Global Market Comments

November 20, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE WEEK THAT WAS)

(SPY), (TLT), (JNK), (NLY) (BA), (UUP),

(TLT), (FCX), (GLD), (GDX), (GOLD)

Global Market Comments

November 20, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE WEEK THAT WAS)

(SPY), (TLT), (JNK), (NLY) (BA), (UUP),

(TLT), (FCX), (GLD), (GDX), (GOLD)

In the long history of stock markets, last week will be viewed as one of the pivotal ones of the 21st century. That was when investors flipped from anticipating the end of interest rate rises to the beginning of interest rate cuts.

That is a big deal.

I have been anticipating this for months, putting all my chips on the most interest rate-sensitive sectors: US Treasury bonds (TLT), Junk bonds (JNK), REITS (NLY), and big tech. The payoff has been huge, with some followers calling me up daily with literal tears of joy. They have just made the most money in their lives.

November has been the best month of the year, up 10% from the October low, and it's only half over.

And here is the good news. We are not only in the first inning of a new bull market for all risk assets but also the first pitch of the first at-bat of the first inning. 2024 should be one of the easiest trading years in a decade. This could go on for a decade.

This is how things will play out.

After the hottest quarter of GDP growth in three years at 4.9% in Q3, the economy is slowing. Virtually every business sector is seeing sales weaken, especially real estate and EVs.

That sets up a sharp drop in the inflation rate from the current 3.2% to the Fed’s target of 2%. Get a few months of that and the Fed starts cutting interest rates from the current 5.25%-5.5%. Fed futures are currently indicating a 40% probability that will happen in March.

We could be at 4.0% overnight interest rates by the end of 2024 and 3.0% by the end of 2025 when they stabilize. Stocks and bonds will eat this up.

Better hope that the Fed stays data dependent as promised, because coming data is weak, even if it doesn’t arrive for months. We only need one weak quarter to kill off inflation, and that quarter began on October 1.

Priority One is for the Fed to de-invert the yield curve or get short-term interest rates below long rates. For encouragement, the Fed should look at the most rapidly shrinking money supply in history, which I have been glued to.

There has been no monetary growth for two years, and zero bank deposit growth for three years. The Fed's balance sheet has plunged by $1.5 trillion in 18 months. Fed quantitative tightening continues at $120 billion a month. This is unprecedented in economic history.

The biggest risk to markets is that Powell delays cutting rates as much as he delayed raising rates two years ago. This is a very slow-moving, backward-looking Fed.

If you have a ten-year view of the markets, as I do, this is all meaningless. You need to buy stocks right now. If the Fed does play hardball and rigidly holds to the 2% target it risks causing a recession.

If you see any reasons to shoot down my bull case please, please email me. I’d love to hear them.

It’s not that stocks are expensive. 2024 S&P 500 (SPY) earnings are now 18X. If you take out the Magnificent Seven, they are at 15X earnings, close to the 2008 crash low. Small cap stocks are at a bargain basement 12X earnings and are already priced for recession.

