While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

August 28, 2013

Fiat Lux

Featured Trade:

(OIL SPIKE SENDS TRADERS SCRAMBLING),

(USO), (GLD),

(ORDER EXECUTION 101),

(THE GREAT COPPER CRASH OF 2013),

(CU), (FCX)

United States Oil (USO)

SPDR Gold Shares (GLD)

First Trust ISE Global Copper Index (CU)

Freeport-McMoRan Copper & Gold Inc. (FCX)

Wow! That was some speech! Secretary of State, John Kerry, was certainly rattling the saber last night when he laid out the irrefutable evidence confirming the use of chemical weapons in Syria. Defense Secretary, Chuck Hagel, then upped the ante by asserting that US military forces are ?ready to go.? Oil (USO) hit a two and a half year high at $109, and gold (GLD) finally resumed its ?flight to safety? character by spiking up $30.

I happened to know that the Joint Chiefs of Staff have been war gaming for Syria for over a year now, and have presented President Obama with a list of graduated levels of response. What is new is the movement off assets to the immediate area, like a major carrier task force, which will park 100 miles offshore in the Eastern Mediterranean for the foreseeable future.

My pick is for a no-fly-zone, which the administration should have executed a long time ago. It is cheap and can be implemented remotely, with no risk of casualties. Drones will come in useful too. F-16 fighters now carry smart missiles with a 70 range. If a pilot in Syria takes off, then poof, they?re gone in 30 seconds.

Although the financial markets are expecting immediate action, we may not get it. When traders started speculating about military strikes, you want to run a mile. Obama is first and foremost a pacifist and needs more than overwhelming evidence to fire a single shot. He even hesitated over taking out Osama bin Laden. He also is a lawyer, so he won?t move until the needed international legal framework is in place, such as a United Nations resolution.

The great irony in all this is that the current crisis has absolutely no impact on the actual supply and demand of oil. Syria doesn?t produce any. It is a net importer of oil. All of the other major crude producers in the Middle East are backing US action, except for Iran, a marginal producer at best. Pure emotion is driving the price here. That is why oil and gold have been going up in tandem, until recently a rare event.

If anything, there is a severe imbalance developing in the crude markets that will soon send prices sharply southward. Thanks to a triple barrel push of improving economic data, Egypt, and then Syria, Wall Street has built up a record long in the oil futures market of some 1.9 million contracts. That works out to an incredible 95 days of daily US consumption, or 256 days of imports. That is a lot of Texas tea sloshing around the books of hot handed traders.

We are just coming to the close of the strongest driving season in 31 years, and demand will soon ebb. And guess what? The economic data is now softening. Unwind just a portion of the speculative long position in oil, and we could quickly return to the $92-$95 range that prevailed before the multiple crisis.

Don?t just stop at oil. Syria?s president, Bashar al-Assad is setting up a buying opportunity for the entire range of risk assets, including longs in US stocks and short positions in bonds, yen, and the euro.? If we get no Fed taper in September, as I expect, it could be off to the races once again.

Meet Your New Trading Strategy

Meet You New Market Timer

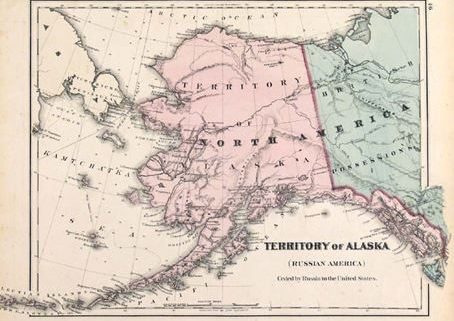

When Dr. Copper (CU), the only commodity with a PhD in economics, suddenly collapses from a heart attack, risk takers everywhere have to sit up and take notice. Since the 2011 top, the red metal has collapsed a shocking 35%.

So called because of its uncanny ability to predict the future of the global economy, copper is warning of dire things to come. The price drop suggests that the great Chinese economic miracle is coming to an end, or is at least facing a substantial slowdown. This dark view is further confirmed by the weakness in the Shanghai index ($SSEC) which has been trading like grim death all year. Will China permabear, Jim Chanos, finally get his dream come true?

It?s a little more complicated than that. Copper is no longer the metal it once was. Because of the lack of a consumer banking system in the Middle Kingdom, individuals are now hoarding 100 pound copper bars and posting them as collateral for loans. Get any weakness of the kind we have seen this year, and lenders panic, dumping their collateral for cash.

The high frequency traders are now in there in force, whipping around prices and creating unprecedented volatility. You can see this also in gold, silver, oil, coal, platinum, and palladium. Notice how they seem to be running the movie on fast forward everywhere these days? Because of this, we could now be seeing an overshoot on the downside in copper which may never actually materialize to this extreme in equities or other asset classes.

Watch Dr. Copper closely. At the first sign of any sustained strength, you should load up on long dated calls for Freeport McMoRan (FCX), the world?s largest producer, which also has been similarly decimated. The gearing in the company is such that a 50% rise in the price of copper triggers a 100% rise in (FCX).

So what is copper telling us today? The longer term charts show a prolonged bottoming process. If this holds, we could be seeing the early days of a resurgence in the global economy. Just get Syria, Egypt, the debt ceiling crisis, and the taper out of the way, and we could be in for a major run. That is a tall order. But just to be safe, I am buying long dated calls in the next major dip in (FCX), which may have started today.

![Pennies]() A Penny for Your Thoughts on Copper?

A Penny for Your Thoughts on Copper?

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.