Below please find subscribers’ Q&A for the May 26 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Lake Tahoe, NV.

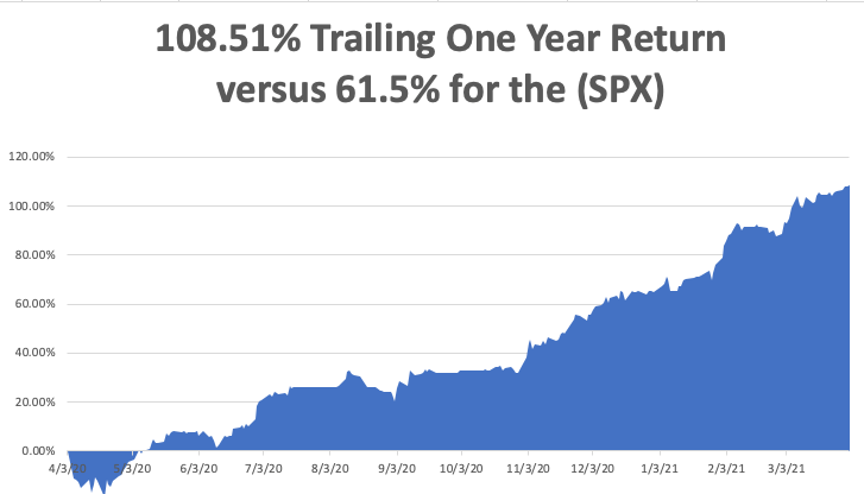

Q: Do you expect a longer pullback for the (SPY) through the summer and into the last quarter?

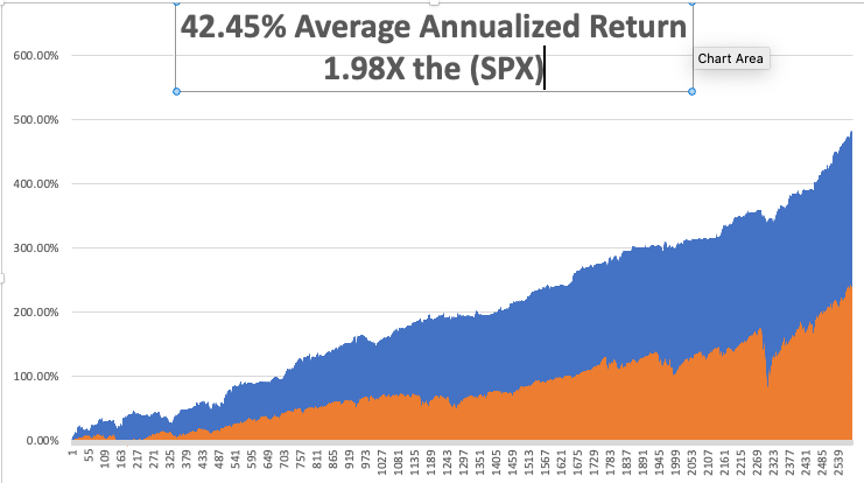

A: No, this market is chomping at the bit and go up and won’t do any more than a 5% correction. We’ve already tested this pullback twice. We could stay in this 5% range for a few more weeks or months, but no longer. If we make it to August before we take off to the upside, that would be a miracle. It seems to want to break out right now and if you look at the tech stocks charts you can see what I'm talking about.

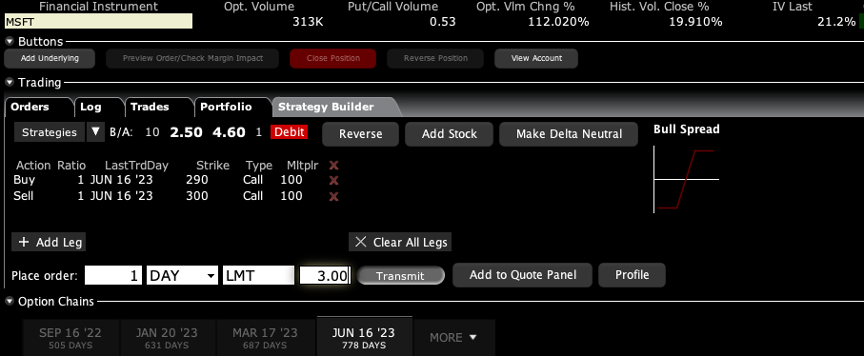

Q: Why do day orders with spreads not good ‘til canceled (GTC)?

A: Actually, you can do good ‘til canceled on these spreads, it just depends on how your platform is set up. Good ‘til canceled won't hurt you—only if we get a sudden reversal on a stop out which has only happened four times this year.

Q: Disney (DIS) seems to be struggling to get back over $180; am I still safe with my January 2023 $250 LEAPS?

A: Yes, out to 2023 we’ll have two summers until those expire, so those look pretty good—that's a pretty aggressive trade, and I’m betting you’re looking at a 500% profit on those LEAPS. And by the way, I always urge people to go out long on these LEAPS, because the second year is almost free when you check the pricing. So, take the gift and that will also greatly reduce your risk. We could have a whole recession and recovery, and still have those LEAPS make it to $250 in Disney.

Q: Should I add to Freeport McMoRan (FCX)?

A: (FCX) I would not add—in fact, I would have a stop loss if we closed below $40 on (FCX) if you’re a short-term trader. There is a slowdown in the Chinese economy going on as well as a clampdown on commodity speculation. This has affected the whole base metal space, including steel and palladium. If you have the long-term LEAPS, keep them, because I think (FCX) doubles from here. The whole “green revolution story” is still good.

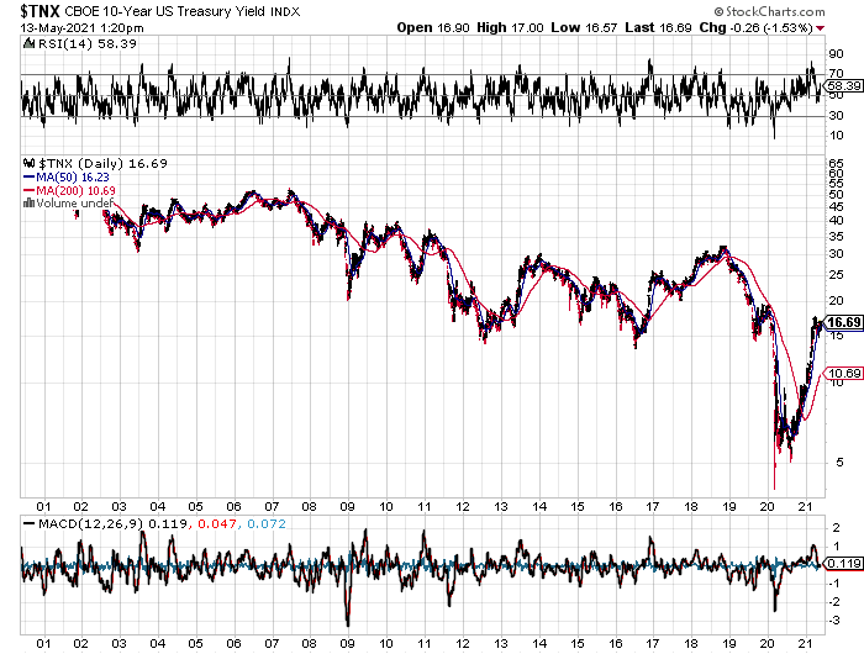

Q: Do you think the United States Treasury Bond Fund (TLT) is going up?

A: No, I think the (TLT) has been going down. I've been buying puts spreads like crazy, and I have a huge chunk of my own retirement fund in long-dated (TLT) LEAPS, so I am praying it will go down. We’ll talk about that when we get to the bond section.

Q: Prospects for U.S. Steel (X)?

A: It’s tied in with the whole rest of the base commodity complex—I think it is due for a rest after a terrific run, which is why I have such tight stop losses on Freeport McMoRan (FCX).

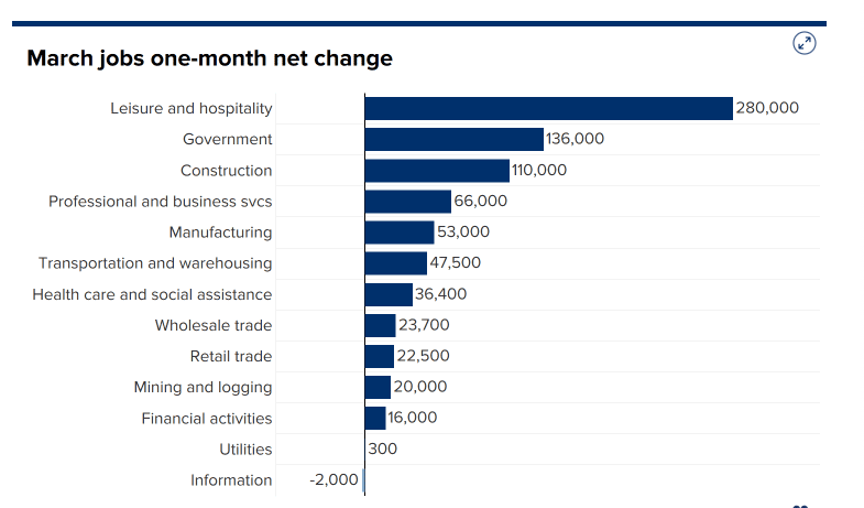

Q: Do you buy the “transitory” explanation for the hot inflation read two weeks ago that the Fed is handing out, or do you think inflation is bad and here to stay?

A: I go with the transitory argument because you’re getting a lot of one-time-only price rises off of the bottom a year ago when the economy completely shut down. Once those price rises work through the system, the inflation rate should go from 4.2% back down to 2% or so. So, I don't see inflation as a risk, which is why I think the stock markets can reach my 30% up target this year. You may get another hot month as the year-on-year comparisons are enormous. But betting on inflation is betting on the reversal of a 40-year trend, which usually doesn’t work out so well.

Q: On your spread trade alerts can we buy less than 25 contracts?

A: You can buy one contract. In fact, I recommend people start with one contract and test out where the real market is. Put a bid for one contract in the middle of the market, and if it doesn’t get done, raise your bid 5 cents, and eventually, your order gets done. Then you can add more if you want to. I always recommend this even for people who buy thousands of contracts, that they test the market with one contract order just to make sure the market is actually there.

Q: Can you recommend a LEAPS for Amazon (AMZN)?

A: The Amazon LEAPS spread is the January 2022 $3150-3300 vertical call debit spread going out 8 months.

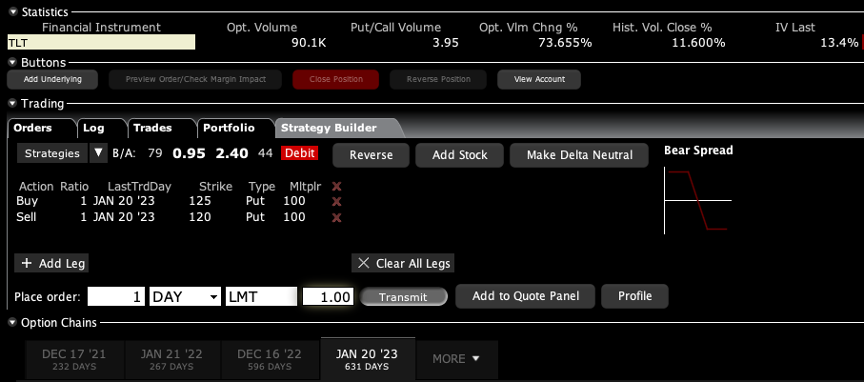

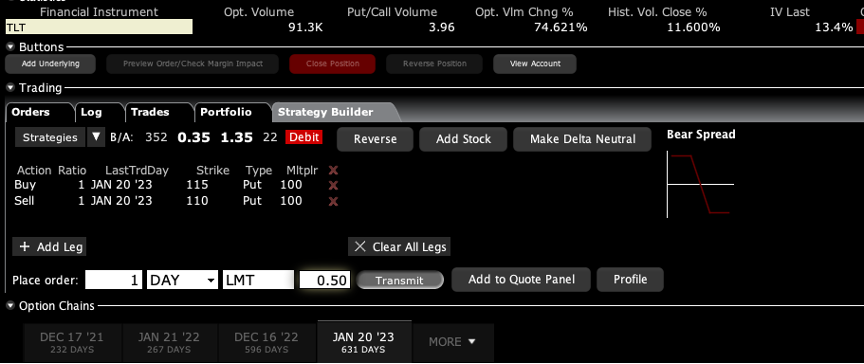

Q: When you short the (TLT), how do you do it?

A: I do vertical bear put debit spreads. I buy a near-money put and sell short and an out-of-the-money put so I can reduce the cost, and therefore triple my size. This strategy triples the leverage on the most likely part of the stock move to take place, which is the at the money. For example, a great one to buy here would be a January 2021 (TLT) $135/140 vertical bear put debit spread where you’re buying the $140 and selling short the $135. The potential 8-month profit on this is around 100%. You’ll make far more money on that kind of trade than you ever would just buying puts outright. Some 80% of the time the single option trades expire worthless. You don’t want to become one of those worthless people.

Q: What’s your best idea for avoiding a U.S. Dollar drop?

A: Buy the Invesco Currency Shares Euro Trust (FXE) or buy the Invesco Currency Shares Australian Dollar Trust Trust (FXA), the Australian Dollar to hedge some of your US Dollar risk. The Australian dollar is basically a call option on a global economic recovery.

Q: I’m a new subscriber, but I don’t get all the recommendations that you mention.

A: Please email customer support at support@madhedgefundtrader.com , tell them you’re not getting trade alerts, and she'll set you up. We have to get you into a different app in order for you to get all those alerts.

Q: How about the ProShares UltraShort 20 Year Treasury ETF (TBT)—is that a bet on declining (TLT)?

A: Absolutely yes, that is a great bet and we’re at a great entry point right now on the (TBT) so that is something I would start scaling into today.

Q: Do you still like Palantir (PLTR)?

A: Yes, but the reason I haven't been pushing it is because the CEO says he could care less about the stock market, and when the CEO says that it tends to be a drag on the stock. Palantir has an easy double or triple on it on a three-year view though. However, small tech has been out of favor since February as it is overpriced.

Q: How far down can the (TLT) go in the next 30 days?

A: It could go down to $135 and maybe $132 on an extreme move, especially if we get another hot CPI read on June 10. However, if you hear the word “taper” from a Fed official, then you’re looking at high $120’s in days.

Q: With the TLT going up, why have you not sent out an alert to double up on put spreads?

A: I tend to be a bit of a perfectionist since I’m a scientist and an engineer, so I’m hanging on for an absolute top to prove itself and start on the way down. On the shorts, I like selling them on the way down, and buying my longs on the way up, because there are always surprises, there’s always the unknown, and heaven forbid, I might actually be wrong sometimes! So, I’m still waiting on this one. And we do already have one position that is fairly close to the money now, the June 2021 $141-144 vertical bear put debit spread, so I don't want to double up on that until we have a reversal in the intermediate term trend.

Q: I see GameStop (GME) is spiking again now up to $230—should I get in for a short-term profit?

A: No. With these meme stocks, the trading is totally random. If anything, I would be selling short, but I would do it in a limited risk way by buying a put spread. However, the implied volatility in the options on these meme stocks are so high that it's almost impossible to make any money on options; you’re paying enormous amounts of money up front, so that's my opinion on GameStop and on AMC Entertainment Holdings (AMC), the other big meme stock.

Q: Will business travel come back after the world is vaccinated?

A: Absolutely. Companies don't want to send people on the road, but customers will demand it. All you need is one competitor to land an order because they visited the customer instead of doing a Zoom (ZM) meeting, and all of a sudden business travel will come roaring back. So that's why I was dabbling in Delta Airlines (DAL) and that's why I like American Express (AXP), where 8% of transactions are for first class airline tickets.

Q: As the work-from-home economy stops and workers go back to the office, do you see a 10% correction in the housing market?

A: Actually, in the housing market with real houses, I don't see prices dropping for years, because 30% of the people who went home to work are staying there for good—that the trend out of the cities into the hinterlands is a long-term trend that will continue for decades, now that Zoom has freed us of the obligations to commute and be near big cities. And of course, I’m a classic example of that; I've been working either in my basement in San Francisco or at Lake Tahoe for the last 14 years. Housing stocks on the other hand like Lennar (LEN), Toll Brothers (TOL) and KB Home (KBH) have had a tremendous run and are basically out of homes. Could they have a 10% correction at any time? Absolutely, yes.

Q: Should I avoid buying dips in last year's work-from-home stocks?

A: Yes I would. DocuSign (DOCO) and Zoom (ZM) are the two best ones because they were both up 12X from their lows, and I tend not to chase things that are up 12X unless they are a Tesla (TSLA) or an Nvidia (NVDA) or something like that. In the end, Tesla went up 295 times.

Q: Are you looking at the carbon credits market?

A: No, but I probably should. That market shut down last year. It’s alive again, and it looks like it's growing like crazy.

Q: What’s the ideal volatility for individual options? What do you use to compare?

A: Always look at the implied volatility of the option compared to the realized volatility of the underlying stock; and when the difference gets too big, you get ideal conditions for putting on call and put spreads, which take advantage of this. These are almost volatility neutral because you’re long on one batch of volatility and short on the other.

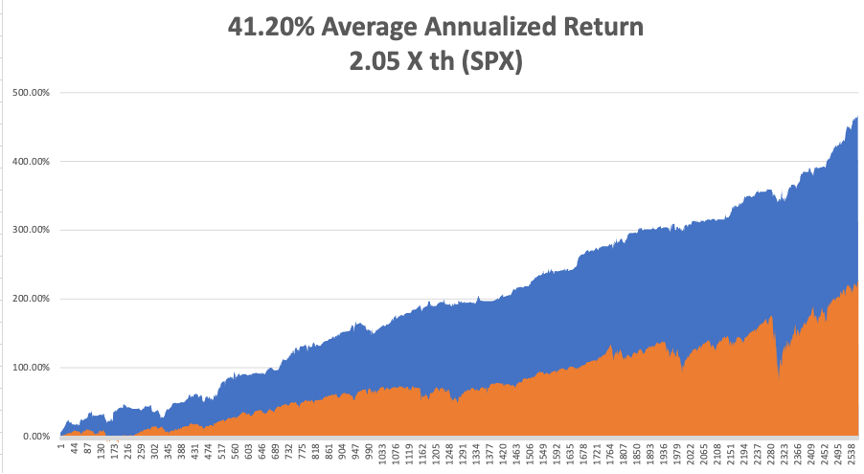

Q: Is it too late to get involved in the ProShares Ultra Technology ETF (ROM), the 2X long ETF in a spread?

A: The November 2021 $121-125 vertical bull call spread, the farthest expiration you can get for the (ROM), was kind of aggressive—I would go closer to the money. We’re right around mid $80s right now, so maybe do a January 2022 $95-100, and even that will get you something like a 400% gain by November.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH (or Tech Letter as the case may be), then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Summit of Mount Rose at 10,778 feet with Lake Tahoe on the Right