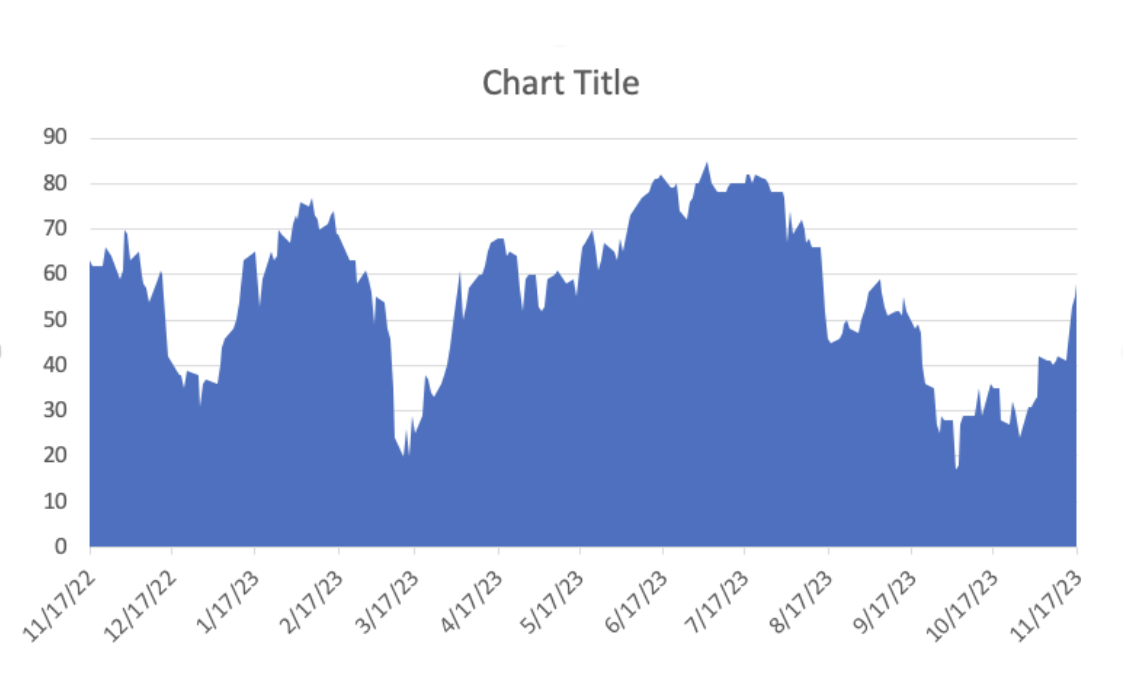

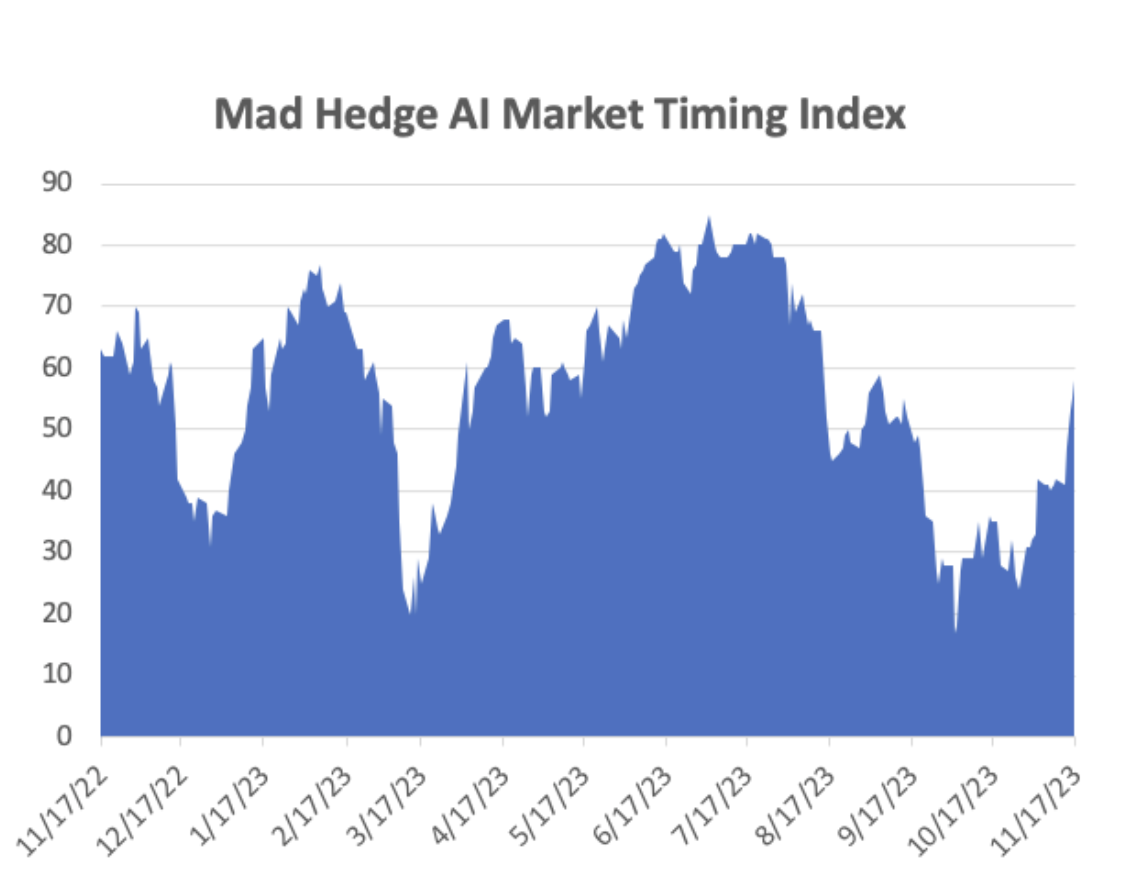

So a strong case for a new decade-long bull market is there. All you have to do is believe it. To see how this will play out look at the chart below as tech stocks are now extremely overbought short term. We no longer have the luxury of waiting for big dips. Small ones will have to do.

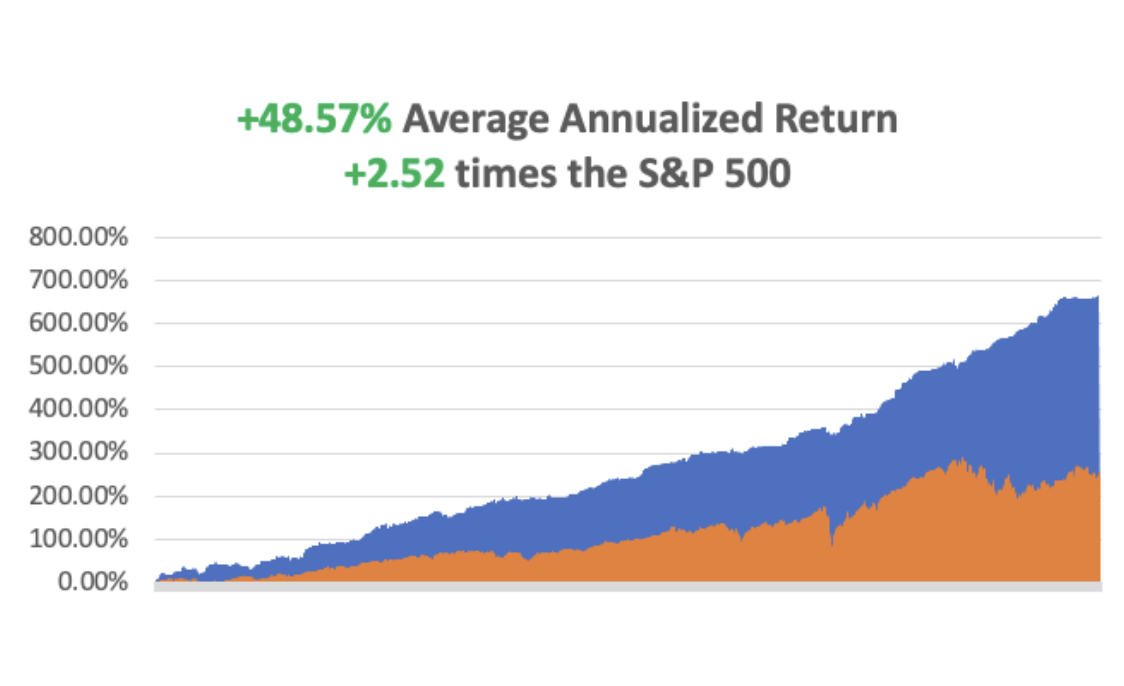

So far in November, we are up a breathtaking +12.59%. My 2023 year-to-date performance is still at an eye-popping +78.76%. The S&P 500 (SPY) is up +18.42% so far in 2023. My trailing one-year return reached +85.42% versus +20% for the S&P 500.

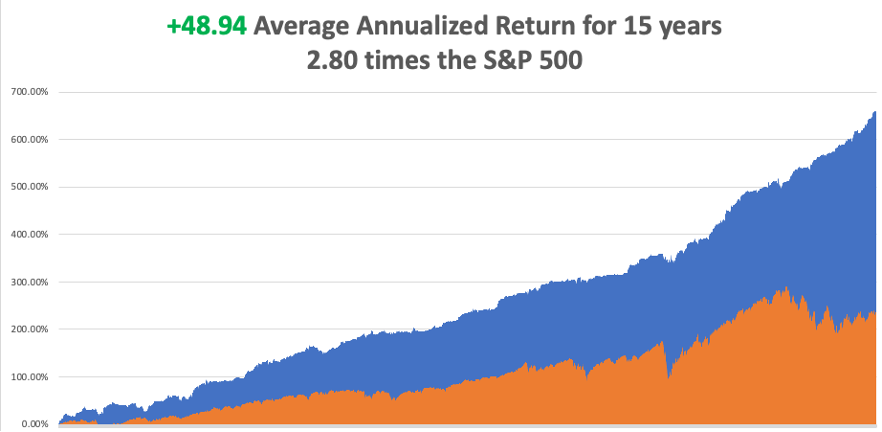

That brings my 15-year total return to +675.95%. My average annualized return ballooned to +48.57%, another new high, some 2.52 times the S&P 500 over the same period.

Some 60 of my 65 trades this year have been profitable.

CPI Comes in Flat at 3.2%, much weaker than expected. This is a game-changer. The first Fed rate cut has been moved up to May. Stocks and bonds loved it, taking ten-year US Treasury yield down to a six-week low at 4.44%. Shelter prices, which make up about a third of the overall CPI index, climbed 0.3%, half the prior month’s pace. Taking profits on my long in (TLT).

Fed to Cut Interest Rates as Early as March, or so says the futures market, which gives this a 40% probability. The (TLT) should top $100 and stocks will rocket, especially the interest sensitives. The most recent indications on the CME Group’s FedWatch gauge point to a full percentage point of interest rate cuts by the end of 2024.

