When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

October 4, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Mad Hedge Kills It with Bond Short, as the US Treasury bond collapse (TLT) goes global. Yet, we caught a 10% home run in two days. The huge expansion of government borrowing this year has come home to roost. Look for 4% bonds next year. Click here.

2) Business is Booming in Australia, as Chinese trade shifts from the US to down under. I wonder why they don’t like us anymore. Click here.

3) FedEx is Paying Huge Premiums for Pilots, to keep them from retiring before the holidays. The pilot shortage is getting that extreme. Roger that! Just found my Christmas gig. Click here.

4) Bed Bath & Beyond Has Put Itself Up for Sale. Another Amazon victim bites the dust. Click here.

5) It’s National Vodka Day and National Taco Day. Great! A hangover AND indigestion. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(TUESDAY OCTOBER 16 MIAMI GLOBAL STRATEGY LUNCHEON),

(BONDS FINALLY BREAK TWO-YEAR RANGE),

(TLT), (TBT), ($TNX),

(HOW SOFTBANK IS TAKING OVER THE US VENTURE CAPITAL BUSINESS),

(SFTBY), (BABA), (GRUB), (WMT), (GM), (GS)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 4, 2018

Fiat Lux

Featured Trade:

(TUESDAY OCTOBER 16 MIAMI GLOBAL STRATEGY LUNCHEON),

(BONDS FINALLY BREAK TWO-YEAR RANGE),

(TLT), (TBT), ($TNX)

Come join me for lunch for the Mad Hedge Fund Trader’s Global Strategy luncheon, which I will be conducting in Miami, Florida, on Tuesday, October 16, 2018.

A three-course lunch will be followed by an extended question-and-answer period.

I’ll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, energy, precious metals, and real estate.

And to keep you in suspense, I’ll be tossing a few surprises out there, too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $248.

I’ll be arriving at 11:30 AM and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a restaurant at a major downtown hotel.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, click here.

Mad Hedge Technology Letter

October 4, 2018

Fiat Lux

Featured Trade:

(HOW SOFTBANK IS TAKING OVER THE US VENTURE CAPITAL BUSINESS),

(SFTBY), (BABA), (GRUB), (WMT), (GM), (GS)

One of the few people who can magnify pressure on the venture capitalists of Silicon Valley is none other than Masayoshi Son.

What a ride it has been so far. At least for him.

His $100 billion SoftBank Vision Fund has put the Sand Hill Road faithful in a tizzy – utterly revolutionizing an industry and showing who the true power broker is in Silicon Valley.

He has even gone so far as doubling down his prospects by claiming that he will raise a $100 billion fund every few years and spend $50 billion per year.

This capital logically would flow into what he knows best – technology and the best technology money can buy.

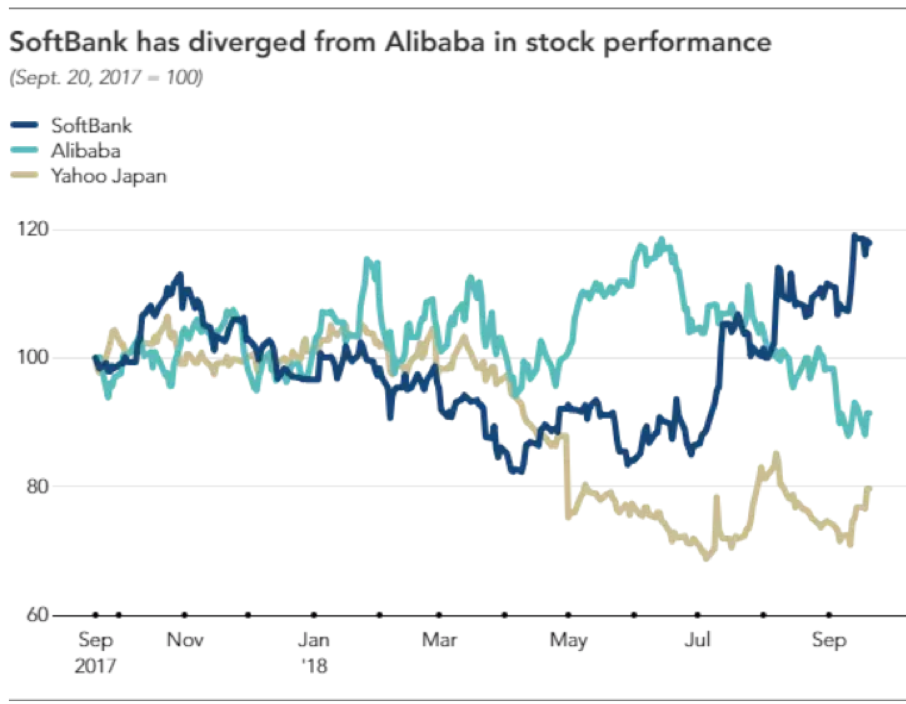

As Yahoo Japan and Alibaba (BABA) shares have floundered, SoftBank’s stock has decoupled from the duo displaying explosive brawn.

