One hundred years from now, historians will probably date the beginning of the fall of the American Empire to 1986.

That is the year President Ronald Reagan ordered Jimmy Carter's solar panels torn down from the White House roof, and when Chinese Premier Deng Xiaoping launched his top secret 863 program to make his country a global technology leader.

Is the End is Near for the US?

Is the End is Near for the US?

The big question today is who will win one of the biggest opportunities of our generation?

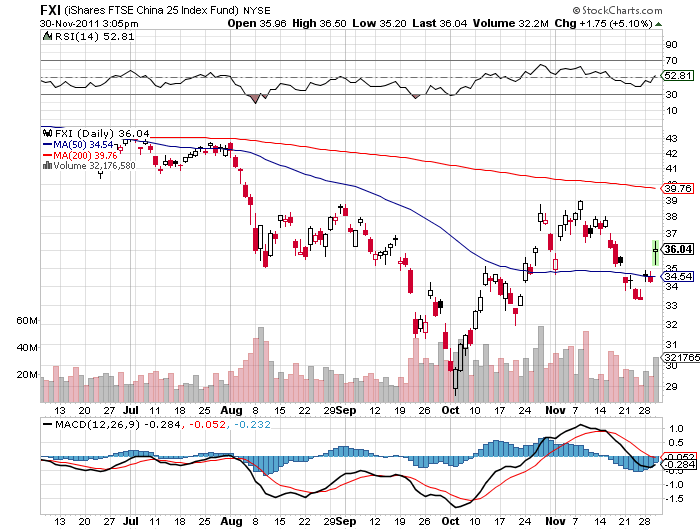

Some 32 years later, the evidence that China is winning this final battle is everywhere. China dominates in windmill power, controls 97% of the world's rare earth supplies essential for modern electronics, is plunging ahead with clean coal, and boasts the world's most ambitious nuclear power program.

It is a dominant player in high-speed rail and is making serious moves into commercial and military aviation. It is also cleaning our clock in electric cars, with more than 30 low cost, emission free models coming to the market by the end of 2013.

Looking from a distance, one could conclude that China has already won the technology war.

And the Winner Is...

General Motors (GM) pitiful entrant in this sweepstakes, the Chevy Bolt, has utterly failed to reach the firm's sales targets. Still, I receive constant emails from drivers who say they absolute love the cars, and at $36,620, with dealer discounts it IS cheap.

This is all far more than a race to bring commercial products to the marketplace. At stake is nothing less than the viability of our two economic systems.

By setting national goals, providing unlimited funding, focusing scarce resources, and letting engineers run it all, China can orchestrate assaults on technical barriers and markets that planners here can only dream about.

And let's face it, economies of scale are possible in the Middle Kingdom that would be unimaginable in America.

Nissan Leaf

Nissan Leaf

The laissez faire, libertarian approach now in vogue in the US creates a lot of noise, but little progress. The Dotcom bust dried up substantial research and development funding for technology for a decade.

While China was ramping up clean coal research, president Bush was closing down ours.

Toyota Plug-In Prius

Mention government involvement in anything these days and you get a sour, skeptical look. But this ignores the indisputable verdict of history.

Most of the great leaps forward in US economic history were the product of massive government involvement. I'm thinking of the transcontinental railroad, the Panama Canal, Hoover Dam, the atomic bomb, and the interstate highway system.

All of these were far too big for a private company ever to consider. If the government had not funneled billions in today's dollars into early computer research, your laptop today would run on vacuum tubes, be as big as a skyscraper, and cost $100 million.

I mention all of this not because I have a fascination with obscure automotive technologies or inorganic chemistry (even though I do).

Long time readers of this letter have already made some serious money in the battery space. This is not pie in the sky stuff; this is where money is being made now.

