Global Market Comments

January 14, 2026

Fiat Lux

SPECIAL ISSUE ABOUT THE FAR FUTURE

Featured Trade:

(PEAKING INTO THE FUTURE WITH RAY KURZWEIL),

(GOOG), (INTC), (AAPL), (TXN)

Global Market Comments

January 14, 2026

Fiat Lux

SPECIAL ISSUE ABOUT THE FAR FUTURE

Featured Trade:

(PEAKING INTO THE FUTURE WITH RAY KURZWEIL),

(GOOG), (INTC), (AAPL), (TXN)

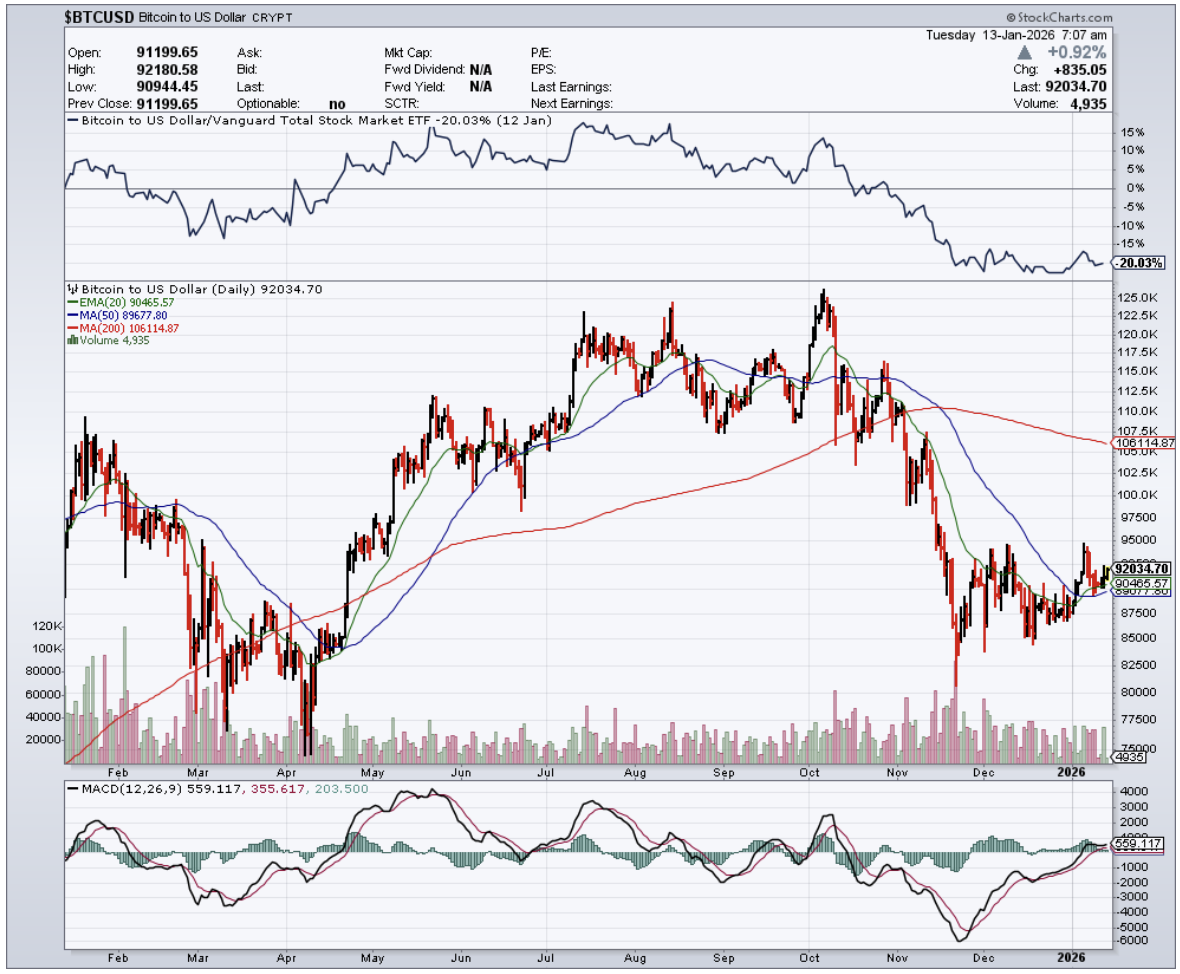

As some of you may have figured out, there are other cryptocurrencies out there besides Bitcoin (BTC).

