It’s official: Absolutely no one is confident in their long-term economic forecasts right now. I heard it from none other than the chairman of the Federal Reserve himself. The investment rule book has been run through the shredder.

It has in fact been deleted.

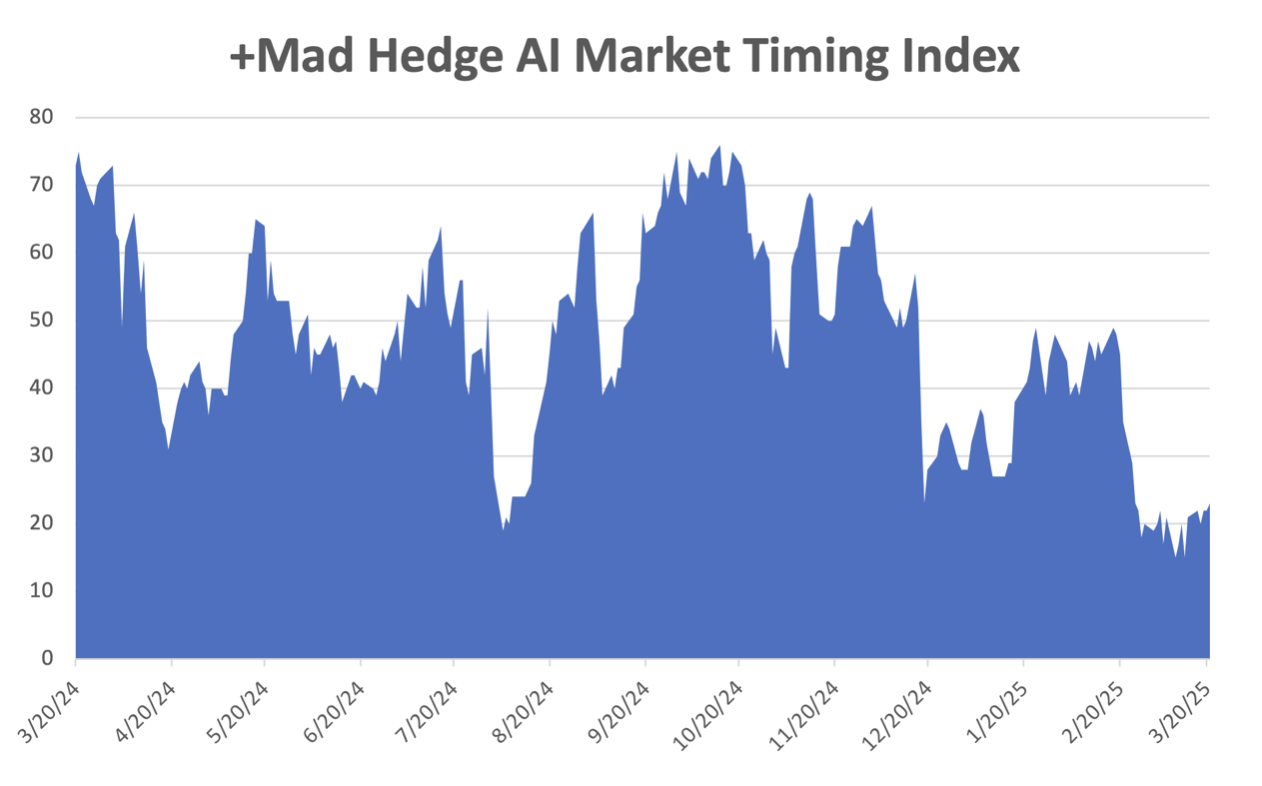

That explains a lot about how markets have been trading this year. It looks like it is going to be a reversion to the mean year. Forecasters, strategists, and gurus alike are rapidly paring down their stock performance targets for 2025 to zero.

When someone calls the fire department, it’s safe to assume that there is a fire out there somewhere. That’s what Fed governor Jay Powell did last week. It raises the question of what Jay Powell really knows that we don’t. Given the opportunity, markets will always assume the worst, that there’s not only a fire, but a major conflagration about to engulf us all. Jay Powell’s judicious comments last week certainly had the flavor of a president breathing down the back of his neck.

It's interesting that a government that ran on deficit reduction pressured the Fed to end quantitative tightening. That’s easing the money supply through the back door.

For those unfamiliar with the ins and outs of monetary policy, let me explain to you how this works.

Since the 2008 financial crisis, the Fed bought $9.1 trillion worth of debt securities from the US Treasury, a policy known as “quantitative easing”. This lowers interest rates and helps stimulate the economy when it needs it the most. “Quantitative easing” continued for 15 years through the 2020 pandemic, reaching a peak of $9.1 trillion by 2022. For beginners who want to know more about “quantitative easing” in simple terms, please watch this very funny video.

The problem is that an astronomically high Fed balance sheet like the one we have now is bad for the economy in the long term. They create bubbles in financial assets, inflation, and malinvestment in risky things like cryptocurrencies. That’s why the Fed has been trying to whittle down its enormous balance sheet since 2022.

By letting ten-year Treasury bonds it holds expire instead of rolling them over with new issues, the Fed is effectively shrinking the money supply. This is how the Fed has managed to reduce its balance sheet from $9.1 trillion three years ago to $6.7 trillion today and to near zero eventually. This is known as “quantitative tightening.” At its peak a year ago, the Fed was executing $120 billion a month quantitative tightening.

By cutting quantitative tightening, from $25 billion a month to only $5 billion a month, or effectively zero, the Fed has suddenly started supporting asset prices like stocks and increasing inflation. At least that is how the markets took it to mean by rallying last week.

Why did the Fed do this?

To head off a coming recession. Oops, there’s that politically incorrect “R” word again! This isn’t me smoking California’s largest export. Powell later provided the forecasts that back up this analysis. The Fed expects GDP growth to drop from 2.8% to 1.7% and inflation to rise from 2.5% to 2.8% by the end of this year. That’s called deflation. Private sector forecasts are much worse.

Just to be ultra clear here, the Fed is currently engaging in neither “quantitative easing nor “quantitative tightening,” it is only giving press conferences.

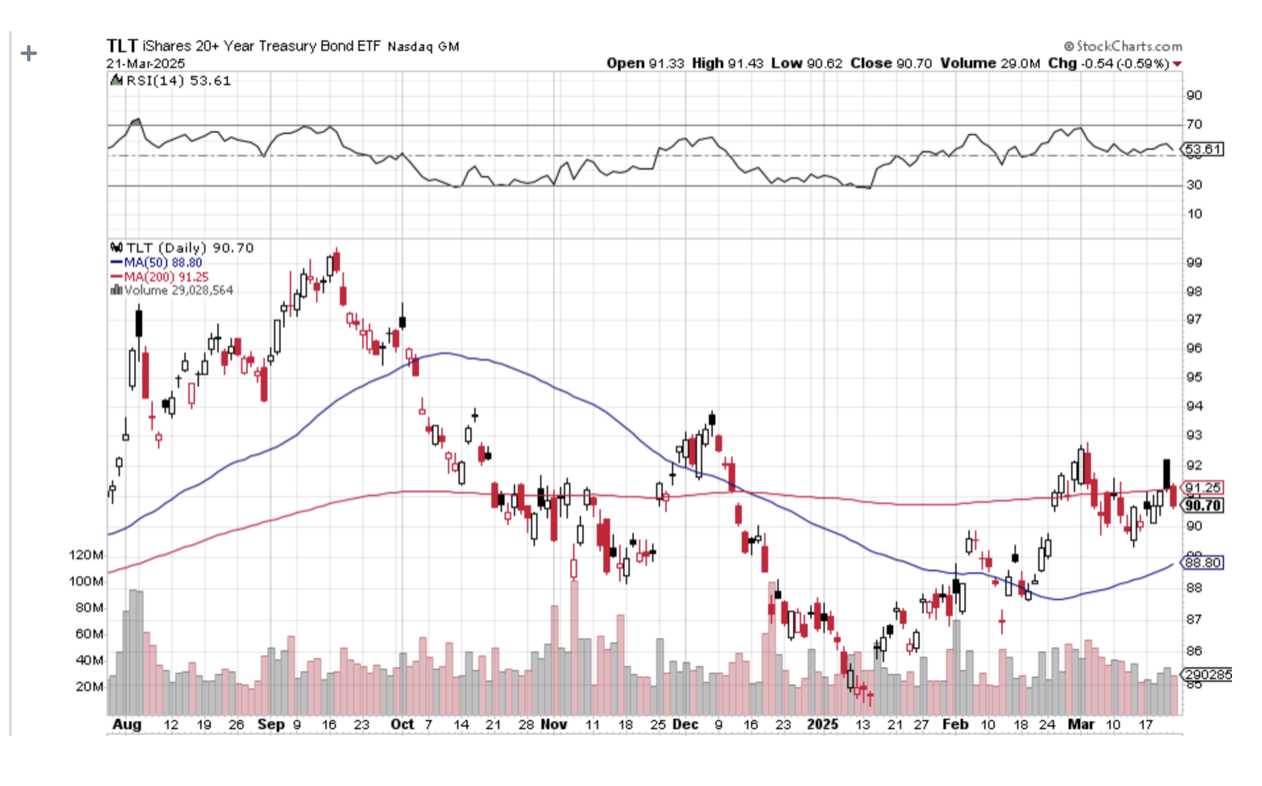

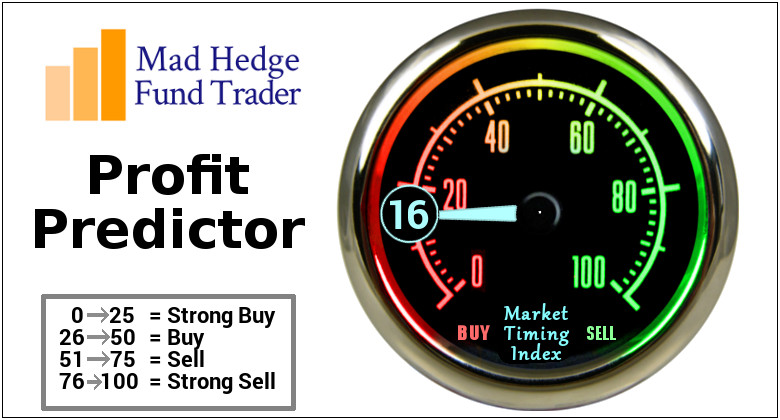

Bottom line: Keep selling stock rallies and buying bonds and gold on dips.

Another discussion you will hear a lot about is the debate over hard data versus soft data.

I’ll skip all the jokes about senior citizens and cut to the chase. Soft data are opinion polls, which are notoriously unreliable, fickle, and can flip back and forth between positive and negative. A good example is the University of Michigan Consumer Confidence, which last week posted its sharpest drop in its history. Consumers are panicking. The problem is that this is the first data series we get and is the only thing we forecasters can hang our hats on.

Hard data are actual reported numbers after the fact, like GDP growth, Unemployment Rates, and Consumer Price Indexes. The problem with hard data is that they can lag one to three months, and sometimes a whole year. This is why by the time a recession is confirmed by the hard data, it is usually over. Hard data often follows soft data, but not always, which is why both investors and politicians in Washington DC are freaking out now.

Bottom line: Keep selling stock rallies and buying bonds and gold (GLD) on dips.

