At our weekly Monday staff meeting, coworkers were griping and grimacing about their failed internet connections and annoying glitches to their favorite e-commerce sites during the mad rush to find the best deal during Black Friday and Cyber Monday.

Internet traffic was that torrential when sites were driven offline for minutes and some, hours by a bombardment of gleeful shoppers hoping to splash their credit card numbers all over the web on sweet discounts.

The crashing of system servers epitomizes the robust transition to online commerce that has most of us pinned to our devices surfing our go-to platforms all day long.

According to data from Adobe (ADBE) analytics, Black Friday sales jumped 23.6% YOY to $6.22 billion, and it was the first time in history that mobile sales broke the $2 billion threshold.

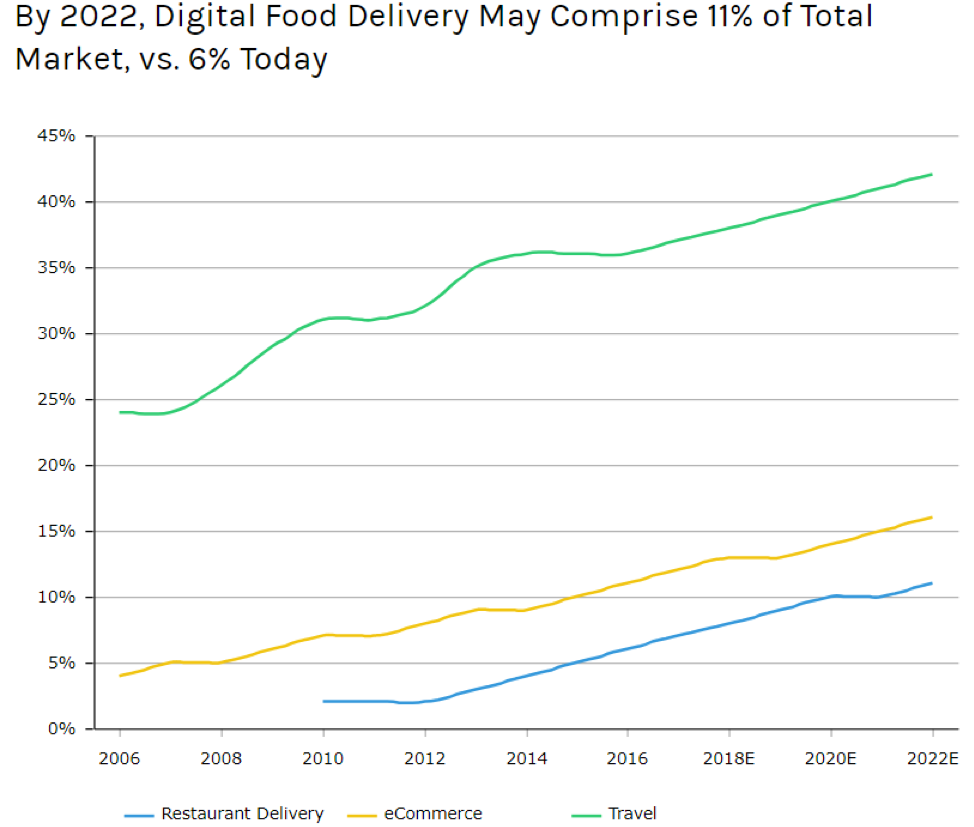

It is a clear victory for e-commerce and, in particular, mobile shopping that has become more integrated into modern tech DNA.

Mobile sales comprised 33.5% of total sales and were up from 29.1% last year, signaling that more is yet to come from this transcending movement that is shoving everything from content, digital ads, entertainment, banking and pretty much everything you can think of to your handheld smartphone.

CEO of Kohl’s (KSS) Michelle Gass confirmed the e-commerce strength by saying, “80 percent of traffic online came from mobile devices.”

The beauty of this movement is that it’s not an “Amazon (AMZN) takes all” scenario with other players allowed to feast on a growing size of the e-commerce pie.

“Click and collect” has been a strategy that has paid off handsomely with sales up 73% YOY during the shopping holidays.

This all supports my prior claim that e-commerce is one of the most innovative and dynamic parts of technology especially the grocery space, and the buckets full of capital attempting to reconfigure the e-commerce spectrum is creating an enhanced customer experience for the final buyer resulting in better products, superior delivery methods, and cheaper prices.