In fact, there are thousands of different cryptocurrencies out there.

Generated, in part, by the transformational narrative of BTC, many have tried to replicate the success of Bitcoin in terms of percentage gain of the underlying asset.

These other peer-to-peer digital currencies have emerged over the last decade and are all chasing BTC.

First, let me get it out of the way by saying that BTC has extraordinarily benefited from its first-mover advantage and the subsequent snowballing network effect.

Altcoins, not even one, have replicated these super boosters.

These digital currencies, better known as altcoins, are mainly designed to overcome the structural and technical limitations of BTC while supporting a diverse set of real-world use cases.

Why should investors keep tabs on altcoins?

Per the date of this writing, BTC has reached market capitalizations well over one trillion dollars at cycle peaks, and altcoins have represented a comparable share of total crypto market capitalization across cycles.

Commanding a substantial portion of the crypto market is enough to warrant attention.

Since altcoins are such a large part of the market, every crypto investor should understand how they work.

In fact, the way you might profit from crypto is not in BTC itself, but in the diverse set of other assets in the space.

It’s true that many missed the BTC boat. Make sure you don’t miss the next boat.

Owing to the growth of the decentralized finance ecosystem, the increased use of smart contracts, and the introduction of environmentally friendly consensus mechanisms, altcoins expanded their market capitalization rapidly between 2020 and 2021, followed by consolidation and shakeouts in subsequent years.

Altcoin popularity signaled the growing breadth of high-quality crypto assets entering the industry.

Many blockchain companies and projects issue their own cryptocurrency tokens, making them the primary utility token for users to interact with their network.

Since there are hundreds of projects and decentralized finance opportunities available, such as staking and yield farming, together with an open market to choose from, it has proven increasingly difficult to determine the most promising projects.

One major variable that must be baked into the pie is that altcoins tend to offer higher risk and higher reward as a cryptocurrency investment.

Although Bitcoin is volatile, it remains the market leader and has already gained substantial value and name recognition, so investors looking for extra juice gravitate toward lower-priced, nascent coins with more upside.

Altcoins have more room to grow, but they also carry higher idiosyncratic and survivorship risk. Therefore, I can’t advise readers to pour their entire net worth into altcoins.

A wonky altcoin has repeatedly gone to zero across cycles, and there is no way to recover fiat capital once that happens.

Readers looking for altcoin exposure should only allocate a small portion of their portfolio into this space, and I would still emphasize using reputable platforms such as Robinhood or Coinbase.

Altcoins are often more experimental. Since they came out after Bitcoin, they have attempted to improve on its technology. In terms of transaction speeds and costs, many altcoins are superior to Bitcoin in narrow technical dimensions, though often at the expense of decentralization or security.

Should you consider investing in altcoins?