Weekly Jobless Claims Hit Three Month High, up 13,000 to 231,000, as the US economy backs off from the superheated Q3. The path for a lower inflation rate is opening up. Do I hear 2%.

PPI Fell by 0.5% in October, a much bigger than expected drop, a three-year low. Inflation is fading fast. YOY came in at 1.3%. Stocks loved the news. 2024 is shaping up to be a great year for risk after two miserable ones.

Government Shutdown Delayed Until 2024, with the passage of a temporary spending bill by the House. It looks like there is a new coalition of the middle of both parties, as the bill passed with 339 votes, topping a two-thirds majority. The Johnson bill would fund some parts of the government through Jan. 19 and others through Feb. 2, setting up the possibility of yet another shutdown deadline on Groundhog Day.

The US Dollar (UUP) Takes a hit as the falling interest rate scenario starts to unfold. Even the Japanese yen rose. This could be a new decade-long trade. Currencies with falling interest rates are always the weakest.

Goldman Sachs Goes Bullish on Gold. The investment bank expects the S&P GSCI, a commodities markets index, to deliver a 21% return over the next 12 months as the broader economic environment improves, OPEC moves to support crude prices as refining is tight and with energy and gold acting as hedges against supply shocks. Buy (GLD), (GDX), and (GOLD) on dips.

Copper Bull Predicts 80% Gain in the Coming Decade, to $15,000 per metric tonne, up from $8,277 says Trafigura’s Kotas Bintas, the world’s largest metal trader. Exploding demand from EV makers is the reason, set to hit 20 million vehicles a year. Electrification of global energy sources is another. Buy (FCX) on dips.

Boeing Lands Monster Order, some $52 billion from Emirates Airlines for 90 new 777x’s and five 787’s. The stock rose 5% on the news. A giant China order is also lurking in the wings. Buy (BA) on dips.

Moody’s Rating Service Downgrades the US, citing deteriorating fiscal conditions and worsening chaos in Washington. However, it maintained its AAA Rating. Oh, and the government shut down on Friday. Buy (TLT) on the dip. Where else are investors going to go for quality?

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, November 20, no data of note were published.

On Tuesday, November 21 at 11:00 AM EST, the Minutes from the previous Fed meeting are released.

On Wednesday, November 22 at 8:30 AM, the Durable Goods are published.

On Thursday, November 23 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, November 24 at 2:30 PM the November S&P Flash PMI’s are published and the Baker Hughes Rig Count is printed.

As for me, I was invited to breakfast last week at the Incline Village Hyatt Hotel and was told to expect someone special, but they couldn’t tell me who for security reasons.

I was nursing a strong black coffee when a bulky figure with white hair wearing a Hawaiian shirt and thermal vest sat down at the table. It was Mike Love, lead singer of the Beach Boys.

During the 1950s, Mike’s dad was a regular visitor to Lake Tahoe, bringing his family up to camp on the then-vacant beaches. My family couldn’t have been far away.

When Mike made his fortune with one of the top rock groups of the 1960s, the natural thing to do was to buy an estate high up the mountain in Incline Village, Nevada with a great lake view. Like me, Mike fell for crystal-clear lake views in summer and spectacular snow-covered mountain vistas in winter. Local real estate agents refer to it as a “poor man’s Aspen.”

Mike ended up raising a family here, his kids eventually growing up and heading out to start their music groups. One was Wilson Phillips, made up of two of Mike’s daughters and the daughter of John Phillips of the Mamas and the Papas, who I taught how to swim at summer camp one year.

But Mike stayed. He loved the lake too much to leave so he made Incline his base for a touring schedule that ran up to a punishing 200 gigs a year.

Mike’s residence was something of a Tahoe insider’s secret. Those who knew where he lived kept the closely guarded secret. We have plenty of celebrities here, Larry Ellison, Mike Milliken, and Peoplesoft’s David Duffield, but Mike is the one everyone loves.

Mike, now 82, is not your typical rock star and I have known many. He is humble, self-effacing, and an alright guy. He avoided drugs and smoking to preserve his voice. He is a health fanatic. He has also been fighting a lifelong battle with depression which kept him off the touring circuit for years at a time and led to contemplations of suicide.

The Beach Boys formed in Hawthorne, California, a beachside suburb of Los Angeles in 1961. The group's original lineup consisted of brothers Brian, Dennis, and Carl Wilson, their cousin Mike Love, and friend Al Jardine. They were the original garage band. Together they created one of the greatest vocal harmonies of all time.

In 1963, the band enjoyed their first national hit with “Surfin USA”, beginning a string of top ten singles that reflected a southern California youth culture of surfing, cars, and teenage romance dubbed the “California sound.”

Those included "I Get Around", "Fun, Fun, Fun", "Help Me Rhonda", "Good Vibrations" and "Don't Worry Baby, which I’m sure you remember well. If you don’t, look them up on iTunes. Their 1966 album “Pet Sounds” was considered one of the most innovative ever produced.

I remember it like it was yesterday. They were one of the few groups that could stand up to the Beatles, who they became friends with. The Beach Boys were regulars on my car’s AM radio.

Buzz kill: the Beach Boys didn’t know how to surf.

All of the early Beach Boys songs were inspired by the Southern California beaches, but only half the country had beaches. So a new manager encouraged them to sing about cars, extending the life of the group by another decade. That is how we got “Little Deuce Coup,” and “409.” After all, the entire country owned cars.

The Beach Boys would eventually sell 100 million records second only to the Beatles. They were also one of the first groups to wrest production control away from the studios, a revolution for the industry that opened doors for generations of successive musicians.

In the late 1960s, the group took a religious bent, traveling to India to study under the celebrity guru Maharishi Mahesh Yogi. Mike has since been practicing transcendental meditation, and it probably saved his life.

By the 1970s, the California sound faded and was eventually killed off by disco. Their last album together was Endless Summer in 1974.

There are only three original Beach Boys left, and Mike Love alone is still touring. In 1983, Dennis Wilson drowned in a boating accident which is thought to be drug-related. In 1998, Carl Wilson died of lung and brain cancer after years of heavy smoking.

Mike was pleased that I recalled his 1980 London concert at Wembley Stadium. I had front-row seats; unaware that I would meet Mike 43 years later. In 1988, Mike was inducted into the Rock and Roll Hall of Fame.

Mike was very annoyed by the pandemic shutdown in 2020 because it prompted the cancelation of over 200 concerts worldwide. He still thinks Covid was fake. He doesn’t need to work as his royalties from 60 years of work are worth a fortune. He tours simply for the love of it.

Mike is now touring with a reconstituted Beach Boys. For their tour schedule, please click here. On November 17, 2023, Love released a special double album entitled “Unleash the Love” featuring 13 previously unreleased songs and 14 Beach Boys classics.

It was a pleasant way to spend a morning recalling the 1960s. It’s a miracle we both survived. It’s all proof that if you live long enough, you meet everyone.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

October 10, 2023

Fiat Lux

Featured Trade:

(FRIDAY, OCTOBER 13 KIEV, UKRAINE GLOBAL STRATEGY LUNCHEON)

(WILL SPACEX BE YOUR NEXT TEN BAGGER?)