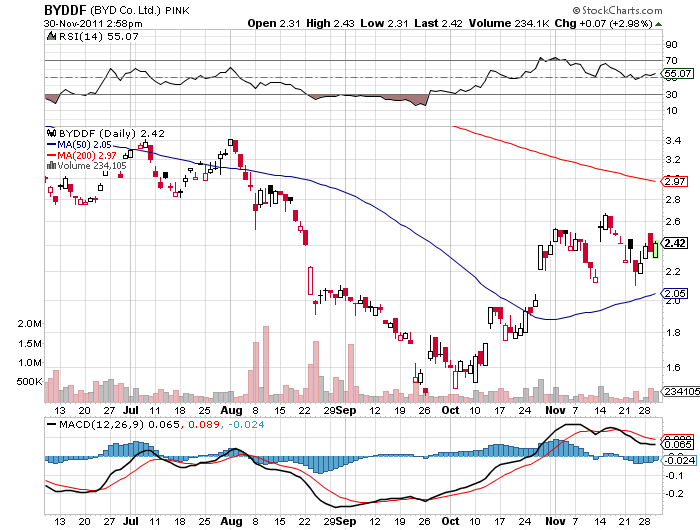

I caught a 500% gain by hanging on to Warren Buffet's coat tails with an investment in the Middle Kingdom's Build Your Dreams (BYDFF).

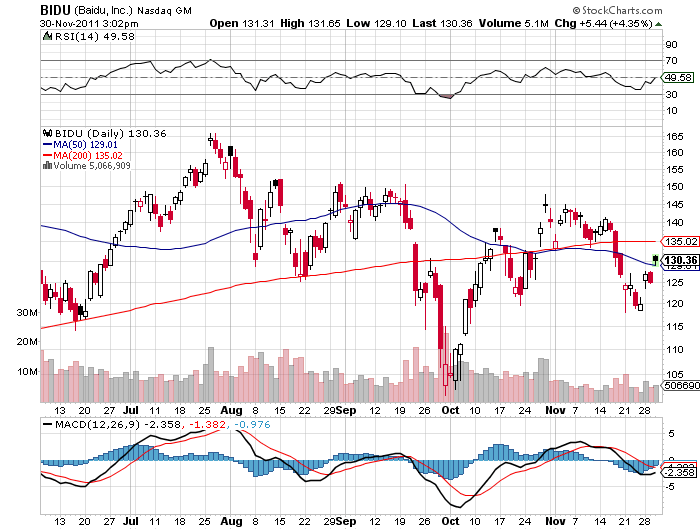

I followed with a 250% profit in Chile's Sociedad Qimica Y Minera (SQM), the world's largest lithium producer. Tesla's own shares have been the top performer in the US market in 2014, up from $16.50 to $392.

These are not small numbers. I have been an advocate and an enabler of this technology for 40 years, and my obsession has only recently started to pay off big time.

We're not talking about a few niche products here.

The research boutique, HIS Insights, predicts that electric cars will take over 15% of the global car market, or 7.5 million units by 2025. Even with costs falling, that means the market will then be worth $225 billion.

Electric cars and their multitude of spin off technologies will become a dominant investment theme for the rest of our lives. Think of the auto industry in the 1920's. (TSLA), (BYDDF), and (SQM) are just the appetizers.

All of this effort is being expended to bring battery technology out of the 19th century and into the 21st.

The first crude electrical cell was invented by Italian Alessandro Volta in 1759, and Benjamin Franklin came up with the term battery after his experiments with brass keys and lightning. In 1859, Gaston Plant discovered the formula that powers the Energizer bunny today.

Further progress was not made until none other than Exxon developed the first lithium-ion battery in 1977. Then, oil prices crashed, and the company scrapped the program, a strategy misstep that was to become a familiar refrain.

Sony (SNE) took over the lead with nickel metal hydride technology, and owns the industry today, along with Chinese and South Korean competitors.

Expect to hear a lot about the number 1,600 in coming years. That is the amount of electrical energy in a liter (0.26 gallons), or kilogram of gasoline expressed in kilowatt-hours.

A one-kilogram lithium-ion battery using today's most advanced designs produces 200 KwH. Stretching the envelope, scientists might get that to 400 KwH in the near future.

But any freshman physics student can tell you that since electrical motors are four times more efficient than internal combustion ones, that is effective parity with gasoline.

Since no one has done any serious research on inorganic chemistry since the Manhattan project, until Elon Musk came along, the prospects for rapid advances are good.

A good rule of thumb is that costs will drop my half every four years. So Tesla S-1 battery that costs $30,000 four years ago, will run $15,000 today, and only $7,500 in 2022.

Per Kilowatt battery costs are dropping like a stone, from $1,000 a kWh in the Nissan Leaf I bought eight years ago to $200 kWh in my new Tesla S-1.

In fact, the Tesla, it is such a revolutionary product that the battery is only the eighth most important thing.

The additional savings that no one talks about is that an electric motor with only eleven moving parts requires no tune-ups for the life of the vehicle.

This compares to over 1,000 parts for a standard gas engine. You only rotate tires every 6,000 miles. That's because the motor runs at room temperature, compared to 500 degrees for a conventional engine, so the parts last forever.

Visit the Tesla factory, and you are struck by the fact that there are almost no people, just an army of German robots. Few parts mean fewer workers, and lower costs.

All of the parts are made at the Fremont, CA plant, eliminating logistical headaches, and more cost. By only selling the vehicle online, the expense of a huge dealer network is dispatched.

The US government rates the S-1 as the safest car every built, a fact that I personally tested with my own crash. Consumer Reports argues that it is the highest quality vehicle every manufactured.

My Personal Crash Test

Indeed, the Tesla S-1 is already the most registered car in America's highest earning zip codes. Oh, and did I tell you that the car is totally cool?

The New Tesla 3

Hence, the need for government subsidies to get private industry over the cost/production hump.

Nissan, Toyota, Tesla, and others are all betting their companies that further progress and economies of scale will drive that cost down to below $100 per kWh.

That will make electric cars cheaper than conventional hydrocarbon powered ones by a large margin. The global conversion to electric happens much faster than anyone thinks.

In a desperate attempt to play catch up, President Obama lavished money on alternative energy, virtually, since the day he arrived in office.

His original 2010 stimulus package included $167 billion for the industry, enough to move hundreds of projects out of college labs and into production.

However, in the ultimate irony, much of this money is going to foreign companies, since it is they who are closest to bringing commercially viable products to market. Look no further than South Korea's LG, which received $160 million to build batteries for the GM Volt.

Since then, all subsidies for electric cars have been eliminated by the tax bill passed in December.

Fortunately, the US, with its massively broad and deep basic research infrastructure, a large military research establishment (remember the old DARPA Net?), and dozens of still top rate universities, is in the best position to discover a breakthrough technology.

The Energy Department has financed the greatest burst in inorganic chemistry research in history, with top rate scientists pouring out of leading defense labs at Los Alamos, Lawrence Livermore, and Argonne National Labs.

There are newly funded teams around the country exploring opportunities in zinc-bromide, magnesium, and lithium sulfur batteries. A lot of excitement has been generated by lithium-air technology, as well as much controversy.

In the end, it may come down to whether our Chinese professors are smarter than their Chinese professors.

In 2007, the People's Republic took the unprecedented step of appointing Dr. Wan Gan as its Minister of Science and Technology, a brilliant Shanghai engineer and university president, without the benefit of membership in the communist party.

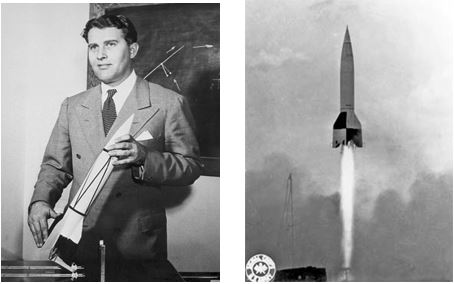

Battery development has been named a top national priority in China. It is all reminiscent of the 1960's missile race, when a huge NASA organization led by Dr. Werner Von Braun beat the Russians to the moon, proving our Germans were better than their Germans.

Consumers were the ultimate winners of that face off as the profusion of technologies the space program fathered pushed standards of living up everywhere.

I bet that's how this contest ends as well. The only question is whether the operating instructions will come in English or Mandarin.