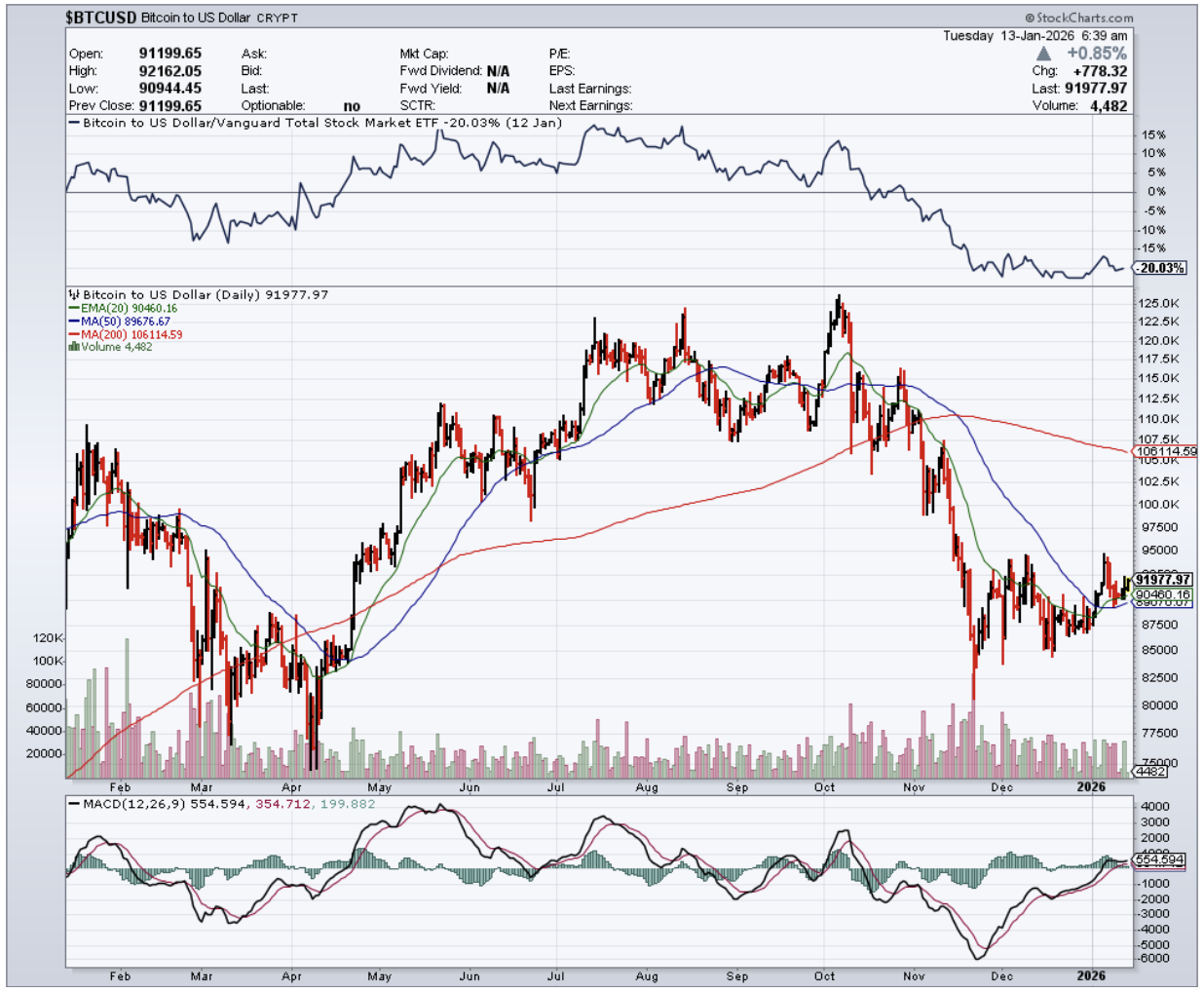

The proverbial low-hanging fruit in BTC was harvested earlier, although Bitcoin remains the benchmark asset in the space.

Another serious challenge with altcoins is how to pick the right one in a crowded setup, which is where we come in.

We continue to navigate through altcoins and give readers the best chance to succeed.

Like real estate, many altcoins are priced relative to the value proposition they offer when compared to a high-five figure or six-figure BTC, which is essentially seen as the best house in the best neighborhood and therefore priced the highest.

The altcoin that performs best in the short run is often the worst house in the best neighborhood, while the greatest long-term potential tends to come from the best house in a rapidly gentrifying neighborhood.

Altcoins and their underlying prices have behaved in a similar fashion to real estate prices, which is why Ethereum and some others have cycled between periods of apparent undervaluation and excess when measured against BTC.

In short, the rising tide lifting all boats has applied unevenly across digital assets over multiple cycles. Bitcoin itself moved through a full market cycle after 2021, but the broader crypto asset class survived, matured, and validated its existence through repeated stress tests.

One might postulate that the price of Bitcoin and Chinese housing have no relevant correlation with each other.

Think again!

Granted, Chinese citizens aren’t denominating their mortgages in Bitcoin to snap up their ritzy Shanghai townhouses overlooking the Bund.

