While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

August 27, 2013

Fiat Lux

Featured Trade:

(THE TECHNICAL/FUNDAMENTAL TUG OF WAR),

(SPY), (INDU), (IWM),

(AND MY PREDICTION IS?.),

(TESTIMONIAL),

(THERE ARE NO GURUS)

SPDR S&P 500 (SPY)

Dow Jones Industrial Average (INDU)

iShares Russell 2000 Index (IWM)

For the last few weeks, I have had two groups of analysts screaming in my ears.

Fundamental researchers are asserting that at $105 per share in earnings, generating a price earnings multiple of 15, stocks are at the historic middle of a 10-22 range. Q2 earnings are over, and modestly outperformed on the upside, although not with the magnitude seen in recent quarters. Plus, the taper is on the table, and the Federal Reserve may deliver a surprise at its upcoming September meeting.

Furthermore, risk assets are about to enter a period of seasonal strength. If you ?sell in May and go away?, you should then ?return in September and buy, fill your boots.?

No, no, cry the technicians. Although the small caps (IWM) have been going gangbusters, the large cam Dow and S&P 500 indexes have failed to put in new highs, raising the risk of a failed double top.

What is a befuddled individual investor to make of all this? My belief is that fundamentals always win out over the long term, and that technical cues are at best, a lagging indicator. I use charts for guidelines on where to place orders on a short term basis. The longer you stretch out your time frame, the less relevant they become.

At best, technicals are right 50% of the time, right in the same league as a coin toss, and most of the brokers and investment advisors out there. How many technical analysis hedge funds are out there? None. They are all fundamentally driven. The same technicians making the incredibly bearish prognostications today were making equally convincing bearish arguments last November.

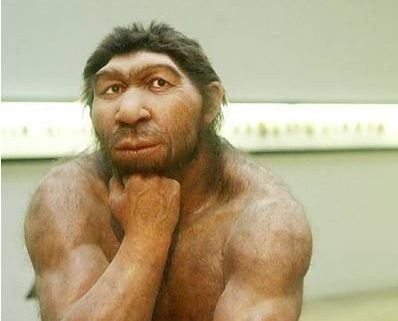

However, since we are descended from prehistoric hunter-gatherers, we are all visually oriented. We respond to stimuli we can see much more rapidly than those we can conceive. A picture truly is worth 1,000 words, and probably a lot more. That?s why so many brokerage firms use them to sell research. I employ charts to back up my fundamental arguments because they are so easy to understand, definitely not the other way around.

So I think the fundamentals will eventually win out, and that we will get the autumn rally that I have been predicting. In fact, we may be only four years into a seven year bull market that is in the process of boosting price earnings multiples from 10 to 18 or 19. The mountain of cash sitting on the sidelines, and the failure of the major indexes to pull back more than 7.5% this year are telling you as much.

Exactly when will the big move up happen? Don?t ask me. Go ask a technician.

Great Technician, Lousy Fundamantalist

I don?t know what I would do without John Thomas?s information. It is informative and entertaining. In the past 2 years I have almost doubled my portfolio, something I couldn't have done on my own.

As a military member, he has enabled me to ensure that I will not only be able to retire on time, but also help my children through college. If things keep going this well, I will be able to pay for their college.

Many blessings to you, John and your staff.

Warm regards,

Charlie

US Military, Del Rio, TX

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

August 26, 2013

Fiat Lux

Featured Trade:

(RIDING WITH TREASURY SECRETARY JACK LEW)

I was perusing my morning email in Zermatt a few weeks ago, and spotted the familiar White House address with the .gov ending. Would I be interested in meeting with the new Treasury Secretary, Jack Lew? It was just what I needed to lure me out of my Alpine lair back to the USA. I responded ?yes,? and instructions followed to meet him at the private jet terminal at San Francisco on August 22.

Half a globe and nine time zones later found me shaking hands with the nation?s 76th Treasury Secretary. The man is maybe 5?8? and squinted at me through wire frame glasses as he gave me a firm handshake. He wore the standard DC uniform, a dark solid suit with a white shirt, which I always thought made everyone look like undertakers.

?You can ride with me to my next event,? he said, inviting me into a spanking new tan GM Suburban with tinted windows. I thought ?Why not GM?? After all, until very recently the government owned a third of the troubled company. After the 1980 Chrysler bailout, that firm provided government rides for decades.

We then took off, escorted by a second Suburban packed with Secret Service agents and bracketed by two California Highway Patrol cars with red lights flashing, racing down Highway 101 at 80 miles an hour. ?Where are we going,? I wondered. ?Google, Apple, or Facebook??

Lew is the first Treasury Secretary appointed in many years who I did not already know. I dated back to the eighties with Tim Geithner in my Tokyo days after he read my books on Japan. Of course, I was long familiar with Hank Paulson from his time with Goldman Sachs, when I was first a competitor, and later a hedge fund client. So my goal today was to try to get the measure of Lew and figure out who he really was.

Lew told me that he was taking over a ship far more seaworthy than the one Geithner inherited four years ago. GDP has bounced back from a negative 5% to a 2% annual rate. Job growth rebounded from 700,000 losses to 200,000 gains a month. Automobile production returned from the grave, soaring from 9 million to 16 million annual units.