(EBAY), (TSLA), (SCTY), (BA), (LMT)

I am constantly on the lookout for ten baggers, stocks that have the potential to rise tenfold over the long term.

Look at the great long-term track records compiled by the most outstanding money managers, and they always have a handful of these that account for the bulk of their outperformance, or alpha, as it is known in the industry.

I’ve found another live one for you.

News came out last week that Elon Musk’s SpaceX has just landed a $70 million contract with the Department of Defense for the creation of its military Star Shield satellite network.

Elon Musk’s SpaceX is so forcefully pushing forward rocket technology that he is setting up one of the great investment opportunities of the century.

In the past decade, his start-up has accomplished more breakthroughs in advanced rocket technology than seen in the last 60 years, since the golden age of the Apollo space program.

As a result, we are now on the threshold of another great leap forward into space. Musk’s ultimate goal is to make mankind an “interplanetary species.”

There is only one catch.

SpaceX is not yet a public company, being owned by a handful of fortunate insiders and venture capital firms. But you should get a shot at the brass ring someday.

The rocket launch and satellite industry is the biggest business you have never heard of, accounting for $200 billion a year in sales globally. This is probably because there are no pure stock market plays.

Only two major companies are public, Boeing (BA) and Lockheed Martin (LMT), and their rocket businesses are overwhelmed by other aerospace lines.

The high value-added product here is satellite design and construction, with rocket launches completing the job.

Once dominated by the US, the market for launches has long since been ceded to foreign competitors. The business is now captured by Europe (the Arianne 5), and China (the Long March 5). Space business for Russia and its Angara A5 rocket abruptly ended with its invasion of Ukraine.

Until recently, American rocket makers were unable to compete because decades of generous government contracts enabled costs to spiral wildly out of control.

Whenever I move from the private to the governmental sphere, I am always horrified by the gross indifference to costs. This is the world of the $10,000 coffee maker and the $20,000 toilet seat.

Until 2010, there was only a single US company building rockets, the United Launch Alliance (ULA), a joint venture of Boeing and Lockheed Martin. ULA builds the aging Delta IV and Atlas V rockets.

The vehicles are launched from Cape Canaveral, Florida and Vandenberg Air Force Base in California, both of which I had the privilege to witness. They look like huge Roman candles that just keep on going until they disappear into the blackness of space.

Enter SpaceX.

Extreme entrepreneur Elon Musk has shown a keen interest in space travel throughout his life. The sale of his interest in PayPal, his invention, to eBay (EBAY) in 2002 for $165 million, gave him the means to do something about it.

He then discovered Tom Mueller, a childhood rocket genius from remote Idaho who built the largest ever amateur liquid-fueled vehicle, with 13,000 pounds of thrust. Musk teamed up with Mueller to found SpaceX in 2002.

Two decades of grinding hard work, bold experimentation, and heart-rending testing ensued, made vastly more difficult by the 2008 Great Recession.

SpaceX’s Falcon 9 first flew in June 2010 and successfully orbited Earth. In December 2010, it launched the Dragon space capsule and recovered it at sea. It was the first private company ever to accomplish this feat.

Dragon successfully docked with the International Space Station (ISS) in May 2012. NASA has since provided $440 million to SpaceX for further Dragon development.

The result was the launch of the Dragon V2 (no doubt another historical reference) in May 2014, large enough to carry seven astronauts.

The largest SpaceX rocket now in testing has Mars capability, the 27-engine, 394-foot-high Starship, the largest rocket ever built.

Commit all these names to memory. You are going to hear a lot about them.

Musk’s spectacular success with SpaceX can be traced to several different innovations.

He has taken the Silicon Valley hyper-competitive ethos and financial model and applied it to the aerospace industry, the home of the bloated bureaucracy, the no-bid contract, and the agonizingly long time frame.

For example, his initial avionics budget for the early Falcon 1 rocket was $10,000 and was spent on off-the-shelf consumer electronics. It turns out that their quality had improved so much in recent years they met military standards.

But no one ever bothered to test them. $10,000 wouldn’t have covered the food at the design meetings at Boeing or Lockheed Martin, which would have stretched over the years.

Similarly, Musk sent out the specs for a third-party valve actuator no more complicated than a garage door opener, and a $120,000, one-year bid came back. He ended up building it in-house for $3,000. Musk now tries to build as many parts in-house as possible, giving it additional design and competitive advantages.

This tightwad, full speed ahead and damn the torpedoes philosophy overrides every part that goes into SpaceX rockets.

Amazingly, the company is using 3D printers to make rocket parts, instead of having each one custom-made.

Machines guided by computers carve rocket engines out of a single block of Inconel nickel-chromium super alloy, foregoing the need for conventional welding, a frequent cause of engine failures.

SpaceX is using every launch to simultaneously test dozens of new parts on every flight, a huge cost saver that involves extra risks that NASA would never take. It also uses parts that are interchangeable for all its rocket types, another substantial cost saver.

SpaceX has effectively combined three nine-engine Falcon 9 rockets to create the 27-engine Falcon Heavy, the world’s largest operational rocket. It has a load capacity of a staggering 53 metric tons, the same as a fully loaded Boeing 737 can carry. It has half the thrust of the gargantuan Saturn V moon rocket that last flew in 1973.

Musk is able to capture synergies among his three companies not available to any competitor. SpaceX gets the manufacturing efficiencies of a mass-production carmaker.

Tesla Motors has access to the futuristic space-age technology of a rocket maker. Solar City (SCTY) provides cheap solar energy to all of the above.

And herein lies the play.

As a result of all these efforts, SpaceX today can deliver what ULA does for 73% less money with vastly superior technology and capability. Specifically, its Falcon Heavy can deliver a 116,600-pound payload into low earth orbit for only $90 million, compared to the $380 million price tag for a ULA Delta IV 57, 156-pound launch.

In other words, SpaceX can deliver cargo to space for $772 a pound, compared to the $7,515 a pound UAL charges the US government. That’s a hell of a price advantage.

You would wonder when the free enterprise system is going to kick in and why SpaceX doesn’t already own this market.

But selling rockets is not the same as shifting iPhones, laptops, watches, or cars. There is a large overlap with the national defense of every country involved.

Many of the satellite launches are military in nature and top secret. As the cargoes are so valuable, costing tens of millions of dollars each, reliability and long track records are big issues.

Enter the wonderful world of Washington DC politics. UAL constructs its Delta IV rocket in Decatur, Alabama, the home state of Senator Richard Shelby, the powerful head of the Banking, Finance, and Urban Affairs Committee.

The first Delta rocket was launched in 1960, and much of its original ancient designs persist in the modern variants. It is a major job creator in the state.

ULA has no rocket engine of its own. So it bought engines from Russia, complete with blueprints, hardly a reliable supplier. Magically, the engines have so far been exempted from the economic and trade sanctions enforced by the US against Russia for its invasion of Ukraine.

