I believe that the pandemic and hyper-accelerating technology is bringing forward the future at an astonishing rate.

More applications will be created in the next year than over the last 40, some 500,000. The sum total of human knowledge is now doubling every year. The profits spun off and investment opportunities will be incredible, which is why I just doubled my ten-year forecast for the Dow Average (INDU) from 120,000 to 240,000.

Here are ten major trends for the economy and the markets that we can see already. It’s the unseen ones that will be really interesting.

(1) The Insurance Industry Changes Beyond All Recognition, confirming from “Recovery After Risk” to “Prevention of Risk”. Today, fire insurance pays you after your house burns down. Life insurance pays your next of kin after you die. And health insurance (which is really sick insurance) pays only after you get sick. During the next decade, we’ll see a new generation of insurance providers that offer you a service to KEEP you healthy and keep your house safe during a wildfire. Also, full autonomous driving will cut hospital admissions by half, dramatically dropping the cost of insurance. This is driven by machine learning, ubiquitous sensors, low-cost genome sequencing, and robotics to detect risk, prevent disaster, and guarantee safety before any costs are incurred.

(2) Autonomous Vehicles and Flying Cars (eVTOL) will make travel cheaper and easier. Fully autonomous vehicles (TSLA), (GOOGL), car-as-a-service fleets, and aerial ridesharing (flying cars) will be fully operational in most major metropolitan cities in the coming decade. The cost of transportation will plummet 3-4X, transforming real estate, finance, insurance, the materials economy, and urban planning. Where you live and work, and how you spend your time, will all be fundamentally reshaped by this future of human travel. Your kids and elderly parents will never drive. Already, a half dozen eVTOL companies have gone public raising more than $10B to fuel their growth. These vehicles are real and will help define the decade ahead. This is driven by machine learning, sensors, materials science, battery storage improvements, and ubiquitous gigabit connections.

(3) On-demand Production and On-demand Delivery Will Create an “Instant Economy of Things”. Urban dwellers will learn to expect “instant fulfillment” of their retail orders as drone and robotic last-mile delivery services carry products from local supply depots directly to your doorstep. Further riding the deployment of regional on-demand digital manufacturing (3D printing farms), individualized products can be obtained within hours—anywhere, anytime. I ordered a new high-end 50-pound garage door opener from Amazon Prime (AMZN) last month after my old one went kaput. Incredibly, they delivered it in hours! This is driven by networks, 3D printing, robotics, and AI.

(4) The Ability to Sense and Know Anything, Anytime, Anywhere. We’re rapidly approaching the era where 100 billion sensors (the Internet of Everything) are monitoring and sensing (imaging, listening, measuring) every facet of our environments, all the time. Global imaging satellites, drones, autonomous car LIDARs, and forward-looking augmented reality (AR) headset cameras are all part of a global sensor matrix, together allowing us to know anything, anytime, anywhere. In this future, it’s not “what you know,” but rather “the quality of the questions you ask” that will be most important. That gives us old guys a huge advantage. This is driven by the convergence of terrestrial, atmospheric, and space-based sensors, vast data networks, 5G and 6G communication networks (AAPL), next-gen Wi-Fi, and machine learning.

(5) Advertising Hyper Evolves. As ads become the primary driver of new services for free, AI becomes increasingly embedded in everyday life and your custom personal AI will soon understand what you want better than you do. In turn, we will begin to both trust and rely upon our AIs to make most of our buying decisions, turning over shopping to AI-enabled personal assistants. Your AI might make purchases based on your past desires, current shortages, conversations you’ve allowed your AI to listen to, or by tracking where your pupils focus on a virtual interface (i.e., what catches your attention). As a result, the advertising industry—which normally competes for your attention (whether at the Superbowl or through search engines)—will have a hard time influencing your AI. This is driven by machine learning, sensors, augmented reality, and 5G/networks.

(6) Cellular Agriculture Moves from the Lab to Inner Cities, Providing High-quality Protein that is Cheaper and Healthier. The next decade will witness the birth of the most ethical, nutritious, and environmentally sustainable protein production system devised by humankind. Stem cell-based “cellular agriculture” will allow the production of beef, chicken, and fish anywhere, on-demand, with far higher nutritional content, and a vastly lower environmental footprint than traditional livestock options. Traditional legacy steaks found at Ruth’s Chris and Morton’s will only to available to the wealthy. This is driven by biotechnology, materials science, machine learning, and agtech.

(7) Your Brain Will Integrate with Super-Fast Hardware and Software. My friend, technologist and futurist Ray Kurzweil, has predicted that by the mid-2030s, we will begin connecting the human neocortex to the cloud. This next decade will see tremendous progress in that direction, first serving those with spinal cord injuries, whereby patients will regain both sensory capacity and motor control. Yet beyond assisting those with motor function loss, several BCI pioneers are now attempting to supplement their baseline cognitive abilities, a pursuit with the potential to increase their sensorium, memory, and even intelligence. Recent demonstrations of a macaque monkey playing Pong using a Neuralink implant is proof of incredible progress. This is driven by materials science, AI/machine learning, robotics, and some fantastic imaginations.