Taxes have been lowered for 98% of taxpayers, and major reform has been carried out in financial services, health care, and education. These gains have been made, despite a fiscal drag created by congress that is slowing the economy by 1% this year.

There was still plenty of work to do on jobs, a task made more difficult by the fact that the Republicans have opposed every jobs bill of the past four years. That is why boosting exports has been a top administration priority. The offshoring trend has slowed, and may even be reversing. Fixing our broken immigration system and getting college costs under control are also important.

Yes, it was all the standard Obama party line. But as this was our first meeting, I couldn?t expect a lot of confidences. Lew lacked the intellectual muscle of his predecessor, Geithner, who could discuss the most obscure parts of the financial history of the world with amazing depth. Lew struck as more of a technocrat with impressive experience in the day to day management of government institutions.

I asked Lew why he was known as the ?father of sequestration,? which has drained $85 billion out of the economy this year. He said the plan was a worst-case scenario that was never intended to be implemented. ?Who would have thought the Gang of Six wouldn?t get anywhere on this?? he asked.

Lew then went on to hint that an equally punitive Sequester II might be on the way in the wake of the next debt ceiling deadline in December. The Republicans are using the credit rating of the United States as a political lever, and the economy will suffer as a result.

Business and consumer confidence suffered a body blow during the last debt ceiling negotiations in 2011, and a jittery stock market plunged 25%. Lew confessed that he didn?t know how long cash on hand will last, and that social security checks, Medicare reimbursements, and payments to veterans may have to be halted.

I asked why the administration had declared war on the banking system.? He opined that 2008 was a failure of regulation and oversight. The financial system should be big and healthy enough to finance every good idea and provide loans to all credit worthy homebuyers. A strong and vibrant financial system was important for the US and the world.

But risks for taxpayers must be reduced, which is the goal of Dodd Frank.? Only 40% of the mandated rules have been drafted, and 60% of the deadlines have been missed, thanks to the overwhelming complexity of the task. International cooperation is needed to prevent business from flowing to the weakest regulator.

It was the day of the NASDAQ failure, and our conversation was interrupted by urgent calls from Washington several times. First there was SEC head, Mary Jo White, and then NASDAQ, Chief Robert Greifeld. When president Obama called for an update, the Treasury Secretary pulled out an armored and heavily encrypted cell phone and spoke in murmured tones. All I could make out during his calm and matter-of-fact explanation was ?server down? and ?no back up?.

The subject of China came up, and Lew confided that he had already met with president Xi Jinping several times. It was clear that the Middle Kingdom had over invested in manufacturing, creating a dangerous level of excess capacity. ?They agree with our recommendations,? he said with some surprise. I said I noticed that too. The real problem was in the execution, getting anything done in an emerging economy of 1.2 billion.

I cautioned the Treasury Secretary not to repeat the same mistake Geithner made in his early days and brand China a ?currency manipulator,? even if it was true. You don?t want to do that to someone who is holding $1 trillion of our debt, and until recently accounted for the purchase of half of all new Treasury issues.

We covered a broad range of other international financial issues, which I can?t discuss here for national security reasons. I hope I don?t read about them on Wikileaks someday.

A native of New York City, Lew did his undergrad at Harvard and his law degree at Georgetown. On graduation, he moved down the street and went straight into politics, where he worked for house majority leader, Tip O?Neill. He held several senior government posts during the Clinton administration. His wilderness years during the Bush administration were spent at New York University, and as the chief operating officer of Citicorp (C).

When president Obama took charge, Lew returned as an assistant Secretary of State, then Director of the Office of Management and Budget, and eventually to White House Chief of Staff. He is said to know more about the American budgeting process than any man alive, a talent that will prove useful in his current incarnation.

I couldn?t help but inquire about his pick for Ben Bernanke?s replacement, the next chairman of the Federal Reserve. Somewhat irritated, he shot back, ?I will keep my advice in the Oval Office where it belongs.?

I finally pulled out what seasoned journalists call their ?throw away? question, the one, if asked, is so annoying that it gets you thrown out of the room, or in this case, left by the side of the freeway. ?Why a lawyer as Treasury Secretary? Wouldn?t someone with a more substantial economic background be better suited to the task??

He smiled when he answered that our first Treasury Secretary, Alexander Hamilton, was also a lawyer (click here for my in-depth piece on him in ?The Two Century Dollar Short?). Several men have recently held the post that came from industry or other professions.

In that case, I cautioned him not to befall the fate of Hamilton, who was shot in a duel by vice presidential candidate, Aaron Burr, on a New Jersey shore.

Just then, our procession pulled up to the Computer History Museum where Lew had to deliver a speech. I said he knew my email address and could call any time. We shook hands, and he breezed past an onslaught of TV cameras. I stopped to offer some comments.

?Is he smart? one reporter asked? I replied ?They?re all smart. The United States has an incredible breadth of smart people. That?s why we are the most dominant country in history.?

I called a taxi to retrieve my car back at the airport. In the meantime, I strolled around this really cool museum, far and away the best of its kind in the world. It displayed a Babbage calculating engine, a WWII German ?Ultra? decoding machine, and Steve Wozniak?s first Apple I, which was built in a wooden case. I even saw the wooden slide rule with which I worked my way through college. ?Yikes,? I thought, I?m becoming an antique myself.

That night, I went home, donned my orange hazmat suit, and caught up on the new season of ?Breaking Bad.?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.