Gazing into the future, investors know it’s time to deploy strategies to make money in 2019.

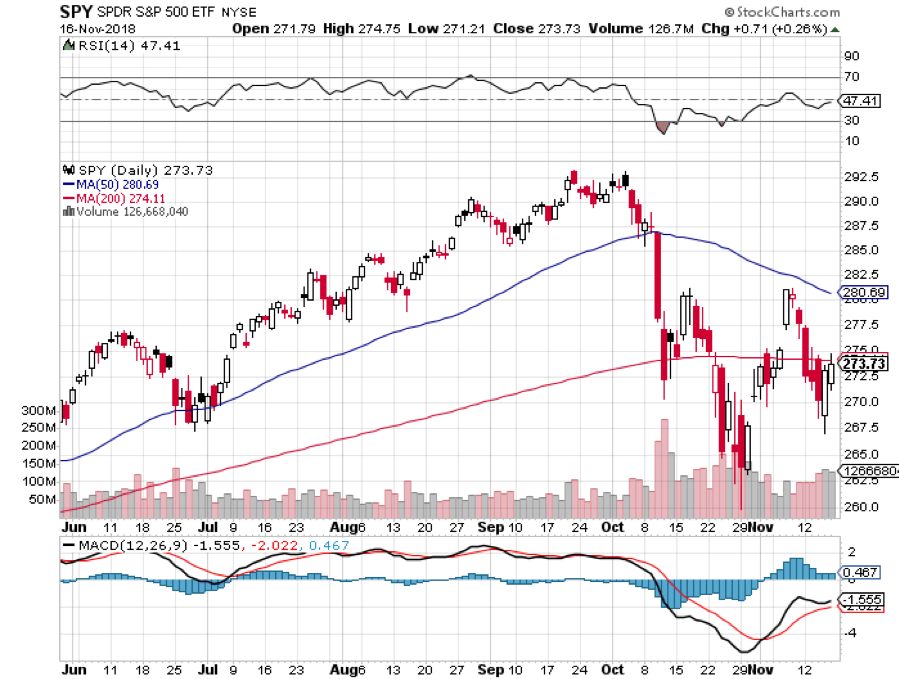

This year has been a bizarre one for technology stocks.

The industry was overwhelmed by a relentless geopolitical circus that had more sway on tech stock’s price action than in any year that I can remember.

Technology stocks have never been more intertwined with politics.

The so-called FANGs have really been taken out behind the woodshed and beaten, and their get-out-of-jail card is no longer free to access with politicians eyeing them as take down targets.

They are no longer invincible even if they still earn bucket loads of money.

A good amount of the public animosity towards the big tech companies has been directed to socially awkward CEO of Facebook Mark Zuckerberg and his negligence towards the concept of personal data.

Facebook was once the best company in technology to work, I can tell you now that prospective applicants are scrutinizing Facebook’s actions with a gimlet eye and turning to other opportunities.

Current Facebook employees are putting in feelers out to former colleagues planning optimal exit strategies.

Remember that it’s not my job to always tell you which tech stocks are going up, but also to tell you which tech stocks are going down.

One stock poised to outperform in 2019 is international FinTech company PayPal (PYPL).

The stock has proven to be Teflon-like deflecting the pronounced volatility that has soured the tech sector in the second half of the year.

The pendulum of regulation-flipping will concoct new winners for 2019 and I believe PayPal is one of them.

PayPal is in a dominant market position with a core customer base of 254 million users and growing.

The company is so dominant that it processes almost 30% of all global payments excluding China where foreign companies are barred from operating in the FinTech space.

The quality of the product is demonstrated by a recent note from research firm Nielsen offering data showing that on average, PayPal customers complete transactions 88.7% of the time.

This astoundingly high number for PayPal checkout conversion is about 60% better than “other digital wallets” and 82% better than “all payment types."

PayPal’s home country, United States, is still vastly unmonetized in terms of the breadth of penetration of online and e-commerce payments.

America has failed so far to adopt the amount of FinTech that Chinese consumers have rapidly embraced.

The great news is that late-stage adoption of FinTech services will offer PayPal a path to profits that bodes well for the earnings and its share price in 2019 and beyond.

Investors can expect total payment volumes (TPV) consistently nudging up in the mid-20% range.

The firm helmed by Dan Schulman is just scratching the surface on pricing power.

PayPal has changed its approach of ‘one‐size‐fits‐all’ in merchant contracts to a dynamic pricing model reflecting the value‐add of recently acquired products that are more powerful.

Jetlore, launched in 2014, is a provider of predictive artificial intelligence for retail companies able to comb through the data to help boost sales.

Hyperwallet distributes payments to those that sell online, and its purchase was centered around protecting the company's core business, enabling marketplaces to pay into PayPal accounts.

iZettle, an international mobile point-of-sale (POS) provider, is better known as the Square of Europe and has a large footprint. The relationship in PayPal has sounded alarm bells in Britain for being too dominant.

Simility, an AI-based fraud prevention specialist, round out a comprehensive list of new tools and services to PayPal’s all-star caliber lineup that can offer upgrades to businesses through a hybrid solution.

This positivity surrounding the sum of the parts will allow the company to build custom solutions for merchants of all sizes.

Augmenting a solid, stable business is a start-up inside of PayPal’s umbrella of assets with enormous growth potential called Venmo making up one of PayPal’s large future bets.

Venmo is a peer-to-peer payment app acquired by PayPal in 2013.

It is a favorite and mainstay of Millennial users who have gravitated towards this FinTech platform.

PayPal is intently focused on monetizing Venmo and the strategy is paying dividends with last quarter seeing 24% of Venmo traffic monetized which is up sequentially from 17% the quarter before.

Part of the increase in profits can be attributed to integrating Uber Eats into the platform, tacking on a charge for instant money transfers linked to bank accounts, and a Venmo debit card rolled out to the masses.

This innovation was not organic and in fact borrowed from FinTech Square, a great company led by Jack Dorsey, but the stock is incredibly volatile scaring off a certain class of investors.

Former CFO of Square Sarah Friar left her post at Square to boldly take on a CEO job at Nextdoor, a social network app, illustrating that an executive management job at Square is a golden credential able to springboard workers to a CEO job in Silicon Valley.

Shares of Square have doubled in 2018 and 2017, and the recent weakness in shares is more of a case that Square went too far over its skis than anything materially wrong with the company as well as a harsh macro climate that stung most of tech.

The price action can sometimes be breathtaking with 7% moves up and down all in a few days.

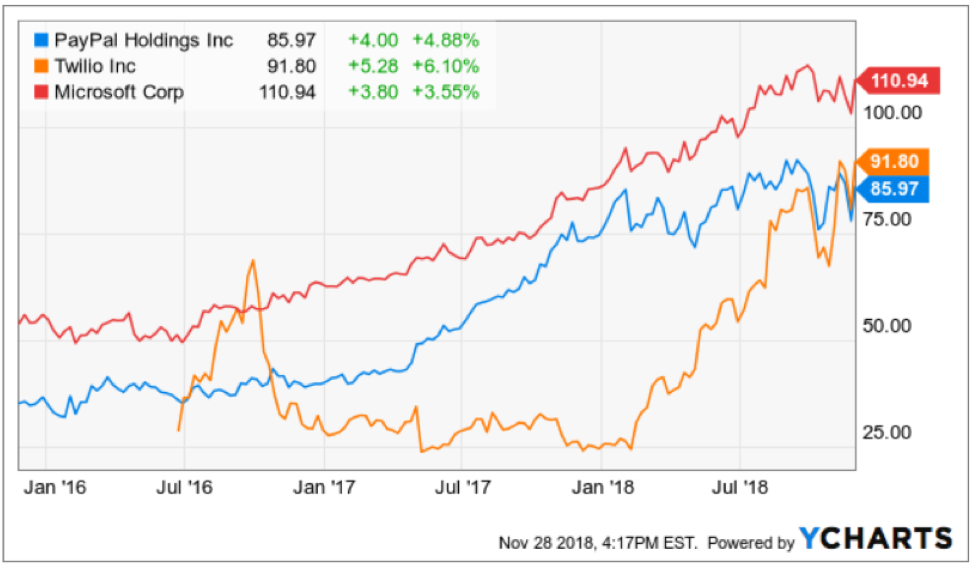

If you are searching for a slow grinder on the way up, then Microsoft (MSFT) would be a better tech play to plop your money into.

