Below please find subscribers’ Q&A for the April 6 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: The iShares Biotechnology ETF (IBB) is down quite a bit—do I wait a bit longer to put on a debit call spread LEAPS for the end of this year and possibly the end of 2024?

A: This is really one of the two most interesting parts of the market right now. The biotech stocks have been absolutely destroyed over the past year—down 70, 80, 90% in some cases; and at that level, the worst-case scenario is in the price. Maybe we bounce along the bottom for another year. In the best case, these things all double or triple or even go up 10 times. We’re very close to putting on a 2024 call spread in the best biotech names, and if you get the Mad Hedge Biotech Letter (Click here for the link), you already know what they are because the downside risk on these things is getting close to nil, and the upside is 10 times. I like that kind of math—when the upside versus the downside is 10 to 1 in your favor. When I see specific LEAPS opportunities, I’ll send them out to you, but the answer is: not yet. We’re getting very close on biotech, however.

Q: I sold about a third of my ProShares UltraShort 20+ Year Treasury (TBT) position at $22.00 for a nice 40% gain, thank you very much. Should I hold the rest for a while? And is there a significant upside for 2022?

A: I’ve been telling everyone: hold those shorts. I know those of you who put on the December $150-$155 vertical bear put spread or the December $145-$150 vertical bear put spread already have substantial profits, but the time value on these options is still large, so there is still quite a lot of these profits to be made hanging on to all of your put spreads in the ProShares UltraShort 20+ Year Treasury Bond ETF (TLT). And is there a substantial downside from here? I think yes! If the Fed goes to a half-point rate hike schedule for the next 4 meetings, the (TLT) is absolutely going down to a $105 or $110 level or so. So, keep those shorts and add to shorts on rallies. We came close. I said sell on a $6 point rally and we got a $5 point rally. I didn't pull the trigger, and of course, now we’re here at new lows.

Q: Are we close to buying LEAPS in tech?

A: Yes, I think that once this current meltdown finishes, I want to go back in there. But I want to go long-dated.

Q: What does rapid unwind of the Fed balance sheet mean for the markets?

A: It’s terrible! The Fed has a balance sheet close to $9 trillion dollars. Before the financial crisis of ‘07, it was $800 million dollars, and in fact, in the last 4 years, it has gone up from $20 trillion to $30 trillion. So these are just bubblicious levels for the Fed to own. And what is QT or quantitative tightening? They sell those bonds. And of course, everyone knows they’re going to sell, so they’re dropping bids for bonds like crazy right now—that's why you’re getting the meltdown in the (TLT). This is bad for the stock market; there’s no world in which the stock market goes up with sharply rising interest rates. The best case is that you give up 20% and then make some of it back, and then give up 20% and then make some of it back. So yeah, expect to hear a lot about QT. We only ended QE or quantitative easing about 3 weeks ago, and it looks like we may go straight into QT as soon as May. And boy, the bond market is sure reflecting that today.

Q: How long will wage inflation last? Can I count on 10% pay increases forever?

A: No, it will last until the next recession. I have a feeling that the unemployment rate will hit all-time lows next month—probably 3.2% or 3.3%. And we’re essentially at a full employment economy right now. What happens next? Recession probably in one or two years. Then those wage hikes disappear completely, and people start getting laid off, and goodbye to inflation of all kinds since 60% or 70% of the inflation calculation is wage cost.

Q: What is a good age to retire?

A: Never. I can’t tell you how many friends I’ve had who retire and die within a year. I had one friend retire and he died the next day. What you could do is keep your old job and cut your hours by half, or you could retire from your old job to go on to a new job that you love, like opening a restaurant or a job built around your lifetime hobby, whatever that is. As long as you stay engaged, you keep Alzheimer’s at bay and you’re an active contributing person to society. As soon as you stop doing that and just start doing something like golf, your days are numbered.

Q: What factors will create a recession in 2022?

A: Well I don't think that's going to happen; that would be like multiple 1% rate rises by the Fed, and the Fed completely panicking like we said, and causing a premature recession. But I do think that by 2024 rates will be so high that we will get a recession, probably a short one, maybe 6 months. A lot also depends on the war and if Europe can replace their Russian gas/oil fast enough or they go into an oil shock and recession there.

Q: Will the Fed destroy the economy in order to save it?

A: Yes, they will, if we get inflation up into the teens, which we saw in the 1980s, they absolutely will raise rates. And then I think the 10-year made it to 12% in the early 80s when Volcker was around, and the overnight rate got to 18%. And I know that because I bought a coop in New York City with a mortgage rate of 18%. I took out one of the first floating rate mortgages and by the time I sold the house, the mortgage rate had dropped down to 11% and the value of the home had doubled.

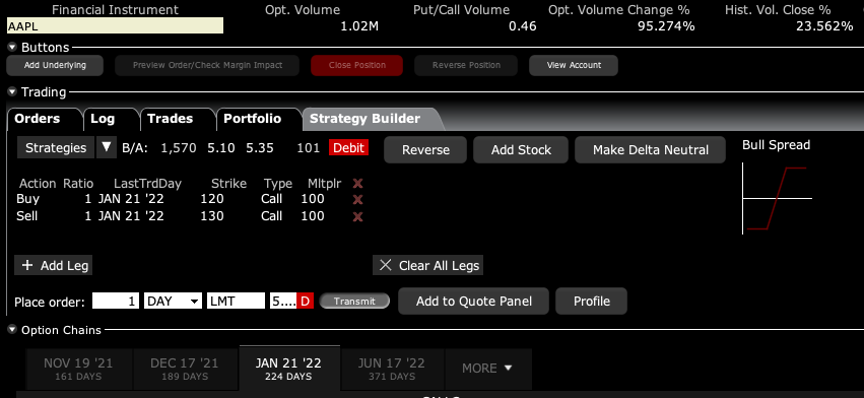

Q: Google (GOOG), Adobe (ADBE), and Apple (AAPL) spreads are treading water.

