Global Market Comments

May 9, 2018

Fiat Lux

SPECIAL REIT ISSUE

Featured Trade:

(MONDAY, JUNE 11, FORT WORTH, TEXAS, GLOBAL STRATEGY LUNCHEON),

(THE DEATH OF THE MALL),

(SPG), (MAC), (TCO)

Global Market Comments

May 9, 2018

Fiat Lux

SPECIAL REIT ISSUE

Featured Trade:

(MONDAY, JUNE 11, FORT WORTH, TEXAS, GLOBAL STRATEGY LUNCHEON),

(THE DEATH OF THE MALL),

(SPG), (MAC), (TCO)

Mad Hedge Technology Letter

May 9, 2018

Fiat Lux

Featured Trade:

(HERE'S THE TOP STOCK IN THE MARKET TO BUY TODAY),

(MSFT), (AMZN), (AAPL), (APTV), (QCOM), (FB)

When the CEO of Microsoft, Satya Nadella, sits down for a candid interview, I move mountains then cross heaven and hell to listen to him, and you should, too.

Microsoft is at the top of my list as a conviction buy.

Nadella is one of the great CEOs of our time and was able to complete Microsoft's makeover after Steve Ballmer's insipid tenure at the helm.

Microsoft's Build conference is the perfect platform for Nadella to share his wisdom about the company, industry, and changes going forward.

In an age where tech CEOs thrive off of smoke and mirrors, Nadella was succinct conveying the concept of trust as the secret sauce that will help tech's digital footprint expand into new territories.

Trust infused products through the cloud and A.I. will be the perfect archetype of future tech that will encourage accelerated adoption rates.

A.I. was the message of the day at the Build conference. Nadella used the term A.I. 14 times and the word cloud four times when interviewed.

It was fitting that Microsoft wowed the audience with a sparkly, new-fangled demo.

The demo put on by Microsoft in conjunction with Amazon's (AMZN) Alexa showed smart-assistants working in collaboration.

Microsoft showed how it is possible to use a PC Windows desktop to order an Uber car through Amazon's Alexa.

This technology is very powerful and is a work-around for the "walled garden" problem where big companies are closing off their systems only to proprietary software and products limiting upside potential.

The ability to collaborate with multiple A.I. smart systems will generate a whole new layer of business catering toward the communication and business developments among A.I. systems.

Nadella also offered extended examples of A.I. applications, for instance, the capability of detecting cracks in an oil pipeline and running recognition software through a drone using a Qualcomm (QCOM) manufactured camera to monitor the state of containers.

Trusting A.I. will expedite the usage of A.I. business applications, and the companies diverting capital into A.I. enhancement will reap from what they sow.

The knock-on effect is that university A.I. staff members are being poached faster than a breakfast egg. There is a bidding war going on as we speak from both sides of the Pacific.

Facebook is opening new A.I. research centers in Seattle and Pittsburgh.

Previously, A.I. was a buzzword and companies would trot out a visually stimulating display with pizzazz. But that is all changing with A.I. swiftly moving into the backbone of all business operations.

Ottomatika, a company that develops software for autonomous cars acquired by Aptiv (APTV), was entirely a Carnegie Mellon University (CMU) in-house project that was picked up by Aptiv for commercial applications.

In one fell swoop, (CMU) lost a whole team of leading A.I. researchers.

Microsoft is a premium stock because it straddles both sides of the fence.

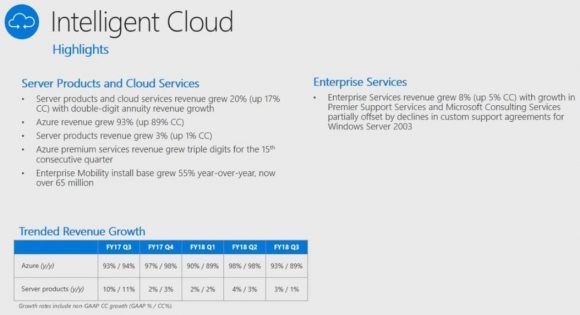

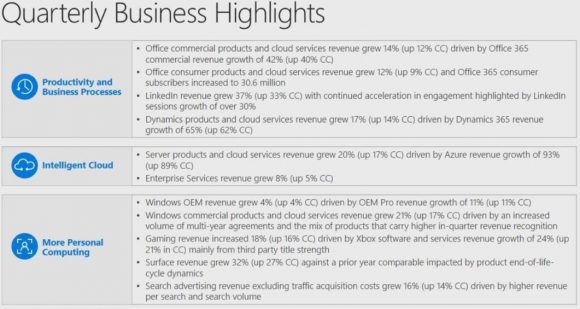

On one side, it's an uber growth company with Microsoft Azure growing 93% YOY satisfying investors requirement for insatiable growth.

