these legacy processors too.

Yet, it’s too early to delve into that threat yet.

Enjoy the ride with Square and better to lay off this potent stock until a better entry point presents itself.

This stock will go higher. Giddy-up!

“Should kids check phones at dinner? I don't know. To me, that's a parenting choice.” - Said Google CEO Sundar Pichai

“Stock don’t stop on a dime when they reach the right valuation. I’m afraid this time, they’re going to overshoot,” said Karen Finerman of Metropolitan Capital Advisors.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.