I don’t mean that.

But Bitcoin is an asset just like stocks, bonds, and commodities, and is exposed to one-off events that shake out the financial system.

What’s brewing in the Middle Kingdom?

China’s biggest property builder, Evergrande, has since collapsed into one of the largest restructurings in global property history.

Add it up, Chinese bank deposits are estimated at over $45 trillion, more than 2x the US.

Would any Chinese financial crisis lead to an epic flight to fiat alternatives?

Does nobody recognize that this is a planned liquidity drain of the property market in China by the CCP?

All escape "exits" have already been shut. You can't even buy paper gold in China either. Forget Bitcoin!

So I don’t believe that the potential disorderly selling of Chinese flats or the bust of a major property developer would end up boosting the price of Bitcoin because the Chinese government has made it abundantly clear that Bitcoin remains a hard prohibition for its citizens, with enforcement expanded through 2024.

If there is a 20% dip in Chinese property prices, the Chinese would believe that’s a once-in-a-century buy-the-dip type of event, which ultimately became a multi-year decline exceeding 30% in many tier-2 and tier-3 cities.

That doesn’t mean that some won’t try to sell on the down low and get their money out of China through hell or high water.

Some certainly will. China made it clear they didn’t want their citizens investing in overseas assets. I know of the odd millionaire spinning out a random credit card to put a down payment on a house in Vancouver.

What this does scream is policy error big time, an overtightening that could result in a hard landing that is ruinous for global growth.

That would be the worst-case scenario, and I would put that at 10%, which in hindsight proved directionally correct, though slower and more structural than abrupt.

Evergrande was once China’s darling real estate developer. Now, it has defaulted, been restructured, and effectively dismantled.

It was founded in 1997 by Xu Jiayin. It has completed around 1,300 commercial, residential, and infrastructure projects, and at its peak, employed over 200,000 people directly, with millions indirectly exposed.

The company’s success came because it was aligned perfectly with the parabolic boom in real estate that has been driven by the last two decades of staggering Chinese growth, growth for a country that is unparalleled in all of modern human history.

The tragedy in all this is that over 1.6 million Chinese put deposits down on homes that hadn’t been built, and this was more often than not their entire life savings.

Most likely, it is they who held the bag, many of whom faced long delays, partial recoveries, or state-mediated completions.

Better them than me.

For a soft landing to happen, the Chinese government has selectively intervened while still allowing developers to fail.

Even though I categorize this as a quasi-gray swan, opposed to a solid black swan, it is highly likely that it did not spill over into the broader global market, and when large bitcoin dips occurred, bitcoin buyers were ultimately gifted lower prices to enter.

These opportunities were few and far between in that cycle, and I can guarantee that MicroStrategy CEO Michael Saylor went on to repeatedly execute additional bitcoin purchases, often financed with corporate paper.

Limiting the fallout proved more complex than initially assumed, with piecemeal liquidity support and moral-hazard constraints shaping policy responses, plugging holes before they became unpluggable, not unlike our own debt ceiling mess.

The larger issue remains to ponder. Was this the tip of the iceberg?

The silence and lack of major actions from policymakers made everyone nervous at the time, but most likely, they were managing it quietly through state banks and local governments.

The response was largely driven by the People’s Bank of China, which initiated targeted liquidity operations that became a multi-year pattern rather than a single rescue event.

Evergrande was ultimately confirmed to have over $300 billion in liabilities, more than any other property developer in the world. At its peak, it was a beast in China’s high-yield dollar bond market.

A lackluster response to an already expensive market proved costly, with real estate still estimated to account for roughly 35 to 40% of household assets in China despite price declines. At the time, home sales by value showed their sharpest drop since the onset of the coronavirus.

Isolating Evergrande became a point of emphasis for the Chinese Communist Party, using the firm as a scapegoat for sky-high property prices.

They were the fall guy.

This was more of a political show than anything else, a show of power, letting the world know that this economic pain was nothing to even bat an eyelid about.

Bitcoin, perceived as a riskier asset along the risk curve, was not immune from sell-offs, and risk-off sentiment contributed to episodic drawdowns during the 2021 to 2022 cycle.

