All traders and portfolio managers with experience approaching a half-century, like myself and a handful of close friends, agree on one thing.

Someday, you will be wrong.

I don’t mean just a little bit wrong, I mean disastrously wrong. A real humdinger, even a life-threatening experience. Even wrong up the wazoo.

In fact, most old salts, even the best performing ones, suffer at least a couple of 50% losses of their total assets, and at least one 75% hit, at least once in their lives.

We’ve all been there.

The 1973 oil crisis. The 1987 stock market crash, when the Dow Average gave up a withering 22% in a single day (I tried to place an order to buy stock at the close and the clerk burst into tears and dissolved into a puddle on the floor).

The Dotcom crash. And of course, the granddaddy of them all, the Great Crash of 2008, which you all remember with the greatest discomfort.

Even my mentor, Warren Buffet, has admitted to taking three 50% hits in his lifetime and lived to tell about it.

The trick is to keep these misfortunes from wiping you out so completely that you can never make a comeback.

Better yet, don’t get into trouble in the first place. And I’ll tell you exactly how to do that right now.

One of the great pleasures of running the Mad Hedge Fund Trader is that I get to speak to thousands of interesting people every year. Believe me, there are all kinds.

I have found kids straight out of school who take to trading like a fish to water. Their instincts are incredible. They figure out the harsh realities of the market decades before I ever did.

When they ask me questions, I think, “Damn! Why didn’t I think of that?”

I have seen several of these gifted, natural born traders use the Mad Hedge Fund Trader turn pennies into millions over unbelievably short times.

You see, they have the trader gene.

Sadly, I also run into the opposite extreme. With some people you could have George Soros sitting on their left, Paul Tudor Jones on their right, both guiding their hands on the mouse to execute trades, and they are still going to still lose money.

These are not stupid people.

I have met many with Harvard MBAs, advanced degrees from MIT, and even Phi Beta Kappa’s, and it doesn’t do them a whit of good on the trading front. They just don’t have trading in them.

In other words, they lack the trading gene.

When I stumble across these people, I tell them to quit trading, end the self-abuse, and preserve whatever wealth they have left. I then order them to buy what I call my “Buy and Forget Portfolio.”