On the other hand, Microsoft is robustly lucrative profiting $21.20 billion in 2017, and would be a Warren Buffett-type of cash flow reliant stock even though he has smothered any inkling of buying Microsoft shares because of his close relationship with co-founder Bill Gates.

Even Microsoft's legacy product Microsoft Office 365 is a gangbuster segment swelling 42% YOY.

This contrasts with other legacy companies that are attempting to wean themselves from their own outdated products.

Office 365 products are still embedded in daily life, and I am using it now to type this story.

On the technical side of it, Microsoft is beefing up its developer tools.

Microsoft will integrate Kubernetes, an open-source system for automating deployment, into the Azure as well as upping its Azure Bot Service adding 100 new features.

There are more than 300,000 developers who operate the Azure Bot Service alone.

The slew of upgrades for developers will enhance the power of Microsoft's software and ecosystem.

The overarching theme to the Build conference is the integration of A.I. into real life business applications and the importance of the cloud.

Now the Cloud.

Nadella reaffirmed Microsoft's position in the cloud wars characterizing the current environment as a duo of Amazon and Microsoft with Google trailing behind.

Microsoft has the potential to nick Amazon's position as the industry's cloud leader because of the unique set of products it can combine with the cloud.

Most of the world utilizes a mix of PC-based hardware, using Microsoft's software and operating system, supplemented by an Android-based smartphone.

As expected, Microsoft, Alphabet (GOOGL), and Amazon are spending a pretty penny advancing their cloud business.

Microsoft spends more than $1 billion per month on Azure cloud data centers.

This number now surpasses the entire annual Microsoft R&D budget.

In the interview, Nadella cited that Microsoft now has 50 domestic data centers.

Amazon habitually holds between 50,000 to 80,000 servers at each data center. Extrapolate the lower range of the number with 50 data centers and Microsoft could have at least 2.5 million servers working for its data needs.

The barriers of entry have never been higher in the cloud industry because the costs are spiraling out of control.

Few people have billions upon billions to make this business work at the appropriate scale.

Tom Keane, head of Global Infrastructure at Microsoft Azure, recently said that Azure meets 58 compliance requirements set forth by the federal government, industry, and local players.

Azure is the first cloud that satisfies the Defense Federal Acquisition Regulation Supplement criteria for contractors to handle Department of Defense work.

Regulation has emerged as one of the controversial issues of 2018, and this did not get lost in the shuffle.

The trust comment was clearly a thinly veiled swipe against Facebook's (FB) much frowned upon business model, making it commonplace these days for prominent CEOs to distance themselves from Mark Zuckerberg's creation.

Protecting a company's image and reputation is paramount in the new rigid era of big data.

Nadella's anti-Facebook rhetoric continued by noting the auction-based pricing standards are "funky," explaining the model is counterintuitive. His reason was that as demand increases, the price should drop and not rise.

Apple (AAPL) CEO Tim Cook has largely been negative about Facebook's tactics. The fury is justified when you consider Apple and Microsoft hustle industriously to develop software and hardware products while Facebook manipulates user data to profit from collected data. A nice shortcut if there ever was one.

It's clear that Apple and Microsoft have no interest in giving third parties access to personal data because the leadership understands it is a slippery slope to go down and unsustainable.

Nadella's emphasis on tech ethics is a breath of fresh air and the data Microsoft accumulates is used to improve the cloud and software products rather than pedal to mercenaries.

The companies that have staying power create proprietary products that cannot be replicated.

Microsoft's assortment of software products acts as the perfect gateway into the cloud and is a moat widening tool.

A.I. and the cloud are all you need to know, and Microsoft is at the heart of this revolutionary movement.

Any weakness of Microsoft's shares into the low-90s is a screaming buy.

_________________________________________________________________________________________________

Quote of the Day

"Innovation has nothing to do with how many R&D dollars you have. When Apple came up with the Mac, IBM was spending at least 100 times more on R&D. It's not about money. It's about the people you have, how you're led, and how much you get it." - said Apple cofounder Steve Jobs.

