Not every stock comes with Warren Buffett's confession that he would like to own 100% of it. But, of course that stock would have to be a tech stock.

As it stands, the Oracle of Omaha owns 5% of Apple (AAPL), and his confession is still a bold statement for someone who seldom forays outside his comfort zone.

Buffett also continues to concede that he "missed" Google (GOOGL) and Amazon (AMZN).

What a revelation!

The outflow of superlatives invading the airwaves is indicative of the strength technology has assumed in the bull market.

The tech sector has been coping with obstacles such as higher interest rates, trade wars, data regulation, IP chaos, and the globalization backlash.

However, the tech companies have come through unscathed and hungry for more.

Their power is not contained to one industry, and techs' capabilities have been spilling over into other sectors digitizing legacy industries.

Every CEO is cognizant that enhancing a product means blending the right amount of tech to suit its needs.

It is not halcyon times in all of tech land either.

There have been some companies that have faltered or were naturally cannibalized by other tech companies that disrupt business.

Times are ruthless and this is just the beginning.

There will be winners and losers as with most other secular paradigm shifts.

Particularly, there are two types of losers that investors need to avoid like the plague.

The first is the prototypical tech company hawking legacy products such as Western Digital Corp. (WDC) that I have been banging on the table telling investors not to buy the stock.

The lion's share of revenue is still in the antiquated hard drive business that has a one-way ticket to obsolescence.

Yes, they are turning around product mixes to factor in its pivot to solid state drives (SSD), but they are late to the game and deservedly punished for it.

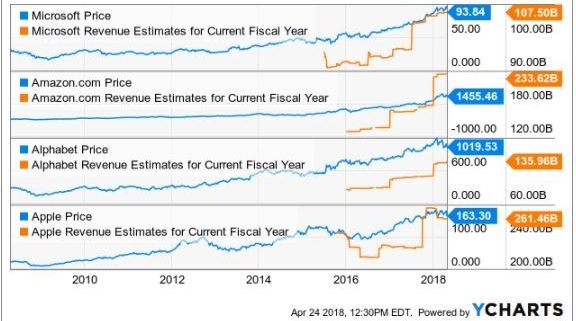

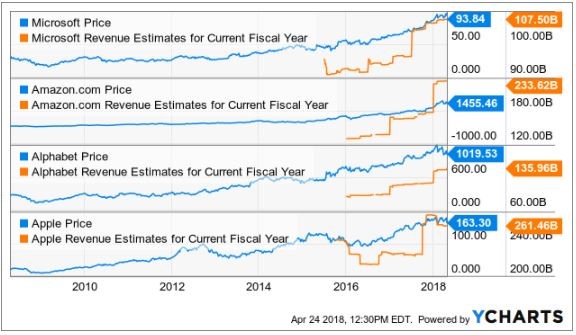

Compare WDC to companies that have completed the transition from legacy reliance to the cloud, and it is simple to understand that companies such as Microsoft, which struggled for years to turn around with CEO Satya Nadella, finally can claim victory.

The problem with WDC is the stock's price action performs miserably because the company is tagged as an ongoing turnaround story.

On the other hand, headliner cloud plays experience breathtaking gaps up due to the strength of the cloud such as Amazon (AMZN), Red Hat (RHT), and Salesforce (CRM), just to name a few.

To pour fuel on the fire, speculative reports citing NAND chip price "softening" beat down the stock into submission.

Effectively, legacy companies become sell the rallies type of stocks.

Transforming a legacy company into a high-octane cloud company is perilous to say the least. Jeff Bezos recently gloated that Amazon Web Service's (AWS) seven-year head start is all investors need to know about the cloud. There is some merit to his statement.

Examples are rife with bad executive decisions by legacy companies such as HP Inc. (HPQ), another legacy tech company that makes computers and hardware. It ventured out to buy Palm for $1.2 billion plus debt after a bidding war with legacy competitor Dell in 2010.

In 1996, the Palm PDA (Personal Digital Assistant) was the first smart phone on the market that predated BlackBerry's smart phone with the full keyboard made by RIM (Research in Motion).

