Mad Hedge Technology Letter

March 19, 2019

Fiat Lux

Featured Trade:

(GOOGLE’S AGGRESSIVE MOVE INTO GAMING),

(GOOGL), (AAPL), (FB), (NFLX), (MSFT) (EA), (TTWO), (ATVI)

Mad Hedge Technology Letter

March 19, 2019

Fiat Lux

Featured Trade:

(GOOGLE’S AGGRESSIVE MOVE INTO GAMING),

(GOOGL), (AAPL), (FB), (NFLX), (MSFT) (EA), (TTWO), (ATVI)

The saturation of tech is upon us.

That is the takeaway from Google’s (GOOGL) hard pivot into gaming.

The goal of their new gaming service is to become the Netflix (NFLX) of gaming allowing gamers to skip purchasing third-party consoles and playing games directly from an Android-based Google device.

Middlemen in the broad economy are getting killed and this is the beginning.

What we are really seeing is a last-ditch effort to protect gaming consoles - these devices will become extinct in less than 20 years boding ill for companies such as Sony and Nintendo

The cloud is still all the rage and companies such as Microsoft (MSFT), Alphabet (GOOGL), and Apple (AAPL) have the natural infrastructure in place to offer cloud-based gaming solutions.

Phenomenon such as internet game Fortnite have shown that consoles are outdated and relying on the cloud as a fulcrum to extract gaming revenue by way of add-ons and in-game enhancements will be the way forward

Another key takeaway from this development is that passive investment is dead, even more so in tech, where these big tech companies are starting to bleed over into each other's territory.

This dispersion will create opportunity and pockets of weakness.

I blame this on a lack of innovation with companies still trying to extract as much as they can from the current smartphone-based status quo which has pretty much run its course.

Technology is itching for something revolutionary and we still have no idea what that new idea or device will be.

The rollout of 5G is promising and companies will need some time to adapt to this super-fast connection speed.

In either case, I can tell you the revolution won’t include foldable smartphones.

In 2018, the gaming industry flourished on accelerating momentum by registering over $136 billion in sales, and the revenue growth rate is already about 15% and increasing.

Naturally, companies such as Amazon and Google want a piece of this action and are hellbent on making inroads in the gaming environment such as Amazon's ownership of Twitch, which is a game streaming service where viewers can watch live tournament-style competitions proving extremely popular with Generation Z.

I applaud this move by Google because they already have proved they can execute on certain mature assets such as YouTube which has become the Netflix replacement of 2019.

Doubling down in the gaming sector would be a bonus as they search a second accelerating revenue driver that will dovetail nicely with the overperformance in YouTube this year.

It’s even possible that YouTube could be modified to support live stream gaming, certainly various synergistic dynamics are at play here.

Even if they fail - it's worth the risk.

Revenue extraction will be painful for certain companies like Facebook (FB) in this new environment, who has seen a horde of top executives abort after the company drastically changed directions, believing the company is on a suicide mission to fines and more regulatory penalties.

I've mentioned in the past that Facebook no longer commands the same type of employee brand recognition they once cultivated.

Facebook will find a tougher time to find the right people they need to execute their private chat plan, by linking the likes of WhatsApp, Instagram, and Facebook Messenger.

This is a high-risk high-reward proposition that could end up with Facebook's co-founder Mark Zuckerberg in tears if regulators give him the cold shoulder, and that is why many executives who are risk-adverse want to cash in now because they sink with the Titanic.

Not only are gaming assets becoming saturated, but the general online streaming environment is attracting a tsunami of supply all at one time.

Online content is already veering into the same type of pricing structures that cable offered traditional customers.

Investors will have to ask themselves, how much will the average consumer spend in content-based entertainment per month?

My guess is not more than $100 per month.

The saturation will cause tech companies to become even more draconian.

Be prepared for some more epic in-fighting until a new gateway of internet monetization opens up.

There has never been a better time to be a tactical and active investor in tech.

