Peter the Great is back!

That is what the latest rumblings out of Russia confirm, with President Vladimir Putin demanding no less than $18 billion in payments from the Ukraine for its natural gas purchases. Never mind that this is more than the beleaguered country could possibly ever use.

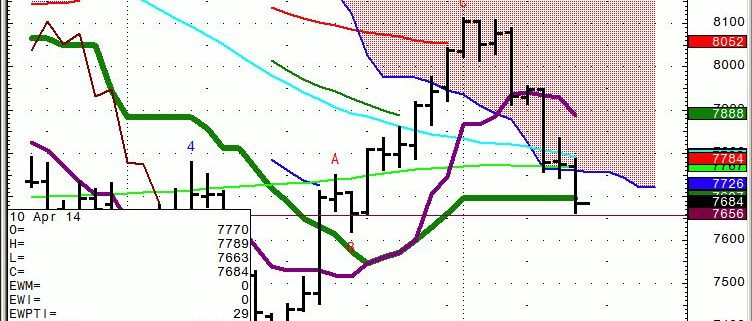

?Pay up, or we invade? seems to be the message. The Dow Average promptly sold off 267 points.

This is so 19th century. It reminds one of when England seized the Suez Canal from Egypt in 1875 after that hapless country?s failure to pay interest on its bonds. A perennially mismanaged Egypt practically invented the concept of sovereign debt default.

I remember it like it was yesterday.

The big problem for we stock traders is that the Russian public has been eating up Putin?s recent actions in the Ukraine, and are egging him on for more. Many are still bitter over the collapse of the old Soviet Union, and are lusting for payback. A partial reconstitution of the old Soviet Union under Russian tutelage would fit the bill nicely. Putin is simply delivering to the people want they want, as does every good politician.

Vlad certainly has a strong base on which to build. During his first premiership and presidency (1999?2008), real incomes increased by 250%, real wages more than tripled; unemployment and poverty more than halved, and standards of living rose dramatically. Putin's first presidency was marked by high economic growth. The Russian economy grew for eight straight years, seeing GDP increase by a heady 72%.

Russia's has a flat income tax of 13%, a rate libertarians here in the US would kill for. As Prime Minister, Putin oversaw large scale military and police reform. His energy policy has affirmed Russia's position as a superpower. Putin supported high-tech industries such as the nuclear and defense industries. A rise in foreign investment has also contributed to a boom in the automotive industry.

Putin is so popular that he has become a pop cultural icon in Russia, with many commercial products named after him. All of this means that he has the domestic political support to push the envelope further. The Ukraine could just be his opening gambit.

You would think that Russia would not be interested in pursuing a second cold war, as the first one drove them broke. However, he is no doubt interested in expanding his country?s power and influence.

Hitler followed a similar course, gobbling up the Rhineland, the Sudetenland, Denmark, Holland, Belgium, Norway, and eventually France, until he vastly overstretched himself and his resources. Let?s hope that Putin doesn?t try the same. The problem is that this time, the aggressor country has 8,500 nuclear weapons with our address still on them.

You can count on Putin?s antics to keep S&P 500 market volatility (VIX), (VXX) at a permanently higher level. You don?t know what he is going to do next, but you know he will do something.

If he confines his visions of grandeur to Ukraine, we might just be able to skate by with a textbook 10% market correction. If he starts to make moves on the Baltic nations of Latvia, Lithuania, and Estonia, all NATO members, then we are really back to another cold war. That would hit us with a massive recession as the ?Peace Dividend? gets returned to sender, and stock markets dive 25% or more.

That is a very sobering thought. Thank goodness I have huge short positions on.