The demise of Palm emerged from a hodgepodge of mismanagement, failed spin-offs, misplaced mergers, and resource wastefulness even with the preeminent technology of its time.

(HPQ)'s stab at the smartphone market resulted in purchasing Palm. However, after heavy selling pressure in its shares, HP shut down this division and sold off the remaining technology to Chinese electronics company TCL Corporation.

The sad truth is many transformations fail at step one, and there is no guarantee a newly absorbed business will perform as expected.

RIM, now changed to BlackBerry (BB), soon found out how it felt to be Palm when Steve Jobs dropped the first iPhone on the market, and the world has never been the same.

(BB) gradually morphed into an autonomous vehicle technology company after the writing was on the wall.

The other types of losers are companies with inferior business models such as Snapchat (SNAP), which I have written about extensively from the bearish side.

In an age where disruptors are being disrupted by other disruptors, CEOs must live in fear that their business will get undercut and hijacked at any time.

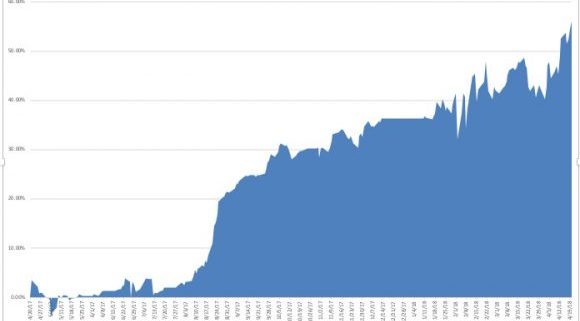

Instagram, a subsidiary of Facebook (FB), has permanently borrowed numerous features from Snapchat. Its Instagram "stories" feature is now used by more than 300 million daily users.

Snapchat is serving as Instagram's guinea pig while CEO Evan Spiegel finds an alternative way to survive against Facebook's unlimited resources.

Both are in the game of selling ads and nobody does it better than Facebook and Alphabet or has the degree of scale.

The recent redesign was met with a chorus of universal boos. The 60 minutes I spent testing the new design reconfirmed my fears that the new design was an unmitigated washout.

In short, Snap's redesign seemed like a different app and became incredibly difficult to use.

Compounding the deteriorating situation, Snapchat laid off 120 engineers due to sub-par performance and withheld last year's performance bonuses even though co-founder Evan Spiegel received $637 million in 2017.

The latest earnings report was a catastrophe.

Daily active user (DAU) growth, the most sought out metric for Snapchat, failed to deliver the goods. The street expected 194.2 million DAU and Snap reported 191 million. A miss of 3.2 million users and a deceleration of growth QOQ.

Remember that Snapchat is substantially smaller than Instagram and should have no problems surpassing expectations on a smaller scale, thus investors voted with their feet and bailed on the stock after the catatonic performance last quarter.

Instagram is six times larger with more than 800 million users as of the end of 2017.

Top line fell short of expectations and average revenue per user (ARPU) dropped to $1.21, far less than the expected $1.27.

The less than stellar redesign faced a rebellion from long-term Snapchat disciples. More than 1.2 million Snap diehards signed a petition hoping to revert back to the old interface, and its updated ratings in Apple's app store has fallen to 1.6 stars out of 5.

Then the perpetual question of why would advertisers want to pay for Snapchat digital ads when they earn more by buying Instagram ads?

This remains unsolved and appears unsolvable.

Snapchat is befuddled by the pecking order and the company is on a train to nowhere.

To hammer the nail in the coffin, Snapchat announced to investors that it expects revenue to "decelerate substantially" next quarter.

In an era where technology companies will lead the economy and stock market, and has an outsized influence in politics and culture, not all tech companies are one-foot tap-ins.

Investors need to separate the wheat from the chaff or risk losing their shirt.

_________________________________________________________________________________________________

Quote of the Day

"We have to stop optimizing for programmers and start optimizing for users." - said American software developer Jeff Atwood