SoftBank’s stock is up 30% in the past few months and I can tell you it’s not because of his Japanese telecommunications business which has served him well until now as his cash cow.

Yahoo Japan, in which SoftBank owns a 48.17% stake, has existing synergies with SoftBank’s Japanese business, but has experienced a tumble in share price as Son turns his laser-like focus to his epic Vision Fund.

His tech investments are bearing fruit and not only that, Son revealed his Alibaba investment is about to clean up shop to the tune of $11.7 billion next year shooting SoftBank shares into orbit.

A good portion of the lucrative windfall will arrive from derivatives connected to the sale of Alibaba, and the other 60% comes from the paper profits finally realized in this shrewd piece of business.

Equally paramount, SoftBank’s Vision Fund hauled in $2.13 billion in operating profits from the April-June quarter underscoring the effectiveness of Masayoshi Son’s tech ardor.

Son said it best of the performance of the Vision Fund saying, “Results have actually been too good.”

So good that after this June, Son changed his schedule to spend 3% of his time on his telecom business down from 97% before June.

His telecommunications business in Japan has turned into a footnote.

It was the first quarter that Son’s tech investments eclipsed his legacy communications company.

Son vies to rinse and repeat this strategy to the horror of other venture capitalists.

The bottomless pit of capital he brings to the table predictably raises the prices for everyone in the tech investment world.

Son’s capital warfare strategy revolves around one main trope – Artificial Intelligence.

He also strictly selects industry leaders which have a high chance of dominating their field of expertise.

Geographically speaking, the fund has pinpointed America and China as the best sources of companies. India takes in the bronze medal.

Unsurprisingly, these two heavyweights are the unequivocal leaders in artificial intelligence spearheading this movement with the utmost zeal.

His eyes have been squarely set on Silicon Valley for quite some time and his record speaks for himself scooping up stakes in power players such as Uber, WeWork, Slack, and GM (GM) Cruise.

Other stakes in Chinese firms he’s picked up are China’s Uber Didi Chuxing, China’s GrubHub (GRUB) Ele.me and the first digital insurer in China named Zhongan International costing him $500 million.

Other notable deals done are its sale of Flipkart to Walmart (WMT) for $4 billion giving SoftBank a $1.5 billion or 60% profit on the $2.5 billion position.

In 2016, the entire venture capitalist industry registered $75.3 billion in capital allocation according to the National Venture Capital Association.

This one company is rivalling that same spending power by itself.

Its smallest deal isn’t even small at $100 million, baffling the local players forcing them to scurry back to the drawing board.

The reverberation has been intense and far-reaching in Silicon Valley with former stalwarts such as Kleiner Perkins Caufield & Byers breaking up, outmaneuvered by this fresh newcomer with unlimited capital.

Let me remind you that it was considered standard to cautiously wade into investment with several millions.

Venture capitalists would take stock of the progress and reassess if they wanted to delve in some more.

There was no bazooka strategy then.

SoftBank has thrown this tactic out the window by offering aspiring firms showing promise boatloads of capital up front even overpaying in some cases.

Conveniently, Son stations himself nearby at a nine-acre estate in Woodside, California complete with an Italianate mansion he bought for $117.5 million in 2012.

It was one of the most expensive properties ever purchased in the state of California even topping Hostess Brands owner Daren Metropoulos, who bought the Playboy Mansion from Hugh Hefner in 2016 for $100 million.

If you think Son is posh – he is not. He only fits himself out in the Japanese budget clothing brand Uniqlo. He just needed a comfortable place to stay and he hates hotels.

In August, SoftBank decided to top off the $4.4 billion investment in WeWork, an American office space-share company, with another $1 billion leading Son to proclaim that WeWork would be his “next Alibaba.”

Son continued to say that WeWork is “something completely new that uses technology to build and network communities.”

The rise of remote workers is taking the world by storm and this bet clearly follows this trend.

The unlimited coffee and beer found in the new Japanese Roppongi WeWork office that opened earlier this year was a nice touch.

WeWork plans to open 10-12 offices in Japan by the end of 2018.

Thus far, WeWork is operating in over 300 locations in over 20 countries.