The Fang trade has splintered off with each company facing unpredictable futures.

Unearthing value will become more difficult because these traditional bellwether tech stocks have decoupled and aren't going straight up anymore.

Those zigs and zags will still be buttressed by a secular tailwind of the migration to digital, but there are certain winners and losers that will result of this.

Apple announcing a new streaming product is proof that these Silicon Valley tech firms are desperate for new profit drivers as the woodchips that fuel the fire start to run noticeably short on supply.

At the bare minimum, this looks disastrous for the traditional gaming companies of Electronic Arts (EA), Take-Two Interactive (TTWO), and Activision (ATVI) whose shares have been effectively shelved due to the Fortnite revolution.

EA has fought back with their own Fortnite lookalike called Apex Legends which showed a Fortnite-like trajectory sucking in 10 million players in the first 72 hours.

The stock exploded 16%, signaling this is the new way forward for gaming companies.

As a whole, these traditional gaming studios simply don’t have the firepower to compete with the big boys, let alone possess a strong cloud infrastructure.

Global Market Comments

March 18, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR A STIFF DOSE OF HUMILITY),

(FCX), (AAPL), (IWM), (SPY), (BA), (FXI), (FXB)

Sometimes markets have to give you a solid dose of humility, blindside you with a sucker punch, and slap you across the face with a wet kipper. Last week was definitely one of those weeks for me.

It was only just a matter of time before this happened. We posted new record gains for the first ten weeks of 2019. It was just a matter of time before the reality check kicked in.

I believed that we have seen the sharpest rally in stocks since the 2009 bottom, we were overdue for a respite. That respite came and only lasted a week. It has been an especially frustrating week for those few of us who watch economic data because it has been unremittingly awful while stocks rose daily.

There were really no reasons for shares to rise that week. There were also no reasons to sell, other than a dozen or so complete disasters that are looming just over the horizon. Still, to quote an old friend of mine, “Markets can remain irrational longer than you can remain liquid.”

The bull market reached ten years old last week, and if you read this letter you caught every dollar of the move up since then, plus some. But how much longer will it last? The technicals say it’s already in its death throes.

China trade negotiations (FXI) endlessly continued as they have for a year, but now the Chinese have thrown up a roadblock. They want everything in writing. In the wake of the North Korean disaster, can you blame them? This will weigh heavily on stocks until it's done.

Another day, another Brexit vote failed again. The pound (FXB) is doing the Watusi. Avoid all UK plays until the issue is decided.

The share buyback blackout started on Friday for many companies which are not allowed to repurchase their own shares up to 30 days ahead of the Q1 earnings reports. If you take the largest buyers of shares out of the market, what is left? Look to play the short side for the market.

Boeing (BA) hit bottom as the US became the last country to ban the 737 Max 8. Imagine being 35,000 feet in the air and you find out your plane is grounded for safety reasons, as 6,000 people did last week. Buy more (BA) on the dip. The next move is from $360 to $450.

Weekly Jobless Claims jumped, by 6,000 to a seasonally adjusted 229,000. Notice claims aren’t falling anymore. Another sign the tax cut stimulus is shrinking? Or that there is no one left to hire with any skills whatsoever?

Tesla (TSLA) released its Model Y SUV, but the cheaper $39,000 version won’t be available until 2021 and the stock dove. We are approaching the make or break level for the stock, the bottom of a two-year range. Get ready to buy on the meltdown. This is a ten bagger in a decade. Buy (TSLA).

The Mad Hedge Fund Trader lost ground last week. The tenth rally in 11 weeks made my short positions lose money faster than my long positions could make it back.

The Mad Hedge Technology Letter was stopped pit of a short position in Apple (AAPL) for a small loss a heartbreaking three days before its options expiration.

February came in at a hot +4.16% for the Mad Hedge Fund Trader. March started negative, down -2.18%.

My 2019 year to date return retreated to +11.46%, a new all-time high and boosting my trailing one-year return back up to +23.72%.

My nine-year return pared back to +311.60%. The average annualized return appreciated to +33.69%.

I am now 60% in cash, 20% long Freeport McMoRan (GLD), 10% short the S&P 500, and 10% short the Russell 2000. My short bond position (TLT) expired at its maximum profit point of $1,140.

As for the Mad Hedge Technology Letter, it covered its short in Apple (AAPL) for a small loss.

Q4 earnings reports are pretty much done, so the coming week will be pretty boring on the data front after last week's fireworks.

On Monday, March 18, at 10:00 AM EST, the March Homebuilders Index is out.

On Tuesday, March 19, 8:30 AM EST, February Housing Starts is published.

On Wednesday, March 20 is the first official day of Spring, at last!

Thursday, March 21 at 8:30 AM EST, the Weekly Jobless Claims are announced. At 10:00 AM, we get a new number for Leading Economic Indicators.

On Friday, March 22 we get a delayed number for Existing Home Sales.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, it’s fundraising time here in the San Francisco Bay Area for local schools and gala balls are now a weekly event. I, who have pursued a lifelong pursuit of low prices and great deals, ended up paying $1,000 for a homemade coffee cake, $7,000 for tickets to the Golden State Warriors, and $10,000 for the best table in the house. Hey, what’s the value of money if you can’t spend it? You can’t take it with you.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 8, 2019

Fiat Lux

Featured Trade:

(MARCH 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SDS), (TLT), (TBT), (GE), (IYM),

(MSFT), (IWM), (AAPL), (ITB), (FCX), (FXE)

Well, that was some week!

After moving up in a straight line for ten weeks, markets are now doing their best impression of a Q4 repeat.

The transports Index (XTN), the most important leading indicator for markets, has been down for 11 straight days, the worst run in 40 years.

And now for the bad news.

Look at a long term chart for the S&P 500 (SPY) and the head and shoulder top practically leaps at you and grabs you by the lapels (that is, if you are one of the few who still wears a suit).

It makes you want to slit your wrist, jump off the nearest bridge, or binge watch all nine seasons of The Walking Dead. It neatly has the next bear market starting around say May 10 at 4:00 PM EST, a rollover point I put out two years ago.

However, hold that move! As long as we have a free Fed put under the market in the form of Jay Powell’s “patience’ policy, we are not going to have a major crash any time soon. That is 2021 business.

It's more likely we trade in a long sideways range until the economy finally rolls over and dies. So when we hit my first (SPY) downside target at the 50-day moving average at $269, which is a very convenient 5% down from the recent top, could well bounce hard and I might add some longs in the best quality names. It all sets of my dreaded flatline of death scenario for the rest of 2019.

Last week saw an unremitting onslaught of bad news from the economy.

The February Nonfarm Payroll report came in at a horrific 200,000 when 210,000 was expected, sending traders to man the lifeboats. The headline Unemployment Rate dropped 0.2% to 3.8%. Average Hourly Earnings spiked 11 cents to $27.66, a 3.4% YOY gain and the biggest pop since 2009.

Construction lost 31,000 jobs, while leisure and Hospitality added no jobs at all. The stunner is that the U6 long term structural “discouraged worker” unemployment rate dropped an amazing 0.8% to 7.4%, the sharpest drop on record. Fewer jobs, but at higher wages is the takeaway here, the exact opposite of what markets want to hear.

US Construction Spending fell off a cliff, down 0.6% in December. It seems that nobody wants to invest ahead of a recession.

The dollar soared (UUP), and gold (GLD) got hammered. You can blame the slightly stronger GDP print on Thursday the week before, which came in at 2.2% instead of 1.8%. As long as Jay doesn’t raise interest rates this is just a brief short covering rally for the buck.

China cut its growth forecast from 6.5% to 6.0% GDP growth for 2019. The trade war with the US and the stimulus hasn’t kicked in yet. The last time they did this, the market fell 1,000 points. Buy (FXI) on the dip.

US Trade Deficit hit ten-year high at $59.8 billion for December, and a staggering $419 billion for the year. It’s funny how foreigners stop buying your goods when you declare war on them. Even Teslas (TSLA) are being stopped at the border in China. Who knew?

New trade tariffs hit US consumers the hardest adding $69 billion to their annual bill. Falling real earnings and rising costs is hardly a sustainable model. Will someone please tell the president?

US growth is fading, says the Fed Beige Book, slowing to a “slight to moderate rate”. The government shutdown is the cause. With Europe already in recession, I’ll be using rallies to increase my shorts. Sell (SPY) and (IWM).

The European Central Bank axed its growth forecast sharply, from 1.7% to 1.1%. Stimulus to renew on all front, including more quantitative easing. It’s just a matter of time before their recession pulls the US down. Sell the Euro (FXE).

You lost $3.7 trillion in Q4, or so says the Fed about the decline of national personal net worth during the stock market crash, the sharpest decline in a decade. You’re now only worth $104.3 trillion.

The Mad Hedge Fund Trader actually gained ground last week, thanks to profits on our short positions rising more than our offsetting losses on our longs.

I have doubled up my overall positions, finally taking advantage of the rollover in all risk assets from a historic ten-week run to the upside. I added shorts in the S&P 500 (SPY) and the Russell 2000 (IWM) against a very deep in-the-money long in Freeport McMoRan (FCX) the world’s largest copper producer.

The thinking here is that with China the only economy in the world that is stimulating its economy and the planet’s largest copper consumer, copper makes a nice long side hedge against my short positions.

The Mad Hedge Technology Letter is happily running a short position is Apple (AAPL) which is now almost at its maximum profit point. We only have four days to run to expiration when the position we bought for $4.60 will be worth $5.00.

February came in at a hot +4.16% for the Mad Hedge Fund Trader. March started out negative, down -0.84%, thanks to a wicked stop loss on Gold (GLD). We had 80% of the maximum potential profit at one point but left the money on the table at the highs.

My 2019 year to date return ratcheted up to +12.84%, a new all-time high and boosting my trailing one-year return back up to +29.92%.

My nine-year return clawed its way up to +312.94%, another new high. The average annualized return appreciated to +33.83%.

I am now 50% in cash, 20% long Freeport McMoRan (FCX), and 10% short bonds (TLT), 10% short the S&P 500, and 10% short the Russell 2000.

We have managed to catch every major market trend this year, loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD). I am trying to avoid stocks until the China situation resolves itself one way or the other.

As for the Mad Hedge Technology Letter, it is short Apple (AAPL).

Q4 earnings reports are pretty much done, so the coming week will be pretty boring on the data front after last week's fireworks.

On Monday, March 11, at 8:30 AM EST, January Retail Sales is ut.

On Tuesday, March 12, 8:30 AM EST, the February Consumer Price Index is published.

On Wednesday, March 13 at 8:30 AM EST, the February Durable Goods is updated.

On Thursday, March 14 at 8:30 AM EST, we get Weekly Jobless Claims. These are followed by January New Home Sales.

On Friday, March 15 at 9:15 AM EST, February Industrial Production comes out. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be headed to the De Young Museum of fine art in San Francisco to catch the twin exhibitions for Monet and Gaugin. When it rains every day of the week, there isn’t much to do but go cultural.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 8, 2019

Fiat Lux

Featured Trade:

(MARCH 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SDS), (TLT), (TBT), (GE), (IYM),

(MSFT), (IWM), (AAPL), (ITB), (FCX), (FXE)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader March 3 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Are you sticking to your market top (SPY), (SDS) by mid-May?

A: Yes, at the rate that economic data is deteriorating, and earnings are falling, there’s no prospect of more economic stimulation here, my May top in the market is looking better than ever. Europe going into recession will be the gasoline on the fire.

Q: Where do you see interest rates (TLT) in 1-2 years?

A: Interest rates in 2 years could be at zero. If interest rates peaked at 3.25% last year, then the next move could be to zero, or negative numbers. The world is awash in cash, and without any economic growth to support that, you could have massive cuts in interest rates.

Q: Will (TLT) be going higher when a market panic sets in?

A: It will, which is why I’m being cautious on my short positions and why I’m only using tops to sell. You can be wrong in this market but still make money on every put spread, as long as you’re going far enough in the money. That said, when the stock market starts to roll over big time, you want to go long bonds, not short, and we may do that someday.

Q: Do you see a selloff to stocks similar to last December?

A: As long as the Fed does not raise interest rates, I don’t expect to get a selloff of more than 5% or 6% initially. If we do get a dramatic worsening of economic data and it looks like we’re headed in that direction, the Fed will start cutting interest rates, the recession signal will be on and only then will we drop to the December lows—and possibly as low as 18,000 in the Dow.

Q: General Electric has gone from $6 to $10; what would you do now?

A: Short term, sell with a 66% gain in a stock. Long term, you probably want to hold on. However, their problems are massive and will take years to sort out, probably not until the other side of the next recession.

Q: Microsoft (MSFT): long term hold or sell?

A: Absolutely long-term hold; look for another double in this company over the next 3 years. This is the gold standard in technology stocks today. Short term, you’re looking at no more than $15 of downside to the December low.

Q: Would you short banks (IYF) here since interest rates have failed to push them higher?

A: I would not; they’ve been one of the worst performing sectors of the market and they’re all very low, historically. You want to short highs like I’m doing now in the (SPY), the (IWM), and Apple (AAPL), not lows.

Q: Is the China trade deal (FXI) a ‘sell the news’ event?

A: Absolutely; there’s not a hedge fund out there that isn’t waiting to go short on a China trade deal. The weakness this week is them front-running that news.

Q: Do you see emerging markets (EEM) pushing higher from the 42 level, or will a global recession bring it back to earth?

A: First of all, (EEM) will go higher as long as interest rates in the U.S. are flatlining, so I expect a rally to last until the spring; however, when a real recession does become apparent, that sector will roll over along with everything else.

Q: Would you buy homebuilders (ITB) if this lower interest rate environment persists?

A: I wouldn’t. First of all, they’ve already had a big 28% run since the beginning of the year— like everything else—and second, low-interest rates don’t help if you can’t afford the house in the first place.

Q: Would you short corporate bonds if you think there’s going to be a recession next year?

A: I’m glad you asked. Absolutely not, not even on pain of death. I would buy bonds because interest rates going to zero takes bond prices up hugely.

Q: Should you buy stocks in front of a blackout period on corporate buybacks?

A: Absolutely not. Corporate buybacks are the number one buyers of shares this year, possibly exceeding $1 trillion. Companies are not allowed to buy their own stocks anywhere from a couple of weeks to a month ahead of their earnings release. By removing the principal buyer of a share, you want to sell, not buy.

Q: What are the chances the China trade deal (FXI) breaks down this month and no signing takes place?

A: I have a feeling Trump is desperate to sign anything these days, and I think the Chinese know that as well, especially in the wake of the North Korean diplomatic disaster. He has to sign the deal or we’ll go to recession, and that would be tough to run on for reelection.

Q: Which stock or ETF would you short on real estate?

A: If you short the iShares US Home Construction ETF (ITB), you short the basket. Shorting individual stocks is always risky—you really have to know what’s going on there.

Q: What’s the best commodity play out there?

A: Copper. If China is the only country that’s stimulating its economy right now, and China is the largest consumer of copper, then you want to buy copper. The electric car boom feeds into copper because every new vehicle needs 20 pounds of copper for wiring and rotors. Copper is also cheap as it is coming off of a seven-year bear market. What do you buy at market tops? Only cheap stuff.