ULA has since signed a contract with Amazon’s Jeff Bezos-owned Blue Origin, which is also attempting to develop a private rocket business but is miles behind SpaceX.

Musk testified in front of Congress in 2014 about the viability of SpaceX rockets as a financially attractive, cost-saving option. His goal is to break the ULA monopoly and get the US government to buy American. You wouldn’t think this is such a tough job, but it is.

Elon became a US citizen in 2002 primarily to qualify for bidding on government rocket contracts, addressing national security concerns.

NASA did hold open bidding to build a space capsule to ferry astronauts to the International Space Station. Boeing won a $4.2 billion contract, while SpaceX received only $2.6 billion, despite superior technology and a lower price.

It is all part of a 50-year plan that Musk confidently outlined to me 25 years ago. So far, everything has played out as predicted.

The Holy Grail for the space industry has long been the building of reusable rockets, thought by many industry veterans to be impossible.

Imagine what the economics of the airline business would be if you threw away the airplane after every flight. It would cost $1 million for one person to fly from San Francisco to Los Angeles.

This is how the launch business has been conducted since the inception of the industry in the 1950s.

SpaceX is on the verge of accomplishing exactly that. It will do so by using its Super Draco engines and thrusters to land rockets at a platform at sea. Then you just reload the propellant and relaunch.

What's coming down the line? A SpaceX cargo business where you can ship high value products like semiconductors from Silicon Value to Australia in 30 minutes, or to Europe in 20 minutes.

Talk about disruptive innovation with a turbocharger!

The company has built its own spaceport in Brownsville, Texas that will be able to launch multiple rockets a day.

The Hawthorne, CA factory (where I charge my own Tesla S-1 when in LA) now has the capacity to build 160 rockets a year. This will eventually be ramped up to hundreds.

SpaceX is the only organization that offers a launch price list on its website (click here for that link), as much as Amazon sells its books. The Falcon 9 will carry 28,930 pounds of cargo into low earth orbit for only $60.2 million. Sounds like a bargain to me.

This no doubt includes an assortment of tax breaks, which Musk has proven adept at harvesting. Elon has been a quick learner of the ways of Washington.

Customers have included the Thai telecommunications firm, Rupert Murdock’s Sky News Japan, an Israeli telecommunications group, and the US Air Force.

So when do we mere mortals get to buy the stock? Analysts now estimate that SpaceX is worth up to $200 billion.

The current exponential growth in broadband and SpaceX’s Starlink will lead to a similar growth in satellite orders, and therefore rocket launches. So the commercial future of the company looks especially bright.

However, Musk is in no rush to go public. A permanent, viable, and sustainable colony on Mars has always been a fundamental goal of SpaceX. It would be a huge distraction for a publicly managed company. That makes it a tough sell to investors in the public markets.

You can well imagine that the next recession would bring cries from shareholders for cost-cutting that would put the Mars program at the top of any list of projects to go on the chopping block. So Musk prefers to wait until the Mars project is well established before entertaining an IPO.

Musk expects to launch a trip to Mars by 2027 and establish a colony that will eventually grow to 80,000. Tickets will be sold for $500,000. Click here for the details.

There are other considerations. Many employees and early venture capital investors wish to realize their gains and move on. Public ownership would also give the company extra ammunition for cutting through Washington red tape. These factors point to an IPO that is earlier than later.

On the other hand, Musk may not care. The last net worth estimate I saw for his net worth was $300 billion. If his many companies increase in value by ten times over the next decade, as I expect, that would increase his wealth to $3 trillion, making him the richest person in the world by miles.

If an IPO does come, investors should jump in with both boots. While the value of the firm may have already increased tenfold by then, there may be another tenfold gain to come. Get on the Elon Musk train before it leaves the station.

To describe Elon as a larger-than-life figure would be something of an understatement. Musk is the person on which the fictional playboy/industrialist/technology genius, Tony Stark in the Iron Man movies, has been based.

Musk has said he wishes to die on Mars, but not on impact. Perhaps it would be the ideal retirement for him, say around 2045 when he will be 75.

To visit the SpaceX website, please click here. It offers very cool videos of rocket launches and a discussion with Elon Musk on the need for a Mars mission.

Global Market Comments

August 15, 2023

Fiat Lux

Featured Trades:

(THE TOP SIX CHINESE RETALIATION TARGETS),

(AAPL), (GM), (WMT), (TGT), (BA), (SBUX), (CAT),

(AND MY PREDICTION IS….)

CLICK HERE to download today's position sheet.

Global Market Comments

June 23, 2023

Fiat Lux

Featured Trades:

(JUNE 21 BIWEEKLY STRATEGY WEBINAR Q&A),

(AAPL), (ABNB), (GLD), (BA), (CAT), (DE), (X), (PYPL), (SQ), (MSFT), (GD), (GE), (INDA), (META) (GOOGL), (CCI), (NVDA), (ABNB), (SNOW), (PLTR), (TSLA)

CLICK HERE to download today's position sheet.

Below please find subscribers’ Q&A for the June 21 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe, NV.

Q: When do we buy Nvidia (NVDA) and Tesla (TSLA)?

A: On at least a 20% dip. We have had ballistic moves—some of the sharpest up moves in the history of the stock market for large stocks—and certainly the greatest creation of market caps since the market was invented under the Buttonwood Tree in 1792 at 68 Wall Street. Tesla’s almost at a triple now. Tripling one of the world's largest companies in 6 months? You have to live as long as me to see that.

Q: Is it a good time to invest in Bitcoin?

A: No, absolutely not. You only want to invest in Bitcoin when we have an excess of cash and a shortage of assets. Right now, we have the opposite, a shortage of cash and an excess of assets, and that will probably continue for several years.

Q: Should I short Apple (APPL)?

A: Only if you’re a day trader. It’s hugely overbought for the short term, but still in a multiyear long-term uptrend. I think we could see Apple at $300 in the next one or two years.

Q: Is it better to focus on single stocks or ETFs?

A: Single stocks always, because a single stock will outperform a basket that's in an ETF by 2 to 1 or even 3 to 1. That's always the case; whenever you add stocks to a basket, it diversifies risk and dilutes the performance. Better to just own Tesla, and if you want to diversify, diversify to Nvidia, but then I live next door to these two companies. That's what I tell my friends. You only diversify if you don’t know what is going to happen, which is most investors and financial advisors.

Q: Is the bottom of the housing market in, and are we due for a spike in home prices when interest rates can only go lower?

A: Yes, absolutely. In fact, we will enter a new 10-year bull leg for housing because we have a structural shortage of 10 million homes and 82 million millennials desperately trying to buy them at any price. I just got a call from my broker and she is panicking because she is running out of inventory. Even the lemons are starting to move.

Q: When do you think energy will rise?

A: Falling interest rates could be a good key because it sets the whole global economy on fire and increases energy demand.

Q: Outlook for the S&P 500 (SPY) second half of the year?

A: We hit 4,800 at least, maybe even higher. That's about a little more than 10% from here, so it’s not that much of a stretch, not like it was at the beginning of the year when it needed to rise 25% to reach my yearend target.