(8) High-resolution Virtual Reality Will Transform Both Retail and Real Estate Shopping & the Future of Education. If you were a couch potato, you are about to become one on steroids. High-resolution, lightweight virtual reality headsets will allow individuals at home to shop for everything from clothing to real estate—all from the convenience of their living room. Need a new outfit? Your AI knows your detailed body measurements and can whip up a fashion show featuring your avatar wearing the latest 20 designs on a runway. Want to see how your furniture might look inside a house you’re viewing online? No problem! Your AI can populate the property with your virtualized inventory and give you a guided tour. On the education front, the use of VR and AI-driven avatars with technology such as that demonstrated by Dreamscape promises a future of game-like, immersive, and powerful education and training. This is driven by VR, machine learning, and high-bandwidth networks. Get your Oculus Rift from Facebook (FB) now!

(9) Increased Focus on Sustainability and the Environment will drive companies to invest in sustainability—both from a necessity standpoint and for marketing purposes. Breakthroughs in materials science, enabled by AI, will allow companies to drive tremendous reductions in waste and environmental contamination. One company’s waste will become another company’s profit center. Want to visit my chalet in Switzerland? You can do so by connecting your Oculus Rift headset to Google Maps….today! This is driven by materials science, AI, CRISPR, digital biology, and broadband networks.

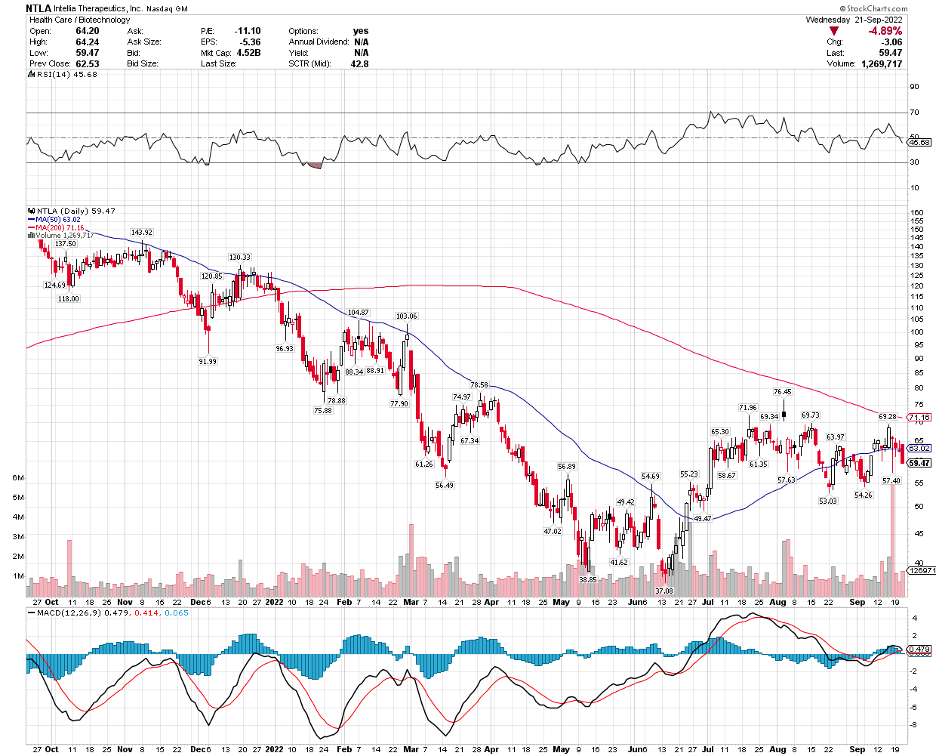

(10) CRISPR and Gene Therapies Will Eliminate Disease. Perhaps one of the most powerful, underappreciated technologies in the world is CRISPR. In 2020, two incredible women won the Nobel Prize in medicine for its discovery, and revenues from CRISPR doubled between 2019 and 2020 to over $1.5B. A vast range of infectious diseases, from AIDS to Ebola, are now potentially curable, as are a wide range of genetic ailments like sickle cell anemia, thalassemia, and certain forms of congenital blindness. In addition, gene-editing technologies continue to advance in precision and ease of use, allowing families to treat and ultimately cure hundreds of inheritable genetic diseases. This is driven by various biotechnologies (CRISPR, Gene Therapy), genome sequencing, and AI. Only three companies have a monopoly in this sector right now, (CRSP), (EDIT), and (NTLA).

In the decade ahead, master entrepreneurs will look beyond the immediate effects of a given technology to seize secondary and tertiary, Google-sized business opportunities on the horizon.

As an investor, you should be asking yourself: What challenges or problems can I help solve? How can I leverage the coming waves of tech advancements?

I just thought you’d like to know.

John Thomas