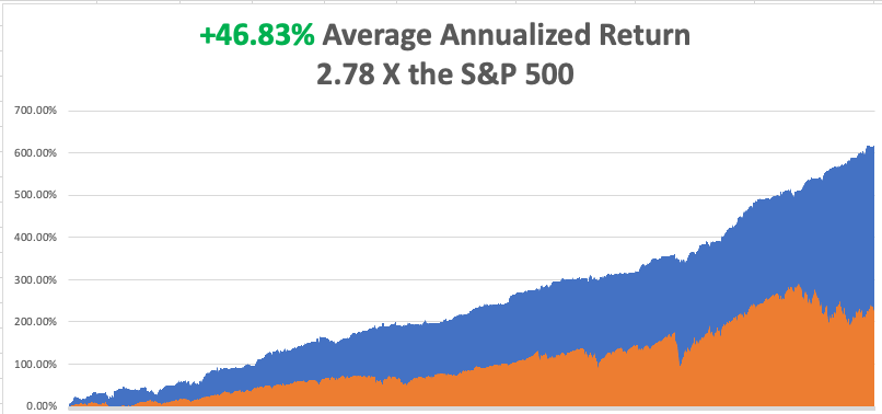

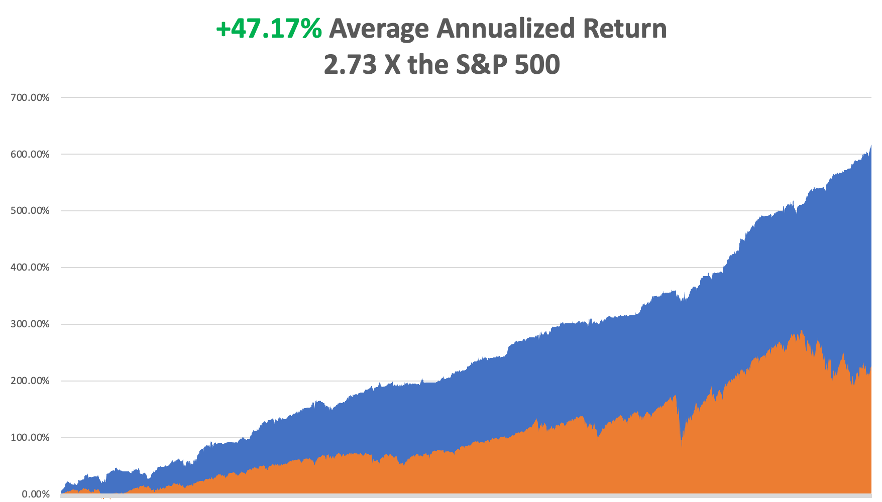

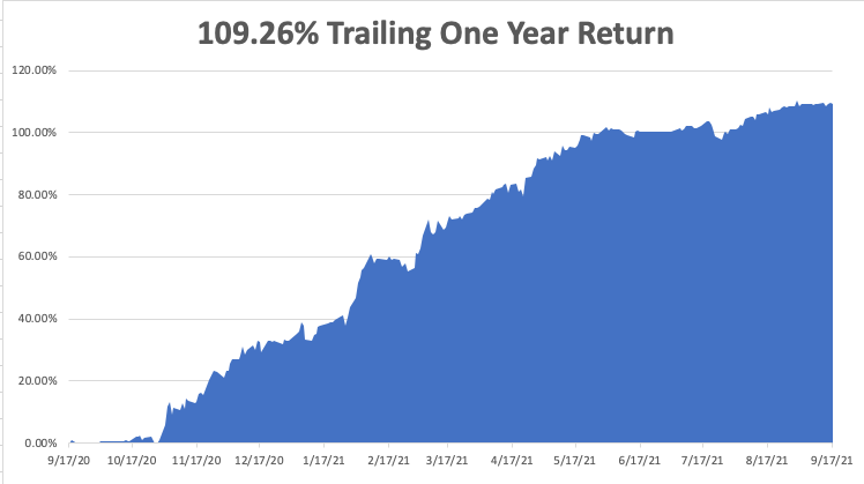

This is a collection of only six investments, which I have assembled over the decades that will be profitable in almost all circumstances. In good years it will grow generously. In bad years it will be down marginally. Over the long term, it will do extremely well.

Here it is:

The Mad Hedge Buy and Forget Portfolio

20% domestic US stocks (SPY)

20% international stocks (IXUS)

10% emerging stock markets (EEM)

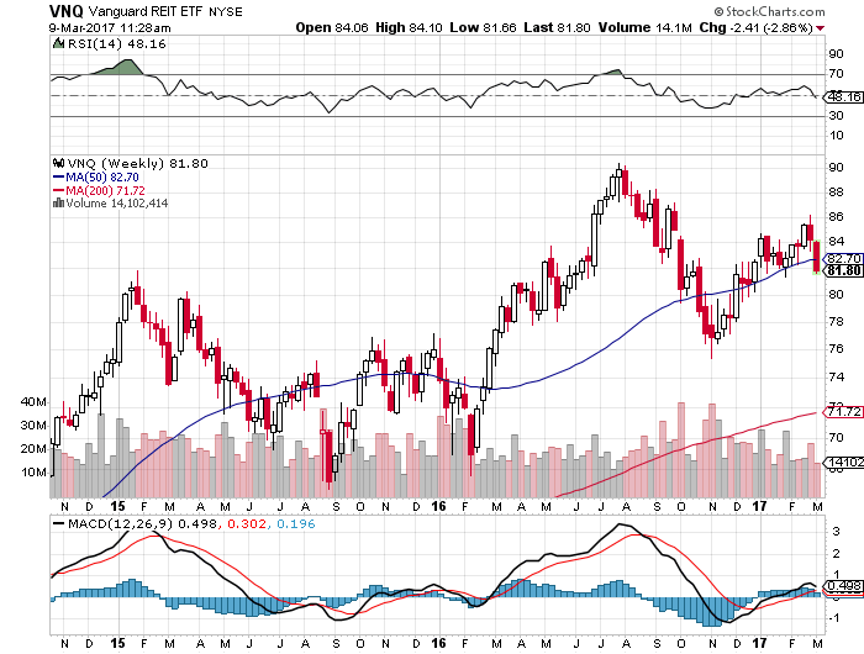

20% Real Estate Investment Trusts (VNQ)

15% long term US Treasury Bonds (TLT)

15% Treasury Inflation Protected Securities (TIP)

Notice that half the money is in equities and the remainder in fixed income securities.

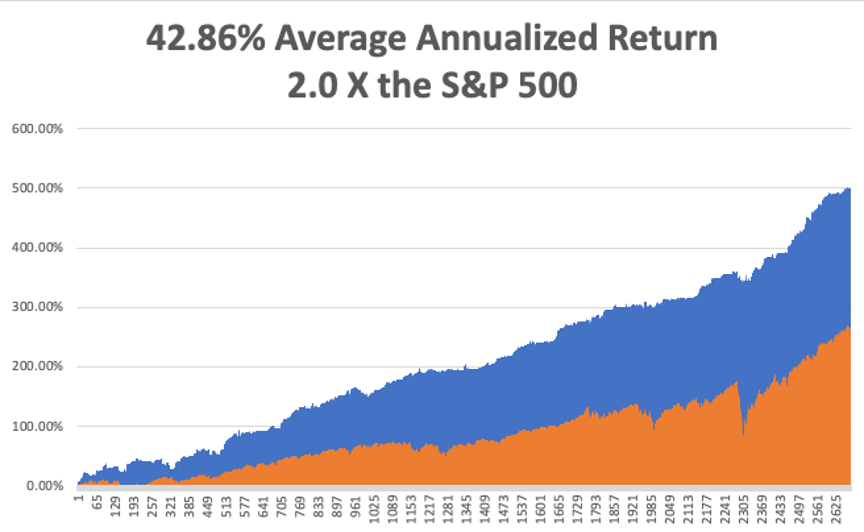

If you initiated this portfolio in 1997, the year that TIPS first became available to the public, you would have earned an average annualized compounded return of 7.86% through the end of 2014, assuming reinvestment of dividends and interest.

During the bear market of 2000-2002, when the S&P 500 dropped 50%, this portfolio never suffered a loss of more than -4.7%. During the Great Crash of 2008, it fell -31%, versus -37% for the (SPY), and then very quickly bounced back.

Most long-only investors would have killed for returns like these.

So the bottom line is this. Expect a 4% drawdown every decade, a 31% hickey twice a century, and one of those twice-a-century events is only eight years behind us. That is not a bad proposition.

The heavy stock weighting can be easily explained by the fact that historically, stocks have outperformed bonds by a large margin.

For long periods of time, such as much of the 19th century, the Great Depression, and now, chronic structural deflation meant that bonds paid very little in interest.

Stocks also have the advantage in that during periods of inflation they can pass rising costs on to consumers via price hikes.

Guess what? We are just going into an inflationary period.

For the past 200 years, stocks have therefore delivered a compounded average annualized return of 8.3%.

Just to give you an example of how valuable the stock advantage can be, $1 invested in 1802 would be worth $8.8 million today.

This is why Oracle of Omaha Warren Buffet constantly sings the praises of compounding and dividend reinvestment and is why he rarely sells anything. In fact, his authorized biography is entitled Snowball (a great read, by the way).

The beauty of the Buy and Forget Portfolio is that the six elements counterbalance each other in all market circumstances. When stocks go up, bonds usually go down, and vice versa.

They both go the wrong way only for very short periods, such as in 2008 and always snap back.

And remember inflation, that long-forgotten thing where prices actually go up? It will make a return someday. And there is no better time to buy TIPS than during the deflationary surge that we are enduring now. TIPS prices are cheap.

Such is the beauty of diversification.

The great thing about the Buy and Forget Portfolio is that you can literally buy and forget about it. You won’t lose sleep at night, you could care less about what they say on CNBC, and don’t have to hide those embarrassing brokerage statements from your spouse.

The only thing you have to do is to rebalance it once a year to restore each component to its original weighting. More often than that and you run up big commission and tax bills.

Remember, you are trying to buy your own yacht, not your broker’s.

This will free you up to focus on the more important things in life.

Will Daenerys Targaryen gain her rightful place on the throne of the Seven Kingdoms in The Game of Thrones? Will Don Draper get his well-deserved comeuppance in the final season of Mad Men? Can the widow, Lady Mary, ever find true love again in the next season of Downton Abbey?

Of course, knowing all of this, some bad traders will continue to trade. For some, it is like an addition. They just have to win, whatever the cost. For others, it's like buying lottery tickets. Some just love the adrenaline and the thrill of the chase, even if it costs them money.

Whatever the reason, they continue trading until they run out of money. Then they will try to borrow your money to trade.

Could this be you?

All I can do is wish them the best.

Leave the trading to the masochists, like me.

Leave the Trading to the Masochists