A question I am getting a lot these days is what to buy at the next market bottom, whether that takes place in 2025 or 2026. It’s very simple. You dance with the guy who brought you to the dance. Those are:

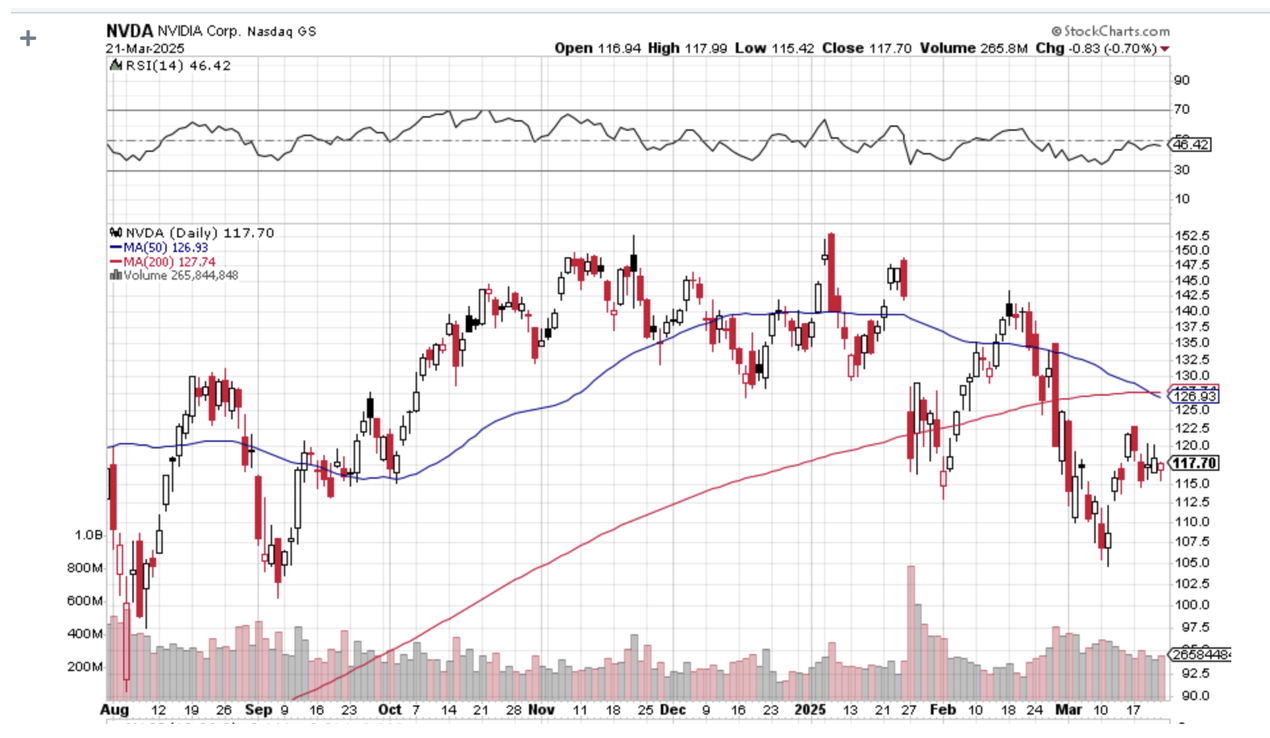

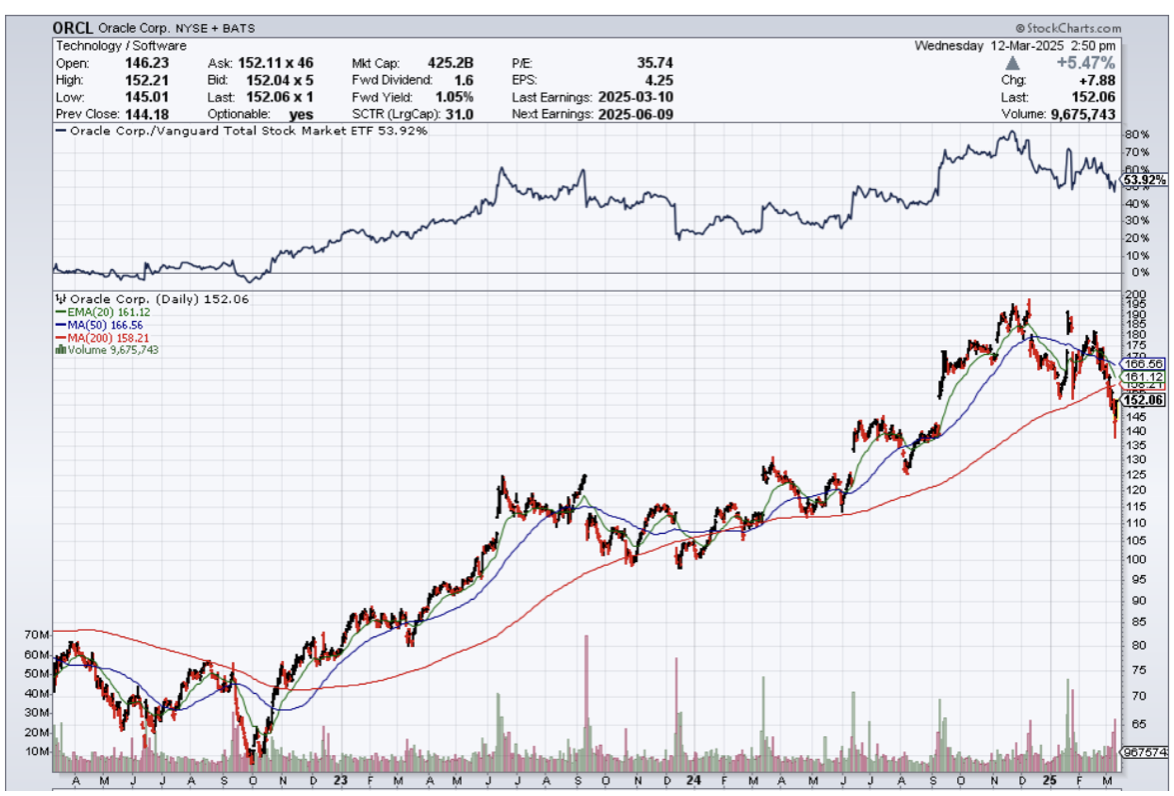

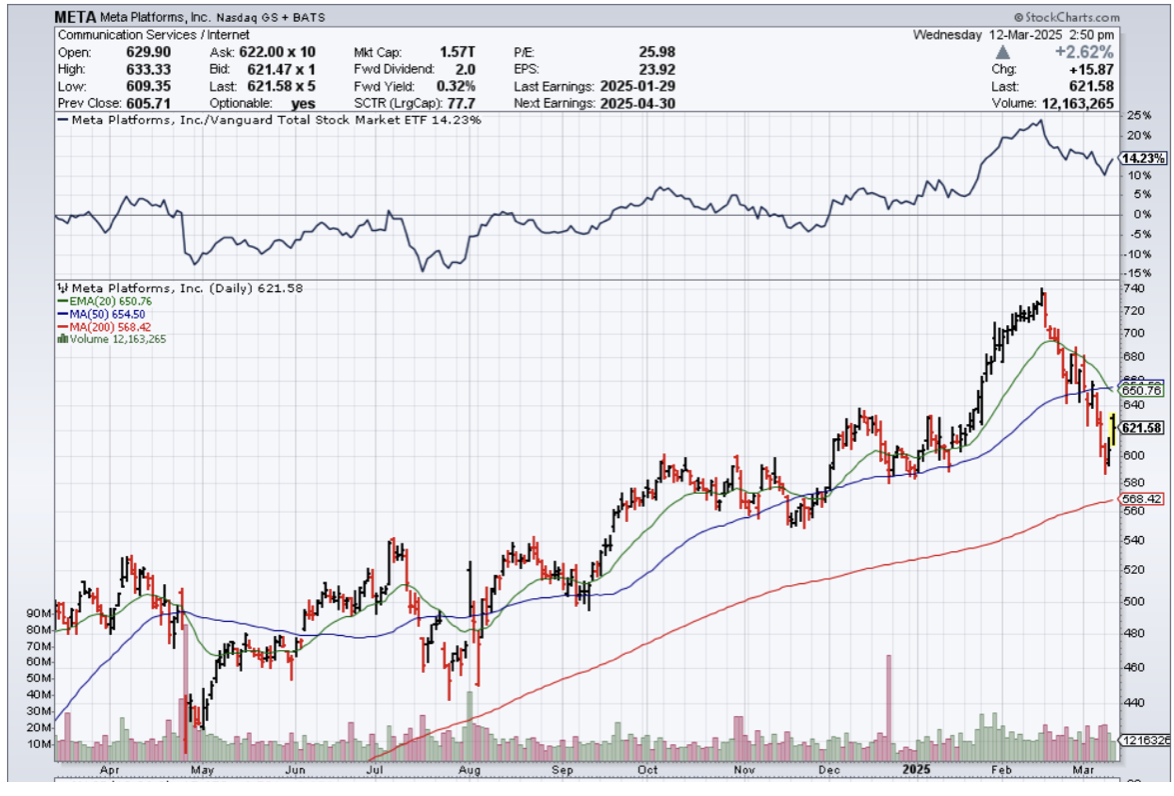

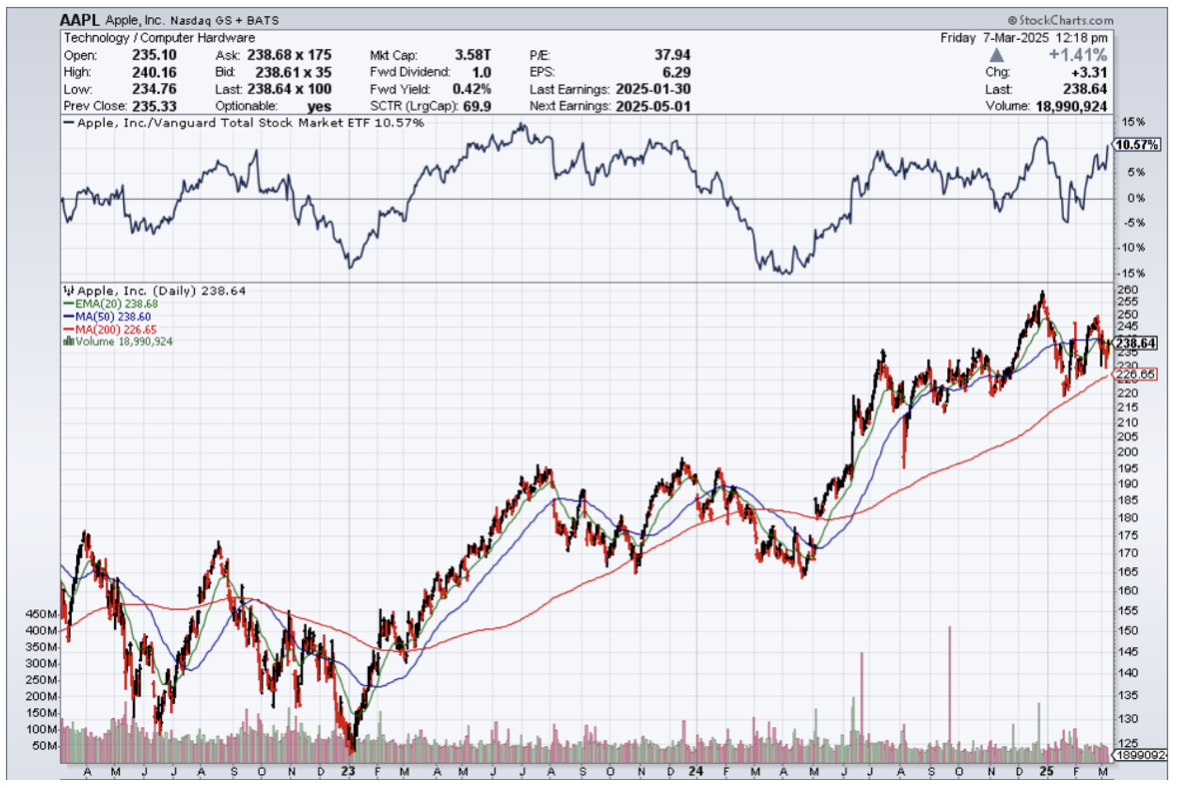

Best Quality Big Tech: (NVDA), (GOOGL), (AAPL), (META), (AMZN)

Big tech is justified by Nvidia CEO Jensen Huang’s comment last week that there will be $1 trillion in Artificial Intelligence capital spending by the end of 2028. While we argue over trade wars, AI technology and earnings are accelerating.

Cybersecurity: (PANW), (ZS), (CYBR), (FTNT)

Never goes out of style, never sees customers cut spending, and is growing as fast as AI.

Best Retailer: (COST)

Costco is a permanent earnings compounder. You should have at least one of those.

Best Big Pharma: (AMGN), (ABBV), (BMY)

Big pharma acts as a safety play, is cheap, and acts as a hedge for the three sectors above.

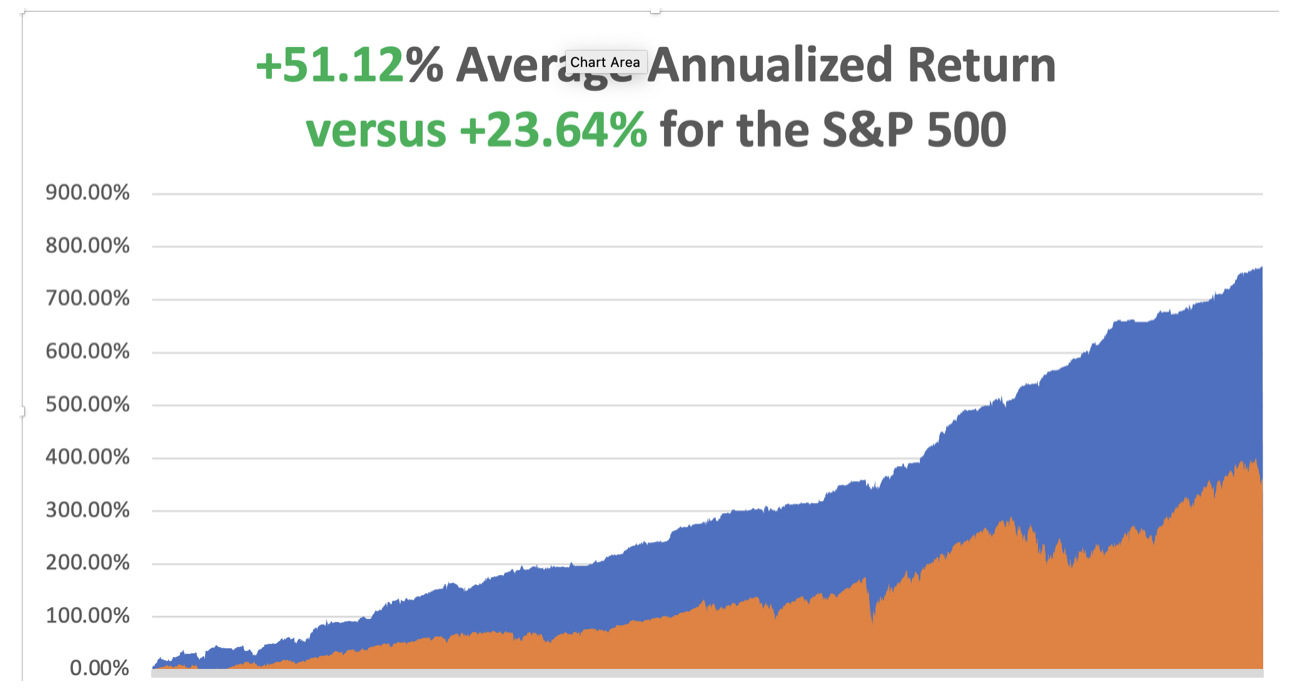

March is now up +2.92% so far. That takes us to a year-to-date profit of +12.29% in 2025. That means Mad Hedge has been operating as a perfect -1X short S&P 500 ETF since the February top. My trailing one-year return stands at a spectacular +82.50%. That takes my average annualized return to +51.12% and my performance since inception to +764.28%.