A: That is a sign that these are the stocks that will lead the next recovery. So, only 20% down, top to bottom, in Apple while all other stocks were getting hammered for 40% or more means Apple is going to lead any recovery in the market. Watch these big tech stocks carefully—they are the new leaders, they just don’t know it yet.

Q: What will inflation do to the housing market? Should I sell or hold my investment properties?

A: Keep them. Housing is one of the biggest beneficiaries of inflation. Not only do the house prices go up, so does everything that goes into the house, like the copper, steel, lumber, kitchen appliances, etc. You really have the best play on inflation, and I don’t think interest rates will kill the housing market. I think all that will happen is people will move from 30-year fixed to 5-year adjustables, as they have done in previous high interest rate cycles.

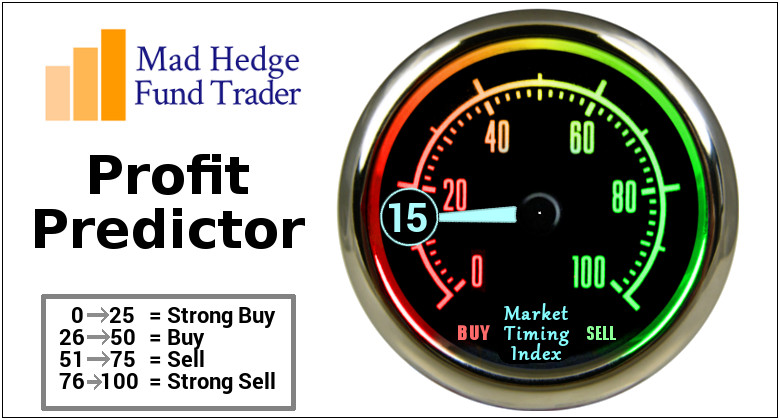

Q: Where is the buy territory on the Mad Hedge Market Timing Index?

A: Below 20. It’s almost impossible to lose money when you buy at a market timing index of 20. You may get a day or two visit down into the teens, but if you hang on, that’ll become a big moneymaker for you. That’s been working for me for 50 years—it should work for you too.

Q: Do the chips and transports breaking down worry you about the general market?

A: No, I think they’re discounting a recession that isn’t going to happen. Remember half of all the recessions discounted in the market don’t actually happen, and I think that these are one of those non-recessionary selloffs. But it may take them a couple of months to figure out that this bull market still has a couple of years of life to it and that it’s too early to sell. By the way, once people realize that they discounted the recession too early, what are they going to pour back into the fastest? The semiconductor stocks. That's why I’ve got a laser focus on NVIDIA (NVDA).

Q: If there is no recession coming, are the retailers getting too oversold?

A: Yes, but in the world that’s out there, where you really only want to own two or three of the best sectors and avoid the other 97, retailers are the ones you want to avoid—unless there's some specific single company story that you know about.

Q: Housing prices can’t fall when there's such enormous demand coming from millennials, right?

A: That’s true. In fact, the number of houses that need to be built to meet this demand is anywhere from one to five million, so this is a shortfall that will take at least a decade to address, and house prices don’t fall in that situation. They may appreciate at a slower rate, but they will appreciate, nonetheless.

Q: Is there any level where you would consider a call spread in the TLT?

A: Well, I had the April $127-$130 vertical bull call spread and I had my head handed to me. So somewhere, but clearly not yet—again, it depends a lot on what the Fed does and how fast.

Q: What’s the outlook for the Euro (FXE), (NVDA)?

A: Lower. Until the Ukraine War ends, they get an economic recovery, and they wean themselves off of Russian energy and move over to American energy. And that's at least a year down the road, so I’m not rushing into any European investment—stocks, bonds, or currencies.

Q: Are rising interest rates good for banks?

A: Yes, but right now those benefits are being offset by recession fears which will probably go away in a couple of months. So that kind of makes banks a strong buy right here.

Q: When the Shanghai lockdown ends, will it create another surge in commodity prices?

A: Absolutely, yes. China is the world's largest consumer of commodities, and the restoration of any of their purchasing power will certainly be great for all commodity prices—food, energy, metals, you name it.

Q: Is Tesla (TSLA) a LEAPS candidate?

A: Yes but wait for it to take a run at the $700 low that we saw last month. We probably won’t get there, but $800 this time around is probably a great LEAPS candidate for Tesla going forward. I expect them to meet all of their goals for production this year.

Q: Won’t Bitcoin ($BTCUSD) keep falling if equity markets are lower?

A: Yes, but we don’t have that much lower to go in equity markets—maybe 10%. So just as we’re looking to buy equities and the smaller technology stocks on dips, we're also looking to buy Bitcoin on dips. If we can get back into the $30,000 handle, that might be a ripe buy territory for all the cryptocurrency plays.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader