Below please find subscribers’ Q&A for the October 6 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley.

Q: When will Freeport McMoRan (FCX) go up?

A: When the China real estate crisis ends, and they start buying copper again to build new apartment buildings.

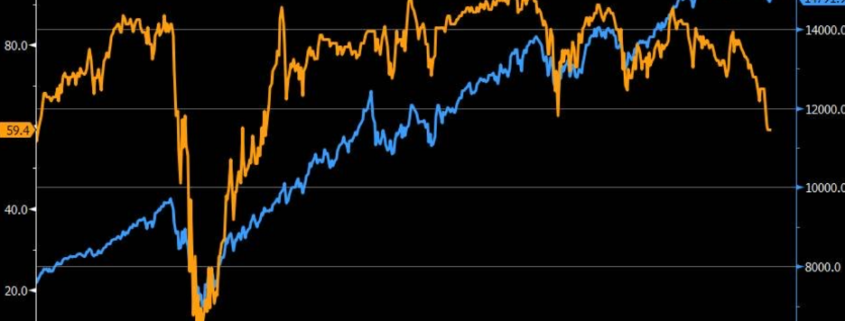

Q: Do rising interest rates imply trouble for tech?

A: Yes, they do, but only for the short term. Long term, these things all double on a three-year view; and the next rise up in tech stocks will start when interest rates peak out, probably with 10-year yields at 1.76% or 2.00%. The great irony here is that all the big techs profit from higher rates because they have such enormous cash flows and balances. But that is just how markets work.

Q: I know you’ve been promoting Tesla (TSLA) for a very long time. What do you think about it here?

A: We’ve just gone from $550 to over $800. It actually has been one of the best performing stocks in the market for the past four months. Short term, you want to take profits; long term you want to hold it because it could go up 10 times from the current level. They just broke all their sales records and are the fastest growing car company in the US or Europe.

Q: If Blackrock (BLK) is reliant on interest rates, will the rise in interest rates hurt them?

A: No, it’s the opposite. Rising interest rates are positive for Blackrock because it improves the return on their investments, which they get a piece of; so rising interest rates mean more money and more fees. That's why I own it— it is a rising interest rate play, not a falling interest rate play.

Q: What do you think about Baidu (BIDU)?

A: Stay away from all China trades right now, it’s uninvestable. Not only do I not know what the Chinese are going to do next—they seem to be attacking a new industry every week—but the Chinese don’t even seem to know. This is all new to them; they had been embracing the capitalist model for the last 40 years and they now seem to be backtracking. There are better fish to fry, like Morgan Stanley (MS) and JP Morgan (JPM).

Q: Don’t you have a bear put spread on Baidu (BIDU)?

A: We did have a bear put spread on Baidu, but that's only a very short term, front month trade. It does look like it’s going to make money; but keep in mind those are high-risk trades.

Q: Could Natural Gas (UNG) trigger an economic crisis?

A: Not really. In the US, natgas is only a portion of our total energy needs, about 34%, and that’s mostly in the Midwest and California. The US has something like a 200-year supply with fracking. Plus, we’re on a price spike here—we’ve gone from $2 to $20/btu in Europe, entirely manipulated by Russia trying to get more money on their exports and more political control over Europe. So, it’s a short-term deal, and you can bet a lot of pros are out there shorting natgas like crazy right here. The real issue here is that no one wants to invest in carbon-based energy anymore and that is creating bottlenecks in the energy supply chain.

Q: How long will it take to provide EV infrastructure to mass gas station availability?

A: The EV infrastructure has in fact been in progress for 20 years, if you count the first generation of EV in the late 90s, which bombed. Tesla has been building power stations in the US for 10 years. They have 10,000 chargers now in 1,800 stations and their goal is 20,000 charging stations. In fact, most people already have the infrastructure for EV charging—you just charge them at home overnight, like I do. The only time I ever need a charge is when I go to Lake Tahoe. For gasoline engines, on the other hand, it took 20 years to build infrastructure from 1900 to 1920 to replace horses. Believe it or not, gasoline cars were the great environmental advance of the day, because it meant you could get rid of all the horses. New York City used to have 150,000 horses, and the city was constantly struggling through streets of two-foot-deep manure piles. So that was the big improvement. It only took 100 years to take the next step.

Q: The latest commodity with supply constraints I hear about is cotton. Is this all just a temporary thing and can we expect supply capacity to be back to normal next year? Is this just the failing of a just-in-time model that simply doesn’t work in the age of deglobalization?

A: We are losing possibly one third of our current economic growth due to part shortages, labor shortages, supply chain problems—those all go away next year, and that one third of economic growth just gets postponed into 2022 which means that the economic recovery is extended over a longer period of time, and so is the bull market in stocks, how about that! That’s why I’m loading the boat right here. It’s the first time I've been 100% invested since May.

Q: What do you think about the airlines here?

A: High risk, but high return play for the next year. Delta (DAL) is a play on business travel recovery. Alaska Airlines (ALK) and Southwest(LUV) are a play on a vacation travel return flying return, which has already started—we’re back to pre-pandemic TSA clearances at airports.

Q: Is Facebook (FB) a buy now?

A: No, I want to wait for the dust to settle before I go back in. I think it does recover and go to new highs eventually but will go to lower lows first. Regulation is certainly coming but we don’t know what.

Q: When will the chip shortage end?

A: Two years. My prediction is much longer than anybody else's because people are designing chips into new products like crazy. All predictions for the chip shortage to end in only a year don’t take that into account.

Q: When do we go into the (ROM) ProShares Ultra Technology long play?

A: When interest rates peak out sometime early next year. It’s probably a great entry point for tech; until then they go nowhere.

Q: Does the appetite for financials extend to Canada and their banks with higher dividends?

A: Yes, US and Canadian interest rates tend to move fairly closely so that rising rates here should be just as good for banks in Canada, and you might even be able to get them cheaper.

Q: Do you suggest we buy Altcoin?

A: No, not unless you're a Bitcoin professional like a miner, who can differentiate between all the different Altcoins. You can buy up to 100 different Altcoins on the main exchanges like Coinbase (COIN). In the crypto business, there is safety and size; that means Bitcoin ($BTCUSD) and Ethereum (ETHE), which between them account for about three quarters of all the crypto ever issued. A Lot of the smaller ones have a risk of going to zero overnight, and that has already happened many times. So go with the size—they’re less volatile but they’ll still go up in a rising market. And you should subscribe to our bitcoin letter just to get the details on how that market works.

Q: Target for Bitcoin by Christmas?

A: My conservative target is $66,000, but if we really go nuts, we could go as high as $100,000. That’s the “laser eyes” target for a lot of the early investors.

Q: Suggestions for a Crypto ETF?

A: It’s not out yet but will be shortly. I think that Crypto will run like crazy in anticipation of the Bitcoin ETF that we don’t have yet.

Q: Should I buy Moderna (MRNA) on this dip at 320 down from 400, or is this a COVID revenue flash in the pan that won’t come back?

A: It’ll come back because they’re taking their COVID technology and applying it to all other human diseases including cancer, which is why we got in this thing two years ago. But we may have to find a lower low first. So I would wait on all the drug/biotech plays which right now are getting hammered with the demise of the delta virus.

Q: What’s your favorite ETF right now?

A: Probably the (TBT) Double Short Treasury ETF. I’m looking for it to go up another 30% from here to 24 or 25 by sometime next year.

Q: EVs have been hot this year; Lordstown Motors is down to only $5 from $27 and just got downgraded by an analyst to $2. Should I buy, or is this a dangerous strategy?

A: I would say highly dangerous. This company has been signaling that it’s on its way to bankruptcy essentially all year, so don’t confuse “gone down a lot” with being “cheap” because that’s how you buy stuff on the way to zero.

Q: What about Anthony Scaramucci’s ETF?

A: We will have Anthony Scaramucci as a guest in our December summit. And the ETF is a basket of stocks as diverse as MicroStrategy (MSTR), Blok (BLOK), Visa (V), and Nvidia (NVDA), so you will only get a fraction of the Bitcoin volatility. That means if Bitcoin goes up 100% you might get a 40% or 50% move in the actual ETF.

Q: Do you have a Bitcoin book coming out soon?

A: I do, it should be out by the end of this month. That’s The Mad Hedge Guide to Trading Bitcoin, and it will have all the research I’ve accumulated on trading Bitcoin in the past year.

Q: Why have you only issued one trade alert in Bitcoin?

A: You don’t get a lot of entry points for Bitcoin. You buy the periodic bottoms and then you run them. Dollar cost averaging is very useful here because there are no traditional valuation measures to use, like price earnings multiples or price to book. When it comes time to sell, we'll let you know, but there aren’t a lot of Bitcoin plays outside the Bitcoin exchanges.

Q: Thoughts on silver (SLV)?

A: It’s horribly out of favor now and will continue to be so as long as Bitcoin gets the spotlight. Also, there’s a China problem with the precious metals.

Q: There are 8 or 10 good public Bitcoin and Ethereum ETFs in Canada.

A: That’s true, if you’re allowed to trade in Canada.

Q: Can the US ban Bitcoin like China did?

A: No, if they did, it would just move offshore to the Cayman Islands or some other place outside the world of regulation.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log on to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Sightseeing in Laos in 1975