Revenue is growing rapidly with the $900 million in 2017 a 12-fold improvement from 2014.

The newest addition to SoftBank’s dazzling array of unicorns is Bytedance, a start-up whose algorithms have fueled news-stream app Jinri Toutiao’s meteoric rise in China.

The deal values the company at $75 billion.

It also runs video sharing app Douyin, and overseas version TikTok.

Bytedance’s proprietary algorithm, serving to personalize streams for users, is the best in China.

They have been able to insulate themselves from local industry giants Tencent and Alibaba.

TikTok has piled up over 500 million users and brilliant investment like these is why Son revealed that the Vision Fund’s annual rate of return has been 44%.

SoftBank’s ceaseless ambition has them in the news again with whispers of investing in a Chinese online education space with a company called Zuoyebang.

China’s online education market is massive. In 2017, this industry pulled down over $33 billion in revenue, and 2018 is poised to break $55 billion.

Zuoyebang has lured in Goldman Sach’s (GS) as an investor.

This platform allows users to upload homework questions for third party assistance – the name of the app literally translates into “homework help.”

Cherry-picking off the top of the heap from the best artificial intelligence companies in the world is the secret recipe to outperforming your competitors.

At the same time, aggressively throwing money at these companies has effectively frozen out any resemblance of competition. Once the competition is frozen out, the value of these investments explodes, swiftly super-charged by rapidly expanding growth drivers.

How can you compete with a man who is willing to pay $300 million for a dog walking app?

Venture capitalist funds have been scrambling to reload and mimic a Vision Fund-like business of their own, but its not easy raising $100 billion quickly.

This genius strategy has made the founder of SoftBank the most powerful businessman in the world.

Son owns the future and will have the largest say on how the world and economies evolve going forward.

I love executing one day wonders.

Since we sold short the US Treasury bond market on Monday, it has plunged a stunning 3 points. Bond yields just performed a rare 10 basis point move up to 3.18%. You usually only see that during a major “RISK OFF” geopolitical event or financial crisis.

You could see all of the key support levels failing like a hot knife for butter. The next support for the United States Treasury Bond Fund (TLT) is now at $111, or some 2.5 points down from here, pointing to a 3.25% yield for the ten-year bond.

My yearend forecast of a ten-year yield of 3.25% and a one-year target of 4.0% is alive and well.

The break marks an important departure from a stubborn two-year trading range….to the downside.

As with major breaks there is not a single a data point that broke the camel’s back. It could have been the agreement to NAFTA 2.0 on Monday or the blistering hot ISM Services print at a 21-year high on Wednesday.

Rather, it has been a steady death by a thousand cuts spread over several points that did it. It was just a matter of time before a 4.2% GDP growth rate crushed the fixed income market.

If I had to point to one single thing that triggered this debacle, it would be Amazon’s (AMZN) decision to give a 25% raise to its 250,000 US employees to $15 an hour.

If Wal-Mart (WMT), McDonald’s (MCD), or Target (TGT) have to resort to the same, you could have a serious outbreak of inflation on 2019. Imagine that, a bidding war for minimum wage workers.

ALL of those costs will be passed on to us, which is highly inflationary, and bonds absolutely HATE inflation.

Other than giving us boasting rights, the bond market move carries several important messages for us.

Money is about to start transferring from borrowers to savers in a major way. You won’t hear about seniors unable to live off of their savings anymore, a common refrain of the past decade.

Cash is now offering a serious competitor to bond and equity investments. And the next recession and bear market have just been moved closer.

The rocketing US budget deficit is starting to bear its bitter fruit as the government is starting to crowd out private sector borrowers. The budget deficit should be running at a $1 trillion annualized rate by the end of this year.

All of you celebrating your windfall tax cuts are getting a sharp reminder that the money has been entirely borrowed, some 40% from foreign bond investors we have been attacking. It will have to be paid back some time.

Of course, we all knew this was coming. It is no accident that the most capital-intensive industries in the country, also the heaviest borrowers, have seen the worst stock performance of 2018 including real estate, REITS, steel, and autos. Their profit margins have all just been seriously chopped.

So, what to do about the bond market now that we have begun the next leg in a 30-year bear market? For a start, don’t sell. Rather, wait for the next rally back up to the old support level at $116. It should revisit the old support level at least once.

When it does, SELL WITH BOTH HANDS.

I Just Love That 25% Wage Hike

“The biggest loss I ever suffered was not buying Amazon when I met Jeff Bezos in 1999,” said legendary value investor Ron Baron, when Amazon was trading at $15 a share.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.