The S&P 500 is now at 1,564, and most strategist forecasts for the end of 2013 hover around 1,550-1,600, plus or minus some spare change. So the next nine months are going to be incredibly boring. Or they won?t.

Even in a bull market, one expects to see pullbacks of at least one third of the recent gain. Apply that logic towards the 224 points the (SPX) has tacked on since the November low, and that adds up to a 74 point, or a 4.7% correction down to 1,490.

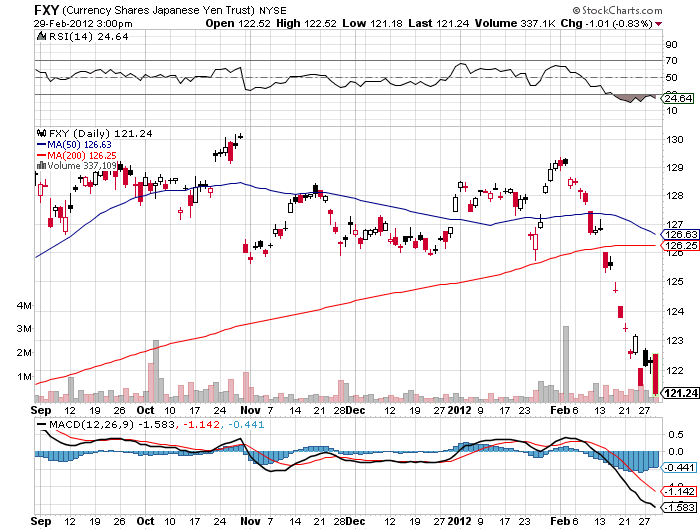

There is massive liquidity in the system, many individuals and institutions are underweight, and interest rates are still at incredibly low levels. It also appears that every foreign financial disaster results in more money getting sent to the US for safety.

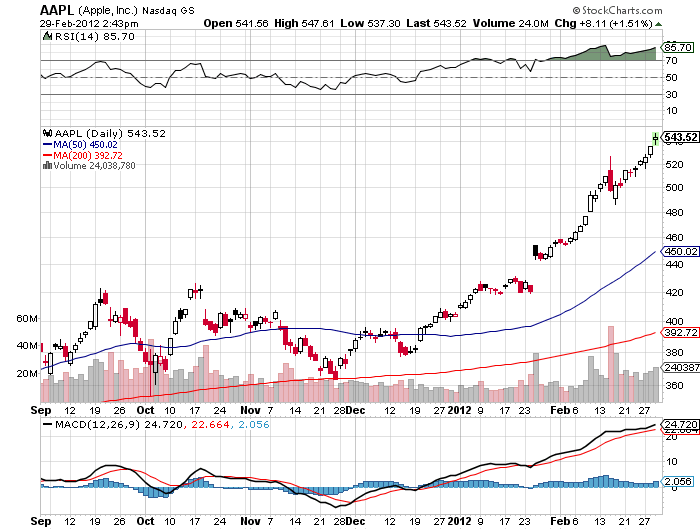

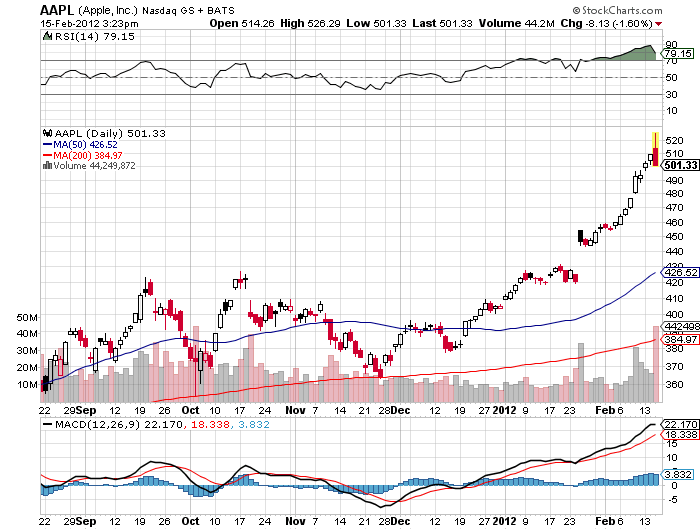

Usually, the (SPX) never rises more than 9% above the 200 day moving average without hitting a correction. This year is different. I can?t remember the last time the index spent this much time at that level without a pullback.

We are therefore likely to see a rolling type market top that unfolds over the next several months. That is in contrast to a spike top, which you can spot on a chart without your glasses from 20 feet away. These tops can be devilishly difficult to trade, with the limits defined more by time than price.