I had faith in the Chinese government’s authority to contain systemic fallout, and while $40,000 proved only a temporary reference point for Bitcoin, the asset ultimately moved through a full cycle drawdown before reaching new highs in subsequent years.

Short-term relief rallies did occur as headlines improved, though always within a broader macro tightening cycle.

This episode should be understood as part of a standard risk reset, where a 5% equity drawdown translated into roughly double that in crypto volatility.

Booking some of those gaudy profits earlier in the cycle to lower cost basis while deploying capital at lower levels ultimately proved to be the correct play.

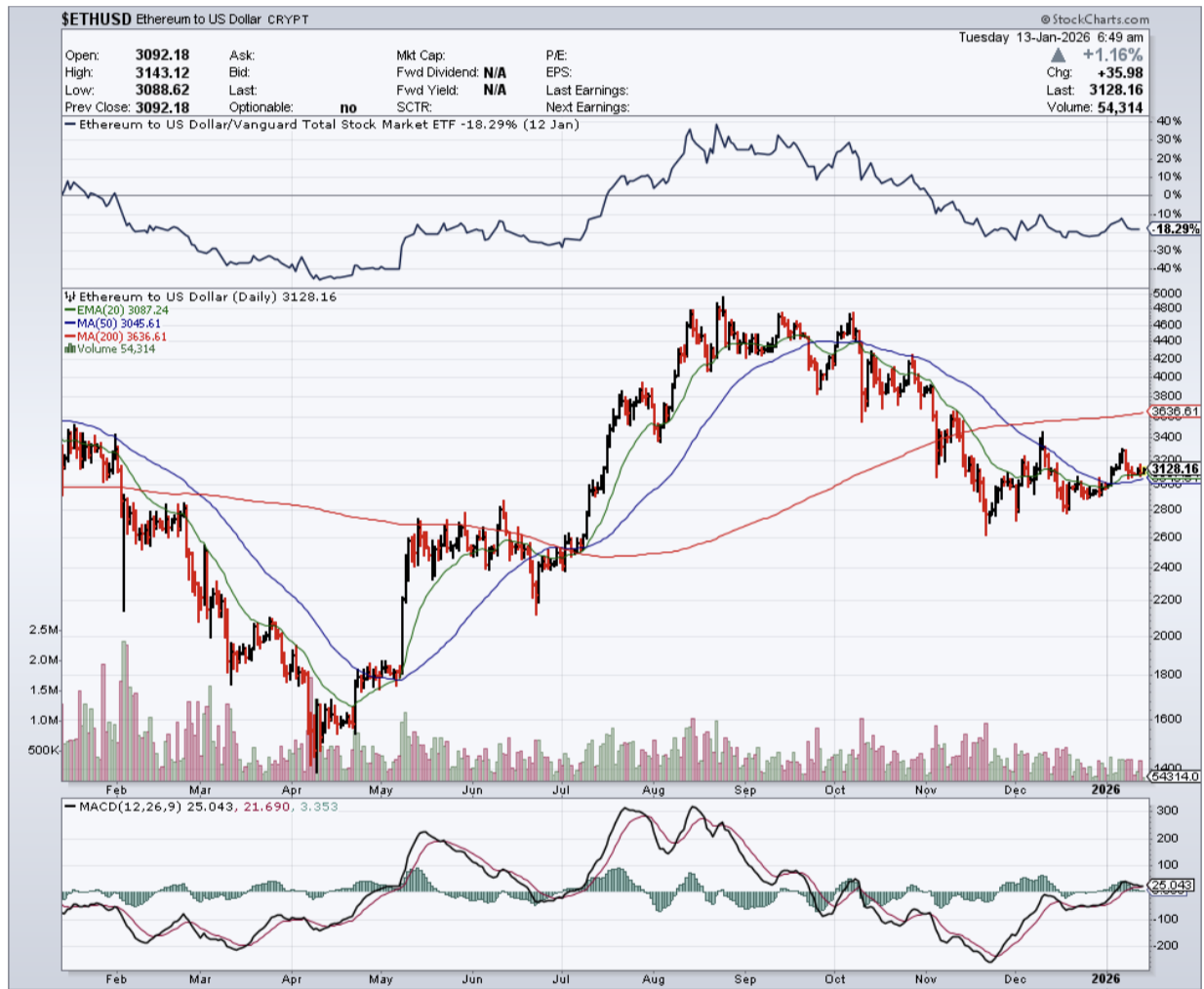

I’ll take you on a short journey on the next best thing after Bitcoin in crypto land.

Ethereum, or ETH.

It’s most likely the most profitable opportunity from the established crypto assets today.

ETH is the second-largest cryptocurrency by valuation, coming in at over $400 billion.

I know many of the readers out there have a hard time wrapping their heads around Bitcoin, and I will vouch that ETH could be the real catch up trade if the initial breakout phase in Bitcoin was missed.

Let’s take a look at what’s driving Ethereum’s price action.

Why is Ethereum on the rise?

ETH was launched in 2015, and it’s famous for being the first cryptocurrency with a programmable blockchain.

While other cryptocurrencies were using blockchain technology to record transactions, ETH offered a blockchain that developers could use.

Through ETH, developers can create decentralized apps, or dApps.

These dApps are a fundamental part of some of the biggest current trends in cryptocurrency. They are used for decentralized finance, or DeFi, which are platforms that provide financial services without a middleman, such as a bank. They are also used with non fungible tokens, or NFTs, which are digital assets that people buy and sell as collectibles.

Offering a robust platform to build other apps on it is one of the biggest differences between bitcoin and ETH and also why ETH could have more upside to the price in the long term.

As of last count, about 60% of dApps are built on ETH, reflecting increased competition from alternative layer one networks.

Fortunately, ETH benefits from the first mover advantage in this respect and continues to attract high quality developers to work on dApps.

The development of dApps has created an ecosystem that far exceeds anything bitcoin can produce at the base layer.

Another critical reason for higher prices in ETH is that the asset has gone through a series of structural upgrades.

The Ethereum network’s long planned transition to a scalable, proof of stake consensus model was completed in September 2022.

This transition, commonly referred to as Ethereum 2.0, fundamentally changed how the network operates.

Major upgrade milestones did produce classic buy the rumor sell the news price action, with strong rallies into events followed by periods of volatility afterward.

These upgrades made ETH significantly more environmentally friendly and improved security, while scalability has increasingly been achieved through layer two rollups rather than the base layer itself.

More specifically, Ethereum’s upgrades fulfilled its original vision of becoming an efficient, global scale, general purpose transaction platform while retaining crypto economic security and decentralization.

Should you buy Ethereum right now?

I believe ETH could outperform Bitcoin on a relative use basis over time, even though Bitcoin remains dominant as a monetary asset.

Why?

Its co originator, Vitalik Buterin, is an Elon Musk type figure in the crypto community, capable of moving mountains and pulling off technical breakthroughs time and time again.

He is the individual who built ETH from scratch.

Second, ETH remains the cryptocurrency of choice for creating dApps.

Ethereum’s transition to proof of stake proved to be a major improvement, allowing it to support far greater transaction volumes through scaling layers while reducing energy usage by more than 99%.

It is relevant in terms of volume and market capitalization, meaning there is a minimal chance this is a fly-by-night phenomenon.

After Bitcoin, ETH has remained the most popular asset for institutional allocation, particularly through ETFs, custody products, and staking-enabled investment vehicles.

Access to ETH is also top-notch and available for purchase at most cryptocurrency exchanges. It is easy to buy compared to many irrelevant coins.

ETH prices have continued to trade through macro uncertainty driven by global rate cycles, regulatory shifts, and alternating risk-on and risk-off regimes.

Historically, ETH has been volatile, reflecting its dual role as both a technology platform and a financial asset.

It has recently traded around $3,000, and ETH continues to position itself as core infrastructure for the digital asset economy.

Ultimately, while near term price targets are always speculative, ETH has already traded well beyond prior cycle highs, and future upside will likely be driven less by hype and more by adoption, fee generation, and real economic usage.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.