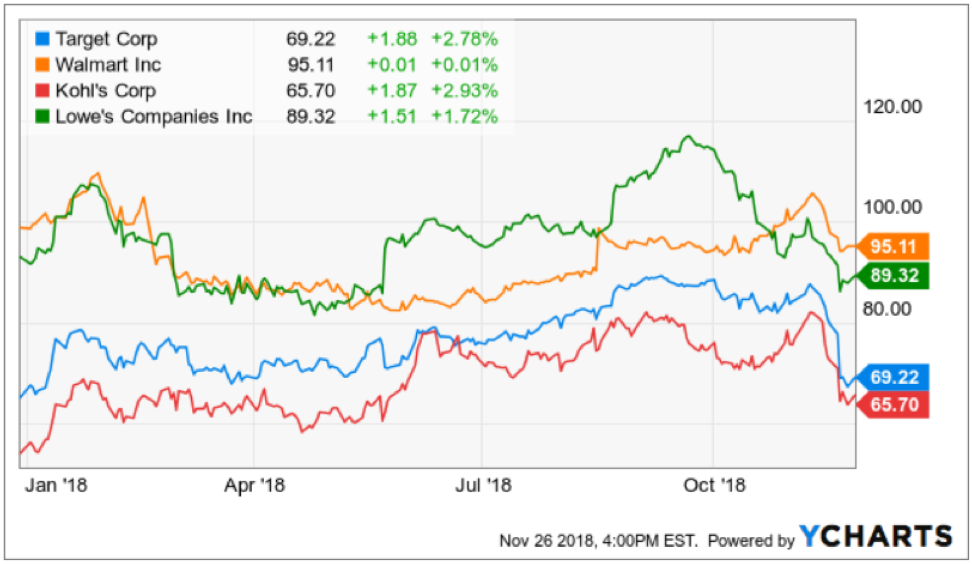

Some other retailers spicing up their e-commerce strategy are dinosaur big-box retailer’s intent to defend their business from the Amazon death star.

If you can’t innovate in-house, then “borrow” the innovation from somewhere else.

That is exactly what Target (TGT) has chosen to do announcing last week that it would grant free 2-day shipping with no minimum sale threshold.

The tactic is bent on undercutting Walmart (WMT) who currently operate a 2-day free shipping policy with a minimum order of $35.

Most shoppers will buy in bulk easily eclipsing the $35 per order mark minimizing the rot of small orders.

And if they aren’t eclipsing the $35 per order mark, it demonstrates the firm’s offerings lack the diversity and quality to compete with Amazon.

Capturing the incremental sale squarely rests on the e-tailers ability to coax out the buyers’ impulses to move on the can’t-miss items.

The lesser known retailers fail miserably at matching the lineup of products that Amazon can roll out.

The bountiful product selection at Amazon leads customers to pay for 3, 4, 5, 6 or more items on Amazon.com.

That said, I am bullish on Walmart’s e-commerce strategy. The “click and collect” strategy has shown to be an outsized winner increasing industry sales of this type 120% YOY.

Walmart is at the center of this strategy and they are refurbishing their supercenters to accommodate this growth in collecting from the curb.

Effectively, this gives customers the option to skip the queue instead of bracing the hoards and navigating the crowds of shoppers in the supercenter.

Other changes are minor but will help, such as offering online product location maps to customers beforehand and allowing customers to pay for large items like big-screen televisions on the spot.

The biggest windfall is derived from the cataclysmic demise of Toy “R” Us, giving Walmart a new foothold into the toy business.

Walmart is beefing up toy items by 40% in the stores and layering that addition with another 30% increase in their e-commerce division.

Adobe’s upper management recently said in an interview that interactive toys have been a wildly popular theme this year amid a backdrop of the best holiday shopping season ever recorded.

Another attractive gift selling like hotcakes are video games, titles boding well for sales at Activision (ATVI), EA Sport (EA), and Take-Two Interactive (TTWO).

Reliant IT infrastructure will be a key component to executing these holiday sales bonanzas.

Clothing retailer J. Crew and home improvement chain Lowe's (LOW) were grappling with sudden disruptions to their IT systems before they managed to get back online.

More than 75 million shoppers parade the internet to shop during Black Friday and Cyber Monday, and the opportunity cost swallowed to a tech glitch is a CEO’s worst nightmare.

Ultimately, what does this all mean?

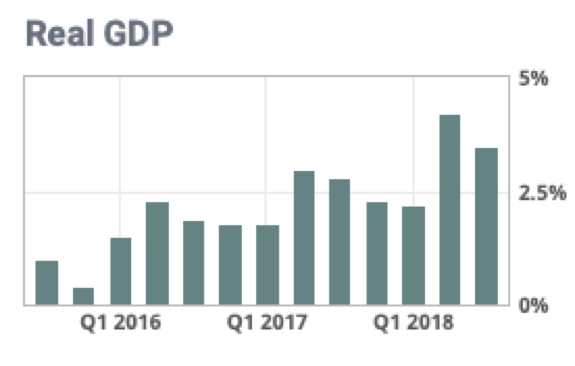

Focusing on the positive side of the surging holiday sales is the right thing to do because the avalanche of momentum will have a knock-on effect on the rest of the economy.

Certain companies are positioned to harvest the benefits more than others.

Amazon guided its 4th quarter estimates conservatively and is in-line to beat top and bottom line forecasts.

Other pockets of strength are Walmart’s tech pivot, albeit from a low base. Walmart still has more room to maneuver and they are in the 2nd inning of their tech transformation snatching the low-hanging fruit for now.

Another interesting e-commerce company swinging its elbows around is Etsy (ETSY).

They sell vintage and handmade craft adding the personalized touch that Amazon can’t destroy.

Margins will be higher than the typical low-cost, value e-commerce platform, but scaling this type of business will be more difficult.

Sales grew 41% sequentially and just in time for a winter holiday blowout.

Etsy became profitable in 2017 after three straight loss-making years, and 2018 is poised to become its best year ever.

The profitability bug is hitting Etsy at the perfect time with its EPS growth rate up 36% sequentially.

They report at the end of February and I expect them to smash all estimates.

There are some deep ramifications for the long term of e-commerce that is beginning to suss itself out.

For one, shipping times will continue to be slashed with a machete. If you are enjoying the 2-day free shipping from Amazon and Target now, then wait until 2-day becomes 1-day free shipping.

Then after 1-day free shipping, customers will get 10-hour shipping, and this won’t stop until goods are shipped to the customer’s door in less than 1-hour or less.

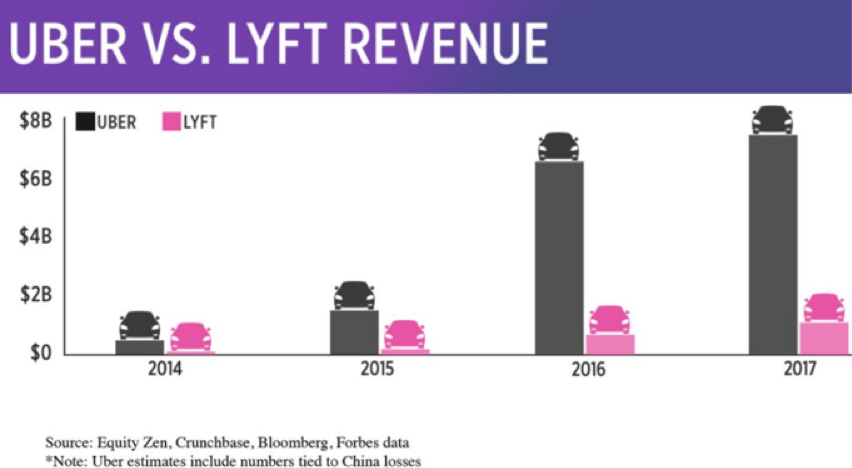

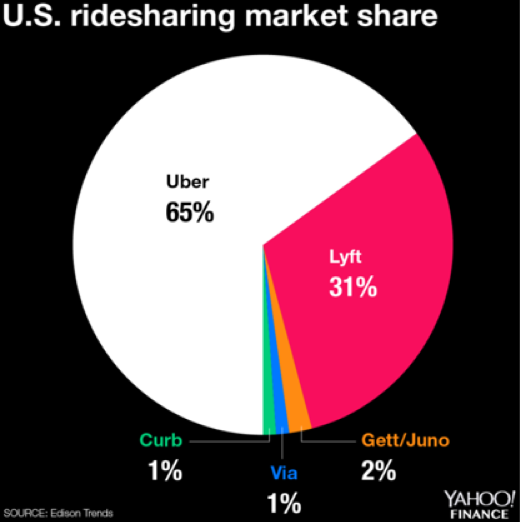

This is what the massive $50 billion in logistical investments over the next five years by the likes of Uber and Amazon are telling us.

It will take years for the efficiencies to come to fruition, but it is certainly in the works.

In the next five years, America’s logistics infrastructure will have to accommodate the doubling of e-commerce packages from 2 billion to 4 billion per year.

Another trend is that omnichannel offerings are sticking and won’t go away anytime soon.

It was once premised that online sales would destroy brick and mortar, yet moving forward, a mix of different sales channels will be the most efficient way of moving goods in the future.

Pop-up stores have been an intriguing phenomenon of late, and surprisingly, 60% of consumers still require interaction with the product to be convinced it's worthy of buying.

Certain products such as fashionable dresses and designer shoes must be given a whirl before a decision can be made. This won’t change anytime soon.

The timing of the sales and marketing push has been moved forward as competitors are eager to get a jump on one another.

Management is agnostic to the timing of the sale.

Thus, discounted sales will show up a week before Thanksgiving as pre-Thanksgiving sales in the future elongating the holiday shopping season cycle by starting it early and delaying the finish of it.

Lastly, the record numbers prove that the e-commerce renaissance and the pivot to mobile is not just a flash in the plan.

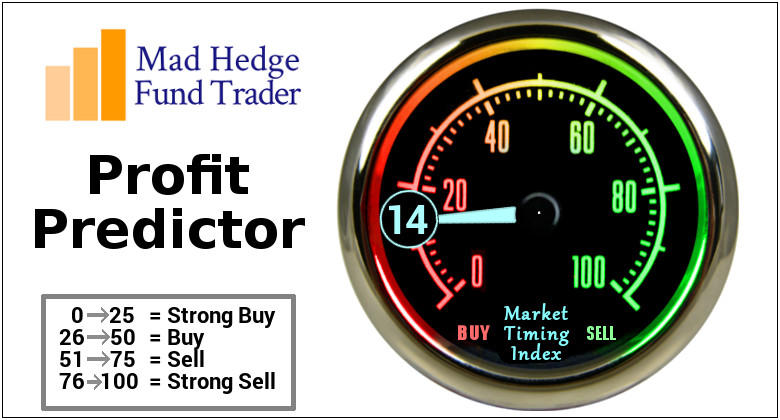

What does this mean for tech equities?

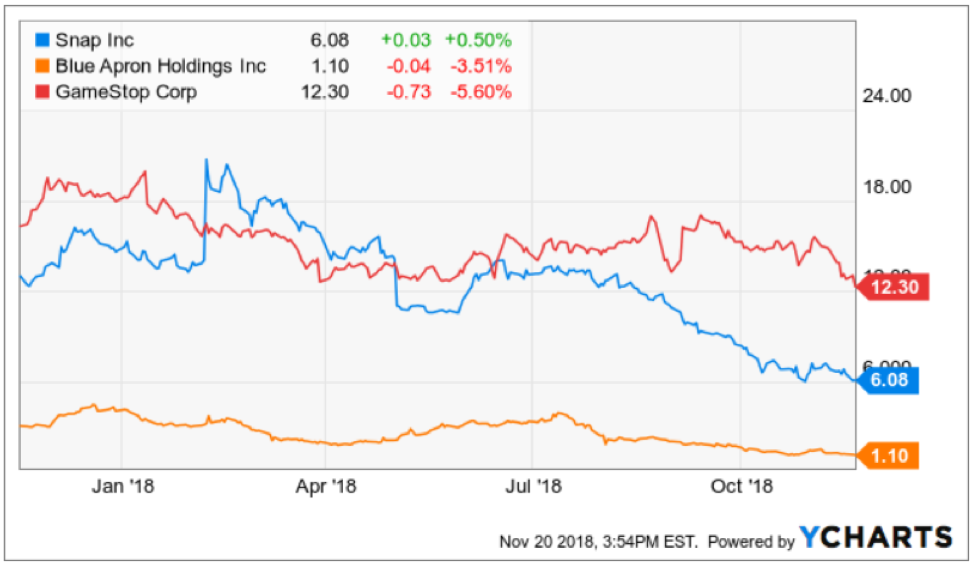

The temporal tech sell-off of late is largely a result of outside macro forces and is not indicative of the overall health of the tech sector that has experienced record earnings.

If the markets can keep its head above the February lows, it sets up an intriguing December fueled by Americans flashing their digital wallets on online platforms.