Below please find subscribers’ Q&A for the January 5 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, Nevada.

Q: What’s a good ETF to track the Russell 3,000 (RUA)?

A: I use the Russell 2,000 (IWM) which is really only about the Russell 1500 because 500 companies have been merged or gone bankrupt and they haven't adjusted the index yet. This is the year where value plays and small caps should do better, maybe even outperforming the S&P500. These are companies that do best in a strong economy.

Q: Should I focus on value dividends growth, or stick with the barbell?

A: I think you have to stick with the barbell if you’re a long-term investor. If you’re a short-term trader, try and catch the swings. Sell tech now, buy it back 10% lower. Keep financials; when they peak out you, dump them and go back into tech. It’ll be a trading year, but if a lot of you are just indexing the S&P500 or doubling up through a 2x ETF like the ProShares ultra S&P 500 (SSO), it may be the easiest way to go for this year.

Q: Will higher rates sabotage tech, particularly smaller companies?

A: They’ve already done so with PayPal (PYPL) down 44% in six months—I’d say that’s sabotaged. Same with Square (SQ) and a lot of the other smaller tech companies. So that has happened and will continue to happen a bit more, but we’re really getting into the extreme oversold levels on a lot of these companies.

Q: Should we cash out on the iShares 20 Plus Year Treasury Bond ETF (TLT) summer 150/155 put spread LEAPS?

A: No, because you haven't even realized half of the profit in that yet since there is so much time value left in those options. As long as you stay below $150 in the (TLT), which I'm pretty sure we will, you will get your full 100% profit on that position. On the six month and one year positions, they don’t really move very much because they have so much time value in them. Once you get into the accelerated time decay, which is during the last 3 months before expiration, they catch like a house on fire. So, if you're willing to keep a safe long-term position, this thing will write you a check every day for the next six months or a year to expiration. I know we have absolutely everybody in these deep in the money TLT puts; some people even did $165-$170’s—you know, my widows and orphans crowd—and they are doing well, but not as much as if you’d had a front month.

Q: What scares you most for the next 12 months?

A: Another variant that is more fatal than either Delta or Omicron. Unlikely, but not impossible.

Q: Do you expect Freeport McMoRan (FCX) to break out to the upside?

A: I do, I did the numbers over the vacation for copper production to meet current forecast demands for electric vehicle production. Global copper has to increase 11 times, and that can’t be done, so prices are going to have to go up a lot. One of my concerns with these lofty EV projections (that even I make) is that there aren’t enough commodities in the world to make all these cars with the current infrastructure. And you’re not going to find a replacement for copper—it's just too perfect of an electrical conductor. So, that means higher prices to me—you increase demand 11 times on a stable supply, and it takes 10 years to bring a new copper mine online.

Q: Do you have any open trades?

A: No, and one reason is that I figured they would probably crash the market on the last trading day of the year, which they did. If I had positions, they would have crushed them on the last year and my performance. And all hedge fund traders do this; they try to go 100% cash at the end of the year to avoid these things. And whatever you lost on Friday you made back on Monday morning at the expense of last year's performance. But you have to wait 15 months to get paid on today's performance, and, that is the reason I do that. So, looking for higher highs to sell, lower lows to buy.

Q: Should I be buying NVIDIA (NVDA) and Tesla (TSLA) on the dip?

A: Absolutely yes, but Tesla's prone to 45% corrections—we had one last year and the year before—and Nvidia tends to have 25% corrections. So yes, NVIDIA could well be the stock of the decade, but you don’t want to buy it right now. It’s starting to lose steam already.

Q: Will ProShares Ultra Technology (ROM) be under pressure?

A: Keep your position small now, take some profits, look to buy on a bigger dip. If the big techs drop 10%, (ROM) will drop 20% and get you below $100.

Q: Do you offer trade alerts on small caps for short term traders?

A: No, because you can’t execute those trades. A lot of them are just so illiquid, you can’t even trade one share unless you want to pay a huge spread. Keep in mind, when I worked at Morgan Stanley (MS), I covered the Rockefeller Foundation, the Ford Foundation, George Soros, Paul Tudor Jones, the government of Abu Dhabi, California State Pension Fund, and a lot of other huge funds; and the last thing they’re interested in is short term trades for the small-cap stocks. So, I don't really know much about those, but they tend to change the names every year anyway. And it really is a beginner trader type area because the volatility is so enormous. You can get 10x moves one day going to zero the next. It is also an area full of scams, cons, and pump and dump schemes.

Q: What is your advice when it comes to the ProShares UltraShort 20+ Year Treasury (TBT)?