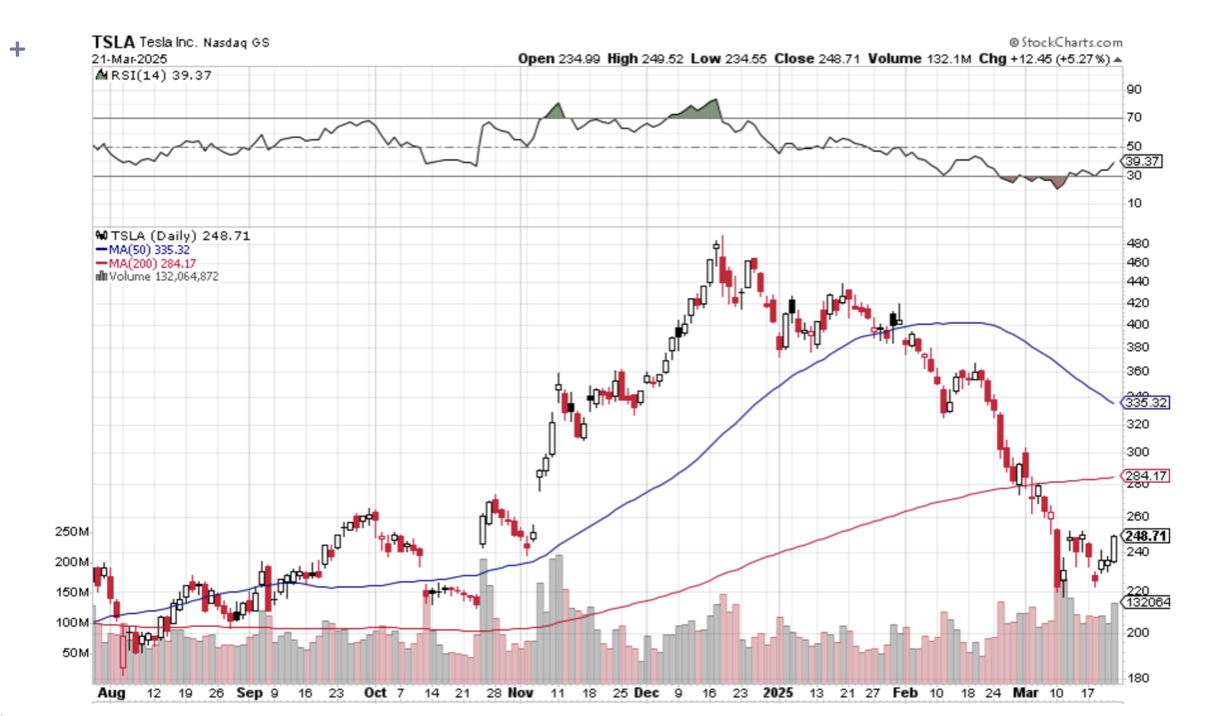

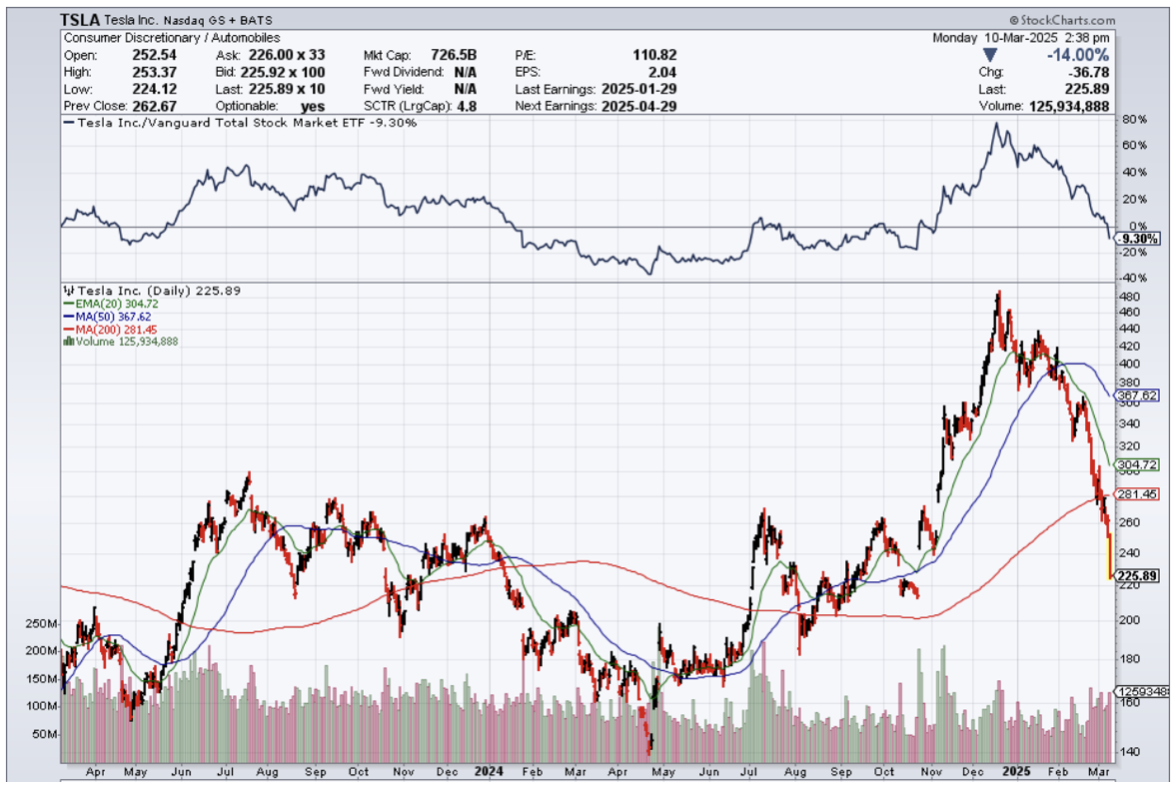

It has been another busy week for trading. I had four March positions expire at their maximum profit points on the Friday options expiration, shorts in (GM), and longs in (GLD), (SH), and (NVDA). I added new longs in (TSLA) and (NVDA). This is in addition to my existing longs in the (TLT) and shorts in (TSLA), (NVDA), and (GM).

