Microsoft's (MSFT) code grab of GitHub was another virtuoso bit of business by Microsoft CEO Satya Nadella.

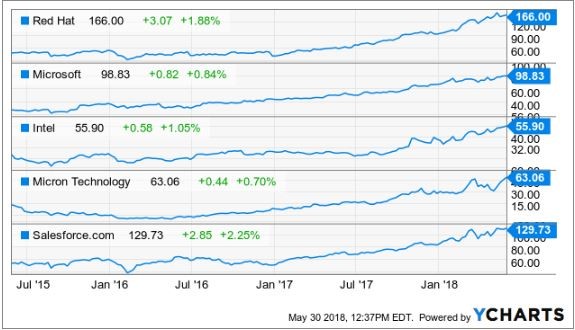

Bill Gates' old stomping ground has been identified as a top 3 tech stock by the Mad Hedge Technology Letter since the early days of the letter.

A company with Amazon-esque growth and Apple-like profits is hard to beat.

There is little doubt that Microsoft will be leading the economy for the foreseeable future and its purchase of GitHub for $7.5 billion, a source code library and platform for developers to collaborate together, is testimony that Microsoft is developer friendly and raises its attractiveness level to the best developers on the market.

Universally, this underlines the strength of large-cap tech that keeps strengthening in an attempt to eclipse the competition.

Large-cap tech outperformance is one of the main overarching narratives in equity markets this year.

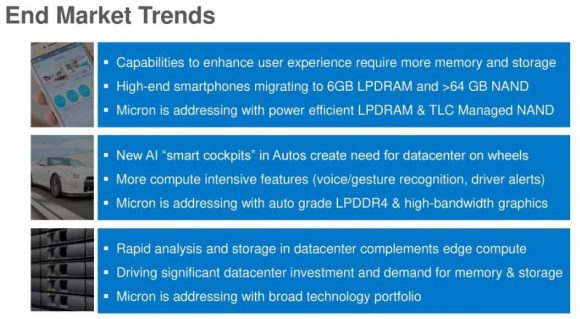

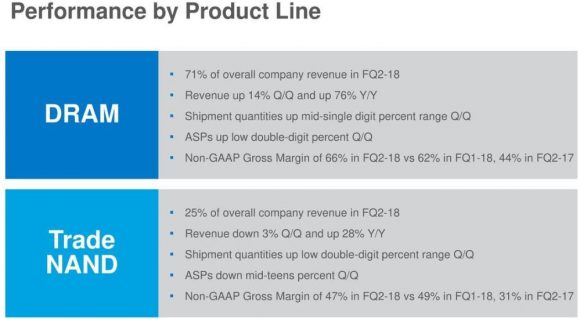

Investors have been handed more and more bullish evidence that has made Morgan Stanley's downgrade of Micron (MU) absurd.

The ultra-competitive environment tech industry is fighting tooth and nail to find the best technology talent around the world.

GitHub is the largest host of source code the world has ever seen and earns revenue by charging corporate customers who run projects on its platform.

This is definitely not a revenue grab as GitHub's marginal revenue is beside the point.

Upon the announcement, Microsoft shares traded higher confirming the stance of investors treating Microsoft as a super growth stock and not a legacy company of yore that focuses on extracting profits while keeping overhead low.

Growth is about spending and spending some more.

This San Francisco-based company plays host to 24 million developers and has become a critical platform for developers working on collaborative projects for Apple (AAPL), Alphabet (GOOGL), and Amazon developers around the world.

Microsoft is its biggest contributor and the purchase makes sense long term and short term.

GitHub has a de-facto monopoly of open source coding repositories. There is only one game in town for developers to collaborate on, boding well for Microsoft.

Not only will Microsoft have the biggest library of code in the world, but the monetization pathway of GitHub squarely falls on the shoulders of Microsoft Azure - Microsoft's sensational cloud business.

GitHub is just another tool that will be incorporated into its cloud and is part of the strategy to surpass Amazon as the No. 1 cloud provider.

Microsoft envisages developers and businessmen working in concert on Microsoft's cloud using its proprietary software and services that will happily feed through to the bottom line in a material way.

Look for Microsoft to keep adding premium selective parts to its software and services lineup.

As for individual developers, GitHub has been the platform to display their talents.

It is commonplace during interviews for developers to point out contributions to projects through GitHub, giving them an edge in the hiring process.

Any reputable developer should have repositories on GitHub chronicling their every move.

Every major tech company deeply respects the functionality of GitHub and what it brings to the industry.

This is not just a flash in the pan.

Crucially, the plethora of new data access about coders streaming into the Redmond, Washington, offices is a dream come true.

This will also allow Microsoft to identify and recruit the best of the best in an algorithmic method to the dismay of other tech companies.

Theoretically, the company could create an in-house ranking system of developers using the data and automate its HR department while topping it off with some artificial intelligence sauce.

There is certain to be untold, untapped talent hidden away in the layers of GitHub repositories. Once Microsoft combs through the nitty-gritty, surely a slew of contract offers will head the way for the dark horses roaming around GitHub.

In a sellers' market, the buyers find you and pay you more than the market price and not the other way around.

GitHub flirted with the possibility of going public before meeting with Nadella.

The meeting blew away GitHub leaving management impressed.

That smoothed the way for the decision to accept Nadella's offer of $7.5 billion paid in Microsoft stock.

The inflated price was a head turner.

Just three years ago, the last private round of valuation estimated GitHub at $2 billion in 2015.

Microsoft even floated the idea of buying GitHub for $5 billion in informal talks at one point.

Therefore, the $7.5 billion in stock paid to GitHub is considered a healthy premium to the market price.

Even with the inflated price, this move was a no-brainer.

The deal will see Microsoft's Vice President Nat Friedman take the reins at GitHub as CEO. He will be instructed by Nadella how to exactly realize the perfect fusion between Microsoft Azure and GitHub's code treasure trove.

Naturally, there is no guarantee all 28 million GitHub users will be coding on the Azure platform. However, if just a few million convert and adopt the Azure platform, then a GitHub purchase will seem like a massive bargain.

It's entirely possible that in the near-term future, Microsoft will be crowned as the best place in the world to work as a developer.

If this does not come to fruition, Microsoft will be in the ballpark of the top echelon.

The ability to recruit the best developers in the world is reinforced by its other big-name purchase of LinkedIn, a job networking site purchased for $26.2 billion in 2016.

LinkedIn and the data that came with it, is another salient tool helping Microsoft identify inefficiencies in the job market.

The historical progression of employees' careers is digitized, and trends can be manipulated from the data.

Microsoft will be able to understand more about the state of the job market than any other company in the world.

Ownership of the biggest coding platform, largest job networking site, and massive amounts of prized data resulting from these platforms are precious gems inside of Microsoft's portfolio.

All of these new functions will derive synergies from each other helping evolve Microsoft into a stronger company.

No doubt there will be GitHub links showing up in LinkedIn profiles.

The applications are unlimited.

In the future it might be difficult to entirely avoid the Microsoft ecosystem. The conscious decision to become even more developer friendly is poised to pay dividends in the quality of its tech staff.

Microsoft will have to extend an olive branch to the portion of developers who disagree with this purchase.

A small minority is skeptical.

The integrity of the platform will have the potential to be compromised favoring Microsoft's narrow interests.

Nadella will need to do some smoothing over with the maverick developers to get them on board with everybody else.

Even though some developers are worried the platform will be undermined, certainly the existing developers at Microsoft are jumping with joy about this development.

The GitHub buy will aid Microsoft developers to build more unique cloud products to sell as add-ons.

Venture capital company Andreessen Horowitz will be rewarded with a $1 billion pay packet from its $100 million investment into GitHub.

A cool 10-fold return.

These were the precise deals that Microsoft used to lose out to the vaunted FANGs.

It shows how far Microsoft has come in such a short amount of time.

Smartly, Nadella has used the cash pile to draw in businesses that have synergies with the existing Microsoft ecosystem.

GitHub is another example of round pegs fitting into round holes.

Microsoft is a darling of the Mad Hedge Technology Letter, and now that it has crossed the $100 threshold, this price level will act as ironclad support.

If the stock somehow gets caught up in macro-headwinds and drops to $95, consider it a gift from God.

_________________________________________________________________________________________________

Quote of the Day

"School districts in the U.S. don't adopt technology very quickly," - said co-founder and CEO of Netflix Reed Hastings.