Q: Best time to invest from here on?

A: Either a 10% pullback in the market, or a sideways move of 3 months—that's called a time correction. It usually counts as a price correction because of course, over 3 months, earnings go up a lot, especially in tech.

Q: I’m seeing grains (WEAT) in rally mode.

A: Yes, that's true. They are commodities, and just like copper’s been rallying, and it’s yet another signal that we may get a much broader global commodity rally in everything: iron ore, coal, energy, gold, silver, you name it.

Q: Will inflation drop to 2%, causing stocks to go on another epic run?

A: The answer is yes, I do see inflation dropping to 2% —maybe not this year, but next year; not because of any action the Fed is doing, but because technology is hyper-accelerating, and technology is highly deflationary. The tech product you bought two years ago is now half the price, and they offer you twice as much functionality with an auto-renew for life. So, that is happening across the entire technology front and feeds into the inflation numbers big time, including labor. There's going to be a lot of labor replacement by machines and AI in the coming years.

Q: Is Airbnb (ABNB) a good stock to buy?

A: Well, if we’re going into the most perfect travel storm of all time, which is this summer, and which is why I’m going to remote places only like Cortina, Italy. Airbnb is the perfect stock to own. It’s a well-run company even in normal times.

Q: Should I buy gold here on the pullback?

A: Yes, you should. Gold is also highly sensitive to any decline in interest rates, and by the way: buy silver, it always moves 2.5x as much as the barbarous relic.

Q: How can inflation not go up if commodities and wage demands are going up due to state and federal unions? What about farm equipment and truck supplies? Costs keep rising, should we buy John Deere (DE)?

A: There are three questions here. Inflation will not go up because, though commodities will rise, they are only 0.6% of the $100 trillion global economy, or $660 billion in 2022. That will be more than offset by technology cutting prices, which is 30% of the stock market. You have to realize how important each individual element is in the global picture. And regarding wage demands going up caused by state and federal unions, less than 11.3% of the workforce is now unionized and that figure has been declining for 40 years. Most growth in the economy has been in non-unionized technology firms which largely depend on temporary workers, by design. What IS unionized is mostly teachers, the lowest paid workers in the economy, so incremental pay rises will be small. Unions were absolutely slaughtered when 25 million jobs were offshored to China during the Bush administration. Buy farm equipment and trucks? Absolutely, buy John Deere (DE) and buy Caterpillar (CAT) on the next dip. I was actually looking at Caterpillar for the next LEAPS the other day, but it’s already had a big run; I'm going to wait for a pullback before I get CAT and John Deere. So, again, people see headlines, see union wage headlines—I say focus on the 89% and not on the 11% if you want to make good decisions.

Q: Is Boeing (BA) a buy on the dip?

A: Yes, they got 1,000 new aircraft orders and the stock hasn't moved. So yes, if you get any kind of selloff down to $200, I'd be hoovering this thing up.

Q: Can you please explain how the profit predictor works?

A: It’s a long story; just go to our website, log in and do a search for “profit predictor,” and you’ll get a full explanation of how it works. It’s actually where Mad Hedge has been using artificial intelligence for 11 years, which is why our performance has doubled. Just for fun, I'll run the piece next week.

Q: Gold (GLD) is having a hard time going up because Russia is being squeezed by other governments. Since they need cash, they may be either selling their gold or stop buying new gold.

A: That is a good point, but at the end of the day, interest rates are the number one driver of all precious metals—period, end of story. We’re long gold too, I’ve got lots of gold coins stashed around the world in various safe deposit boxes, and I'm keeping them. I’ve got even more silver coins, which take up a lot of space.

Q: Do you like India (INDA) long term?

A: Yes, it’s the next China. But as Apple is finding out it is very difficult to get anything done there. A radical reforming Prime Minster Modi may be changing things there with his recent Biden visit and (GE) contract to build jet engines.

Q: What do you think of General Dynamics Corp (GD)?

A: I like General Dynamics because I think defense spending is in a permanent long term upcycle as a result of the Ukraine war. And it won’t end with the Ukraine war—the threat will always be out there, and the buying is done by not only us but all the other countries that think Russia is a threat.

Q: Do you like MP Materials Corp (MP)?

A: Yes, I do. The whole commodities space is ready to take off and go on fire.

Q: What about Square (SQ)?

A: The only reason I’m not recommending Square right now is huge competition in the entire sector, where all the stocks including PayPal (PYPL) are getting crushed. I will pass on Square for now, especially when I can buy US Steel (X) at close to its low for the year.

Q: If you had to pick one: Nvidia (NVDA), Tesla (TSLA), Microsoft (MSFT), Meta (META), and Google (GOOGL), which is the best to buy for next year?

A: All of them. Diversify. If I have to pick the top performer, it’s going to be either Tesla or Nvidia, probably Nvidia. But you need at least a 10% correction before you do anything. Actually, the split-adjusted price for our first (NVDA) recommendation eight years ago was $2 a share.

Q: Do you like Crown Castle International (CCI)?

A: Yes, I like it very much—it has very high dividend yield at 5.5%. The reason it hasn’t moved yet is that as long as interest rates are high, any REIT structure will suffer, and (CCI) has a REIT structure. Sure, it’s in a great sector—5G cell towers—but it is still a REIT nonetheless, and those will start to recover when interest rates go down; that’s why we did a 2.5-year LEAPS on CCI. For sure interest rates are going to go down in the next 2.5 years, and you will double your money on (CCI). That’s why we put it out.

Q: Which mid cap will do best over the long term: Airbnb (ABNB), Snowflake (SNOW), or Palantir (PLTR)?

A: That’s easy: Snowflake. They have such an overwhelming technology on the database and security front; I would be buying Snowflake all day long. Even Warren Buffet owns Snowflake, so that’s good enough for me.

Q: Could you comment on the pace of EV adoption/potential for (TSLA) robot fleet acceleration and implications for oil investments in holding pattern till the eventual collapse to near 0?

A: Yes, oil may collapse to near zero, but it may take twenty years to do it—that’s how long it takes to transition an energy source. That’s how long it took the move from horses and hay to gasoline-powered cars at the beginning of the 20th century. A national robot fleet of taxis with no drivers at all is a couple of years off. There are about 1,000 of them working in San Francisco right now, but they still have more work to do on the software. When it gets foggy, they often congregate at intersections causing traffic jams. Suffice it to say that eventually Tesla shares go to $1,000 and after that, $10,000—that’s my bet. By the way, my Tesla January 2025 $595-$600 LEAPS are starting to look pretty good.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

2018 in Australia

Global Market Comments

May 16, 2023

Fiat Lux

Featured Trades:

(LAST CHANCE TO ATTEND THE THURSDAY, MAY 18, 2023 TAMPA FLORIDA STRATEGY LUNCHEON)

(LOOKING AT THE LARGE NUMBERS)

(TLT), (TBT) (BITCOIN), (MSTR), (BLOK), (HUT)

CLICK HERE to download today's position sheet.

Global Market Comments

May 14, 2023

Fiat Lux

Featured Trades:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or I’M GOING ON STRIKE!)

(TSLA), (TLT), (AAPL), (BRK/B), (BA), (GOOGL)

CLICK HERE to download today's position sheet.

I think it’s time for me to go out on strike. I’m downing my tools, tearing up my punch card, and manning a picket line.

I get up at 5:00 AM every morning, well before the sun rises here on the west coast, looking for great low-risk high return trades. But for the last several weeks, there have been none, nada, bupkiss.

I have gotten spoiled over the last few years. The financial crisis, pandemic, recovery, and banking crisis provided me with an endless cornucopia of trading opportunities which doubled my average annualized return from 24% to a nosebleed 48.94%.

Part of the problem is that with a success rate of 90%, so much of the market is now copying my trades so that they are getting harder to execute. That wasn’t a problem when markets were booming. It is when trading volumes have shrunk dramatically, as they have done this year.

At The Economist magazine in London whenever plagiarism was discovered, they used to say that “Imitation is the sincerest former of flattery.”

There is no doubt that the economy is weakening, as the data has definitively shown over the last two weeks. It appears that after 500 basis points in interest rate rises in a year, the Fed’s harsh medicine is finally starting to work. The debt ceiling crisis, and regional banking crisis are scaring more investors further to the sidelines.

Notice how every stock market rally has become increasingly short-lived? Which all raises a heightened risk of recession.

Economies are like families. All are happy for the same reasons but are unhappy in myriad different ways.

In fact, they provide a generous helping of alphabet soup. If you look very closely, you can find some bay leaves, oregano, black pepper, and lots of V’s, W’s, U’s, and L’s.

Now, let’s play a game and see who can pick the letter that most accurately portrays the current economic outlook.

Here is a code key:

V – The very sharp collapse we saw in 2008 and again in 2020 is followed by an equally sharp recovery. I think it is safe to say we can now toss that one out the window. With technology hyper-accelerating, it is safe to write off the “V” recovery scenario.

W – The sharp recovery that began in October 2022 fails and we see a double dip back to those lows.

U – The economy stays at the bottom for a long time before it finally recovers.

L – The economy collapses and never recovers.

The question is, in which of these forecasts should we invest our hard-earned cash?

For a start, you can throw out the “L”. Every recession flushes out a lot of financial Cassandras who predict the economy will never recover. They are always wrong. Usually, they know more about marketing newsletters than economics.

I believe what we are seeing play out right now is the “W” scenario. This is the best possible scenario for traders, as it calls for a summer correction in the stock market when we can load the boat a second time. If you missed the October low you will get a second bite of the Apple (AAPL), both literally and figuratively.

If I’m wrong, we will get a “U”, a longer recovery. This cannot be dismissed lightly as the unemployment rate is clearly about to rise.

If I limited the outlook to only four possible scenarios, I’d be kidding you. The truth is far more complicated.

Each industry gets its own letter of the alphabet. Technology, some 27% of total stock market capitalization, gets no letter at all because it is thriving, thanks to the explosion of AI applications. That explains the single-minded pursuit of big tech by investors since January.

Someone asked me last week how long I would continue trading and I cited the example of Warren Buffett, who at 92 is 21 years older than me.

I have since found a better example.

Former Secretary of State under Nixon, Henry Kissinger, turns 100 this week, the only man in the world who President Biden, Vladimir Putin, and President Xi Jinping would immediately take a call from.

During the shuttle diplomacy between Israel and Egypt in 1974, I rode with the Secretary on Air Force One, then an antiquated Boeing 727, which is now in a museum in Seattle. For the rest of that story see below.

He gave me “Henry” privileges, while everyone else had to address him as “Mr. Secretary” because my knowledge of history exceeded that of anyone else then in the White House Press Corps, even those who had degrees in the subject.

It also helped that at that point I had already had six years of experience on the ground in the Middle East. It was all heady stuff for a journalist who at 22 was just starting out.

So, that sets the bar higher for me. The good news for you is that I’ll be sending out my wit, wisdom, and trade alerts for at least another 29 years.

So far in May, I have managed a modest +1.70% profit. My 2023 year-to-date performance is now at an eye-popping +63.45%. The S&P 500 (SPY) is up only a miniscule +8.15% so far in 2023. My trailing one-year return reached a 15-year high at +122.11% versus +6.70% for the S&P 500.

That brings my 15-year total return to +660.64%. My average annualized return has blasted up to +48.94%, another new high, some 2.80 times the S&P 500 over the same period.

Some 41 of my 44 trades this year have been profitable. My last 21 consecutive trade alerts have been profitable.

I initiated only one new trade last week, a long in Tesla (TSLA). That leaves me with my two remaining positions. Those include longs in Tesla and the bond market (TLT), which expires this coming Friday. I now have a very rare 80% cash position due to the lack of high-return, low-risk trades.

Treasury Secretary Yellen Warns of Economic Catastrophe, if the debt ceiling is not raised. Congress has voted 98 times to raise the debt ceiling to $31 trillion over 106 years to pay for money already spent. One-third of this was under the previous president who back then warned that he would default. It’s a grasp for power the House just doesn’t have. There really isn’t such a thing as a debt ceiling which has gained an importance far beyond its original housekeeping intention.

Boeing Lands Blockbuster 300 Plane Order, from Ireland’s Ryan Air worth $40 billion. Europe’s Top budget air carrier is loading up on the once troubled 737 MAX. Keeping buying (BA) on dips, now the world’s largest aircraft manufacturer.