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

UCLA Andersen School of Business announced a “Recession Watch,” the first ever issued. UCLA, which has been issuing forecasts since 1952, said the administration’s tariff and immigration policies and plans to reduce the federal workforce could combine to cause the economy to contract. Recessions occur when multiple sectors of the economy contract at the same time.

Retail Sales Fade, with consumers battening down the hatches for the approaching economic storm. Retail sales rose by less than forecast in February and the prior month was revised down to mark the biggest drop since July 2021.

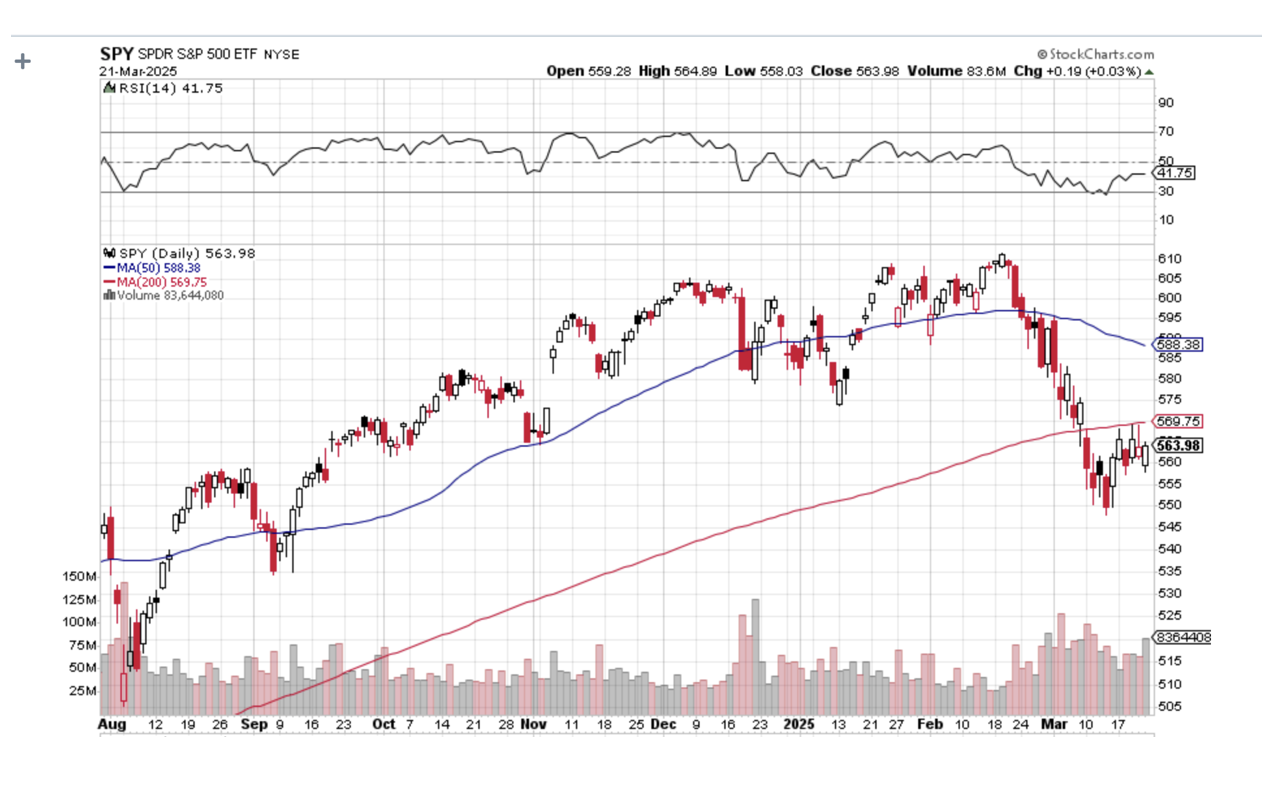

This Has Been One of the Most Rapid Corrections in History, leaving no time to readjust portfolios and put on short positions.

The rapid descent in the S&P 500 is unusual, given that it was accomplished in just 22 calendar days, far shorter than the average of 80 days in 38 other examples of declines of 10% or more going back to World War II.

Home Builder Sentiment Craters to a seven-month low in March as tariffs on imported materials raised construction costs, a survey showed on Monday. The National Association of Home Builders/Wells Fargo Housing Market Index dropped three points to 39 this month, the lowest level since August 2024. Economists polled by Reuters had forecast the index at 42, well below the boom/bust level of 50.

BYD Motors (BYDDF) Shares Rocket, up 72% this year, on news of technology that it claims can charge electric vehicles almost as quickly as it takes to fill a gasoline car. BYD on Monday unveiled a new “Super e-Platform” technology, which it says will be capable of peak charging speeds of 1,000 kilowatts/hr. The EV giant and Tesla rival say this will allow cars that use the technology to achieve 400 kilometers (roughly 249 miles) of range with just 5 minutes of charging. Buy BYD on dips. It’s going up faster than Tesla is going down.

Weekly Jobless Claims Rise 2,000, to 223,000. The number of Americans filing new applications for unemployment benefits increased slightly last week, suggesting the labor market remained stable in March, though the outlook is darkening amid rising trade tensions and deep cuts in government spending.

Copper Hits New All-Time High, at $5.02 a pound. The red metal has outperformed gold by 25% to 15% YTD. It’s now a global economic recovery that is doing this, but flight to safety. Chinese savers are stockpiling copper ingots and storing them at home distrusting their own banks, currency, and government. I have been a long-term copper bull for years as you well know. New copper tariffs are also pushing prices up. Buy (FCX) on dips, the world’s largest producer of element 29 on the Periodic Table.

Boeing (BA) Beats Lockheed for Next Gen Fighter Contract for the F-47, beating out rival Lockheed Martin (LMT) for the multibillion-dollar program. Unusually, Trump announced the decision Friday morning at the White House alongside Defense Secretary Pete Hegseth. Boeing shares rose 5.7% while Lockheed erased earlier gains to fall 6.8%. The deal raises more questions than answers, in the wake of (BA) stranding astronauts in space, their 737 MAX crashes, and a new Air Force One that is years late. Was politics involved? You have to ask this question about every deal from now on.

Carnival Cruise Lines (CCL) Raises Forecasts, on burgeoning demand from vacationers, including me. The company’s published cruises are now 80% booked. Cruise lines continue to hammer away at the value travel proposition they are offering. However, the threat of heavy port taxes from the administration looms over the sector.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, March 24, at 8:30 AM EST, the S&P Global Flash PMI is announced.

On Tuesday, March 25, at 8:30 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, March 26, at 1:00 PM, the Durable Goods are published.

On Thursday, March 27, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the final report for Q1 GDP.

On Friday, March 28, the Core PCE is released, and important inflation indicator. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, I received calls from six readers last week saying I remind them of Ernest Hemingway. This, no doubt, was the result of Ken Burns’ excellent documentary about the Nobel Prize-winning writer on PBS last week.

It is no accident.

My grandfather drove for the Italian Red Cross on the Alpine front during WWI, where Hemingway got his start, so we had a connection right there.

Since I read Hemingway’s books in my mid-teens I decided I wanted to be him and became a war correspondent. In those days, you traveled by ship a lot, leaving ample time to finish off his complete work.

I visited his homes in Key West, Cuba, and Ketchum Idaho.

I used to stay in the Hemingway Suite at the Ritz Hotel on Place Vendome in Paris where he lived during WWII. I had drinks at the Hemingway Bar downstairs where war correspondent Ernest shot a German colonel in the face at point-blank range. I still have the ashtrays.

Harry’s Bar in Venice, a Hemingway favorite, was a regular stopping-off point for me. I have those ashtrays too.

I even dated his granddaughter from his first wife, Hadley, the movie star Mariel Hemingway, before she got married, and when she was also being pursued by Robert de Niro and Woody Allen. Some genes skip generations and she was a dead ringer for her grandfather. She was the only Playboy centerfold I ever went out with. We still keep in touch.

So, I’ll spend the weekend watching Farewell to Arms….again, after I finish my writing.

Oh, and if you visit the Ritz Hotel today, you’ll find the ashtrays are now glued to the tables.

As for last summer, I stayed in the Hemingway Suite at the Hotel Post in Cortina d’Ampezzo Italy where he stayed in the late 1940’s to finish a book. Maybe some inspiration will run off on me.

Hemingway’s Living Room in Cuba, Untouched Since 1960

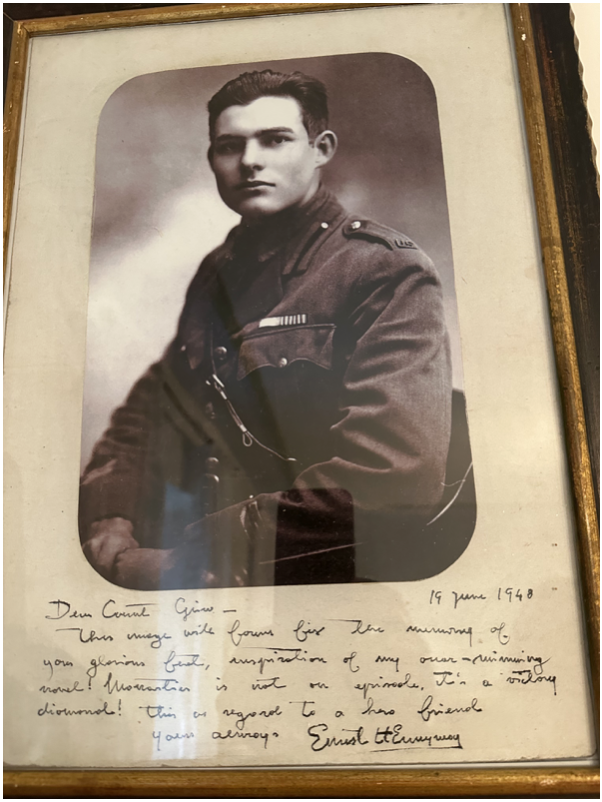

Earnest in 1918

Typing at Hemingway’s Typewriter in Italy from the 1940’s

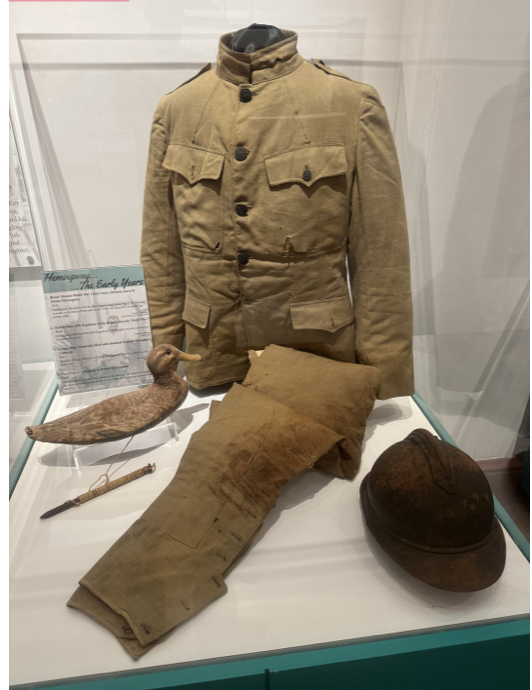

The Red Cross Uniform Hemingway Wore when He was Blown Up in 1917

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader