Many “experts” have been advising investors to buy the dip in Roku (ROKU) since it dropped to $370 from the peak of $480 it reached in July 2020.

These experts kept banging the drum to buy the dip on Roku as it slid to $350 then $320.

The calls for dip-buying continue as Roku nosedived to $280 then most recently on a downgrade, Roku fell all the way to $177.

Painful as it feels to be an investor in Roku, this is not the time to double down on high-tech growth stocks.

Growth tends to usually overshoot to the upside as investors give a pass to growth for losing money and selectively put a premium on high growth rates.

But that deal is only valid in a low-interest rate environment and what we are witnessing is the reverse happen as investors are bolting from Roku like stallions out the back of a stable.

At a micro level, there is somewhat distaste at the ever-increasing competition Roku is facing and the lack of growth prospects overseas.

Overseas is usually the growth engine for many of these streaming cohorts, but the dilemma here is that margins are lower because of a poor purchasing power profiles for the median consumer overseas.

That’s not to say it’s easy to succeed in the U.S. — hardly so.

However, Roku’s business in the United States has been highly successful, but the issue here is that the market is getting somewhat saturated and since the stock market is priced based on future cash flow, where does the incremental buying come from to save Roku’s stock?

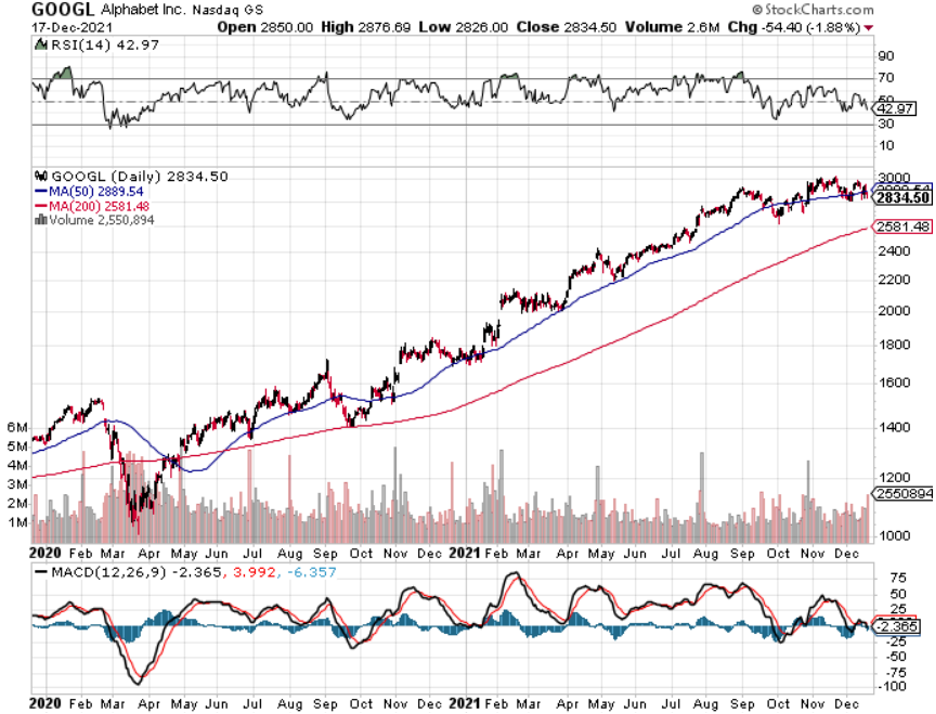

Roku faces a perilous uphill challenge to convince the incremental platform user to install its Roku stick at a time when Amazon (AMZN) and Google (GOOGL) are using their greater clout and sharper elbows to get rid of the tech peons.

Amazon reported sales of over 150 million Fire TV devices recently. Roku has over 56 million active accounts, although it’s not a direct comparison because Amazon’s figure counts sold devices and includes Fire TV devices that are not being used.

There is no possible way that Roku can secure 50% of the market here and 40% would be a stretch capping its ceiling.

Another leery signal came when smart television maker TCL who have partnered to make the Roku smart TV decided to jump ship to Google.

This could represent a red flag as these bigger companies have the capacity to poach talent, know-how, and convince suppliers to jump ship with a more lucrative contract for a larger install base.

This could be the first point of contact that could eventually lead to Google buying out TCL and cutting off Roku from a source of a hardware supplier.

TCL has now claimed to be one of the biggest sellers of sets featuring Google’s connected TV operating system and the partnership will take precedence over anything Roku is involved with.

In the short term, readers need to stay away from Roku as we need more commentary on how it plans to shake off Google and Amazon and how it plans to navigate a perceived saturation in its domestic business while underperforming overseas.

Granted, it’s intimidating to go up against Google and Amazon because there are less tools available in the tool kit in terms of stacking resources and convincing consumers that they are indeed a higher quality product.

Long term, I don’t see it for Roku.

Short term, it’s dicey at best.

This stock promises to be volatile in the next three months and actively trading this stock will probably mean selling sharp rallies and avoiding dips.

The first-mover advantage was stellar for a while and Roku rode that donkey up the mountain of success, but now as reality sets in and the first-mover advantage dissipates, they need a miracle or should just negotiate to sell itself while the stock price is still near $200.

It’s sink-or-swim at this point.