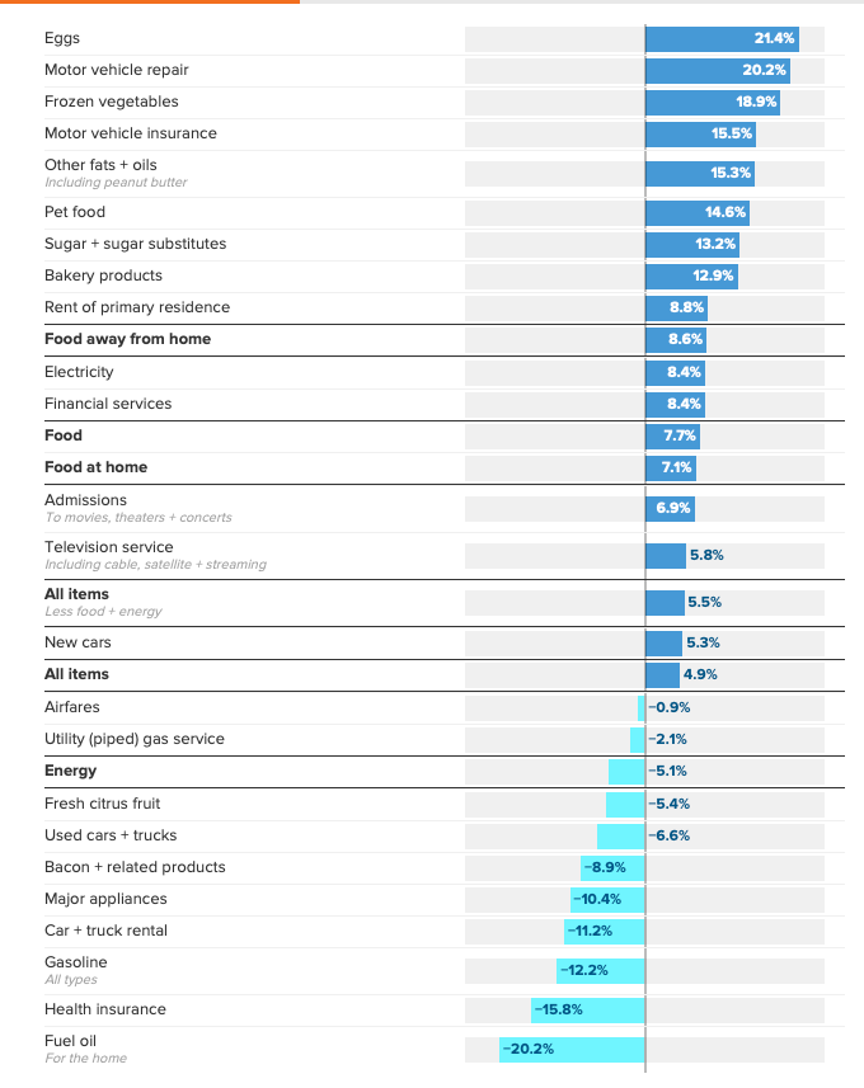

CPI Hits 4.9% YOY, after the 0.40% report for April. It’s still headed in the right direction as far as the Fed is concerned and puts a September cut on the table. Eggs were the leader, up 21.4%, while fuel oil is the laggard, down 20.2%. My own 4% inflation rate forecast by yearend is starting to look conservative. Perish the thought!

The Oil Collapse is Signaling a Recession, as is weakness in all other commodities, even lithium. Texas tea has plunged 22% I three weeks to a new two year low at $62. It’s one of the worst performing asset classes of 2023. Widespread EV adoption is finally making a big dent, as are the price wars there. OPEC Plus production cuts were unable to stem the decline. Buy (USO) on dips as an economic recovery play.

Is a Bank Short Selling Ban Coming? The Feds could bar hedge funds from launching raids on small regional bank shares with the aim of taking them to zero. Such a ban was enforced for all banks in 2008.

Elon Musk Appoints New Twitter CEO, removing a major management distraction. Linda Yaccarino is the new CEO of Twitter, poached from her from online advertising at NBC. This is a positive for Tesla, as it frees up the heavy burden of turning around Twitter from Musk, allowing him to devote more time to Tesla. It also reduced the risk that Musk will sell more Tesla shares to finance said turnaround. Guess who just got the worst job in the world? Buy (TSLA) on dips.

Weekly Jobless Claims jump to 264,000, a new 18 month high, providing another recession indicator.

US Budget Deficit Shrinks to $1.5 Trillion, down from a $3 trillion peak during the previous administration. Government Bond selling will drop by a similar amount. That’s still up $130 billion from 2022. Increased tax revenues from a recovering economy is the reason. Buy (TLT) on every dip.

Google Ramps Up AI Effort, launching a new suite of AI tools at its annual developer conference. With a 93% market share in online search (GOOGL) has a lot to defend. The stock popped 4% on the news.

FANGS to Rise 50% by Yearend, says Fundstrat’s ultra-bull Tom Lee. I think he’s right, once the debt ceiling debacle gets out of the way. The contribution of AI is being vastly underestimated.

Berkshire Hathaway (BRK/B) Earnings Soar, with operating earnings up 12.6% in Q1, but Warren Buffet expects business to slow. Many companies now have to unwind big pandemic inventories with aggressive sales, crimping inflation. That’s why Berkshire owns $130 billion in cash and Treasury bills.

My Ten Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, May 15 at 7:30 AM EST the NY Emore State Manufacturing Index is out.

On Tuesday, May 16 at 6:00 AM, Retail Sales are announced.

On Wednesday, May 17 at 11:00 AM the US Building Permits are printed.

On Thursday, May 18 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Producer.

On Friday, May 19 at 2:00 PM the University of Baker Hughes Rig Count is released.

As for me, Egypt and I have a long history together. However, when I first visited there in 1974, they tried to kill me.

I was accompanying US Secretary of State Henry Kissinger on Air Force One as part of his “shuttle diplomacy” between Tel Aviv and Cairo. Every Arab terrorist organization had vowed to shoot our plane down.

When we hit the runway in Cairo, I looked out the window and saw a dozen armored personnel carriers chasing us just down the runway. All on board suddenly got that queasy, gut-churning feeling, except for Henry.

When the plane stopped, they surrounded us, then turned around, pointing their guns outward. They were there to protect us.

The sighs of relief were audible. In a lifetime of heart-rending landings, this was certainly one of the most interesting ones. Those State Department people are such wimps! Henry was nonplussed, as usual.

As a result of the talks Israel eventually handed back Sinai in return for an American guarantee of peace which has held to this day. Egyptian president Anwar Sadat was assassinated by his own bodyguard for his efforts shortly afterwards.

Israel was so opposed to the talks that when I traveled to Tel Aviv, El Al Airline security made sure my luggage got lost. So the Israeli airline gave me $25 to buy replacement clothes until my suitcase was delivered. On that budget, all I could afford were the surplus Israeli army fatigues at the Jerusalem flea market.

A week later, my clothes still had not caught up with me when I boarded the plane with Henry. That meant walking the streets of Cairo in my Israeli army uniform. It would be an understatement to say that I attracted a lot of attention.

I was besieged with offers to buy my clothes. Egypt had lost four wars against Israel in the previous 30 years, and war souvenirs were definitely in short supply.

By the time I left the country, I was stripped bare of all Israeli artifacts, down to my towels from the Tel Aviv Hilton, and boarded the British Airways flight to London wearing a cheap pair of Russian blue jeans I had taken in trade.

Levi Strauss never had a thing to worry about.

The bewitching North African country today is still a prisoner of a medieval religion that has left its people stranded in the Middle Ages. While its GDP has doubled in the last 70 years, so has its population, to 110 million, meaning there has been no improvement per capital income at all in a half century. That is a staggering number for a country that is mostly desert.

In 2019, I took my two teenaged daughters to Egypt to visit the pyramids and ride camels as part of an impromptu trip around the world. My logic then was that at the current rate of climate change, this trip might not be possible in five years.

As it turns out, it was not possible in six months when the pandemic started.

We were immediately picked up by Egyptian Intelligence right at the gate who remembered exactly who I was. It seems they never throw anything out in Egypt.

After a brief interrogation where I disclosed my innocent intentions, they released us. No, I wasn’t working for The Economist anymore. Yes, I was just a retired old man with his children. They even gave us a free ride to the Nile Hilton where I spent my first honeymoon in 1977.

Some people will believe anything! And I never did get that suitcase back.Good luck and good trading!

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

2019 Over Sinai

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.