If you want to see what such a rolling top looks like, take a peak at the chart for my old friend, Dr. Copper, that great prognosticator of future economic activity. He put in such a rolling top during the first eight months of 2011, and has been trying to recover ever since, to no avail.

This no doubt reflects the slowing economy and the building copper inventories in China, where the red metal is widely used as a monetary instrument. China, in effect, is on a copper standard. It is rare to see the (SPX) going up and copper dropping like, well, a bar of copper.

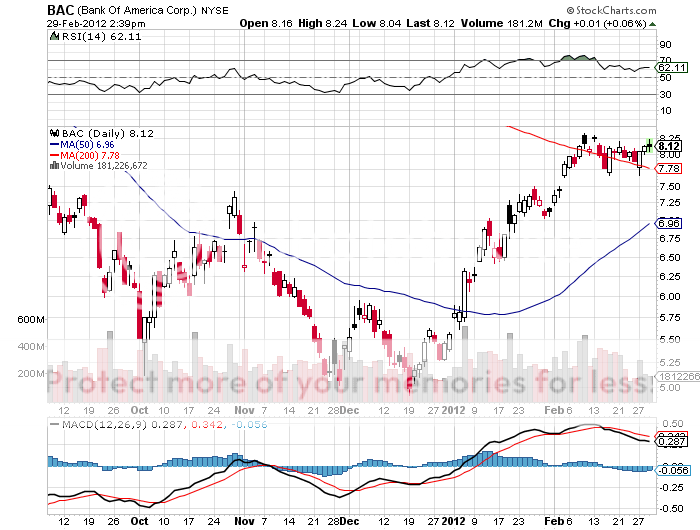

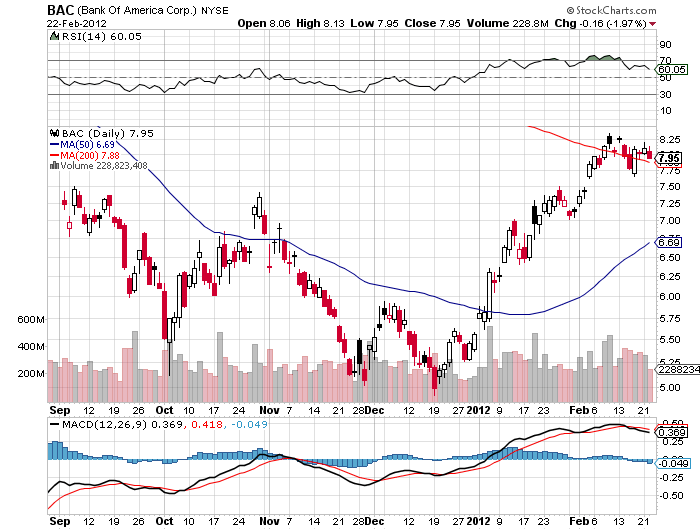

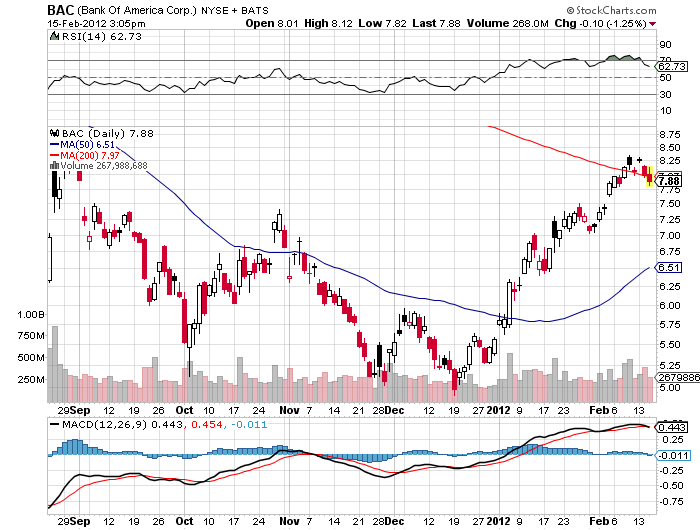

While the broader indexes are likely to deliver a rolling top, that is not the case with individual sectors and stocks. That means you can use these individual spikes to assist in your timing of the overall market. You need to watch the market leaders like a hawk, such as the financials and the transports. If Bank of America (BAC) and United Continental Group (UAL), suddenly crash and burn, you can bet the rest of the market won?t be far behind. This is one of the reasons why I have these two names in my model-trading portfolio, on which you should maintain your laser focus.

The consumer discretionary and retail sectors are two additional pathfinder sectors that are the most economically sensitive in the market, which also make great canaries in the coalmine. As long as consumers are packing MacDonald?s (MCD), Home Depot (HD), and Target (TGT), or burning up their Comcast (CMCSA) broadband connections buying stuff from Amazon (AMZN), you won?t see appreciable market weakness. Earnings disappointments at these businesses, which could start in three weeks, are another great precursor of market trouble.

Finally, there is another class of stocks that may lead the charge on the downside, and that is small caps. Look at the chart below for the ETF for the Russell 2000 (IWM). Small companies are always hardest hit in any slowdown because they are more highly leveraged and have less access to external financing, like bank loans and equity floatations. I made a bundle last year shorting the (IWM) into the ?Sell in May? market meltdown, and plan to do so again this year.

Of course, timing is everything, and I?ll tell you what worries me the most. The overdependence of this bull market on the largess of the Federal Reserve cannot be underestimated. Any hint that quantitative easing is about to join the dustbin of history will take the market with it.

The conventional wisdom is that our esteemed central bank won?t embark on this path until year-end. What if it surprises us with a June tightening? The bull market would die of an instant heart attack. What would trigger this? A blowout monthly nonfarm payroll number approaching 300,000, which would quickly take the headline unemployment rate close to the Fed?s publicly announced 6.5% target. With the economy perhaps growing at a 3% rate this quarter, such a development might be only a handful of Friday?s away.

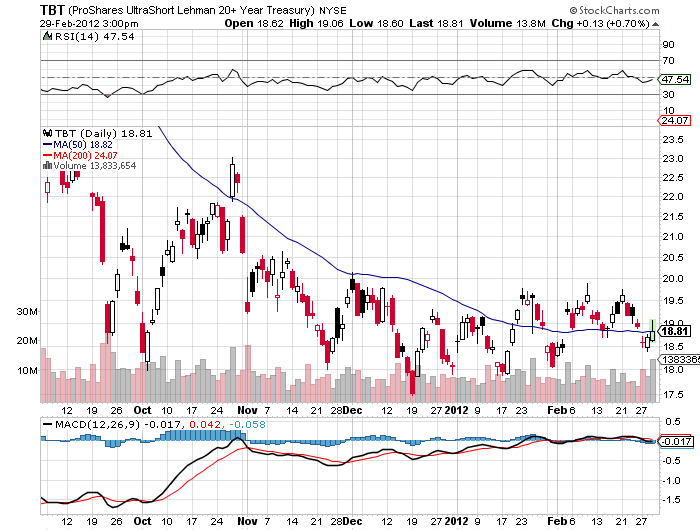

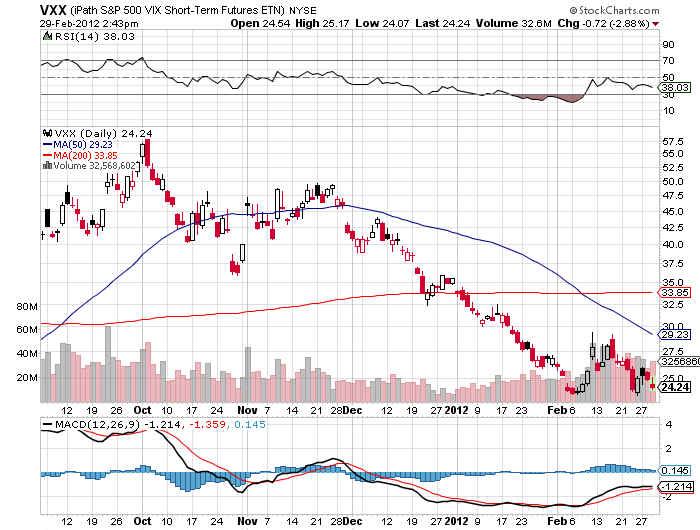

So how is the genius, aggressive hedge fund trader going to deal with these opaque markets? Bet that the market is going to stay in a broad range for a few more months. We aren?t going to the moon, nor are we going to crash. We are more likely to die of ice than fire. That?s what the volatility markets (VIX) are telling us.

There are several ways to play this kind of market. If you have a plain vanilla stock portfolio, you should be executing ?buy writes? against your existing holdings to take in extra premium income. With the bull move five months old, call options are trading at historically rich levels. This low risk, high return strategy involves selling short call options against existing stock positions. If your stock gets called away, you just say ?thank you very much? and buy it back on the way down.

For the more aggressive, you can add naked short sales of deep out of the money calls one month out. You don?t get rich with a strategy like this, but you earn a living.

You might also buy some deep out-of-the-money index puts for pennies. They are now trading near the cheapest prices in history. One market hiccup, and these things double very quickly.