A: Short term, take the profits—you just got a $14 point rally in your favor. Short term traders, take profits on bonds here, cover your shorts. Long term investors keep it, the cost of carry is only about 4% right now, not that high, so I would keep it for a great year-end move for 2.5% yields on the ten-year.

Q: I hate oil (USO) because it’s going to zero. Should I keep trading in it?

A: Very few are nimble enough to trade oil, it’s really an insider’s game. No new capital is moving into the oil industry and oil companies themselves won’t invest in their own businesses anymore.

Q: Would you put on a new position on the iShares 20 Plus Year Treasury Bond ETF (TLT) today?

A: No, you don’t sell short things after they move down $14 points. You put them on before that. If I were to do a short-term trade in (TLT) I would be a buyer, I’d maybe buy it for a countertrend rally of maybe $4 or $5 points.

Q: What should I do with my FCX 2023 LEAP?

A: There is enough time on it, so I would keep running it along as is—don’t get greedy. Keep the LEAPS you have and you should do well by it.

Q: Could the iShares 20 Plus Year Treasury Bond ETF (TLT) bottom out in the near term?

A: Yes, it could, on a short-term basis. $141 is the nine-month low for the (TLT), so a great place to take short term profits. (TLT) is right now at $142.56, so we’re approaching that $141 handle closely. Every technical trader on the market’s going to cover their shorts on the $141 or $142 handle, so just congratulate yourself going into this move short, and take the money and run. You take every $14 point move in your favor in the (TLT); and let it rally 5 points and then reestablish, that’s how you trade.

Q: Do you think there will be a delay in the first interest rate hike due to COVID?

A: Yes, Jay Powell is the ultra-dove—any excuse to delay rate hikes, he’ll do it. And the way you’ll know is he’ll delay the end of other things which you don’t see, like daily mortgage bond purchases, daily US Treasury purchases, and other backdoor forms of QE. We’ll know well in advance if he’s going to raise or not by March or even June. We watch this stuff every day, we talk to people at the Fed every week. And remember, the Treasury Secretary Janet Yellen is a good friend of mine, I get a good handle on these things; this is why 99% of my bond trades make money.

Q: What if I have the $135-$140 put spread in January?

A: Sell it now, take what you can, take the hit; because that’ll expire at zero unless we break down to new lows on the (TLT) in the next ten days or so. That's not a good bet, especially on top of a $14 point drop. Capture what you can on that one and keep the cash for a better entry point. That’s exactly what I did—I sold all my January positions yesterday no matter what they were, because when you get to two weeks to expiration the moves become random.

Q: Do you think inflation will last longer than expected?

A: No, I think it will last shorter than expected because I think at least half of the inflation rate, if not more, are caused by supply chain problems which will end within the next six months, and therefore lead to the over-order problem that I was talking about earlier.

Q: What’s your outlook on energy this year?

A: It could go higher. On the way to zero, you’re going to have several double, tripling’s, even 10x increases in the price of oil, like we saw in the last 18 months. We went from negative numbers to 80, and what happens is oil becomes more volatile as the supply becomes more variable, that's a natural function. But trading this is not for non-professionals.

Q: Since sector rotation is happening, do you think we should sell all tech positions?

A: Short term yes, long term no. Tech will still lead with earnings, and even if they have a bad five months coming, they have a terrific long-term view. For the last 30 years, every sale of tech has been a mistake, especially in Apple (AAPL). So if you’re a trader, yes, you should have been selling since November. If you’re a long-term investor, keep them all.

Q: Is the ProShares UltraShort S&P 500 (SDS) a good position to buy up when the market timing index goes into sell territory?

A: Yes it is, and that will probably work better this year than it did last year because narrow range volatile markets are much more technically oriented than straight-up markets or long term bull markets. Pay close attention to those markets, you could make a lot of money trading them.

Q: Do Teslas have good car heaters for climates up North in -25 or -30?

A: You plug them in. When it gets below zero you actually get a warning message on your Tesla app telling you to plug it in, and then the car heats itself off of the power input. Otherwise, if you get to below zero, the range on the car drops by half. If you have a 300-mile range car like I do and then you freeze it, it drops to like 150 miles. In Tahoe, I keep my car plugged in all the time when I'm not using it, just to keep it warm and friendly.

Q: Is Zoom (ZM) a good buy here?

A: No, I think they’re going to keep punishing these overpriced small cap techs like they have been. We’re a long way from value on small tech. That was a 2020 story.

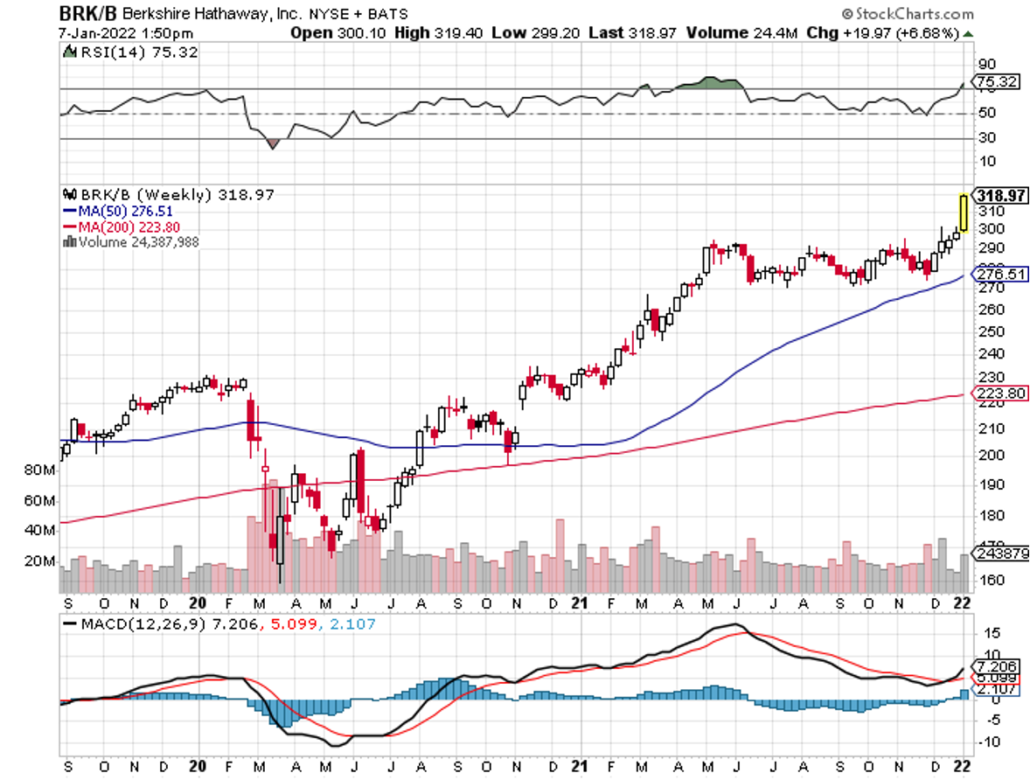

Q: What about Berkshire Hathaway (BRKB)?

A: Berkshire Hathaway is doing a major breakout because they own financials up the wazoo and they’re all breaking out. And YOU should be long up the wazoo on these things because I’ve been recommending them for the last 4 months.

Q: What do you think of Robinhood (HOOD)?

A: Robinhood I like long term, but it is high risk, high volatility. It is down 78% from the IPO so it is busted. Kind of tempting down here, but again, all the non-earning overvalued stocks are getting their clocks cleaned right here; I'm not in a rush to get involved.

Q: When you enter a LEAP, is the straight call or call spread?

A: It’s a call spread. You finance the high cost of one-year options by selling short a call option against it further out of the money. And that way you can get enormous leverage for practically nothing, 10 or 20 times in some cases, depending on how you structure the strikes.

Q: Best stock to play Copper?

A: Freeport McMoRan (FCX). I’ve been recommending it since it was $4.00.

Q: Oil is the pain train until EVs actually take over.

A: That’s true, and they haven’t. EVs have about a 6% market share now of new car sales worldwide, but that could rapidly accelerate given all the subsidies that EVs are getting. Also, we have many future recessions to worry about, during which oil could easily drop 290% like it did last year. If you can hack that kind of volatility, go for it, but I find better things to do quite honestly. And I think my next oil trade will be a short, especially if we go over $100.

Q: What about Bitcoin?

A: It could go sideways in a range for a while. If we can’t hold the 200-day, we’re going back down to the high 30,000s, where we were at the start of the year—we could give up the entire year of 2021. Bitcoin also suffers from rising interest rates since they don’t yield anything.

Q: Is this recorded?

A: Yes, the webinar recording goes out in about 2 hours. Log into the madhedgefundtrader.com website and go to my account, where you’ll find it with all the different products you’ve purchased.

Q: I just closed out my (TLT) 150 put option for the biggest single trade profit in my life; I just made 20% of my annual salary alone today. Thank you, John!

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader