The Amazon (AMZN) and Netflix (NFLX) model is not the only technology business model out there.

Micron (MU) has amply proved that.

Bulls were dancing in the streets when Micron announced a blockbuster share buyback of $10 billion starting in September.

This is all from a company that lost $276 million in 2016.

The buyback is an overwhelmingly bullish premonition for the chip sector that should be the lynchpin to any serious portfolio.

The news keeps getting better.

Micron struck a deal with Intel to produce chips used in flash drives and cameras. Every additional contract is a feather in its cap.

The share repurchase adds up to about 16% of its market value and meshes nicely with its choreographed road map to return 50% of free cash flow to shareholders.

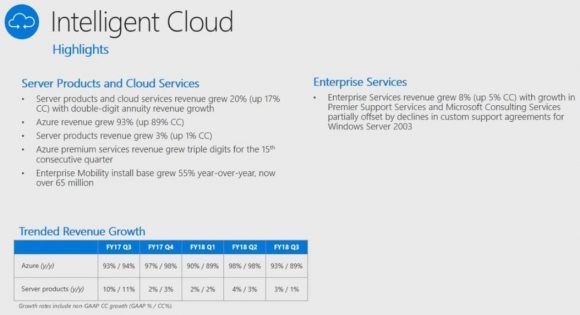

Tech's weighting in the S&P has increased 3X in the past 10 years.

To put tech's strength into perspective, I will roll off a few numbers for you.

The whole American technology sector is worth $7.3 trillion, and emerging markets and European stocks are worth $5 trillion each.

Tech is not going away anytime soon and will command a higher percentage of the S&P moving forward and a higher multiple.

The $5 billion in profit Micron earned in 2017 was just the start and sequential earnings beats are part of their secret sauce and a big reason why this name has been one of the cornerstones of the Mad Hedge Technology Letter portfolio since its inception as well as the first recommendation at $41 on February 1.

Did I mention the stock is dirt cheap at a forward PE multiple of just 6 and that is after a 35% rise in the share price so far this year?

What's more, putting ZTE back into business is a de-facto green light for chip companies to continue sales to Chinese tech companies.

China consumed 38% of semiconductor chips in 2017 and is building 19 new semiconductor fabrication plants (FAB) in an attempt to become self-sufficient.

This is part of its 2025 plan to jack up chip production from less than 20% of global share in 2015 to 70% in 2025.

This is unlikely to happen.

If it was up to them, China would dump cheap chips to every corner of the globe, but the problem is the lack of innovation.

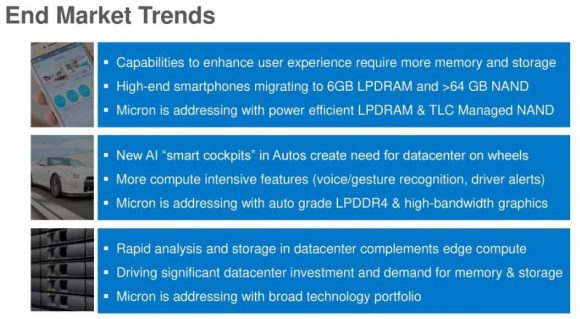

This is hugely bullish for Micron, which extracts half of its revenue from China. It is on cruise control as long as China's nascent chip industry trails miles behind them.

At Micron's investor day, CFO David Zinsner elaborated that the mammoth buyback was because the stock price is "attractive" now and further appreciation is imminent.

Apparently, management was in two camps on the capital allocation program.

The two choices were offering shareholders a dividend or buying back shares.

Management chose share repurchases but continued to say dividends will be "phased in."

This is a company that is not short on cash.

The free cash flow generation capabilities will result in a meaningful dividend sooner than later for Micron, which is executing at optimal levels while its end markets are extrapolating by the day.

As it stands today, Micron is in the midst of taking its 2017 total revenue of about $20 billion and turning it into a $30 billion business by the end of 2018.

Growth - Check. Accelerating Revenue - Check. Margins - Check. Earnings beat - Check. Guidance hike - Check.

The overall chips market is as healthy as ever and data from IDC shows total revenues should grow 7.7% in 2018 after a torrid 2017, which saw a 24% bump in revenues.

The road map for 2019 is murkier with signs of a slowdown because of the nature of semi-conductor production cycles. However, these marginal prognostications have proved to be red herrings time and time again.

Each red herring has offered a glorious buying opportunity and there will be more to come.

Consolidation has been rampant in the chip industry and shows no signs of abating.

Almost two-thirds of total chip revenue comes from the largest 10 chip companies.

This trend has been inching up from 2015 when the top 10 comprised 53% in 2016 and 56% in 2017.

If your gut can't tell you what to buy, go with the bigger chip company with a diversified revenue stream.

The smaller players simply do not have the cash to splurge on cutting-edge R&D to keep up with the jump in innovation.

The leading innovator in the tech space is Nvidia, which has traded back up to the $250 resistance level and has fierce support at $200.

Nvidia is head and shoulders the most innovative chip company in the world.

The innovation is occurring amid a big push into autonomous vehicle technology.

Some of the new generation products from Nvidia have been worked on diligently for the past 10 years, and billions and billions of dollars have been thrown at it.

Chips used for this technology are forecasted to grow 9.6% per year from 2017-2022.

Another death knell for the legacy computer industry sees chips for computers declining 4% during 2017-2022, which is why investors need to avoid legacy companies like the plague, such as IBM and Oracle because the secular declines will result in nasty headlines down the road.

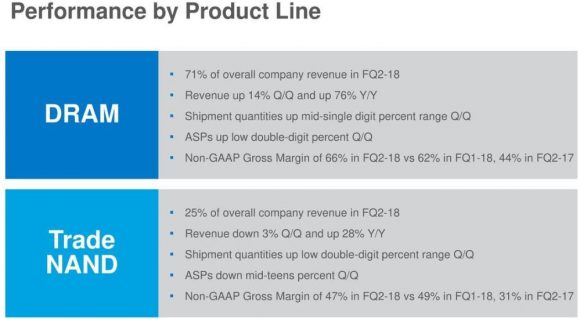

Half way into 2018, and there is still a dire shortage of DRAM chips.

Micron's DRAM segments make up 71% of its total revenue, and the 76% YOY increase in sales underscores the relentless fascination for DRAM chips.

Another superstar, Advanced Micro Devices (AMD), has been drinking the innovation Kool-Aid with Nvidia (NVDA).

Reviews of its next-generation Epyc and Ryzen technology have been positive; the Epyc processors have been found to outperform Intel's chips.

The enhanced products on offer at AMD are some of the reasons revenue is growing 40% per year.

AMD and Nvidia have happily cornered the GPU market and are led by two game-changing CEOs.

It is smart for investors to focus on the highest quality chip names with the best innovation because this setup is most conducive to winning the most lucrative chip contracts.

Smaller players are more reliant on just a few contracts. Therefore, the threat of losing half of revenue on one announcement exposes smaller chip companies to brutal sell-offs.

The smaller chip companies that supply chips to Apple (AAPL) accept this as a time-honored tradition.

Avoid these companies whose share prices suffer most from poor analyst downgrades of the end product.

Cirrus Logic (CRUS), Skyworks Solutions (SWKS), and Qorvo Inc. (QRVO) are small cap chip companies entirely reliant on Apple come hell or high water.

Let the next guy buy them.

Stick with the tried and tested likes of Nvidia, AMD, and Micron because John Thomas told you so.

_________________________________________________________________________________________________

Quote of the Day

"Bitcoin will do to banks what email did to the postal industry." - said Swedish IT entrepreneur and founder of the Swedish Pirate Party Rick Falkvinge.