Q: Why did you go so far in the money in the Freeport-McMoRan (FCX) call spread with only a 10% profit on the trade in five weeks?

A: In this kind of market, I’ll take 10% in 5 weeks all day long. But additionally, when prices are this high, I want to be as conservative as possible. Going deep in the money on that is a very low-risk trade. It’s a bet that copper doesn’t go back to the December lows in five weeks, and that’s a bet I’m willing to make.

Q: Will a new round of QE in Europe affect our stock market?

A: Yes, it’s terrible news. It will weaken the Euro (FXE), strengthen the dollar (UUP), and force US companies to lower earnings guidance even further. That is bad for the market and is a reason why I have been selling short.

Global Market Comments

March 5, 2019

Fiat Lux

Featured Trade:

(THE BIPOLAR ECONOMY),

(AAPL), (INTC), (ORCL), (CAT), (IBM),

(TESTIMONIAL)

Corporate earnings are up big! Great!

Buy!

No, wait!

The economy is going down the toilet!

Sell!

Buy! Sell! Buy! Sell!

Help!

Anyone would be forgiven for thinking that the stock market has become bipolar.

According to the Commerce Department’s Bureau of Economic Analysis, the answer is that corporate profits account for only a small part of the economy.

Using the income method of calculating GDP, corporate profits account for only 15% of the reported GDP figure. The remaining components are doing poorly or are too small to have much of an impact.

Wages and salaries are in a three-decade-long decline. Interest and investment income are falling because of the ultra-low level of interest rates. Farm incomes are at a decade low, thanks to the China trade war, but are a tiny proportion of the total, and agricultural prices have been in a seven-year bear market.

Income from non-farm unincorporated business, mostly small business, is unimpressive.

It gets more complicated than that.

A disproportionate share of corporate profits is being earned overseas.

So, multinationals with a big foreign presence, like Apple (AAPL), Intel (INTC), Oracle (ORCL), Caterpillar (CAT), and IBM (IBM), have the most rapidly growing profits and pay the least amount in taxes.

They really get to have their cake and eat it too. Many of their business activities are contributing to foreign GDPs, like China’s, far more than they are here.

Those with large domestic businesses, like retailers, earn less but pay more in tax as they lack the offshore entities in which to park them.

The message here is to not put all your faith in the headlines but to look at the numbers behind the numbers.

Caveat emptor. Buyer beware.

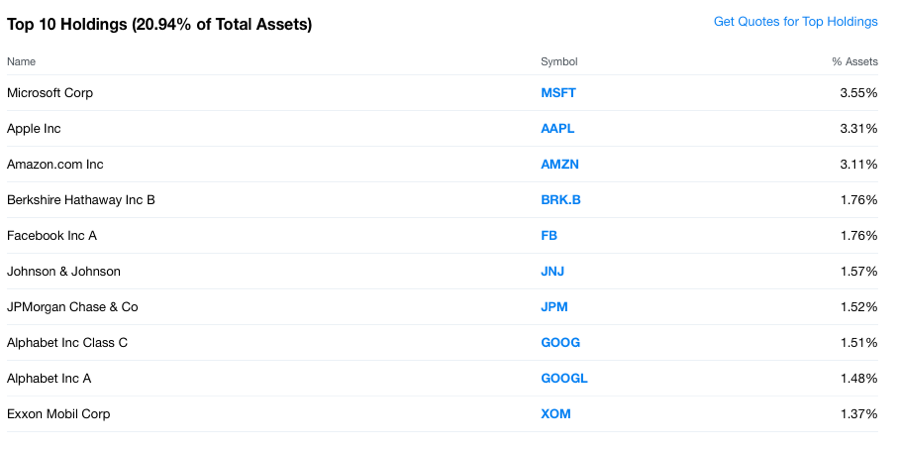

S&P Top 10 Holdings 3-4-2019

S&P Top 10 Holdings 3-4-2019 Has the Market Become Bipolar?

Has the Market Become Bipolar?Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.