In my eyes, Microsoft is the most durable, all-terrain tech stock that will weather any type of gale-force squall in 2019.

For me, CEO of Microsoft Satya Nadella is the best CEO out there in the tech industry minus Jeff Bezos at Amazon (AMZN).

The Azure Cloud business is ferociously nipping at Amazon’s heels and Nadella has created a subscription-based monster out of legacy components left behind by failure Steve Ballmer who almost sunk Microsoft.

The stock has risen three-fold since Nadella took the reins, and I believe that Microsoft will soon surpass the trillion-dollar market capitalization level and end 2019 as the most valuable tech company.

Microsoft is indestructible because it’s a hybrid mashup of a growth company whose legacy products are also still delivering fused with a top-notch gaming division and a chance at catching the Amazon cloud.

The only company that can compare in terms of potency is Amazon.

Microsoft is not a one-trick pony like Apple, Facebook, Netflix and the way I see it, there are only two top companies in the tech landscape that will leave the last three companies I mentioned in the rear-view mirror.

Echoing Microsoft, PayPal has adopted a similar magical formula with its legacy core growing at 20% yet has growth levers with Venmo layered with targeted add-on companies that will enhance the firm’s offerings.

Moving forward, tech companies that have one or more growth drivers funded by a successful legacy base will become the ultimate tech stocks.

Playing on the same trope, Adobe (ADBE) is another company that has a software-based iron-clad legacy twinge to it and has the potential to spread its wings in 2019.

PayPal, Microsoft, and Adobe do not have the potential to double like Square or Roku next year, but they have minimal China trade war risk if things turn ugly, highly profitable with growing EPS, and are pure software companies whose CEOs put a massive emphasis on software development.

Expect this trio to melt up in 2019, and be prepared to strap on call spreads at advantageous entry points.