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 8, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE MAY 9 GLOBAL STRATEGY WEBINAR),

(REMINDING YOU WHY YOU SHOULD BE SELLING IN MAY),

(QUANTITATIVE EASING EXPLAINED TO A 12-YEAR-OLD)

My next global strategy webinar will be held live from Silicon Valley on Wednesday, May 9, at 12:00 PM EST.

Co-hosting the show will be Mad Day Trader Bill Davis.

I'll be giving you my updated outlook on stocks, bonds, commodities, currencies, precious metals, and real estate.

The goal is to find the cheapest assets in the world to buy, the most expensive to sell short, and the appropriate securities with which to take these positions.

I will also be opining on recent political events around the world and the investment implications therein.

I usually include some charts to highlight the most interesting new developments in the capital markets. There will be a live chat window with which you can pose your own questions.

The webinar will last 45 minutes to an hour. International readers who are unable to participate in the webinar live will find it posted on my website within a few hours.

I look forward to hearing from you.

To log into the webinar, please click on the link we emailed you entitled, "Next Bi-Weekly Webinar - May 9, 2018" or click here.

Followers of my Trade Alert service have watched me shrink my book, reduce risk, and cut positions to a rare 100% cash position.

No, I am not having a nervous breakdown, a midlife crisis, nor have I just received a dementia diagnosis.

It's because I am a big fan of buying straw hats in the dead of winter and umbrellas in the sizzling heat of the summer.

I even load up on Christmas ornaments every January when they go on sale for 10 cents on the dollar.

There is a method to my madness.

If I had a nickel for every time that I heard the term "Sell in May and go away," I could retire.

Oops, I already am retired!

In any case, I thought that I would dig out the hard numbers and see how true this old trading adage is.

It turns out that it is far more powerful than I imagined.

According to the data in the Stock Trader's Almanac, $10,000 invested at the beginning of May and sold at the end of October every year since 1950 would be showing a loss today.

Amazingly, $10,000 invested on every November 1, and sold at the end of April would today be worth $702,000, giving you a compound annual return of 7.10%!

This is despite the fact that the Dow Average rocketed from $409 to $26,500 during the same time period, a gain of 64.79 times!

Since 2000, the seasonal Dow has managed a feeble return of only 4%, while the long winter/short summer strategy generated a stunning 64%.

Of the 68 years under study, the market was down in 25 May-October periods, but negative in only 13 of the November-April periods, and down only three times in the past 20 years!

There have been just three times when the "good 6 months" have lost more than 10% (1969, 1973 and 2008), but with the "bad six month" time period there have been 11 losing efforts of 10% or more.

Being a long-time student of the American and, indeed, the global economy, I have long had a theory behind the regularity of this cycle.

It's enough to base a pagan religion around, like the once practicing Druids at Stonehenge.

Up until the 1920s, we had an overwhelmingly agricultural economy.

Farmers were always at maximum financial distress in the fall, when their outlays for seed, fertilizer, and labor were the greatest, but they had yet to earn any income from the sale of their crops.

So, they had to borrow all at once, placing a large cash call on the financial system as a whole.

This is why we have seen so many stock market crashes in October. Once the system swallows this lump, it's nothing but green lights for six months.

After the cycle was set and easily identifiable by low-end computer algorithms, the trend became a self-fulfilling prophecy.

Yes, it may be disturbing to learn that we ardent stock market practitioners might in fact be the high priests of a strange set of beliefs. But hey, some people will do anything to outperform the market.

It is important to remember that this cyclicality is not 100% accurate, and you know the one time you bet the ranch, it won't work.

But you really have to wonder what investors are expecting when they buy stocks at these elevated levels, over $205 in the S&P 500 (SPY).

Will company earnings multiples further expand from 19X to 20X or 21X?

Will the GDP suddenly reaccelerate from a 2% rate to the 4% promised by the new administration, when the daily sentiment indicators are pointing the opposite direction?

I can't wait to see how this one plays out.

It's May!

Mad Hedge Technology Letter

May 8, 2018

Fiat Lux

Featured Trade:

(BUFFETT GOES ALL IN WITH APPLE),

(SNAP), (WDC), (GOOGL), (AMZN),

(CRM), (RHT), (HPQ), (FB), (AAPL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.