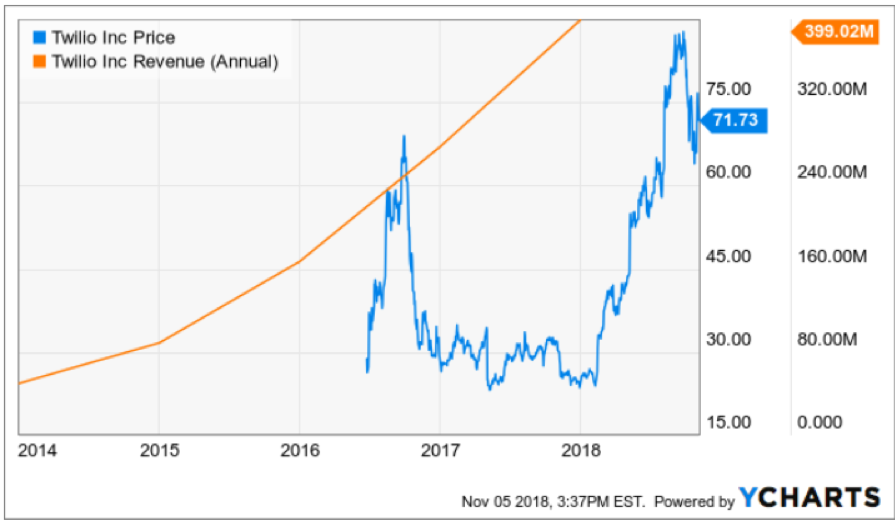

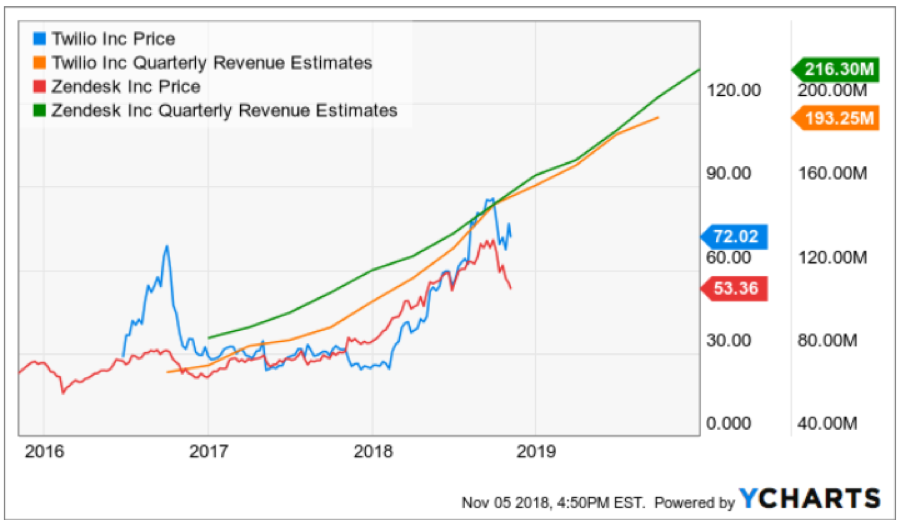

Another pure software service stock I love for 2019 is Twilio (TWLO) who I chronically use when I call an Uber to shuttle me around and take weekend getaways on Airbnb.

I would also lump Salesforce (CRM) into the discussion for stocks to buy in 2019 too.

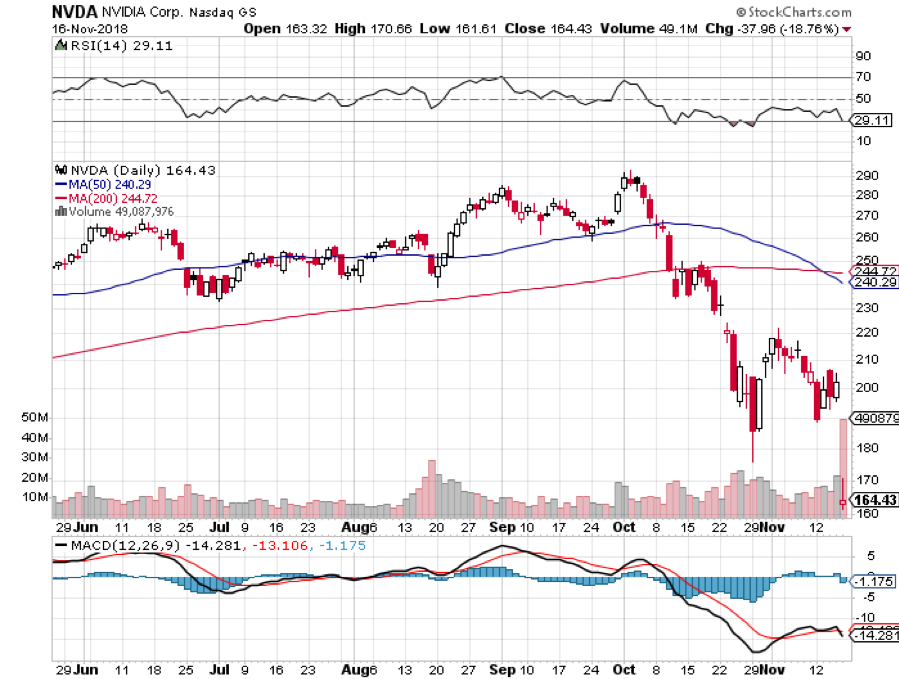

Notice that all the stocks I favor next year are heavily weighted towards software and not hardware.

Hardware is going out of fashion at warp speed, the China tariffs just exacerbated this trend since most of the hardware supply chains are based in China.

Currently, the Mad Technology Letter has open positions in Microsoft and PayPal and if you are like most people online, you will probably use their service next year and more than a few times.